Is Midland Funding a scam or a legitimate company? Are Midland Credit Management and Midland Funding the same company? Will Midland Credit Management sue me? How do I deal with MCM collection accounts? Can I negotiate with Midland Credit? Can I benefit from the lawsuit against MCM? Questions continue to roll in at Golden Financial Services about Midland Funding and Midland Credit Management, so we’ll do our best to answer them all today.

The truth is, you may not have to pay a Midland Credit Management debt and could get it removed from your credit if it’s invalidated.

We’re about to explain federal laws to help you deal with MCM debts. Are you eligible to walk away from an MCM debt? We’ll reveal the violations that these collection agencies were charged with to help you identify whether or not you could benefit. Worst case scenario, we will help you settle an MCM debt for less than the full amount.

Who is Encore, Midland Funding, Midland Credit Management, Portfolio Recovery, and Cavalry Portfolio?

Midland Funding, Midland Credit Management (MCM), Portfolio Recovery, and Cavalry Portfolio are among the world’s largest third-party debt collection agencies.

What does Midland Credit Management do? Midland Credit Management collects on credit cards, medical bills, private student loans, and unsecured loans. MCM buys past-due accounts from banks and financial companies for sometimes as low as 10%-20% of the original balance. MCM will then collect at least half of the original debt, producing profit margins above 40%.

For example, if you owed a Bank of America or Citibank credit card and could not afford to pay it, there’s a good chance MCM bought the account and is now coming after you over the debt.

Will Midland Credit Management sue me? MCM will try to sue consumers in some cases, but often the lawsuits are fraudulent, according to the recent lawsuit against the company.

Can Midland Funding garnish my wages?

Midland Funding can only garnish your wages if they issue you a summons to go to court, and you then skip the court date. So whatever you do, if MCM or a debt collection company sues you, don’t skip court. Collection agencies want you to skip court so that they can win a default judgment against you. Just by showing up at court, the judge could elect to dismiss your case.

By the time you finish reading this article, you’ll be fully equipped to resolve MCM debts and avoid wage garnishment.

Is MCM on my side, or are they on the bank’s side?

MCM and Encore debt collection tactics take an interesting approach.

Their website reads as if they partner with the debtor offering a debt relief program to help them get out of debt. But hold on, they are the debt collection company, not a debt relief program trying to help. Instead, their goal is to make money by collecting the highest possible amount.

Who owns Midland Funding and Portfolio Recovery?

Midland Funding and Portfolio Recovery are both owned through Encore. “Encore Capital Group is a global specialty finance company with operations and investments across North America, Europe, Asia, and Latin America.”

According to Wikipedia, “Encore Capital Group, Inc. and its subsidiaries form the largest publicly traded debt buyer by revenue in the United States.[2] It has operations and investments in 15 countries.”

Source: Wikipedia

Is Encore Capital Group a scam?

Midland Credit Management Lawsuit Requires $60 Million in Refunds

According to Credit.com, “Encore (including Midland Funding) and Virginia-based Portfolio Recovery Associates must refund approximately $60 million to consumers and immediately stop all collection activity on $128 million in existing debts after an action filed by federal regulators.”

Both debt collection agencies were accused of “pressuring consumers with false statements and churning out lawsuits using Robo-signed court documents.” So, in other words, the lawsuits were spun out by computer systems without properly being reviewed for accuracy. The result; the lawsuits are filled with inaccurate information and errors.

This type of lawsuit is common against third-party debt collectors in the US. For example, ally Financial just lost a class-action lawsuit in a similar case. “Ally Financial Inc. has reached a near $20 million settlement deal to resolve a class-action lawsuit claiming that the company hit vehicle owners with hidden fees that were allegedly not listed in their lease-to-own agreements.”

How to get an MCM summons dismissed without a lawyer:

So how do you beat Midland Funding in court? In many cases, just attend the court appearance, and you could beat MCM in the case because they probably won’t show up, and the summons will be flawed with inaccurate and incomplete records.

- First, carefully review an MCM summons for inaccurate information that you can point out to the judge.

