As more and more consumers get the COVID-19 vaccine in Utah, debt relief programs simultaneously rescue many of these people from financial disaster. As of May 2021, all Utahns ages sixteen and older can get the covid vaccine. Utah bankruptcy debt relief filings are projected to skyrocket unless more consumers get vaccinated and qualify for a debt relief program. Utah residents with over $10,000 in combined unsecured debt; credit cards, unsecured loans, medical bills, and collection accounts – will qualify for Utah debt settlement and consolidation alternatives at Golden Financial Services.

How to consolidate debt (Utah residents)

Call today toll-free at (866) 376-9846 to learn your options and check if you’re eligible for some of the best Utah debt relief, settlement, and consolidation programs. Non-profit consumer credit counseling programs in Utah are another option for consumers that need credit card interest rates reduced.

The following page will take a closer look at all of the available options in 2021 to help with debt for Utah residents. We will also take a look at debt collection laws in Utah. Credit card consolidation loans may even be viable options for consumers with a minimum FICO score of 715 or higher, which we will explain below.

FDCPA, FCRA, Credit Card Act, FCBA to Dispute Collection Accounts

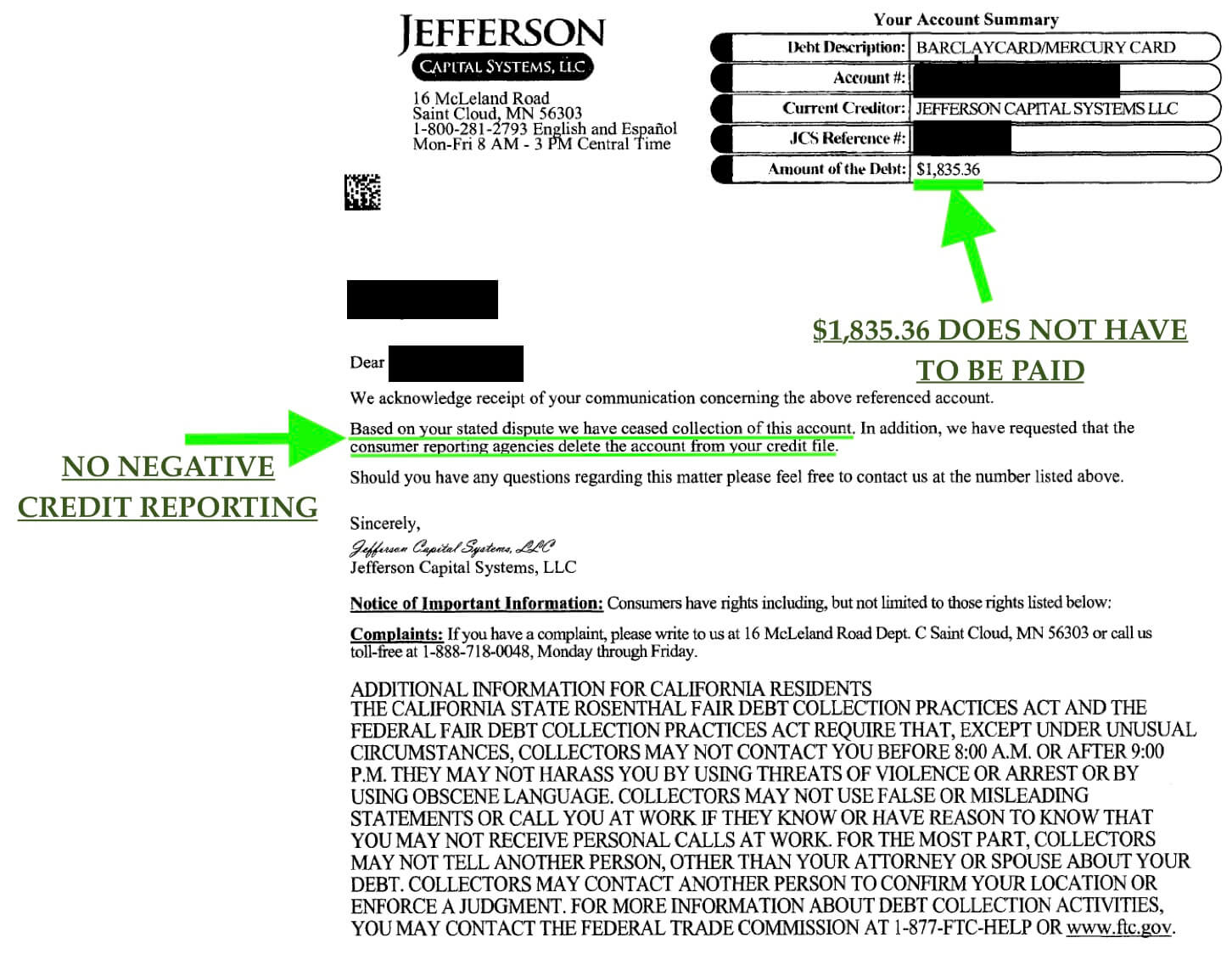

Owe money to a collection agency? Utah debt validation plans can dispute the collection account, and if proven to be legally uncollectible–you may not have to pay it. Use the calculator below to check how much you can save with a debt validation program. These plans dispute your debt, but not saying the debt is not yours or that you never spent the money; instead, a validation plan forces your creditors to prove that they are legally authorized to be collecting on the debt. Legally authorized means that they must maintain accurate records and complete documentation as required by laws. Debt collection companies, in many cases, cannot prove that they are legally authorized to be collecting on debt, including credit cards, medical bills, and most unsecured loans.

Utah Debt Validation Example Letter

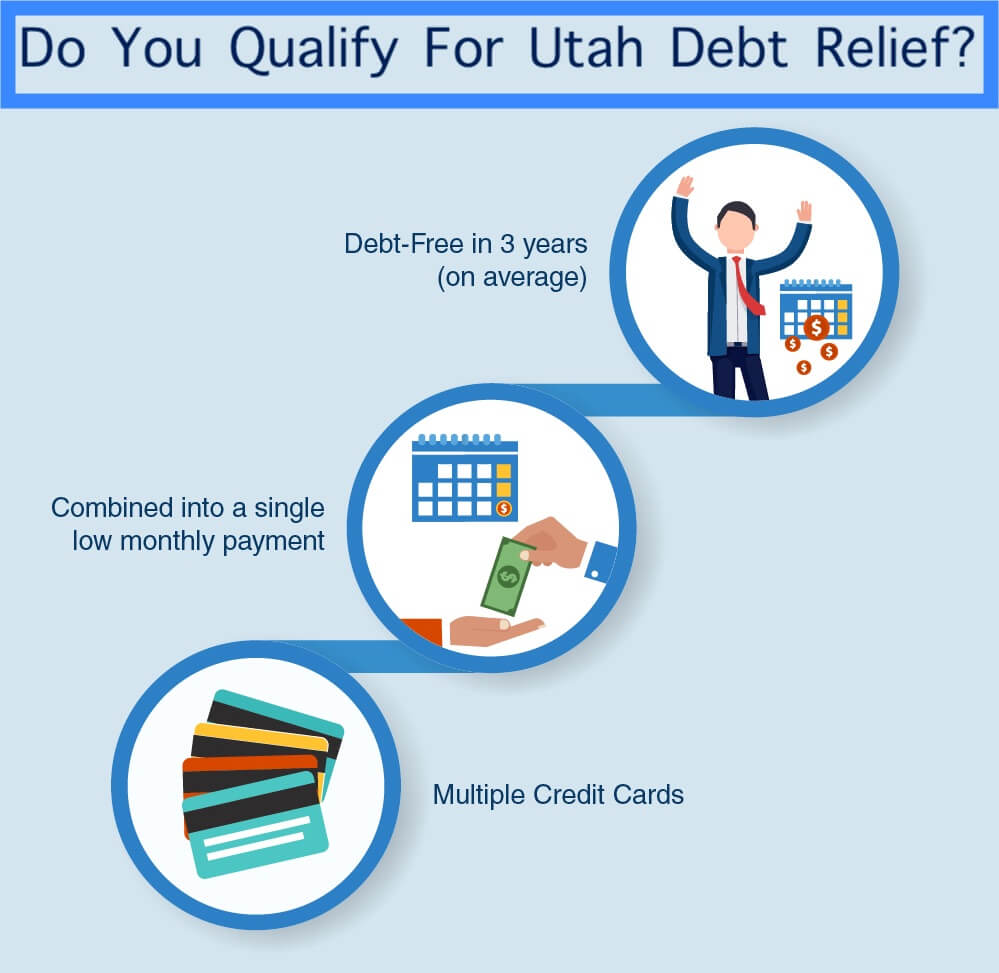

Are you struggling to get out of debt? Utah debt relief & settlement programs provide you with one consolidated and reduced monthly payment. You can become debt-free in 24-48 months, paying less than what you are currently paying when paying minimum payments. How fast do you want to get rid of your debt? The calculator below lets you compare your options.

