Student loans, IRS, and credit card debt forgiveness programs are rescuing millions of Americans as creditors resume monthly payments that were temporarily paused due to COVID-19. Nearly 40% of those with a household income below $40,000 reported a job loss in March, according to the Economic Well-Being of US Households report. As of May 12th, approximately one-third of people surveyed in the United States lost 10 to 25 percent of their income over the past 4 weeks due to the coronavirus pandemic.

- Credit card companies are resuming payments as of May, and some in June.

- Student loan lenders are offering 0% interest and no payment until September, but then payments will resume.

- The IRS has extended its tax deadline until July 15, 2020. At that point, you’ll have to file and pay federal income taxes that were originally due on April 15. No late-filing penalty, late-payment penalty or interest will be due, but you’ll still have to pay your entire balance.

You do have an option to make your bills affordable to pay, you can apply for a debt forgiveness program. Here are three debt forgiveness programs to address credit card and unsecured debt, student loans, and money owed to the IRS.

What are debt forgiveness programs?

Debt forgiveness programs help you pay off your bills and collection accounts for less than the full balance owed, resulting in a portion of the debt getting forgiven. Debt forgiveness programs are not all the same, depending on the type of debt you have. We’re about to explain each program.

Unfortunately, you can’t combine all of your debt into one program, you have to get approved for separate programs for each type of debt.

1. Student Loan Debt Forgiveness Programs:

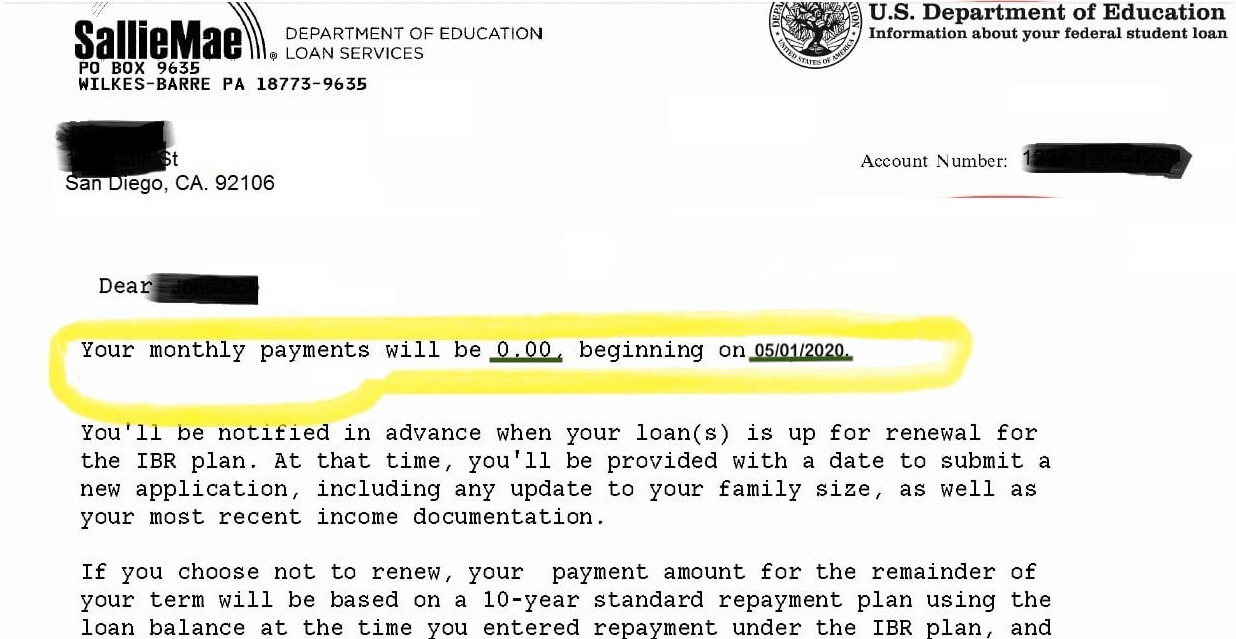

When it comes to student loans you can consolidate and get on an income-based repayment (IBR) plan. The IBR does offer student loan debt forgiveness. If you have a public service job, like police officers and teachers, you can qualify for loan forgiveness in only ten years through the Public Service Loan Forgiveness (PSLF) program. For anyone else, you can qualify for student loan forgiveness in 20-25 years.

With student loan income-based repayment plans, your payments can get reduced to as low as $0 per month.

CLICK HERE FOR INSTRUCTIONS ON HOW TO GET STUDENT LOAN DEBT FORGIVENESS.

Every year you’ll need to recertify for an income-based repayment plan until you’re eligible for loan forgiveness. In addition to recertifying you’ll need to submit your employment certification form every year if you’re approved for the PSLF program.

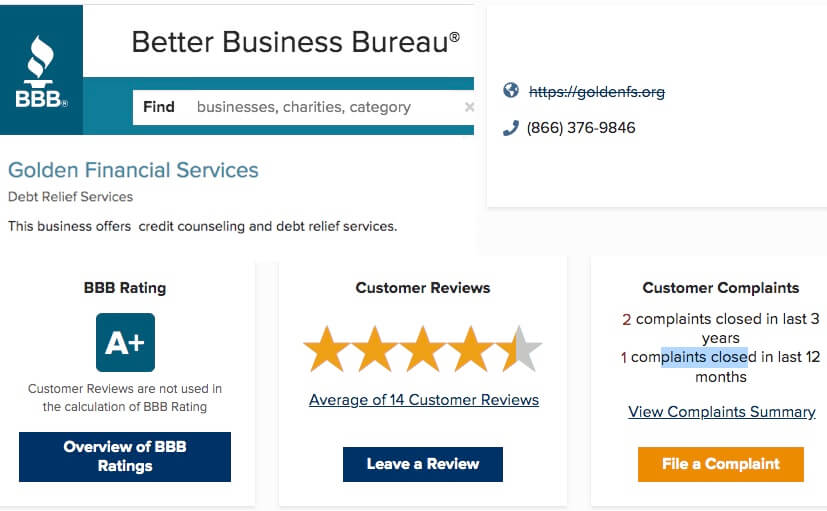

Need Help? Contact Golden Financial Services for debt assistance at (866) 376-9846.

