How to Choose a Credit Card Relief Program

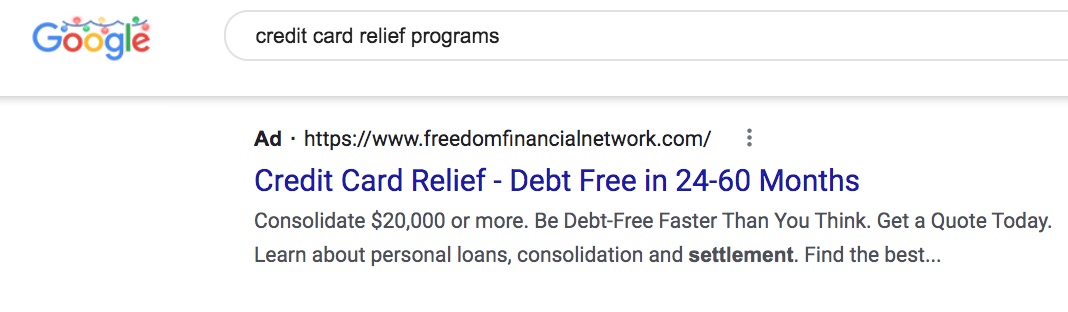

Credit card relief programs advertised on the internet scream out to consumers, “Get Out Of Debt Fast and Consolidate. Be Debt-Free in 24-60 Months.” From California to Texas, to New York, debt relief programs are going viral online. Pandemic forbearance helped consumers avoid falling behind on credit card payments, but now that stimulus debt relief and forbearance ended, consumers are drowning in debt, and many are ready to jump at the first thing they can grab.

The Danger of Clicking on Top Internet Ads That Advertise Credit Card Relief

Unfortunately, these top internet ads only contain a short title and description, neglecting to be transparent about what they’re selling. And consequently, most of the time consumers end up using the wrong solution. Credit card settlement programs can be a viable option, but there are better options to first consider.

And before anything, understanding the potential downsides of each credit card relief program needs to be at the forefront. Potential downsides are just that, they are potential downsides that can derail you from the path that you’re traveling to become debt-free. However, if you know how to deal with these obstacles along the way and are equipped with the tools to do so, you can successfully get out of debt through any one of the following credit card relief programs.

The following guide provides details about how each credit card relief program works, the fees that debt relief companies charge, and red flags to watch out for.

Don’t skip a word. This is your financial well-being at stake, and we’re about to give it to you straight.

Understand the Details Inside a Credit Card Relief Agreement.

Before you sign up for a credit card relief program, make sure you read and understand the program agreement. Do not just electrically sign it real quick because a fast-talking salesperson tells you to do so.

When it comes to a credit card relief program agreement, make sure to fully understand:

- How creditors get paid (i.e., in one lump sum payment or monthly)

- From each monthly payment, how much goes to creditors versus the program’s fees

- The total cost of the program

- How fees are collected (e.g., only after a debt is settled and paid, up-front, spread over every monthly payment)

- The downsides of the program (e.g., effect on credit)

- If there is a guarantee or assurance of performance

Some additional questions to ask before signing up for a credit card relief program:

- Is it a loan?

- What’s the APR?

- Is it debt settlement?

- How much will you pay in total?

- How much is the total fee? Some companies charge a percentage of the total debt enrolled. Other companies will charge a percentage based on the amount saved.

- Will your credit card interest rates get reduced?

- Will your creditors get paid monthly? And if not, when and how much will they get paid?

- What will happen to credit scores?

When are the fees collected on a credit card relief program?

Legally, debt settlement companies can only charge a fee after the debt is settled and at least one monthly payment has been made towards the settlement. So, therefore, debt settlement programs should not charge any fees until after clients get results.

Golden Financial Services can set you up on an FTC-compliant debt settlement program. Call today at (866) 376-9846. Our IAPDA certified counselors can help you get approved on the right program for free.

Credit card consolidation loans and balance transfer cards may charge an up-front loan origination fee, interest rates, and late fees. Understand all of these fees and more importantly, understand how to avoid paying fees and reduce the cost of a loan. For example, with credit cards, if you pay the balance in full every month you can avoid paying interest.