Are you considering a debt consolidation loan? Utah debt relief programs can save you a lot more money! Before applying for a loan, get a quote on debt relief programs by using the calculator below or calling (866) 376-9846.

In general, if your credit score is under 715, be careful applying for debt consolidation loans. Utah lenders, including Lending Tree, will charge above 25% interest rates to sub-prime borrowers and up-front loan origination fees, making a consolidated loan one of your most expensive routes to getting out of debt.

Do you owe $10,000 or more credit card debt? You qualify for multiple options to help you get out of debt. Credit cards are the most popular type of debt that Utah consumers need help paying off, but just about all unsecured debt qualifies for Utah debt reduction programs. Are you behind on your credit card payments? Programs can help you settle your debt for only a fraction of the total owed, and all late fees and interest will get mitigated into the settlement. See Utah credit card debt relief options BELOW (inside the easy-to-read INFOGRAPHIC).

Utah Statute of Limitations (credit cards)

Have any old collection accounts that were once a credit card? The statute of limitations in Utah for credit card debt is only six years. If you have an old credit card that you have not made a payment on for more than six years, there is a good chance that you won’t have to pay the debt because it’s probably expired past the statute of limitations. Having said that, even if you have a collection account that is less than six years old, there’s a chance you won’t have to pay it. Utah collection agencies are known to have flawed records, missing documents, and inaccurate information on behalf of consumers. You can check if a debt is valid by using debt validation.

No matter what your situation looks like, call (866) 376-9846 for help. Debts can be combined into one low payment, and you can become debt-free in 24-48 months.

Again, you have multiple options to choose from, but first, you must understand the downsides and benefits that come with each plan.

An IAPDA certified counselor can go over each option with you for FREE or continue reading the rest of this page.

Use Calculator for Utah Debt Relief, Settlement & Consolidation Program Quote

This calculator will provide you a summary of your options, including;

- paying minimum payments on your own

- using a program to settle your debt

- utilizing a debt validation program

- using a consumer credit counseling program

Counselors are available to talk with you for free. During your consultation, you can find out if you’re eligible for any of the programs above. If you’re eligible, you can get approved today! There are no fees to start. As a matter of fact, the programs offered through Golden Financial Services only charge you a fee after results are achieved.

All debt relief programs do come with downsides. It is important to understand and know about the downsides. The following infographic highlights the pros and cons of each program.

Pros & Cons of Utah Credit Card Debt Relief Programs (INFOGRAPHIC)

Who is Golden Financial Services?

If you Google Golden Financial Services, you’ll find lots of positive reviews. We’ve helped millions of consumers across the nation in becoming debt-free, going back since 2004.

Our organization is IAPDA Certified and Better Business Bureau A+ Rated.

And what we are most proud of is the fact that positive consumer reviews resulted in us being awarded #1 Debt Relief Company for 2019. Check it out on Trusted Company Reviews.

We work with the top programs in the nation, making it easy for you to find the lowest possible payment and the right solution. We don’t provide the back-end service. Our job is to teach consumers in Utah about their options and then, if eligible, help a person get approved for the plan of their choice.

We empower Utah residents with the ability to choose from multiple options and truly find the right path to achieve financial freedom. We’ve done the due diligence and understand each program. We will make it easy for you to compare your options and get approved for the plan of your choice. We make sure only to offer proven Utha debt relief programs with the top-rated companies that are certified and accredited. Debt relief options include debt relief, settlement, consolidation, and consumer credit counseling. Utah residents can now call for a free consultation at (866) 376-9846.

Do you qualify for any of these Utah Debt Relief Programs?

Talk to an IAPDA Certified Utah Debt Relief Counselor for FREE at 866-376-9846.

Compare Utah Debt Relief Options

Looking to Reduce Interest Rates?

There are two debt relief options available in Utah that can reduce your interest rates. Consumer credit counseling and debt consolidation programs can both reduce your interest rates.

Debt Consolidation Loans – Utah

Debt consolidation loans can be used to pay off high-interest debt, leaving you with one low-interest loan to pay back and allowing you to get out of debt faster. Sounds great, right?

Well, as good as it sounds, debt consolidation is the last resort that you should consider.

Why are Utah debt consolidation programs usually a last resort? If you’re struggling with debt, your credit score is also feeling the negativity of your high debt. If your credit score is less than 700, you won’t qualify for a low-interest loan. So unless your credit is in superb shape, you don’t want to get caught up in another high-interest loan.

