Best Debt Settlement Programs

A debt settlement program, also known as debt negotiation, is one of the preferred national debt relief services. Debt settlement programs offer the fastest path to pay off bills that you can’t afford to stay current on. With a debt settlement program, each account gets reduced to a fraction of the balance. Debt negotiators work with each creditor one by one to reduce the balance and settle. Debt settlement programs do have potential downsides that consumers need to understand.

For example, it is important to understand how a settlement program affects a person’s credit score to plan to rebuild your credit throughout the program. It is also important to know what the debt settlement company will do if a creditor issues a summons. How will it get resolved?

Debt settlement programs let you choose from flexible payment options.

Debt settlement services are custom-built to best meet the consumer’s needs, depending on their financial situation and the level of debt they are in. You get to choose from flexible and affordable monthly payment options that get clients out of debt in around four years or less.

Golden Financial Services will work with you to find the most cost-effective and affordable debt settlement program to fit your financial needs. Our IAPDA certified counselors will go over exactly what you need to know before enrolling, explaining the benefits and downsides.

Call 1-866-376-9846 for a free consultation, or fill out the simple contact form below to get started.

What type of debt settlement program can Golden Financial Services offer you?

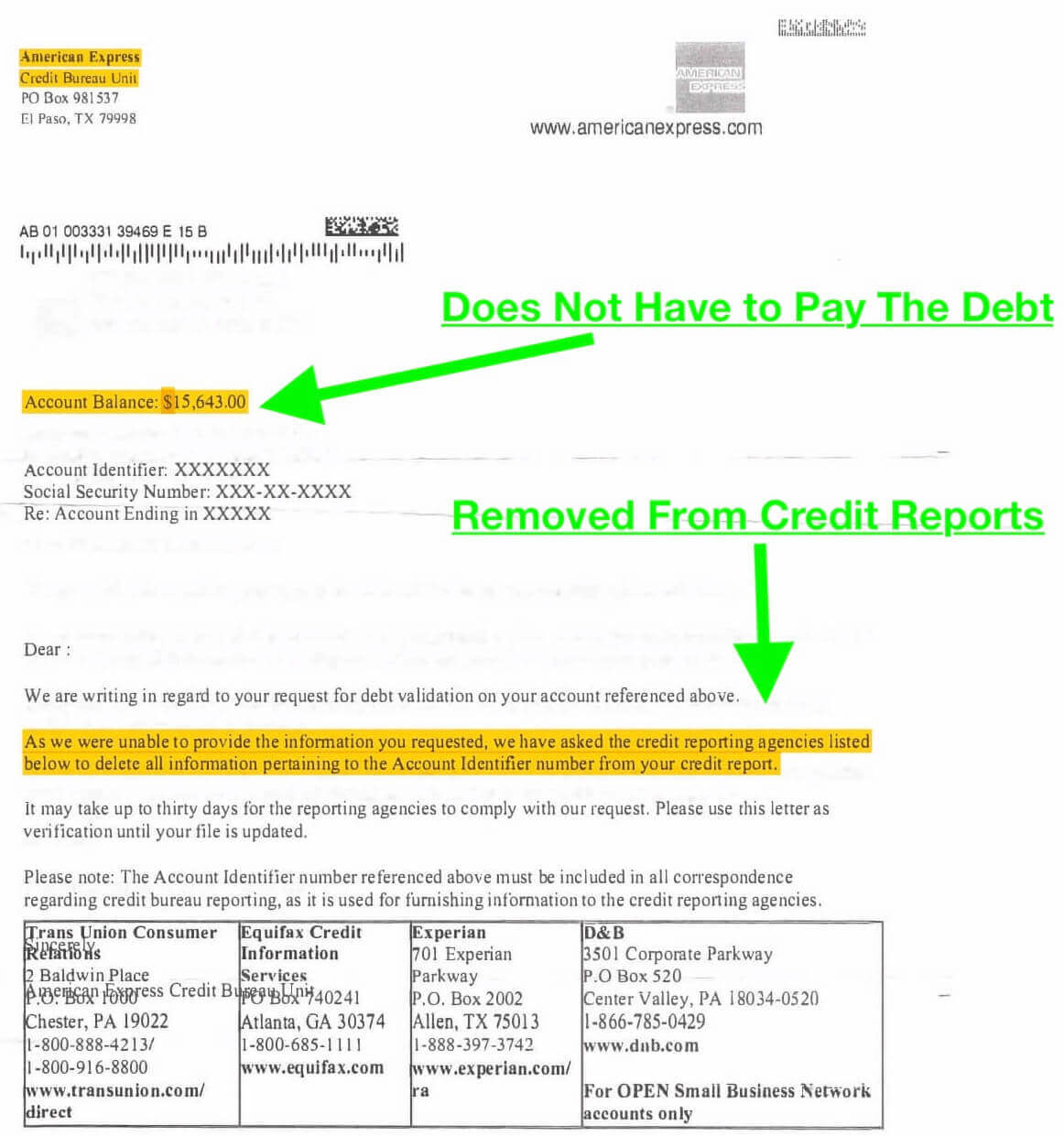

Golden Financial Services works hand in hand with trusted partners that specialize in debt settlement solutions. But not only do our partners specialize in debt settlement, programs include validation. The best debt relief programs will first work to invalidate a debt before using debt settlement.

The best debt relief services will force each collection agency to prove that they are legally authorized to collect on debt before negotiating a settlement. This method of dealing with debt is called debt validation. A validation program is less expensive than a debt settlement program and can potentially result in an account getting removed from the consumer’s credit report entirely.

To learn more about a debt validation program, visit this page next, or call 866-376-9846.

Click here to learn more about how debt relief programs work.

Who qualifies for a debt settlement program?

Debt settlement programs are offered to those who are unable to continue making payments under the original terms. If you are suffering from a financial hardship or find that you can’t keep making credit card payments or debt payments, you may be eligible for a debt settlement program.

Why do creditors agree to settle for less than the full amount?

Your negotiator will come to a settlement with creditors for a new, more affordable monthly payment. Creditors are willing to come to a settlement on your debt to avoid a lengthy collection process or losing repayment altogether due to bankruptcy.

What are the downsides of a debt settlement program?

You can save a tremendous amount of money by enrolling in a debt settlement program, but it comes with its downsides. If you have a high credit score and perfect payment history, settling your debt for less than the full balance should be your last debt relief option that you consider before bankruptcy.

