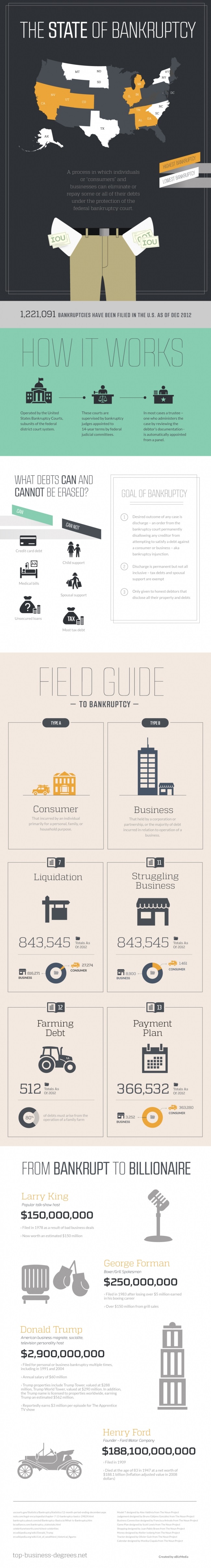

Take a look at this Awesome Bankruptcy Debt Relief Infographic. All of the answers to the most frequently asked questions regarding bankruptcy, reside in this image.

Bankruptcy Debt Relief – Questions & Answers

Question:

What is bankruptcy?

Answer:

Bankruptcy is a process that allows an individual or business to eliminate or repay a portion of their debt, or at times all of their debt, under the protection of the United States federal bankruptcy court.

Question:

What Ten States have the highest number of bankruptcies?

Answer:

The highest number of bankruptcies exist in California, Nevada, Colorado, Utah, Michigan, Indiana, Illinois, Tennessee, Alabama and Georgia.

Refer to the top of this infographic.

Question:

What is a bankruptcy trustee? This term is commonly used when bankruptcy is being discussed.

Answer:

The trustee is automatically appointed from the panel and the trustee is the person who administers the case by reviewing the debtor’s documentation

Question:

What type of debt will bankruptcy eliminate?

Answer:

Bankruptcy could eliminate credit card debt, unsecured loans and medical bills.

Question:

What type of debts CANNOT be erased with bankruptcy?

Answer:

Bankruptcy WILL NOT eliminate child support, spousal support and most tax debt.

Question:

What does the term “Discharge” refer to when it comes to bankruptcy?

Answer:

Bankruptcy discharge, also known as bankruptcy injunction, is an order from the court permanently disallowing any creditor to attempt to satisfy a debt against a person or business.

Question:

How does bankruptcy affect your credit?

Answer:

Bankruptcy will lower and make it very difficult to rebuild your credit score. Lenders are likely to deny you for future loans including car and home loans if they see that you have bankruptcy on your credit report. Or if you do get approved for future loans, you will most likely be given the highest possible interest rates, and high interest can cost you thousands of dollars.

Try this debt relief program calculator and learn about bankruptcy alternative options.

Question:

What is the difference between Chapter 7 & 13 Bankruptcy?

Answer:

Chapter 7 bankruptcy is when your property is liquidated or sold, to cover your debts. Chapter 13 bankruptcy is when your debt payments are simply reorganized in order to make the payments easier for you to pay over 3-5 years on average. Both types of bankruptcy will drastically damage your credit.