America in 2020: Millions of Americans are quarantined to their homes. Kids can’t go to school. Businesses are shut down. The streets of New York are empty because people are scared to leave their houses. College and professional sports across the nation have been canceled. Bars and restaurants are closed. This is not the America that we know. If you just awoke from a coma, you’d think we were being attacked by zombies. But one thing is still the same …. credit card bills will continue to roll in and bills need to get paid.

If your income was reduced due to COVID-19, credit card debt relief programs are available. Speak to one of our IAPDA certified counselors for help at (866) 376-9846. You have the power to choose from affordable payment options to help you become debt-free.

Some consumers will need to utilize a debt relief program, while others will be better off contacting their creditors directly and getting only temporary relief.

The following page outlines all of the credit card relief options currently available.

Does the COVID-19 Stimulus Bill Include Government Credit Card Debt Relief?

The $2 trillion stimulus package does not include any type of credit card debt relief.

Click here for a detailed summary of the COVID-19 Stimulus Bill and Economic Security Act (CARES).

Withdrawing from retirement to pay off credit card debt

AARP explains: “Under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, Americans can withdraw up to $100,000 in 2020 from retirement plans, and have up to three years to pay taxes on the withdrawal. You won’t have to pay the 10 percent penalty if you’re younger than 59 1/2. You can also recontribute that money to your retirement account in one or more payments over three years.”

Should I withdraw from my retirement to pay off credit cards?

Never sell stocks when they’re down. As of May 6th, 2020, the S&P 500 Index is down by 11.17%, so if your portfolio of investments is primarily made up of stocks you’ll be losing over 11% of your retirement savings.

If you have all past due credit cards and no other savings besides your retirement, you could use a debt relief program to reduce your balances and pay your debt off in one lump sum payment, saving more than 11%. I would not recommend credit card debt settlement if you’re current on payments and have a high credit score because your credit score will take a hit and it won’t be worth it.

Are your finances being negatively affected by Coronavirus? Credit card debt relief options can make your credit card bills more affordable. You can choose from debt relief options being offered directly by your creditors (see highlighted options below) or use a reputable debt relief service. Credit card relief programs are available through Golden Financial Services (GFS) at (866) 376-9846, an IAPDA accredited, and BBB “A+” rated company.

Consumers must owe $10,000 or more in credit card debt to qualify, and not all states are eligible (see state list towards the bottom of page). Debt relief programs include debt negotiation, debt validation, credit card consolidation, and consumer credit counseling.

How to Deal With Credit Card Debt If Your Income Has Been “Temporarily Reduced”

Are you dealing with only a temporary financial problem or loss of income?

Almost all major credit card companies are willing to offer one of the following:

- Increase your credit limit

- Waive your next monthly payment

- Offer credit card forbearance

You can always call your creditor directly by calling the phone number on the back of your credit card. Ask to speak with a supervisor. Let them know about the details of your situation. If your business closed down over the Coronavirus and you have no income at this time, let them know just that.

Example Script; “Hello and how are you? Your website directed me to contact you for assistance with my credit card debt. I cannot afford to make a credit card payment for the next 3-4 months because my job/business closed its doors, and I have no other money in savings. What option can you offer to help me at this time?” If they try to defer the interest and capitalize it, that’s not helping you because your debt will only grow higher by doing that.

Tip: Don’t except a forbearance because that is only deferring your payments while interest continues to accrue, and you don’t want that.

What’s your financial plan, for after credit card payments resume in June?

After credit card payments resume in around June, at that point, you’ll need to be prepared with a plan to pay off your credit cards. If you don’t want to use a program and you can afford to pay at least minimum payments every month, I recommend the debt snowball method as your first option.

Start with a budget analysis:

To use the debt snowball method, start by creating a budget analysis with our free budget calculator here.

Use the debt snowball method:

After you create your budget you’ll be directed to the snowball calculator here.

Have a financial plan in place to pay off your debt and save money, whether it’s a debt relief program or by using the snowball or avalanche method. Don’t just aimlessly make minimum payments and hope to one day become debt-free because you may find yourself paying on debt for the rest of your life.

Check out the 10 Best Ways to Clear High Credit Card Debt.

What about a balance transfer card to pay off credit cards?

Don’t use a balance transfer card to consolidate unless you’re 100% certain that you can pay the entire balance with the introduction-rate period and your goal is to save money on interest.

These balance transfer cards include upfront fees and if you can’t pay off the entire balance within the introduction-rate period when the interest rate is low, interest rates will skyrocket back up to higher than where they are today. Use a debt calculator to figure out all of the math so that you know exactly how much you’ll end up saving and if it’s feasible, before signing up for a balance transfer card.

How to Deal with more than just a temporary reduction in your income (permanent solution)

Debt relief companies can offer you a few different plans.

