Debt Validation Letter Template (Free Sample)

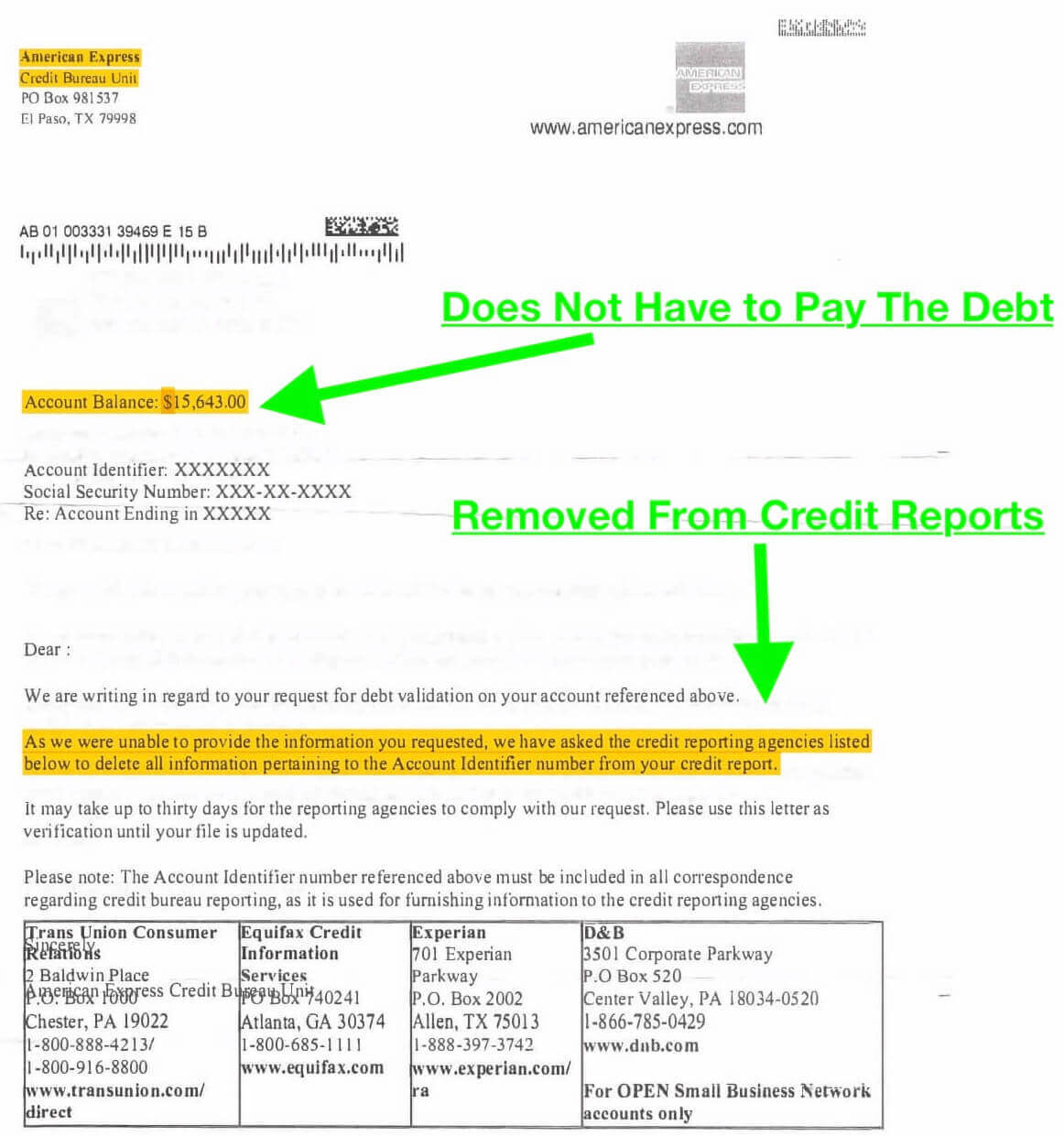

The following blog post shares a peek at the documentation sent out on a debt validation program (i.e., the debt validation letters and template) used to dispute a debt and get it invalidated. Debt is disputed using up to fourteen federal laws.