- Request proof of MCM’s allegations at court in front of a judge. Consider what you owed to the original creditor that you agreed to pay as outlined in the original contract you signed with the original creditor. Let the judge know that the amount MCM claims you owe is invalid. To show proof of your dispute that the debt is not valid, simply request a copy of the original contract signed by the original creditor. By law, the collection agency must provide this original contract that you signed with the original creditor, so just by asking the judge to produce the original agreement will force the judge to request proof of this document from MCM. If MCM skipped court, they wouldn’t be able to respond to your request, and the case could get dismissed on the spot. On the other hand, if MCM attends court and can provide the original agreement to the judge, the terms inside that agreement won’t match the amount they are alleging you now owe, resulting in the dismissal of the case.

What was Midland Charged With?

The CFPB says both firms misled and harassed consumers.

- “Encore is accused of calling debtors before 8 a.m. or after 9 p.m.

- Portfolio Recovery is accused of misleading consumers into consenting to receive Robo-dialed calls to their cellphones.”

According to Credit.com, “Midland Funding and their affiliates purchased a mammoth amount of debt resulting from unpaid bills — together, more than $200 billion in defaulted consumer debts on credit cards, phone bills, and other accounts, according to the CFPB. Encore and Portfolio purchase the right to collect on the debts for pennies on the dollar, then attempt to collect the original amount from consumers.”

According to the Chicago Law Center, “Midland buys the debts for an average of 4 cents on the dollar and then sues the consumer for the full amount. That a whopping 2,500% profit to them…from you. They know that 90% of people won’t show up in court, and 8% of people enter into a payment plan (usually with terrible terms). Their business model depends on it.” So again, creditors issue a summons with the goal that the consumer skips court and win automatically by default judgment.

Is Midland Credit Management (MCM) a Scam?

MCM has been sued multiple times for illegally attempting to collect on debt. However, Midland Credit Management is a licensed collection agency.

According to the Better Business Bureau, there is government action against the company.

The BBB reveals: “Midland Credit Management Inc entered into an Assurance of Voluntary Compliance/Assurance of Discontinuance with the State of Alaska. The Assurance settles allegations that the business used illegal tactics to collect unverified debts by failing to verify debt information and properly document debts. Under terms of the Assurance, the business agreed to provide debt relief and compensation in the amount of $577,783 to District of Columbia consumers, $25,000 to each state for restitution, provide accurate information about valid debts, pay a $6 million penalty to the States, stop debt-reselling for two years, properly oversee and train its agents. The Assurance was for settlement purposes only and should not be considered as an admission of guilt or finding of a violation of the law.”

Is MCM an accredited debt collector?

The company is a BBB accredited debt collection agency but has no BBB rating. You will find the company has over 220 complaints at the BBB.

Source: BBB

How do I get rid of Midland Credit Management?

- Communicate only in Writing or let a debt relief company deal with them on your behalf.

- Use debt validation first, and only if the account is validated will you need to settle the debt.

- If you do settle the debt, only settle if they agree in writing to remove the debt from credit reports.

- After an MCM collection account is invalidated, it can be disputed from credit reports. So don’t try fighting the debt before getting it invalidated.

Resources:

Click here to learn more about debt validation programs.

Click here to learn more about debt settlement programs.

Click here to learn more about credit card debt relief programs.

Disclosure: After a debt is invalidated, it does not disappear. The debt still exists, but legally the collection agency can no longer collect on it or report it to the credit reporting agencies. Therefore, there is a chance that the debt could re-appear on your credit or with a new collection agency. A debt validation program continues to follow up if another collection agency takes over the debt and will continue to do so until the statute of limitations expires on the debt.

Golden Financial Pro Tip: Make sure to hold onto your “Uncle Letter” after an account is invalidated. This letter acts as a defensible record proving an alleged debt to be invalid.