Non-profit consumer credit counseling companies get paid by creditors and in addition, they can charge clients up to $50 per month. Understand all fees associated with a consumer credit counseling program.

Can you get sued on a debt settlement program?

There is a chance that you can get sued by a creditor before the company’s debt negotiators get you a settlement. What will the debt relief provider do to help resolve the summons? Make sure they are clear and transparent about this subject. Also, make sure they have a clear plan of action to resolve a credit card summons. Debt negotiation programs can result in clients getting sued over credit card debt, that is a fact.

However, some companies have more experience dealing with a summons than other companies. A summons can easily get reduced and settled. But if ignored or not responded to in a timely manner it can turn into a credit card judgment, wage garnishment, or your assets being frozen.

How reputable debt negotiation companies deal with a summons

A credit card summons automatically should become the priority debt that needs to get settled because there’s a court date attached to it. Therefore, a settlement company should respond to the summons, for example, they may file an extension to the court date within the deadline date. Check the paperwork and verify that your debt negotiation lawyer filed the response prior to the deadline. Get that verification in writing by email so that you have proof to show the judge if the debt settlement company fails to do its job.

Having that extension and more time gives debt negotiators a chance to work out a settlement with the collection agency before the court date, resolving the debt prior to court so a client never has to see the courtroom.

A reputable debt negotiation attorney will carefully review the summons looking for errors or legal violations. The lawyer will use any violations as leverage to negotiate a more attractive settlement or could file for debt dismissal. Only an attorney can advise you on this matter.

Is a Credit Card Relief Company Being Transparent?

Debt relief companies aren’t always transparent with clients. Instead, they tell you what you want to hear.

Thoughts to consider before joining a credit card relief program:

Do you understand the processes that they will use to reduce your debt?

What guarantees are there?

What are the potential downsides?

What happens if a creditor issues you a summons for court? How will it be dealt with and resolved?

Questions to ask:

How does the program reduce my interest rates?

What happens if creditors disagree with the debt settlement offer? What is the alternative debt relief plan?

How are creditors paid (i.e., monthly or in a lump-sum payment)?

What is the total interest that will get paid over the entire program?

What is the breakdown of all fees, including the total cost? (Understand how much goes to creditors versus the program’s fees)

***Verify the numbers match up inside the program contract to what they told you over the phone***

What type of license does your company have? (Verify their license)

How long have you been in business?

What is your Better Business Bureau (BBB) rating?

What other debt-relief options do you offer?

Your obligation in a credit card relief program:

In some cases, the failure of a debt relief program to work is the consumer’s fault because they didn’t listen clearly during their initial debt consultation.

Now I know, folks, you probably don’t want to hear this, but this guide speaks the facts and the truth. Perhaps, the consumer had the news on during the entire phone call with the debt counselor and selectively listened to only the parts they wanted to hear during their initial consultation. They hear the part about how low the monthly payment will be.

Then to make matters worse, the consumer doesn’t carefully read the program contract. Instead, they quickly click on each button that says “sign,” “sign,” and “sign,” electronically signing the program client agreement and not reading a word of it.

Then during the compliance call, disclosures are reiterated, and the consumer must confirm they understand each one; they say “yes, I understand, yeah, yeah,” but not listening to a single word all along.

Then, six months later, they receive a lawsuit, panic, and demand a refund, then go online and submit complaints about the company. The consumer could have completed the program successfully and resolved the summons that they received if they only listened during the part of the consultation when being enrolled that explained the lawsuit defense.

Credit Card Relief Program Red Flags to Watch Out For:

- Companies guarantee to settle a debt at a certain percentage rather than giving estimates based on past client results. Companies cannot guarantee an exact amount that debt will get settled (i.e., your savings).

- Companies fail to emphasize what happens if you get sued by a creditor. Companies should be transparent that you could get sued while on the program and explain how the lawsuit would get resolved.

- Companies fail to clearly explain all fees, including the APR getting charged and how the fees are collected (i.e., upfront or in monthly payments).

- If a company’s website is purely promotional without proper disclosures illustrating both pros and cons.