Here are some of the laws used inside the debt validation letters to dispute debt.

- The Truth In Lending Act protects consumers against inaccurate and unfair credit billing and credit card practices.

- The Fair Debt Collection Practices Act (FDCPA) protects consumers from abusive debt collectors. For example, creditors can’t harass a person, call them non-stop or call them after they’re notified that the consumer has attorney representation.

- The Fair Credit Reporting Act (FCRA) protects a person’s credit report from inaccurate, unfair, and unverifiable information. This law also gives consumers the right to dispute and have a legally invalidated debt removed from their credit report.

- The Credit Card Accountability Responsibility and Disclosure Act (i.e., Credit CARD Act of 2009) protects consumers from unfair credit card fees and deceptive and abusive practices by credit card companies. This law deals directly with the original creditor.

- The Fair Credit Billing Act (FCBA) gives consumers the right to dispute billing errors, including unauthorized charges and inaccurate information. Collection agencies must be able to verify and prove that the fees and charges they claim a person owes are valid. How did they come up with the alleged debt? They must be able to provide a detailed breakdown explaining and verifying each charge, including a full accounting trail that goes back to the original creditor. Are any of the fees being charged for services that the consumer never received or agreed to? Is the information, including amounts, dates, and your address, accurate?

The bottom line:

Over thirty pages of documentation get sent to a third-party debt collection agency in the initial round of disputes after a client enrolls in a debt resolution program. Below, we’re sharing just a few of these pages with the public to educate people on consumer protection laws.

The debt validation sample letters below should not be used on your debt. These debt validation letter samples are a small piece of the actual debt validation package. And a debt resolution program offers much more than debt validation.

For example, the GFS-recommended debt resolution program also uses an attorney and includes legal protection for clients.

After a client receives approval for the program, an attorney will contact each creditor, notifying them that the client enrolled in the program. If creditors violate any federal laws an attorney will represent the consumer helping them fight to get the debt dismissed and compensation. Some clients end up getting their debt dismissed, paying nothing on it, and also being rewarded compensation for legal violations committed by creditors.

So to be clear, we’re not recommending you use this information or attempt to invalidate debt on your own.

Do debt validation letters work?

A one-page debt validation letter could invalidate a small collection account that expired the statute of limitations. We can even recommend using this free debt validation letter creator for that scenario. However, if you have high credit card debt, we would not recommend trying to dispute your debt on your own. You’re likely to end up with a credit card lawsuit.

Of course, scams do exist that claim they can dispute your debt and get it dismissed with a single letter. But that’s a scam. You’re likely to end up getting sued, a judgment against you, and ruined credit for many years to come if you attempt to dispute high credit card debt with the information below. Click here to learn about the best debt relief programs available for 2022 to help you become debt-free, including the pros and cons that come with each plan.

Without further ado, let’s dive in and take a look at what’s inside a debt validation dispute package.

Page 1 of 31: Debt Validation Letter – Notice to stop communication and notice of debt dispute.

“Dispute of Account Name and Account # _______________, and claim against (debtor’s name)

To whom it may concern:

As the duly Authorized Representative of (Debtor’s name), I am writing to you to officially dispute the alleged debt of (Debtor’s name – Account # _______________), to determine if it is a valid, legally owed obligation based on a verifiable debt wherein mutual consideration was provided and a verified, and verifiable operational contract exists that is devoid of misrepresentation, mistake, error, or other invalidating causes.

There is reason to believe that this account may be one of the many in which some sort of misrepresentation, fraud, or illegal collection practices have, or are, taking place. Therefore, if you are not the person in your organization who should be receiving this communication, please forward it to the appropriate party or department.

As you may be aware, a recent Daily Finance report quoting a New York Times article states that financial companies like American Express, Citigroup, Chase, and Discover Financial have committed fraud in financial dealings, are using erroneous paperwork, have incomplete records, and their legal processes are faulty; this includes the information sent to debt collectors.