2. Credit Card Debt Forgiveness Programs

If you can’t afford to pay your credit cards and fall behind on payments, eventually the credit card companies will write off the debt. After the credit card company writes off a debt, at that point they wipe their hands clean of the debt and sell it to a collection agency. This may sound horrible, but this situation can be turned into a positive by using credit card forgiveness options or debt validation.

Collection accounts can get settled for less than the full amount where a portion of the debt gets forgiven. To get an estimate on how much money you can save through debt forgiveness programs click here.

Are there downsides with debt forgiveness programs?

A downside to debt settlement is that after a debt is settled and paid, the late and collection notations can remain on a person’s credit report for up to seven years. You can owe taxes on the forgiven portion of the debt. It is unlikely but creditors could sue you over an unpaid debt. And there’s no guarantee that creditors will settle for a certain amount. Through Golden Financial Services we can set you up on a debt settlement program where no fees get charged until after the debt is settled and paid, but debt settlement should only be a last resort.

Before settling a debt, Golden Financial Services recommends applying for a debt validation program.

Benefits of validation over settlement:

- no tax consequences if invalidated

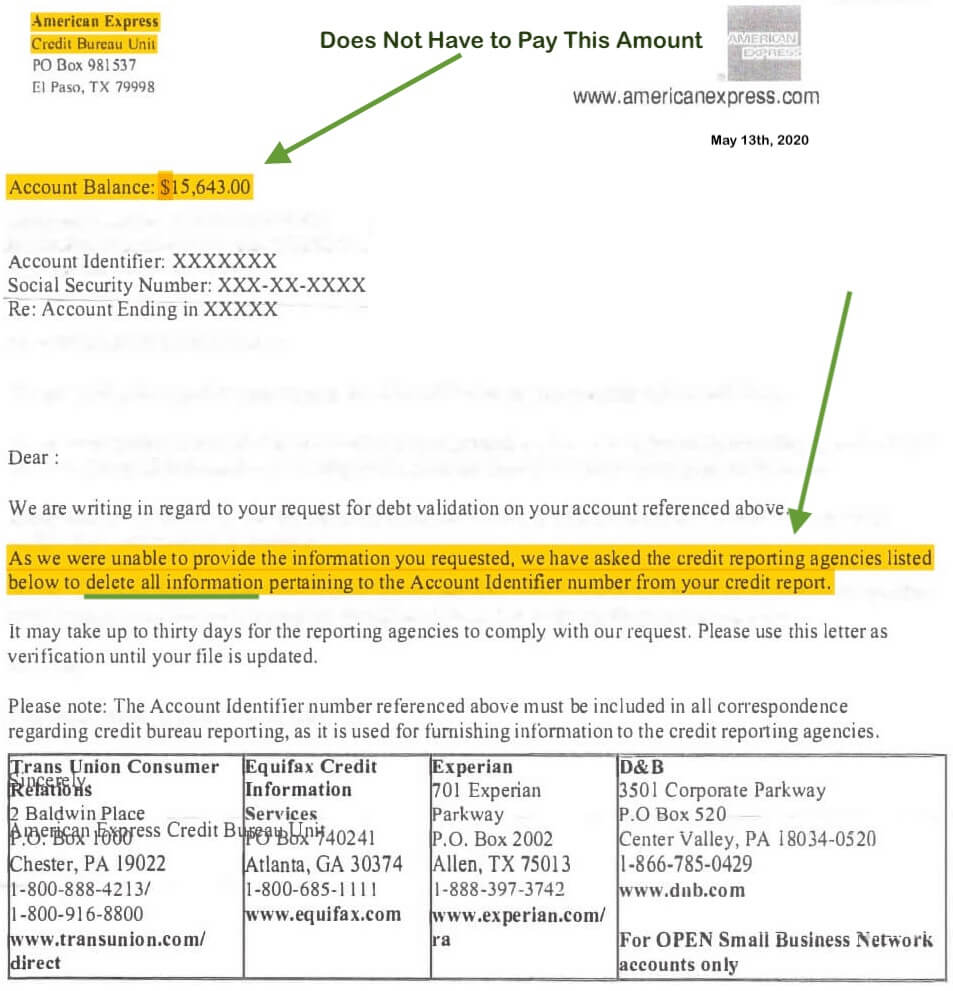

- could get removed from credit reports (as shown in the example below)

- less expensive, due to the debt not having to get paid if proven legally uncollectible

- money-back guarantee included

COMPARE THESE TWO DEBT RELIEF PROGRAMS SIDE BY SIDE BY CLICKING HERE:

Here’s an example of debt validation, disputing a debt, making it legally uncollectible (does not have to get paid and getting removed from credit)

Call Golden Financial Services Toll-Free at (866) 376-9846 to see if you qualify for a credit card debt forgiveness program.

If you don’t want to join a debt relief program, check out the 10 Best Ways to Clear High Credit Card Debt by click here.

3. Coronavirus (COVID-19) Tax Relief

The IRS’s People First Initiative offers tax debt relief for taxpayers with Offers in Compromise.

An offer in compromise is the same as debt settlement, you can settle your tax debt for less than the full amount you owe. You do need to have a financial hardship to qualify. CLICK HERE TO LEARN ABOUT IRS DEBT FORGIVENESS OPTIONS & HOW TO APPLY