- Companies only explain one program rather than giving you all debt relief options.

- If you find lots of negative online reviews about a company.

- Companies with only five or fewer years in business.

- Debt settlement companies that can’t produce a debt settlement license.

- Consumer credit counseling companies not listed on the Department of Justice’s (DOJ) website. If a company is a licensed and non-profit consumer credit counseling company, it will be listed on the DOJ website.

- Debt consolidation lenders that are not transparent about interest rates and fees (view the fine print in the agreement they provide you and specifically look for fees or costs that they didn’t explain).

Verify everything.

Credit Card Relief Program Fees:

Debt relief companies cannot charge up-front fees.

It’s against the law.

“The ban on advance fees reflects changes that the Federal Trade Commission made to its Telemarketing Sales Rule.”

Consumer credit counseling companies can charge a monthly fee of up to $50.

Average fees that debt settlement companies charge:

Debt settlement companies often charge anywhere from 15%-25% of the total debt enrolled into the program. Alternatively, settlement companies charge a percentage of what they save the client.

For example, settlement companies may charge 25% or more of the savings. So if you enroll in debt settlement and end up paying a total of $75,000 for $100,000 in debt, your savings would be $25,000. So in this example, the fees would come out to $6,225.

What are credit card relief programs available in 2022?

There are several different credit card relief programs that consumers have available. Unfortunately, none of these options include government credit card relief.

Programs available in 2022 include:

- consumer credit counseling

- debt settlement

- debt validation

- debt resolution

Consumer credit counseling companies should be licensed and non-profit. Debt settlement companies are private companies, but they are also required to be licensed in the state they operate.

You can find a directory of non-profit consumer credit counseling companies listed on the Department of Justice’s website. Here is a list of non-profit consumer credit counseling companies: https://www.justice.gov/ust/list-credit-counseling-agencies-approved-pursuant-11-usc-111

Unfortunately, consumer credit counseling programs are the least popular option because they are the most costly and take the longest to complete.

Summary of the best credit card relief programs for consolidating debt:

- Consumer credit counseling (CCC) reduces interest rates and consolidates payments into one. CCC is not a loan. Instead, negotiators work with your creditors to lower interest rates. With this program, consumers remain current on credit card monthly payments minimizing any negative credit effect.

- Debt settlement negotiates credit card debt balances to be lower and more affordable. However, you will have to fall behind on monthly payments for credit card modification to be an option.

- Debt resolution incorporates multiple attorney-based debt relief strategies to resolve debt at the most affordable rate and utilizes debt validation for the most favorable outcome in terms of savings and minimizing negativity on credit reports.

- Debt validation uses federal laws to challenge the validity of a third-party collection account. This option aims to invalidate debt, so it does not have to get paid. Another benefit of debt validation is invalidated debt cannot legally remain on a person’s credit report. This option can save consumers the most money because creditors don’t get paid anything after being invalidated. The consumer could end up only paying debt relief program fees.

What is the best credit card relief program all around?

Debt resolution is the best option because:

- multiple debt relief strategies are built-in one program, including debt validation and debt settlement

- included is lawsuit defense by an attorney

- it offers the best overall savings out of any program

- the program contains legal protection from an attorney

- it can result in the removal of the debt, collection account, and late marks from credit reports

- monthly payments are lower than what they would be with consumer credit counseling and debt settlement

- Most unsecured debts qualify.

The best credit card relief program will depend on your situation and goals.

Is your goal to stay current on the credit card monthly payments?

If staying current on monthly payments is your primary goal, you don’t want to enroll in a debt settlement program.

If a person’s goal is to stay current on credit card monthly payments, consumer credit counseling could be their best option.

Speak to a debt expert or experienced credit counselor for debt assistance at (866) 376-9846.

Common misconceptions about credit card relief programs:

- In many cases, consumers sign up for debt settlement, thinking it’s a loan. Debt settlement is not a loan.

- People believe debt settlement helps their credit score. It does not.

- People may sign up for debt validation thinking their creditors are getting paid monthly. Instead, a validation program challenges the legal validity of a debt, forcing the collection agency to prove they are legally authorized to collect the debt.

