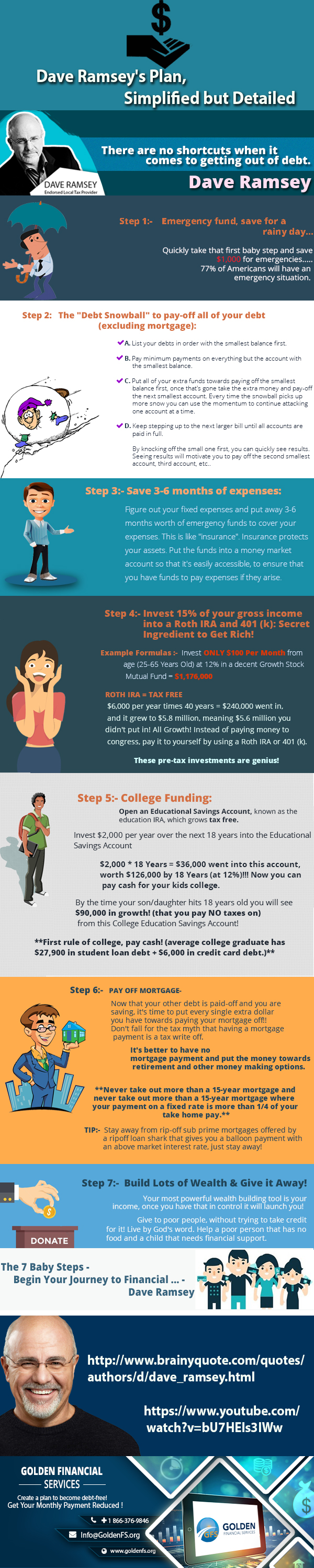

Dave Ramsey’s Debt Snowball and Seven Baby Steps

Dave Ramsey’s 7 Baby Steps will show you how to save money for emergencies, become debt-free, and build wealth by investing through the stock market.

BROUGHT TO YOU BY GOLDEN FINANCIAL SERVICES

https://goldenfs.org/seven-baby-steps-by-dave-ramsey

GOLDEN FINANCIAL SERVICES

Reference URL

https://www.brainyquote.com/quotes/authors/d/dave_ramsey.html

https://www.youtube.com/watch?v=bU&HELs3LWw

Share this Image On Your Site

Inside the infographic above are the 7 steps recommended by Dave Ramsey that a person must take to achieve financial freedom. These steps will transform your finances, helping you go from being in debt to achieving financial freedom.

Debt Snowball Method

According to the famous Dave Ramsey, America’s “top financial guru,” the snowball method is the best credit card relief option.

Here at Golden Financial Services, we do agree! The problem is that not everyone can afford to pay more than minimum monthly payments.

The snowball method lets you save money, get out of debt fast, and your credit score should improve simultaneously.

The snowball method of getting out of debt simplifies the entire debt relief process. Start by creating a budget analysis. A budget lets you find extra money that you can then put towards paying off your smallest debt first while continuing to pay minimum payments on the rest. Start here with our free budget analysis tool.

After creating your budget analysis, next, go to the snowball calculator.

Can’t afford the debt snowball method?

Try the debt relief program calculator, which gives you a side by side comparison of your potential savings on each program so that you can quickly spot the plan which you can afford.

These programs do negatively affect credit scores. Having said that, if you’ve been paying only minimum payments on maxed-out credit cards, your credit score has probably already been adversely affected.

Golden Financial Services highlights the 10 Best Ways to Clear Your Debt Quickly. (Click Here to See Options)

ROTH, or 401(K)?

The 401(K) uses pre-tax dollars, so more of your money will be invested and put to work in the stock market. The funds get invested before the taxes are taken out – investing 100% of your gross income!

The ROTH IRA uses after-tax dollars, so your net income gets invested. The benefit of the ROTH is that you’ve already paid the taxes so when you are retired and want to use the money, no additional taxes need to get paid.

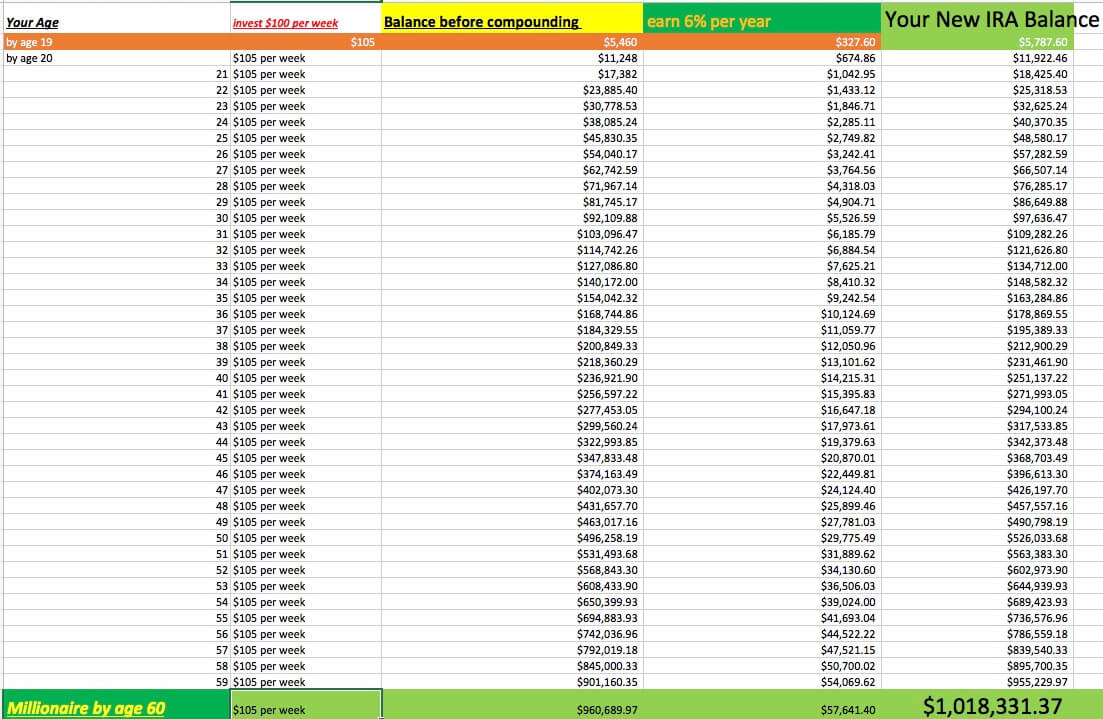

Invest weekly, not once per year. This investment strategy is called “dollar-cost averaging.” By investing weekly, some weeks you’ll by more stock because stock prices are low and you won’t miss out on buying at the right time.

How to Become a Millionaire by Age 60

Start investing $105 per week at age 19. If you invest $105 per week, that’s $5,460 per year. If you earn on average 6% per year, by the time you turn 60 years of age, you’ll have over one million dollars saved. From there, you can start living off the profit you earn each month, and live happily ever after!

If you invest only once per year and you pick a day to invest when stocks are at their highest, you’ll surely only lose money.

Behind on your credit card payments?

In your case, you’ll be better off using a debt relief program.

Plans include a money-back guarantee and credit restoration.

Debt relief lets you pay a small fraction of what’s owed to become debt-free, making your debt affordable!

Call 866-376-9846 for a Professional Debt Relief Program Consultation

Unfortunately, some of us need to deal with other priorities before implementing these 7 Baby Steps. Priorities including; paying off delinquent debts, improving credit, or getting a job. At Golden Financial Services, we can assist with the credit and debt issues. Learn more about our debt relief programs by visiting this page next.