Many debt collectors are using erroneous information to collect on debts, are acting as creditors when they are not, or are not in a position to legally collect the debt for lack of a state license, incomplete records, or other reasons.

This dispute is made pursuant to the Fair Credit Billing Act, Fair Debt Collections Practices Act (FDCPA) codified in law at 15 USC §1692 et seq., Truth in Lending Act, Credit Card Act of 2009, and other applicable laws listed in the enclosed Notice and Demand For Verification of Debt.

I must demand proof this debt is a valid, legally owed obligation, devoid of invalidating causes such as mistake, misrepresentation, concealment of material fact, and the like, pertaining to a specific, actionable contract or other instrument bearing the signature of the Purported Debtor, a well as proof of your authority in this matter, and a full accounting of the debt including where the funds lent originated. Absent such evidence, you must cease collection activities.

To be clear, this is not a refusal to pay but a notice that your claim is disputed in accordance with various federal laws.

Please return the enclosed Debt Collector Disclosure Statement with answers to all questions therein and the documents demanded in the attached Notice and Demand for Verification of Debt to the notary listed below so that we can keep a clear commercial record of the dispute.

Failure to return the requested documentation proving the debt is a valid and legally owed obligation, that you are legally and contractually empowered to collect, and that no errors or other invalidating causes occurred throughout this account will be considered a stipulation of non-authority on your part and legal action may be taken should you proceed with collection activities without having first provided the specifically requested proof of verification, validity, and legality of the alleged debt.

“Communicating or threatening to communicate to any person credit information which is known or which should be known to be false, including the failure to communicate that a disputed debt is disputed, is a violation of § 1692e.”

Per the Fair Credit Reporting Act (FCRA), a United States federal law codified at 15 U.S.C. § 1681 et seq, you are defined as an “Information Provider” to the Credit Reporting Agencies (CRAs) and have a legal duty to provide complete and accurate information, including that a debt is disputed. Failure to accurately report the status of a debt may be a violation under § 616 (15 U.S.C. § 1681n), and Purported Debtor may recover the greater of either actual damages or a statutory minimum of $100 to a maximum of $1000, plus possible punitive damages, as well as reasonable attorney’s fees and costs.

Your failure to satisfy the enclosed demand for verification, validity, and proof of the alleged debt upon which you are collecting will be construed as your absolute waiver of all claims against (Debtor’s name).

Sincerely,

Signature

Debtor’s Name, Authorized Representative

Respond to:

Name of Notary

Re: Debtor’s Name

Attention: (Debtor’s Name)

Address”

Do you owe above $10,000 in unsecured debt?

Suppose you owe above $10,000 in unsecured debt and are interested in applying for the debt resolution program call (866) 376-9846. The program starts with disputing each debt collection account through debt validation. The law firm will then attempt to dispute and remove invalidated debts from credit reports. And lastly, the law firm uses debt negotiation to settle any validated accounts or a credit card summons.

Debt Validation Letter Page 2 of 31: “Actual and Constructive Notice to Cease Collection Activities Until Alleged Debt is Verified”

- Phone calls, billing statements, addition of a negative file on a credit report, lawsuit, and written demands for payment (hereinafter “Presentment(s)”) sent or made by ____________________ imply that __________________ possesses authorization for collecting a binding, lawful, and valid debt from (Debtor’s name) , hereinafter “Purported Debtor.”

- Purported Debtor, via Authorized Representative, herewith provides Respondent with this ACTUAL AND CONSTRUCTIVE NOTICE, hereinafter “ACN,” for the purpose, among other things, of noticing Respondent that: (A) No bonafide and verifiable debt exists that is binding on Purported Debtor unless full verification of debt is provided by sending Authorized Representative all documents, accounting, and other instruments of proof, including a returned Debt Collector Disclosure Statement, which are requested in the enclosed Notice and Demand for Verification of Debt-Security Agreement, from now on (B) Respondent is devoid of valid authority for pursuing any collection action against Purported Debtor before full verification of debt as defined in the enclosed debt validation dispute package. (C) The respondent must provide Purported Debtor, via Authorized Representative, with verification under oath of documentary proof of the origin, nature, and contractual validity of the alleged debt and Respondent’s authority for collecting thereon. (D) Any and all action by any person acting under authority of _____________________.