- Consumers think debt settlement programs make payments to creditors monthly. However, debt settlement programs do not make monthly payments to creditors. Instead, settlement companies pay creditors in one lump sum payment, and only one creditor at a time gets paid over the three to a four-year program.

- People often think paying minimum payments on maxed-out credit cards is helping their credit, and they avoid a debt relief program to continue on this path. Unfortunately, the credit utilization ratio makes up 30% of a person’s credit score. Maxing out your credit cards is one of the most damaging actions you can take for your credit. First, you have no available credit on a maxed-out card. Second, if you pay minimum payments on maxed-out credit cards, you’re choosing the slowest route to improve your credit score.

Should you use a credit card relief program or continue paying minimum payments?

If you can only afford minimum monthly payments, you won’t get out of debt quickly. Credit card companies want you to pay the minimum credit card payment.

The insight you should know about how credit card companies operate:

The following information is good to know. Use this information to your advantage.

We’re going to tell you how credit card companies make the most money so you can avoid going on this path.

Creditors don’t want you to pay off your balance in full because they won’t make any money by you going that route.

For example, credit card companies make money when consumers carry a balance by charging interest. And they also make money by charging annual fees.

Credit card companies make the most money when consumers have maxed out credit cards and pay the minimum monthly payment. So that’s what they want you to do.

However, there’s a fine line, they can’t issue you more credit than what they believe you can afford to pay, or you’ll fall behind on payments. So they will increase your credit limit to get you to raise your balance to the highest possible point before you can’t afford to pay it off. Because the higher the balance that you carry over to the next month, the more interest they can charge.

Therefore, if you can only afford to pay minimum payments, you need to find a better solution. Don’t fall victim to the credit trap.

Is a credit card settlement program worth the hit you’ll take on your credit?

Consider the following scenario:

You enroll in debt settlement to pay off $20,000 in credit card debt.

Your credit score falls from 750 down to 615.

However, you become debt-free in three years.

You also only end up paying $13,500 to resolve your entire debt by settling.

Debt Settlement Vs. Paying Minimum Payments

Compare that to if you continued to pay minimum payments on the credit cards. Then, you would pay over $30,000 with interest over the next ten years, which is how long it would take to pay off your debt.

So in total, you’re saving well over $15,000 by using debt settlement. Then suppose you invest the savings every month into an index fund through an IRA. Within five years, that $15,000 grew to $25,000.

You’re also using and paying in full one of the cards you left out of the program every month. In addition to that, you’re making monthly payments on your student loan and car. All that positive payment history is getting established while enrolled on the debt settlement program.

Within five years after enrolling in a debt settlement program:

- Your credit score is back up to 750

- You have no debt.

- You have $25,000 saved up in a Roth IRA.

Is the debt settlement program worth it in this example?

For most people, yes, it would be worth it. Of course, the consumer could have done even better if enrolled in a debt resolution program, but even so, debt settlement is worth it in this case.

The key is, you have to have a long-term financial plan in place to rebuild your credit score, save the maximum amount of money and ensure your program is successful.

Click Here to Compare Benefits Vs. Downsides of Each Credit Card Debt Relief Program.

A detailed explanation about negotiating debt settlement with credit card companies

After you fall behind on credit card payments, each of your creditors will write off the debts within about six months, or they may sue you before that timeframe.

The original creditor wipes their hands clean of the debt after it’s written off. By doing so, they get reimbursed through tax credits. Credit card companies write off credit card debt just like a person writes off certain expenses, like mortgage interest, or how a person would deduct stock losses to reduce personal income.

Are creditors losing money when you stop paying your credit cards?

Nope, not a dime. Creditors recoup 100% or more of the debt. They write it off and get full reimbursement through a tax credit and banking insurance. And they generate additional profit by selling the debt to a third-party collection agency.

Collection agencies can buy credit card debt for much less than the entire balance (e.g., sometimes as low as ten cents on the dollar).

Consequently, collection agencies settle a debt with the consumer for much less than the total balance owed.

But there’s no guarantee that they will settle for a certain percentage.

Will debt settlement pay my creditors monthly?

