Most tax filers, even those that use TurboTax or a tax accountant, know what tax deductions are. But did you know there are also things called tax credits that can significantly alter the amount you owe or receive after tax filing? Knowing the difference between tax credits and tax deductions can be vital to an accurate return and debt relief.

Simply put, tax deductions reduce the total amount of your taxable income, while tax credits reduce your bill dollar for dollar. On one hand, deductions help you reduce the total dollar amount the federal government considers earnings that they can receive a percentage of, while tax credits are essentially discounts on the total amount of income for which you are responsible.

If you are looking for tips on how to use tax rebates for your small business, take a quick detour before continuing on.

Using these options to the best of your ability can significantly assist you if you are struggling with severe debt, or just want to be able to have extra cash in your pocket on that dream vacation. We wouldn’t advise that you spend your refund on a shopping spree, but hey, it helps there too when you have a bigger return due to tax deductions and tax credits. Here’s how to use tax credits to pay off debt.

5 biggest tax credits which you might be able to use

For the general public, there are a solid five tax credits that are wide-spread and actually a part of nearly everyday life. These tax credits are easy to apply for, and TurboTax does an excellent job of bringing them to your attention when/if you file with their software this year. Using these tax credits to pay off debt can be easy in this manner, just be sure to seek counsel if you are a little shaky on how to apply for these at the time of tax filing. Here are the five tax credits, with some descriptions of each:

- Earned Income Tax Credit: (Description from TurboTax) “One of the most substantial credits for taxpayers is the Earned Income Tax Credit. Established in 1975—in part to offset the burden of Social Security taxes and to provide an incentive to work—the EITC is determined by income and is phased in according to filing status: single, married filing jointly or either of those with children. Eligibility and the amount of the credit are based on adjusted gross income, earned income and investment income. A person must be at least 25 years old and younger than 65 to qualify. If married, both spouses must have valid Social Security numbers and must have lived in the country for more than six months. If you may be claimed as a dependent on another filer’s tax return, you do not qualify.”

- American Opportunity Tax Credit: This tax credit covers those that are currently paying tuition for higher education. The credit was originally called the “Hope Credit,” but this name didn’t accurately depict what the credit was for, so it was renamed. The full credit is available to people whose (modified or adjusted) gross income is $80,000 or less, or $160,000 or less for married couples filing jointly.

- Lifetime Learning Credit: Very similar to the American Opportunity Tax Credit, accept this one covers any year of post-secondary (high school) education, while the AOTC only covers the first 4 years of college. This one is more commonly used by prospective doctors, psychiatrists, dentists, and others planning on specializing in a highly technical field while requiring further education.

- Child and Dependent Care Credit: Provides a break for those that must work full-time in order to support dependents under the age of 13. This particular tax credit is popular with single parents because it also covers the costs of daycare or babysitting services. It’s available to people who must pay for childcare of dependents under age 13 in order to work or look for work.

- Savers Tax Credit: Again from TurboTax: “formerly the Retirement Savings Contributions Credit, is for eligible contributions to retirement plans such as qualified investment retirement accounts, 401(k)s and certain other retirement plans. Taxpayers with the least income qualify for the greatest credit—up to $1,000 for those filing as single, or $2,000 if filing jointly.”

How to use tax credits to pay off debt

Now that you know about these common tax credits (and MagnifyMoney.com shares several more), it’s time to put a plan into action to maximize your help with debt relief. If you have a return coming from your taxes once all tax credits (and tax deductions) have been applied, plug your return into a debt calculator, and decide what debt you can attack first with the greatest impact. If you are planning on using your tax return to start attacking debt, be sure to take a look at the debt snowball payment method, and contact us if you have any other questions!

Know the strings attached to tax credits

When you file taxes, you are dealing with the federal government. That means expect to have strings attached to anything that looks too good to be true. In the case of tax credits, NerdWallet makes some valid points:

- Some are nonrefundable. That means that if you don’t owe a lot in taxes to begin with, you don’t get the full value if the credits take your tax bill below zero. In other words, a $600 tax bill combined with a $1,000 nonrefundable credit doesn’t get you a $400 tax refund check.

- Some credits are refundable. If you qualify to take refundable tax credits — things such as the Earned Income Tax Credit or the Child Tax Credit — the value of the credit goes beyond your tax liability and can result in a refund check.

- The IRS lays out specific criteria you must meet to qualify for both non-refundable and refundable credits.

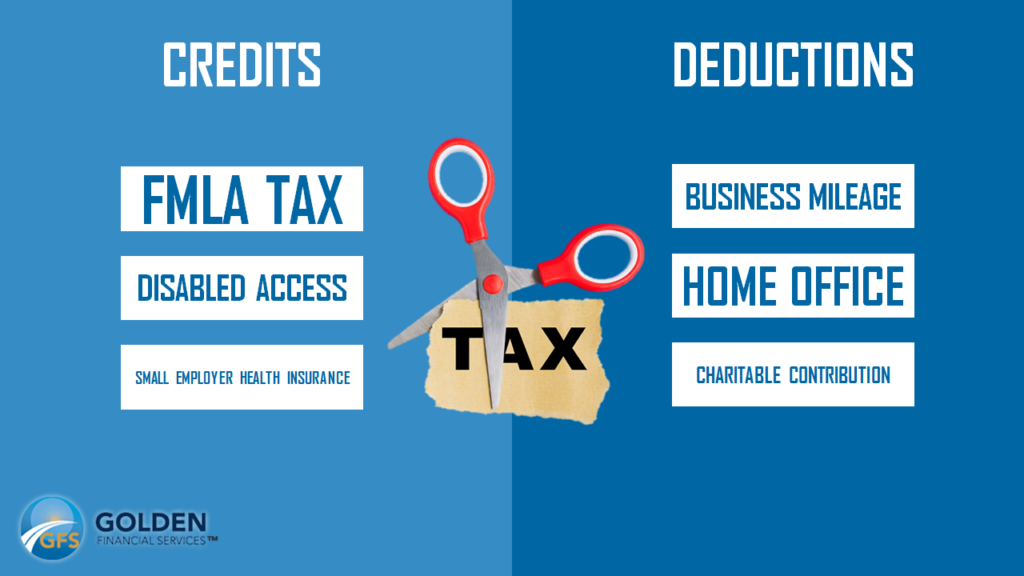

Common Tax Deductions

NerdWallet defines tax deductions like this: “A tax deduction lowers your taxable income and thus reduces your tax liability. You subtract the amount of the tax deduction from your income, making your taxable income lower. The lower your taxable income, the lower your tax bill.”

Some of the most common deductions used to lower taxable income include:

- Business mileage: If you use your personal vehicle as part of your job, it qualifies for a tax deduction. Keep your receipts in case you need to show proof of mileage. This includes any client relations, in-person meetings, and company meetings off-site from your normal job location.

- Home office: Freelancers commonly use this deduction because a well-maintained home office is best for maintaining a business. The IRS recognizes this effort and allows a write-off deduction based on the size of the office. This can even include heating and lighting bills, but note it is a separate filing from office supplies.

- Charitable donations: You can be rewarded for aiding your community or other causes! This includes monetary donations to local or national charities. Keep a record of how much you give throughout the year, and try to have a digital copy for reference.

____________________________

If you found our blog looking for financial advice or assistance with credit card debt relief or debt consolidation, call Golden Financial Services today at (866)-376-9846 or info@goldenfs.org. You can check out the rest of our blog here, and do your research on our services here. Let’s talk soon!