- Click Here for information on Consumer credit counseling

- Click Here for info on Credit Card Debt Settlement

- Click here for details on Debt Validation to Help With High Credit Card Debt

In summary, consumer credit counseling programs allow you to stay current on your payments but reduce interest rates getting you out of debt faster. You pay back all of your debt with consumer credit counseling, just less interest. Debt settlement and validation require you to stop paying your creditors altogether, in order to pay a significant amount less than the total that you owe. Settlement plans negotiate your balances down to a fraction of the total debt owed. Validation disputes the debt, similar by nature to how a person challenges a speeding ticket, whereafter it’s proven legally uncollectible the debt no longer needs to get paid and can no longer legally remain on credit reports.

Try Credit Card Debt Relief Calculator to Compare Programs

Source: National Debt Calculator

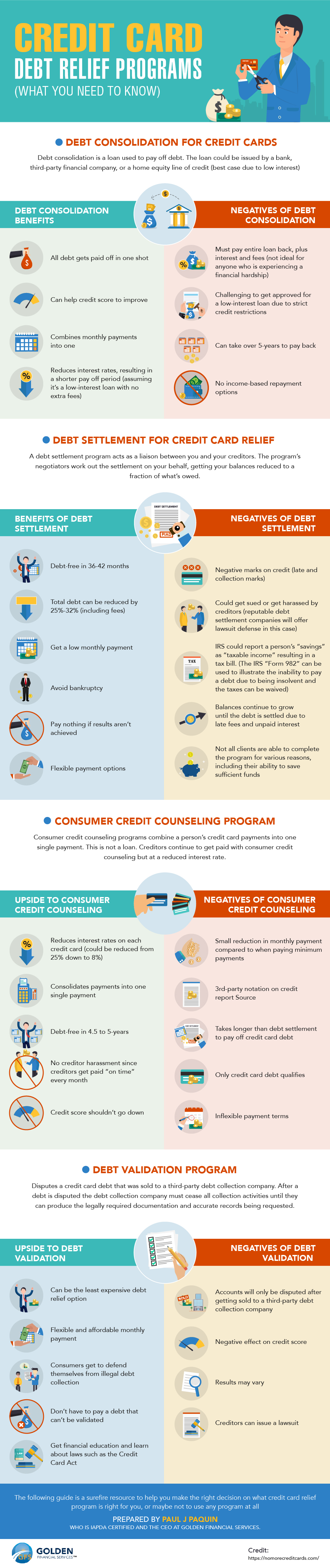

Compare Pros and Cons of Each Credit Card Relief Program

Unfortunately, all credit card relief programs include pros and cons. Here’s a summary of the benefits and downsides of each option:

For a Free Consultation Call (866) 376-9846. IAPDA certified counselors are working overtime over the next several weeks to facilitate the increased volume of calls coming in from consumers that need a more affordable credit card payment due to “loss of income” inflicted by Coronavirus.

Before using a debt relief service, consider the debt snowball method and this free spreadsheet tool here.

Coronavirus Debt Relief Options (available directly through your Credit Card Company)

Goldman Sachs – Apple Credit Card

Apple is offering to:

- eliminate interest payments temporarily

- allow individual cardholders to skip their next monthly payment without accruing any interest fees.

How to get help:

First: Call the phone number on the back of your Apple credit card for debt relief options.

Second: make sure to present the financial hardship details that you’re experiencing in the most transparent way possible to maximize the benefits that they are willing to offer you. The more financial hardship you can illustrate, the more debt relief they will be ready to provide in most cases.

Capital One Credit Card

Capital One is offering personalized debt relief plans, similar to what Apple is offering.

Capital One has stated that “they will cater to each person on a case to case basis.”

How to get help:

Call the phone number on the back of your Capital One card.

Citibank Credit Card

Citibank is offering “always-on” assistance programs, which include credit line increases, waivers on monthly service fees, and collection forbearance options. Forbearance is when you temporarily postpone payments, but the interest still accumulates by getting capitalized to the back of the loan, causing your balance to grow. Why would you need your credit limit increased? Because you may need additional funds available to pay for increased expenses during your time off from work. Just be careful not to grow your debt higher than what you can afford to eventually pay back because government credit card relief does not exist at this time.

Additionally, Citibank is offering:

- “Waivers on monthly service fees, for both regular and small business customers

- Waived penalties for early CD withdrawal, for both regular and small business customers

- Fee waivers on remote deposit capture for small business customers

- Bankers available after hours and on weekends to support small business customers

- Some credit card customers may be eligible for credit line increases and collection forbearance programs.

- Some mortgage customers may be eligible for a hardship program through Cenlar FSB, the bank’s service provider. For assistance, call Cenlar FSB at 855-839-6253 (8:30 a.m.–8 p.m. ET Mon–Fri, 8:30 a.m.–5 p.m. ET Sat).”