Debt settlement programs set clients up with a low monthly payment. But that payment gets deposited in a trust account or a special purpose savings account, not going to creditors.

So your creditors don’t get paid monthly payments.

Instead, the monthly payments accumulate in the trust account.

As funds accumulate, the debt negotiators begin negotiating with each collection agency. The goal is to get your debt reduced to the lowest possible payoff amount.

You will be contacted about the goods news when a creditor is ready to settle. First, you must agree to the offer, and then that’s when the funds are released from your trust account and paid directly to the creditor. If you want a better deal, you can reject the settlement offer and wait longer.

Sometimes, just by making creditors wait longer to get paid, you’ll end up getting a better deal, but other times, by not taking action, you could end up getting sued.

One by one, each debt gets negotiated, settled, and paid. The process continues until you’re debt-free.

How credit card debt settlement affects credit scores

Your debt to income ratio can improve throughout a debt settlement program. Credit scores will continue to go down over the first year, however.

After credit card debt gets reduced with debt negotiation, it shows on the consumer’s credit report as “settled for less than the full amount,” “paid as agreed,” or “settled in full.” Your credit score won’t benefit from any of these notations. Your credit score will only improve if the debt and its entirety (i.e., late marks and collection account) get removed from your credit report.

According to Experian: “Settled Accounts Remain on Your Credit Report for Seven Years.” The late marks and collection account will not get removed from your credit report after a settlement unless you dispute the debt or the collection agency requests for it to get deleted.

How to get a debt, late marks, and collection account removed from credit reports after settling:

Debt collection companies don’t request for the debt to get removed from your credit report after it’s settled and paid. That would require them to do extra work. They’d have to contact the credit reporting agencies and make this request.

Unless, of course, you or your debt settlement lawyer specifically asks the collection agency to request the removal of the debt from your credit as part of your settlement. Best case, you get the collection agency to agree to these terms.

Negotiate this clause into the terms of your debt settlement.

Alternatively, after a collection account is settled and paid, you could dispute the notation from your credit report on your own. Hopefully, the collection agency will ignore the dispute because they have been paid already.

You see after a debt collection account gets disputed from someone’s credit report, the credit reporting agency contacts the collection agency asking for them to verify the debt. If the collection agency fails to respond within 30 days, the debt and its associated marks get removed from your credit.

You can dispute information on your credit report for free on Experian.com.

FDCPA Law Could Result in Debt Dismissal

After joining a debt settlement program, an attorney will contact all your creditors, notifying them that you have attorney representation. Creditors can no longer contact you after they receive this notification.

If a creditor contacts you illegally, your attorney can sue them for violating the Fair Debt Collection Practices Act (FDCPA). Sometimes creditors agree to dismiss a debt at that point rather than losing a lawsuit for breaking the law. So legal violations become negotiating leverage when on a credit card reduction program.

Are you considering debt negotiation? Debt settlement can reduce balances allowing consumers to pay only a fraction of the debt. Explore your options with Golden Financial Services today, the top-rated credit card relief company. Reviews about the top ten credit card relief companies are illustrated at TrustedCompanyReviews.com.

5 Downsides to Know About With Debt Settlement:

- There is no guarantee that creditors will settle a debt for a certain percentage, and credit scores will continue to go down over the program’s first year because creditors don’t get paid monthly.

- Do you want a guarantee of exactly how much you will pay on a debt settlement program? Unfortunately, no company can give you that guarantee. There are no guarantees with debt settlement. Instead, you protect yourself by ensuring to sign up with a performance-based company, one that only charges you a fee after each debt gets settled. Or, some companies will charge you based on how much they can save you. In this case, their motivation is to save you the most money possible because that’s how they earn more. However, companies that charge based on the savings often charge the highest fees.

- You could get sued while on a debt settlement program. However, experienced debt settlement companies know how to deal with a lawsuit. An attorney will first intervene. They review the summons to find inaccurate information, missing documentation, or legal violations. Second, an attorney could file for dismissal of the debt. Finally, as a last case scenario, the attorney will negotiate a settlement with the collection agency to resolve the debt before the court date.