You don’t want to lose that high credit score that you worked so hard to achieve, so before using debt settlement, consider other options. One of these other options that you may want to consider is the debt snowball method, invented by Dave Ramsey. The snowball method allows you to organize your balances from small to large, prioritizing paying off one debt at a time. If you can afford to pay more than minimum monthly payments, start using this free budget and snowball calculator tool.

Not only will the debt snowball method get you out of debt fast, but your credit score may also improve while using this effective debt relief option.

Debt Settlement Services

What type of debt can be settled in a debt relief program?

A debt settlement program can help you pay off unsecured debt, including credit card debt, store, gas card bills, medical bills, utility bills, and personal loans. You cannot settle secured debt such as home mortgages and car loans in a debt settlement program.

What are the benefits of a debt settlement?

- Your creditors will not be paid every month. However, we set your program up so that you are only responsible for paying one monthly payment. This eliminates the stress of dealing with multiple creditors. As money accumulates, we can then settle one creditor at a time until you are debt-free.

- Golden Financial Services will deal directly with the creditors, so you will avoid dealing with them on your own.

- By settling your debt, you avoid having to file for bankruptcy.

- On average, clients that are successful with debt settlement become debt-free in under four years.

- You can resolve 100% of your debt for less than the full amount owed, including all interest and late fees.

Golden Financial Services has been settling debt for over fifteen years. We maintain an A+ Rating with the Better Business Bureau and have zero unresolved customer complaints.

To find out if you qualify for our debt settlement service, please contact Golden Financial Services at 1-866-376-9846. Schedule your free consultation with one of our highly skilled debt counselors today!

Debt settlement program disclosures

- There are fees included in the settlement program but only earned after each account is settled and paid.

- A settlement plan can lower credit scores. After enrolling in the plan, credit scores can continue to decline until accounts are settled and paid.

- Potential tax consequences can result from settling a credit card bill for less than the full amount, as a person’s savings could appear as taxable income.

- Creditors can issue a summons if you fail to pay your creditors fully and on time each month.

- Not all clients graduate from the program successfully due to various reasons, including a person’s inability to afford all of the payments.

- Golden Financial Services does not offer settlement services in all states, including Connecticut and Wisconsin.

- Most unsecured accounts can be settled, but not all creditors will qualify for the settlement program.

- Your total balances will increase after enrolling in a settlement program due to late fees and interest.

- It’s illegal for a debt settlement program to charge fees before an account is settled. Fees can only be charged after a settlement is completed.