- No communication of Purported Debtor is intended as constituting a refusal by Purported Debtor for paying any alleged debt but is a notice that Respondent’s claim is disputed and that Respondent must verify the alleged debt in accordance, among other things, with the Fair Debt Collection Practices Act, Fair Credit Billing Act and other consumer protection laws, as a condition precedent for proceeding in any action involving collection, court complaint, etc., against Purported Debtor re alleged debt.

- All communication with Purported Debtor must be in writing only through Authorized Representative; upon receipt of enclosed documentation from Purported Debtor’s “Authorized Representative,” all communications should go through the office of the Authorized Representative.

- Any telephone calls received by (Debtor’s name)

- The respondent may invoke the Respondent’s right to remain silent.

- Purported Debtor is not requesting a “verification” that Respondent possesses any details concerning Purported Debtor, such as a mailing address, telephone number, etc., but is requiring verification by Respondent under oath and penalty of perjury of all items required in this debt validation dispute package for establishing on the record proof that:

- Purported Debtor owes a valid debt, based upon a bona fide, verifiable contract enforceable at law, including providing Purported Debtor through Authorized Representative with proof of the nature and source of the valuable consideration provided by alleged Original Creditor for creating a valid contract and a genuine debt owed by Purported Debtor;

- Respondent is proceeding full compliance with all demands set forth in this debt validation dispute package, such as verification of the debt and proof of authorization for collecting thereon.

- Respondent has the legal capacity to collect the alleged debt.

- The respondent may be aware that sending unsubstantiated demands for payment through the United States Mail System may constitute mail fraud under federal and state law.

- Every unauthorized contact with Purported Debtor constitutes an additional count of harassment for which the contacting party is personally and professionally liable.

- Respondent’s failure to satisfy the criteria and demands contained herein constitutes Respondent’s absolute waiver of all claims against Purported Debtor, as well as Respondent’s tacit agreement for compensating Purported Debtor for damages, penalties, costs, and attorney’s fees.

THIS NOTICE IS BINDING UPON EVERY PRINCIPAL AND AGENT OF RESPONDENT RE THE SUBJECT MATTER SET FORTH HEREIN

Authorized Representative of Purported Debtor:

By: _______________________________________________________________________________ Authorized Representative of Purported Debtor:

RESPOND TO:

Notary Name and Details

Attention: (Debtor’s name and address)

Page 3 of 31: NOTICE AND DEMAND FOR VERIFICATION OF DEBT

A. FOUNDATIONAL CRITERIA

- This dispute is based on the following laws: “Fair Debt Collection Practices Act” codified at statute at 15 USC §1692 et seq., “Truth in Lending Act,” “Accountability, Responsibility, and Disclosure Act (the Credit Card Act) of 2009,” and the “Unfair and deceptive Practices Act” (“FTC Act” 15 U.S.C. § 45).

- Authorized Representative is aware that based on a recent call or letter from your agent or company to (Debtor’s Name), your company is claiming a debt is owed by (Debtor’s Name), i.e., “Purported Debtor,” who just became aware in the last 30 days that said claim of your alleged debt may be invalid, and fraudulent.

