APR (Annual Percentage Rate) can quite literally make or break the value of a mortgage, loan, or credit card balance. Put in the simplest of terms, APR is the term that refers to the interest you’re being charged to borrow money. It is essentially what you are paying to the lender for the service of the loan. APRs can be calculated as simple or compound interest, and rates will be classified as either fixed or variable.

Understanding how APR works can greatly help you determine whether a loan is worth its weight, or whether you can survive the loan by making the payments on time without getting further into debt. Think of APR as an adversary on a battlefield: If you continue to keep your enemy on their side of the field without advancing, you will never have to deal with falling behind in the fight. In other words, if you continue to pay down the full balance on your credit cards monthly, you will never have to pay interest when “borrowing” money.

However, for those in heavy debt, paying down the full balance monthly is simply not an option. These are the types of battles that last years, not days, and a solid understanding of APR is therefore crucial for battle success. Here are some tips, and what to know about APR.

What is a good APR?

APRs are adjusted for inflation, so the best rate you can receive now might not stick, and it might rise over time while still being considered a rate that benefits the borrower rather than the lender (although obviously anything over 1% is a payment to the lender).

According to TheBalance.com, “The national average credit card APR is 15.09%, according to a February report from the Federal Reserve. On accounts assessing interest, the average is 16.91%. An APR below the average of 17.57% would be considered a good APR.”

Realistically, ideal APR is therefore between 15%-20%. However, those with high debt numbers will likely be in the 25%-30% range. That is potentially double the lower percentage rate enjoyed by those with excellent FICO credit scores. If you are paying attention, you will quickly notice that the system is set up to reward those already ahead of the game with great credit scores. These are the people that are least likely to default on loans and credit cards and are therefore more trustworthy than others. The goal for those with high debt numbers would be to devise a strategy to free up cash flow, thereby increasing their credit score, and lowering APR on all types of loans. They are absolutely tied together (APR and credit score success), so increasing your credit score goes hand-in-hand with decreasing APR.

What is 24% APR on a credit card?

Simply put, a 24% APR means you are paying an additional quarter’s worth of your remaining balance at the conclusion of the billing period, which is almost always 30 days. Get familiar with the billing period of each of your credit cards. They sometimes follow a calendar 30 days, and often your billing statement will arrive in the middle of the month as it takes the credit card company or lender about two weeks to calculate interest and finalize your statement.

An APR of 24% isn’t *that* crazy, but it isn’t great either. A 24% APR is usually offered to someone with a credit score in the 650-750 range, but can be obtained with aggressive offers for those with a credit score around 625. Here is how a 24% APR will affect your monthly credit bill, according to ValuePenguin.com:

“…imagine that your total outstanding credit card balance is $1,000, with a minimum payment of $100. Of that balance, $500 is accumulating 15% interest, and the other half has an interest of 24%. If you write a check for $500 to your bank as payment, $100 will go towards paying the 15% balance, while the other $400 will pay down the 24% balance.”

