Do you need Help With Credit Card Debt? Over $10,000 in credit card debt makes you eligible for debt settlement, consumer credit counseling, and debt validation through Golden Financial Services. Debt relief programs have been available for almost two decades now. After all these years, these programs are highly effective as of today. Most debt relief programs will allow a minimum of $10,000 in combined unsecured loans, medical bills, collections accounts, and credit card debt. Some consumer credit counseling companies offer a minimum of $5,000 in credit cards to qualify.

How about government help with credit card debt, does it exist? Unfortunately, no government credit card relief program or grants to pay off credit card debt exists. Credit card companies did offer clients the option to defer payments for up to 3-6 months due to COVID-19, but as this relief expired thousands of consumers started searching for ways to get help.

There are restrictions that could disqualify you for these programs. We’ll explain how each debt relief program works, the most significant downsides to know about for each, and factors that could deny your eligibility.

Debt Validation

Debt validation is the newest program to help with credit card debt, but it’s not new. Through Golden Financial Services, validation has been the top choice for consumers for over six years now. This program can result in an inexpensive resolution to high balances and as a bi-product of it, a debt could potentially get removed from credit reports entirely. We can set you up with a debt validation program to dispute not one, but all of the credit cards that you owe.

Have you ever gone to a garage sale? Items are cheap. You can buy an electrical saw for $10, or a puzzle for the kids for $1, or a cool collection of baseball cards for $5. The reason stuff at a garage sale is cheap is that parts may be missing and items are used and just don’t work the same.

Debt collection companies buy debt just like consumers buy stuff at a garage sale, they’re looking for bargains when buying delinquent and old credit card accounts. They offer credit card companies thousands of dollars for sometimes hundreds of thousands of dollars in delinquent credit card accounts. Collection agencies pay a cheap price for debt because they realize it’s aged and there’s no guarantee they will collect any money from it. Collection agencies also realize that documentation may be missing inside delinquent credit card files and that information may not be validated if disputed.

Debt validation is a person’s legal right to dispute a debt before paying it, to ensure collection agencies are maintaining complete and accurate records. Immediately after a debt is disputed all collection activity must come to a stop until the debt can be proven valid. To prove a debt is valid collection agencies must produce complete and accurate records, including everything from the original credit card contract that the consumer signed when first applying for the card, all statements from that day to today, and even including the debt collectors license to collect on the debt. Collection agencies must be able to answer related questions about a debt, from when the statute of limitations expires, the original account number, date the account was sold and when the last payment was made.

These are just a few examples of what can be requested when disputing debt with validation, but on a professional debt validation program the disputes are much more in-depth, fully utilizing numerous federal laws.