- The average credit score for consumers in Utah sits at 678

- 9% of Utah residents have a declining credit score and would not qualify for a debt consolidation loan

Warning: Bad credit debt consolidation loans exist in Utah, but the companies offering these loans will charge you astronomically high-interest rates and fees. Don’t be tricked into one of these bad credit consolidation loan scams. Utah PayDay loans are not worth the money; they often come with the highest fees.

Utah Debt Consolidation Loans for Good Credit

If you have a credit score of 700 or higher, here are your best options for debt consolidation in Utah:

- Use a home equity line of credit as a debt consolidation loan to pay off your high-interest debts.

- Find a low-interest credit union debt consolidation loan.

Consumer Credit Counseling Utah

Utah’s non-profit consumer credit counseling programs can drastically reduce interest rates. If you’re current on your monthly payments and can comfortably afford to pay at least minimum payments — consumer credit counseling could be an outstanding option for you to use to get out of debt faster.

Upside to Utah Consumer Credit Counseling Programs

- Debt-free in 4.5 to 5 years

- Minimal negative effect on credit scores

- Late fees can be waived, and late payments can be re-aged to current

- Creditors continue getting paid each month, so you don’t have to deal with creditor harassment

- You only pay a single monthly payment, making it easier to manage your credit cards

The downside to Consumer Credit Counseling

- It takes longer to graduate than debt settlement and debt validation programs

- 3rd party notation shows up on your credit report, and though this doesn’t lower your credit score, lenders do look down upon these marks, and it could prevent you from getting approved for future purchases that you attempt to make with your credit

- Very minimal reduction in payment compared to when making minimum monthly payments

Utah Debt Relief Programs are Available at 866-376-9846.

Utah Debt Settlement and Debt Validation Options

Debt negotiation and settlement services can lower the overall balance on each debt, allowing you to become debt-free in 36 months on average.

However, before you sign-up for a debt settlement program, use debt validation first to challenge the validity of each debt — because you may not have to pay a debt.

With debt validation, your debts will be disputed, and the debt collection companies will be forced to prove that they’re legally attempting to collect on each debt — and often they can’t prove it!

- If a debt can’t be validated, you don’t have to pay it

- A debt and its associated negative marks could be removed from credit

- Debt validation can be the least expensive route to dealing with a debt

If you’re behind on monthly payments, contact one of Golden Financial’s IAPDA Certified Counselors Today.

- First, we need to evaluate your credit report and look to see if you could qualify for debt validation.

- After evaluating your credit report and budget, we can present your best debt relief options to you.

- If you don’t qualify for debt validation, the next best option would be debt settlement services.

Benefits of debt settlement programs in Utah

- Debt-free in around 36 months on average

- Payless than the full balance owed

- A single low monthly payment

- You see results throughout the program (e.g., one debt may get paid off within six months, another debt can be resolved within nine months, and then another debt within 13)

The downside to debt settlement programs

- Negative marks on credit

- Potential tax consequences that occur when a person settles a debt for less than the full balance owed — the IRS considers this income, and you could be required to pay taxes on the extra income. How to deal with this? File a #984 IRS form that shows you’re insolvent so that you don’t owe any taxes.

- Creditors aren’t paid each month, causing balances to increase before they get resolved (your debt can get worse before it improves)

Utah Student Loan Debt Relief and Consolidation Options

For federal student loan debt relief, Utah consumers can consolidate at StudentLoans.Gov. If your income has been negatively affected, use one of the government’s income-driven repayment plans. These plans can even provide you with loan forgiveness. Here are step-by-step instructions on how to consolidate and get student loan forgiveness.

If you need assistance with consolidating your student loans, contact Golden Financial Services. The Association for Student Loan Relief certifies our agents, and we can help!

For private student loans, you can settle these debts for less than the full balance owed. Call today at (866) 376-9846.

Best Utah Debt Relief, Consolidation and Settlement Company

Golden Financial Services is one of the few debt relief companies in Utah to maintain zero Better Business Bureau (BBB) complaints and an A+ rating. We have been focussing on Utah debt relief services since 2004 and offer all of the options discussed on this page today.

Golden Financial Services Credentials:

- No BBB complaints (click to verify)

- All positive reviews on Google and Yelp (Google “Golden Financial Services”)

- Only pay if results are achieved

- IAPDA Accredited

- AFSLR Certified (click to verify)

- BBB A+ rating (click to verify)

- Golden Financial Services was incorporated in 2004 in Florida and is Licensed for debt management services in TX