- Balances rise after joining a debt settlement program because late fees and interest accumulate. Therefore, don’t join a debt settlement program and quit six months later because you’ll end up in worse financial shape, with more debt than you started.

- You must pay taxes on the savings from a debt settlement. Therefore, the amount a person saves on a settlement is considered taxable income. However, you can file certain IRS forms that any accountant could help you file to illustrate insolvency and eliminate the tax debt.

Learn About a Debt Resolution Program

A much more effective credit card relief program is debt resolution.

What is debt resolution?

This plan uses federal laws to dispute and challenge the validity of a debt.

When collection agencies can’t validate the debt, it becomes legally uncollectible. And a legally uncollectible debt does not have to get paid. It also cannot legally remain on credit reports.

How debt resolution resolves a debt and gets it off credit reports

After each credit card debt is proven to be legally uncollectible, an attorney will dispute the debt from credit reports to get each debt and its associated negative marks removed entirely from credit reports.

With a debt resolution program, only if an account is validated will the attorney negotiate a settlement. But most of the time, the debt gets invalidated and does not have to get paid.

Consequently, debt resolution saves you more money and offers benefits for your credit, over debt settlement as a credit card relief option.

Think of debt resolution like if you were to get a speeding ticket. You could plead guilty and pay the ticket. However, your insurance will cost more in the future, and you’ll have this ticket show up on your DMV record.

Or, you could hire an attorney to dispute the ticket and get it dismissed. Debt validation acts similarly in this way; rather than agreeing to the debt, you’re challenging its validity and working on getting it invalidated.

Learn the Consumer Credit Counseling Process

Consumer credit counseling is the only credit card relief program that allows you to stay current on monthly payments.

Non-profit consumer credit counseling companies have relationships established with credit card companies. These relationships allow credit counseling companies to consolidate your credit cards, getting lower interest rates.

You pay the consumer credit counseling company a single payment every month. From that payment, they disperse payments to your creditors but at a lower interest rate allowing you to become debt-free faster.

Interest rates are reduced, resulting in a lower monthly payment.

Main benefits of Consumer Credit Counseling

- save money on interest

- minimal impact on credit

- debt free faster than paying minimum payments on maxed-out high-interest cards

- avoid late marks on credit reports

- get past due payments re-aged to show current

- no creditor harassment

Compare the savings you can get on each program using this debt calculator.

Downsides of Consumer Credit Counseling

- close to a five-year program and no way to speed it up

- it will show up on credit reports that a person is enrolled in consumer credit counseling

- only credit cards qualify

- the entire balance needs to get paid back with interest

- there is minimal reduction in monthly payments

Another point to consider is that credit counseling companies work for creditors. Therefore, it’s the creditor’s best interest that a consumer credit counseling company has. They help creditors get paid in full.

Credit card consolidation loan

Credit card consolidation is a loan, not a debt relief program. If you’re looking for a loan, visit a few local credit unions nearby. Debt consolidation loans through a credit union can offer the lowest interest rates and fees.

Especially if you already have a checking account, mortgage, or car loan with a local credit union, that existing relationship will help you get approved for a debt consolidation loan. In addition, you can get credit card relief using a low-interest loan because you can pay off all of your high-interest accounts with that loan and save money.

You may want to consider taking out a home equity line of credit and using that to pay off your high-interest credit cards but beware of the danger involved. You’re swapping unsecured debt (i.e., credit cards) for secured debt. The benefit is that a home equity line of credit has a low-interest rate, often around 5%, and that’s much lower than the average interest rate for credit card bills.

Avoid online lenders that charge high up-front loan origination fees. And beware of balance transfer cards that charge up-front fees that can cost above 5% of the total debt getting transferred to the card.

A $50,000 Debt Consolidation Loan Can Cost You $121,531.10 in Interest Over 11 Years. Click here to learn about the risks of debt consolidation.

Last but not least, people are wondering about Christian credit card relief programs.

There is no special debt management license for Christian debt relief programs.

These companies that call themselves “Christian credit card relief companies” are operated by Christians. And that’s all there is to it.

Christians use their religion for marketing their debt relief program. Credit card relief programs are no different when using a Christian-based company.