American Express (AMEX) Credit Card

American Express cardholders can call the number on the back of their card, or chat online or through the AMEX app. Explain your financial hardship in detail to a Supervisor. AMEX offers personalized Coronavirus related debt relief options.

Under the AMEX financial hardship program, consumers can get:

- monthly payment reduced

- temporary relief from late payment fees

- temporary reduction in interest rates

- prevent their accounts from going past due

Bank of America (BOA) Coronavirus Help

Bank of America credit card assistance can be obtained by calling the number on the back of your credit card or (800) 732-9194.

BOA has acknowledged that they are willing to offer:

- small business clients personalized credit card relief help if Coronavirus impacted their business

- consumer debt relief options that include forbearance

Chase Coronavirus Credit Card Relief

Chase’s website states:

“If you’re affected by COVID-19 and need help with your accounts or making payments, please reach out to us.”

Visit Chase online at https://www.chase.com/digital/resources/coronavirus

In an email to Forbes, Chase detailed what this help could potentially look like, but explains that, as of right now, it’s being addressed on a case-by-case basis.

“We are helping customers who contact us, as we always do and notably did during hurricanes and wildfires in years past. Things we’ve done for customers (and small businesses) in past crises include things like fee waivers or refunds, changing due dates, extending credit lines. Sometimes, if there’s been a government-designated area (like for a Hurricane), we will proactively waive certain fees. We’re not there yet with this, of course. We’re working with our customers on a case-by-case basis right now.”

U.S. Bank

U.S. Bank is offering “product discounts and other customized solutions,” including lowered interest rates on select loan products, effective Friday, March 13.

Barclays Credit Card Options

Barclays credit cardholders are urged to call for help if they have a problem paying their credit card bill because of COVID-19. Barclay credit card help is available at (866) 928-8598.

American Express Credit Cards

As reported by Richard Kerr of The Points Guy, “Amex will waive interest charges and late fees and offer lower interest rates on a case-by-case basis for those who request assistance.”

According to The New York Times, “American Express will also allow cardholders to skip payments without accruing interest.”

AMEX is also working together with most airlines to waive fees for trip cancelations.

Which cards include trip cancellation and interruption insurance?

The Platinum Card® from American Express, the Business Platinum® Card from American Express, Corporate Platinum Card, Hilton Honors Aspire Card from American Express, Delta SkyMiles® Reserve American Express Card, Delta SkyMiles® Reserve Business American Express Card, and the Marriott Bonvoy Brilliant™ American Express® Card.

How to get help with AMEX:

Call the phone number on the back of your AMEX card. Make sure to explain how COVID-19 has impacted your financial situation and ability to pay your credit card bill. Don’t just skip a payment without specifically asking for assistance and verifying that the interest won’t continue to accrue.

How to avoid Coronavirus-related debt relief scams

Call your creditor directly, or call a top-rated debt relief company.

Where to find a reputable debt relief company? Visit BBB.org, TrustedCompanyReviews.com, Yelp.com. These sites will show you the best-rated companies and real customer reviews.

If someone calls you about credit card help and you didn’t request the call, hang up the phone immediately and call the number on the back of your credit card to avoid scams.

Unless you specifically request help from a debt relief service, nobody should be cold-calling you about debt relief assistance unless it’s your credit card company.

If you visit your credit card company’s website, make sure to double verify the URL (i.e., web address). For example, let’s compare the following two web addresses:

1. www.Bankofamerica.com

2. www.Bankfamerica.com

Do you see a difference in these two URLs?

Well, if you look closely you will see the difference. The second web address, BankFAmerica.com, is the scammer. Scammers will buy a similar looking web address to trick consumers into believing that it’s the real credit card company’s website, so double verify the web address before providing any website your personal information.

The 30 States that GFS is offering debt relief services in:

1. Alabama Debt Relief

2. Alaska Debt Reduction

3. Arizona Debt Relief

4. Arkansas Credit Card Settlement

5. California Credit & Debt Relief

6. Colorado Debt Relief

7. Delaware Debt Relief

8. Florida Debt Relief

9. Hawaii Debt Relief

Illinois Debt Relief, Settlement, and Consolidation Programs

Indiana Debt Reduction Services

Iowa

Kentucky

Louisiana

Michigan

Mississippi

Missouri

Montana

Nebraska

Nevada

New Jersey

New Mexico

New York

Oklahoma Debt Relief

Pennsylvania

Rhode Island

Tennessee

Texas Debt Relief

Virginia Debt Relief

Wyoming Debt Relief

For more information on debt relief programs in your state (if you’ve been impacted by Coronavirus), visit GoldenFS.org and choose your state.