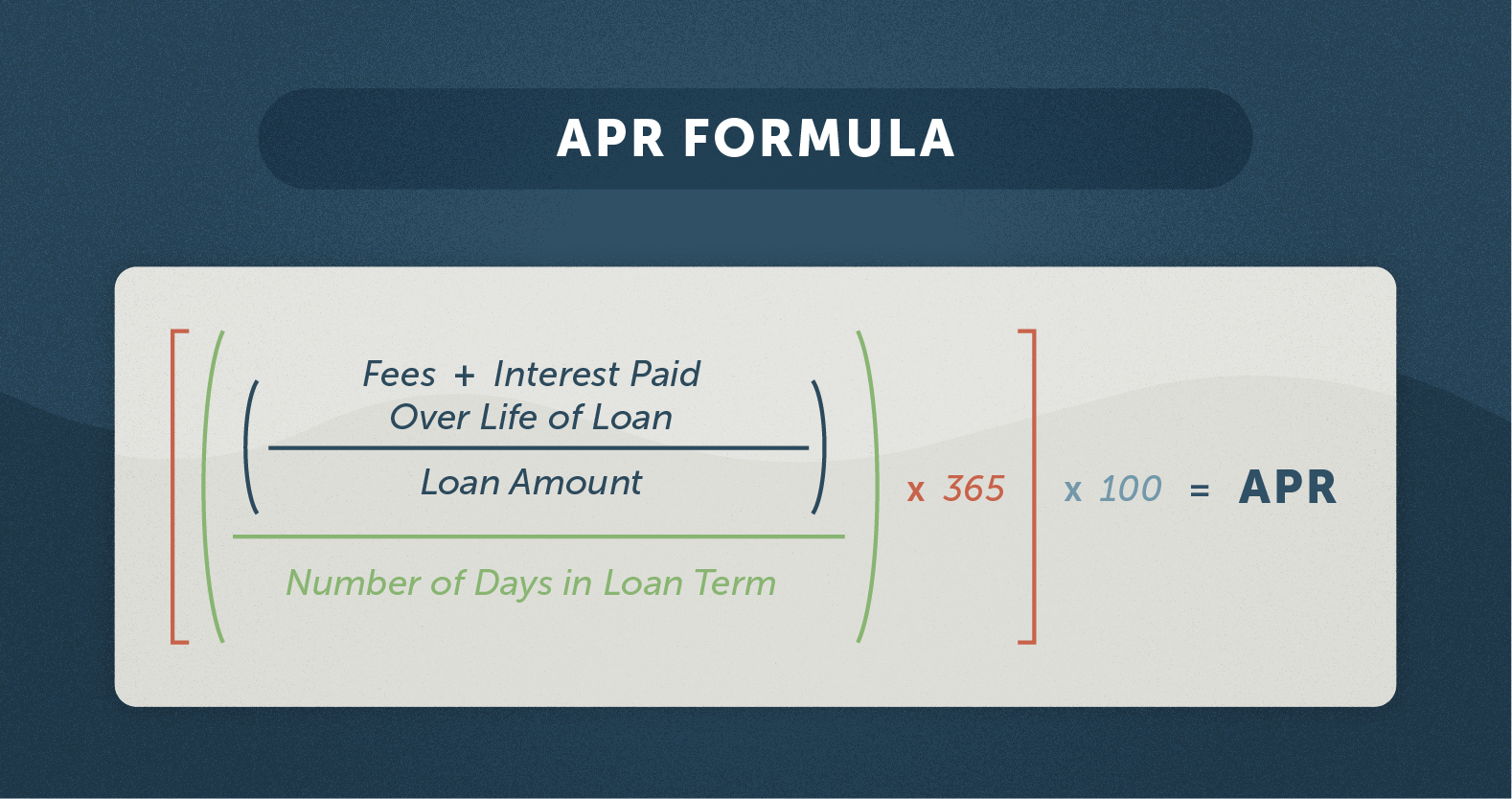

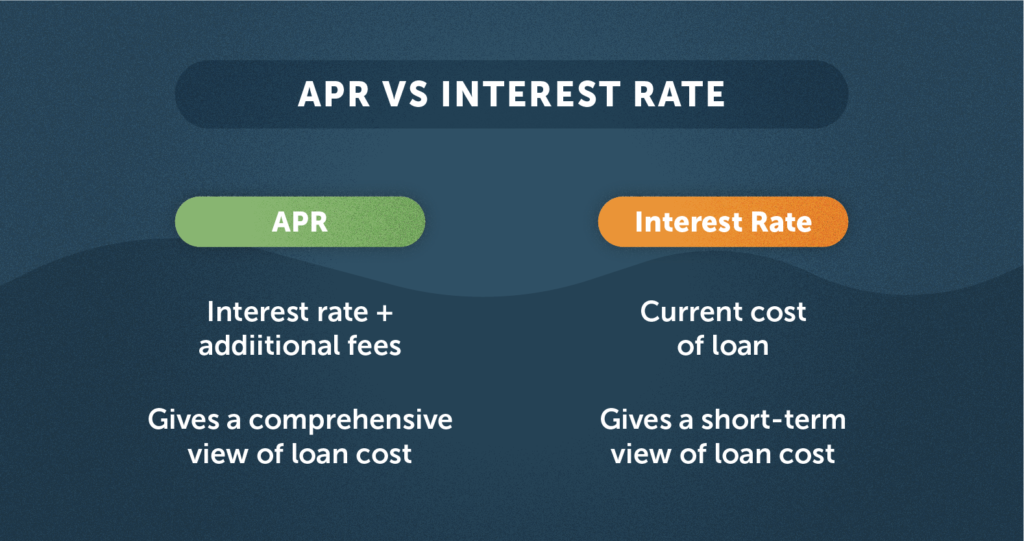

What is APR vs Interest Rate?

Interest Rate is the cost of borrowing the principal loan amount. The rate can be variable or fixed, but it’s always expressed as a percentage. Doing the math means comparing the agreed-upon amount of the loan, minus one-time service fees, to the percentage rate of interest. This determines the total loan amount.

APR is a broader measure, most often used in mortgage terms, of the cost of a mortgage because it includes the interest rate other costs such as closing costs, broker fees, and other things like discount points, expressed as a percentage.

BankRate explains why you may encounter both of these numbers when applying for a mortgage: “Both the APR and the interest rate are ways for consumers to comparison shop as well as determine the affordability of the loan. The interest rate is determined by prevailing rates and the borrower’s credit score.” BankRate continues, “For instance, the higher your credit score the lower your interest rate will be. Your monthly payment is based on the interest rate and principal balance, not the APR. The APR, conversely, is determined by the lender, since it’s composed of lender fees and other costs that vary from lender to lender.”

How to get the best APR on a loan

From NerdWallet: “The quickest way to get a lower APR might be to open a new card with a better rate or an introductory 0% period. If you’d rather stick with your current card, ask your issuer.”

Additional actions can be using the Snowball Debt Payment method to reduce your overall debt. This will free up cash flow while improving your credit score. Remember, the better the credit score, the lower the APR or interest rate. Knowing your budget is the place to start.

____________________________

If you found our blog looking for financial advice or assistance with credit card debt relief or debt consolidation, call Golden Financial Services today at (866)-376-9846 or info@goldenfs.org. You can check out the rest of our blog here, and do your research on our services here. Let’s talk soon!