- Authorized Representative asserts and claims that: (A) No alleged debt implied by your claim is valid, lawful, nor binding on Purported Debtor in any manner unless proved to be a valid, legally owed obligation devoid of fraud and misrepresentation; (B) Respondent is devoid of authorization for collecting any alleged debt from Purported Debtor regarding claim, both directly and through deployment of any third party without first verifying and validating the alleged debt is a valid, legally owed obligation of Purported Debtor pursuant to non-waivable essential elements of universal contract law per, inter alia, California Civil Code §§ 1549 et seq., the Fair Debt Collections Practices Act, and—in accordance with full faith and credit—other applicable laws; (C) Authorized Representative disputes any claim of authorization by any person of right for acting in any manner against any interests of Purported Debtor without first proving that debt collector has legal capacity to collect debt including proof of being properly licensed in Purported Debtors state to collect a debt, and proof you are empowered by current creditor of record to collect alleged debt. Authorized Representative includes herewith -A Debt Collector Disclosure Statement so Respondent may answer the questions contained herein, and provide the information requested herein; (D) Any seizure, transfer, confiscation, etc., by any person, of any funds in any accounts of Purported Debtor renders said person a “third-party trustee” under the Foreign Corrupt Practices Act, PL 105-366, 15 USC 78dd-1 et seq., and a “debt collector” under the Fair Debt Collection Practices Act, 15 USC 1692 et seq.

- This letter notices Respondent, and all principals and agents of Respondent, that the alleged obligation owed implied by the claim is insufficient, invalid, and defective on the basis, among other things, of the following: (A) No Legal Capacity of Collector. Purported Debtor is not aware if the debt collector is licensed to collect the alleged debt if collector is holder in due course of the alleged debt, has been assigned the debt, or by what legal authority is empowered to make demands for payment. (B) Absence of valid signature. The claim is devoid of any signature of Respondent that legally binds and identifies Respondent and does not define the commercial liability that Respondent stakes on the validity, veracity, accuracy, relevance, and verifiability of alleged debt being collected upon. (C) No True Bill. Purported Debtor does not have any true bill in commerce regarding account, nor affidavit(s) of responsibility/liability for each accounting entry, concerning which Purported Debtor is in default of payment. (D) No Verification of Debt. Purported Debtor is not in receipt of, nor aware of, any verification that alleged debt is a valid, legally owed obligation or past the statute of limitations allowing collection in Purported Debtors state of residence.

- CONDITIONS PRECEDENT FOR ACTING RE PRESENTMENT AGAINST PURPORTED DEBTOR: The Undersigned presumes that good faith and fair dealing are implied in law, i.e., that the law presumes that men act reasonably and honestly and deal in good faith and without deceitful intent, such as without any intention of cheating, defrauding, and committing wrongful acts. In any disputed transaction regarded as being capable of two constructions, the transaction that is fair and honest must be upheld, and the other interaction of dishonest construction must be invalidated. It may not be construed as a valid contract enforceable by law. Therefore, Respondent must provide Authorized Representative with all of the items enumerated hereinbelow as conditions precedent for proceeding against any interests of Purported Debtor based on the alleged debt.

- Proof of Valid Signature: Within thirty (30) days of Respondent’s receipt of this letter, hereinafter “Stipulated Time,” Respondent must provide Authorized Representative through the notary public designated herein, with non-hearsay documentary material evidence by affidavit, sworn accurate, correct, and complete under penalty of perjury based on firsthand personal knowledge and pledge of unlimited commercial liability for the validity, veracity, accuracy, relevance, and verifiability of everything stated, claimed, or alleged whereby is established on the evidentiary record: (A) Identity of claimed creditor for whom Respondent is collecting alleged debt, and signature of person making claim, with official declaration that the signature is in fact Respondent’s legal signature and fully identifies and binds Respondent in Respondent’s official and personal capacity; (B) The commercial liability, defined with particularity, which Respondent stakes on the validity, veracity, accuracy, relevance, and verifiability of alleged debt upon which you are collecting against Purported Debtor, and Respondent’s authorization for collecting alleged debt; and (C) Proof that debt collector is licensed to collect alleged debt, and providing the date of the license, the name on the license, the license number, and the name, address and telephone number of the state agency issuing the license.

If you’re interested in obtaining the rest of the debt validation dispute package, please email info@goldenfs.org or submit a comment below. In addition, if you’re interested in qualifying for a debt validation or settlement program, call (866) 376-9846. We hope you learned from this inside peek at the debt validation letters used on a validation program.