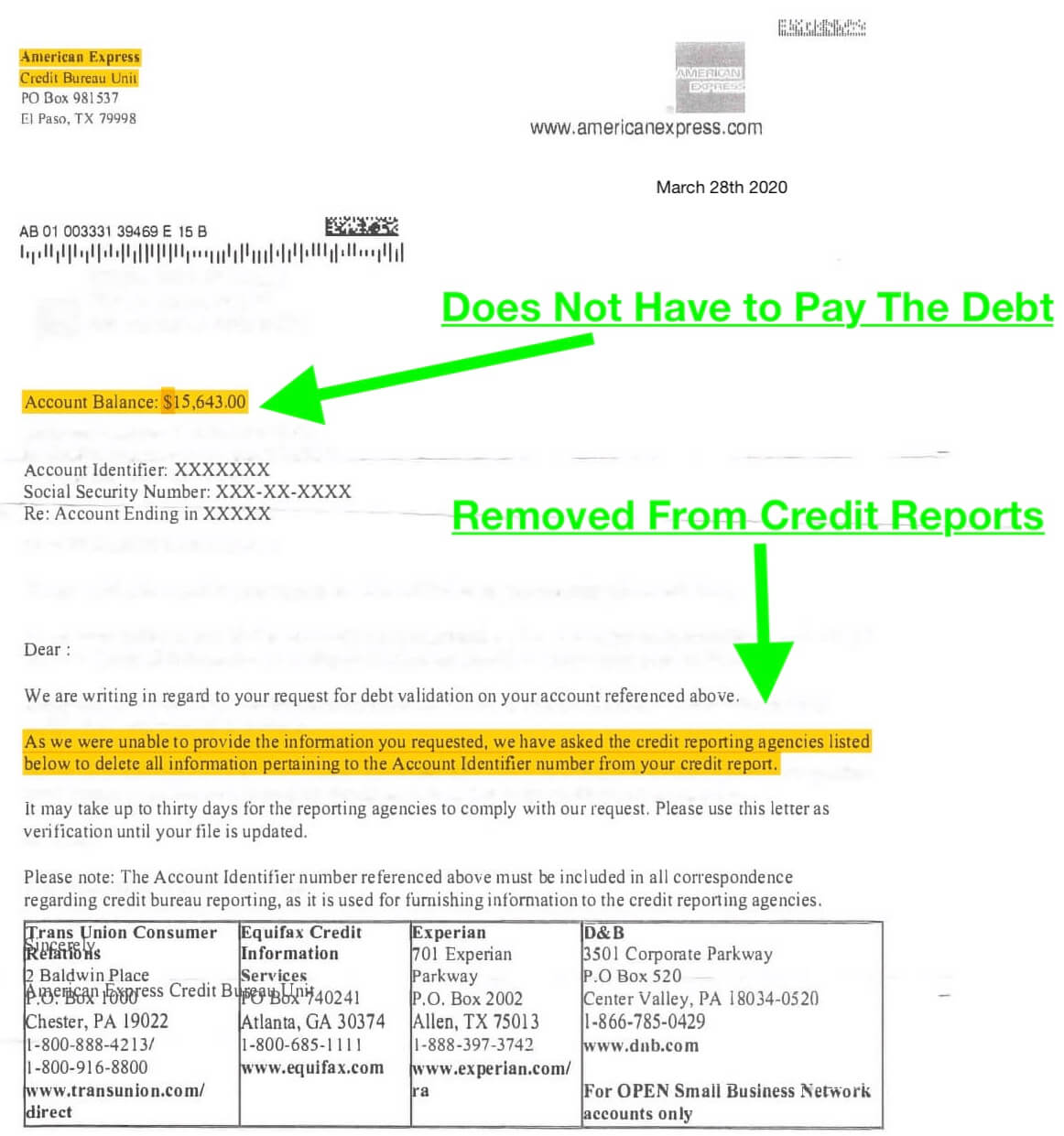

This client had over $15,000 in credit card debt. Help was provided in the form of a debt validation program. Here’s the result, the entire $15,000+ was proven legally uncollectible, not having to get paid and being removed from the client’s credit reports.

Click here to learn the best way to reduce credit card debt, with no money.

Debt Settlement

If you’ve been served a credit card summons or have accounts that can’t be included in debt validation, a debt settlement program may be your best solution. If you used a debt validation program and one of your debts was proven valid, you can settle it at that point. As explained above, after a person stops paying on credit cards eventually they get written off and sold to collection agencies, sometimes sold for as low as five cents on the dollar. As a result, these same collection agencies will offer a settlement for less than the full amount owed on a debt. Think about it, if a collection agency pays $5,000 for $50,000 worth of debt, even if they sell the debt for 50% discount (so they settle $50K for $25K), their profit margins are still at least 50% (which is phenomenal). A few of the main downsides with settling debt include potential tax consequences and the fact that late marks and collection accounts can remain on credit reports for up to seven years unless you make a settlement contingent on having the debt and its derogatory marks simultaneously removed from all three credit reports upon the settlement getting paid.

Debt settlement programs can help consumers avoid bankruptcy, paying off all of their unsecured debt in around 3-4 years.

Consumer Credit Counseling (CCC)

If you don’t want to fall behind on credit card payments and only need a reduction in interest rates, credit counseling offers just that! In fact, you can also get one consolidated payment wit this type of program. Another benefit of consumer credit counseling is that if you’re only one to two months behind on monthly payments and want to get caught up to be current, CCC offers you that as well.

Consumer credit counseling is the most costly of the three options but has the least effect on credit scores and zero chance of you getting sued by creditors. You won’t have to deal with any collection accounts on your credit report either!

Nonprofit credit card consolidation companies will charge you the least amount in fees. Non-profit consumer credit counseling companies can’t charge you more than $50 per month. The only reason this type of program is the most costly is that you’ll pay all of the debt back plus interest, just less interest than you may be paying today.

These debt relief programs are similar to stocks. If you want to make or save the most money, debt settlement and validation will be your best chance. Validation and settlement plans are riskier because there’s a chance you can get a summons and have your credit negatively affected.

Learn how to consolidate debt on this page next.

How to get safe and reputable help with credit card debt

Check reviews online about a company and its debt relief products. Check the Better Business Bureau, Yelp, and Google reviews to further evaluate a company. The good companies are honest, and they are equipped to help with debt summons and potential downsides. In life, in general, downsides can occur. What matters is how you deal with these downsides. For example, if the worst-case scenario occurred after joining a debt relief program and you were sued, as long as the company ensures the debt summons is settled and paid off prior to court, in the end, you’re debt gets resolved and you’ve saved hundreds to thousands of dollars.

I need help with my credit card debt, how do I get started?

If you want to get help with credit card debt, start by talking with Golden Financial Services at (866) 376-9846.

Disclosures:

Debt validation programs assist consumers in sending out the documentation required to dispute a debt, but like with debt settlement, there is a chance that creditors pursue litigation to collect on a debt. Golden Financial Services (GFS) is not a law firm but if a consumer is sued over a debt, the validation program may refund the consumer and refer them to a law firm to assist in settling a summons and avoiding court. Debt settlement and validation programs don’t pay creditors on a monthly basis, resulting in a potentially negative effect on credit scores and account balances to rise before getting resolved. There are no guarantees creditors will settle for a certain amount or that debt will get invalidated every time. Fees only get charged if results are obtained, and for debt settlement programs fees can only be charged after a settlement gets completed and at least one payment towards that settlement has been made. These programs include fees, where in the end consumers could pay up to 75% of their debt with settlement services (still saving at least 25%, assuming clients make all scheduled payments and complete the program). GFS does not administer these debt relief programs, but rather is an enrollment center that has a duty to fully educate consumers on their options, then assisting in the data collection and document preparation to get approved for the program of the consumer’s choice. GFS is not licensed in every state, and some states may not be eligible for the debt relief programs mentioned. GFS does not charge consumers a fee and is only paid by the debt relief companies. With consumer credit counseling programs credit scores can go down at the end of the program, which is when accounts get closed. If you need help with credit card debt start by speaking with a certified counselor from Golden Financial Services today, an IAPDA certified company!