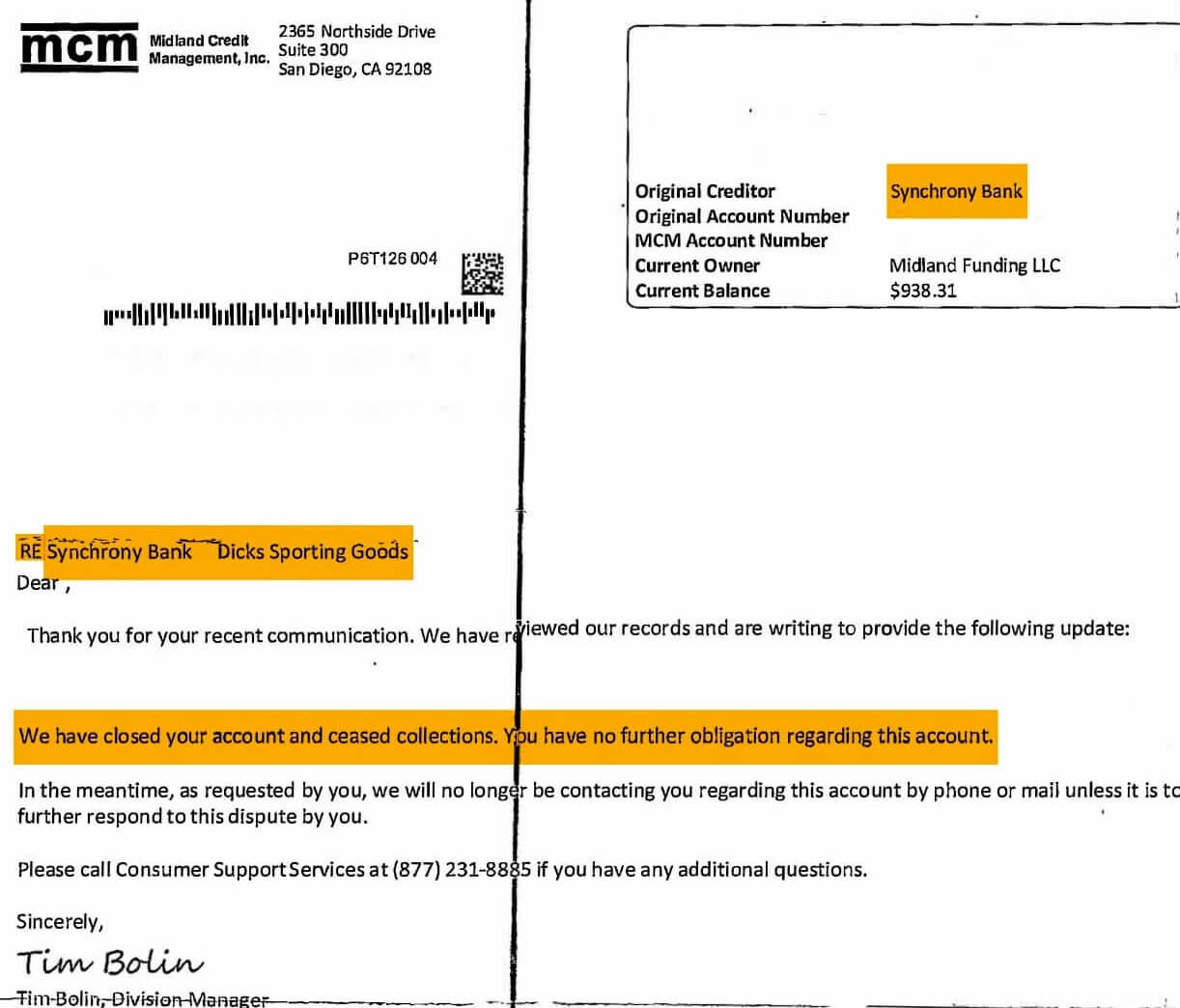

What is an Uncle Letter? (i.e., the letter illustrating the collection agency’s agreement to stop collection on a debt)

An Uncle Letter is the letter received by the consumer after a debt is initially invalidated. This letter illustrates the collection agency agreeing to stop collection on a debt due to their inability to provide complete and accurate records that are being requested. If a new collection agency picks up an invalidated debt, the Uncle Letter can act as a defensible record proving the debt to be invalid.

Why is MCM or Midland Credit Management on my credit report?

“If Midland Credit Management, Inc. appears on your credit report, that means the original account was sold to MCM and that your credit report was updated to reflect the new owner of the original debt.”

Source: MidlandCredit.com

Dispute Midland Funding and Midland Credit Management Debts:

Before settling collection debt, Golden Financial Services recommends using a debt validation program to dispute its validity. Debt validation programs force the collection agency to prove that they have the legal authority to collect on a debt before paying it. In addition, validation programs can be the best way to deal with high credit card balances that you can’t afford to pay.

For example, suppose you owe above $10,000 in combined unsecured debt balances (i.e., credit cards, medical bills, unsecured loans). In that case, you can enroll your accounts in a validation program and get one low monthly payment.

Think about when you buy a used car. First, you check the title to make sure the person you are paying for the vehicle is indeed the owner. A car title verifies ownership of a car. Similarly, debt collection companies are obligated to supply you with proof that they are legally authorized to collect on a debt.

How to invalidate an MCM collection account

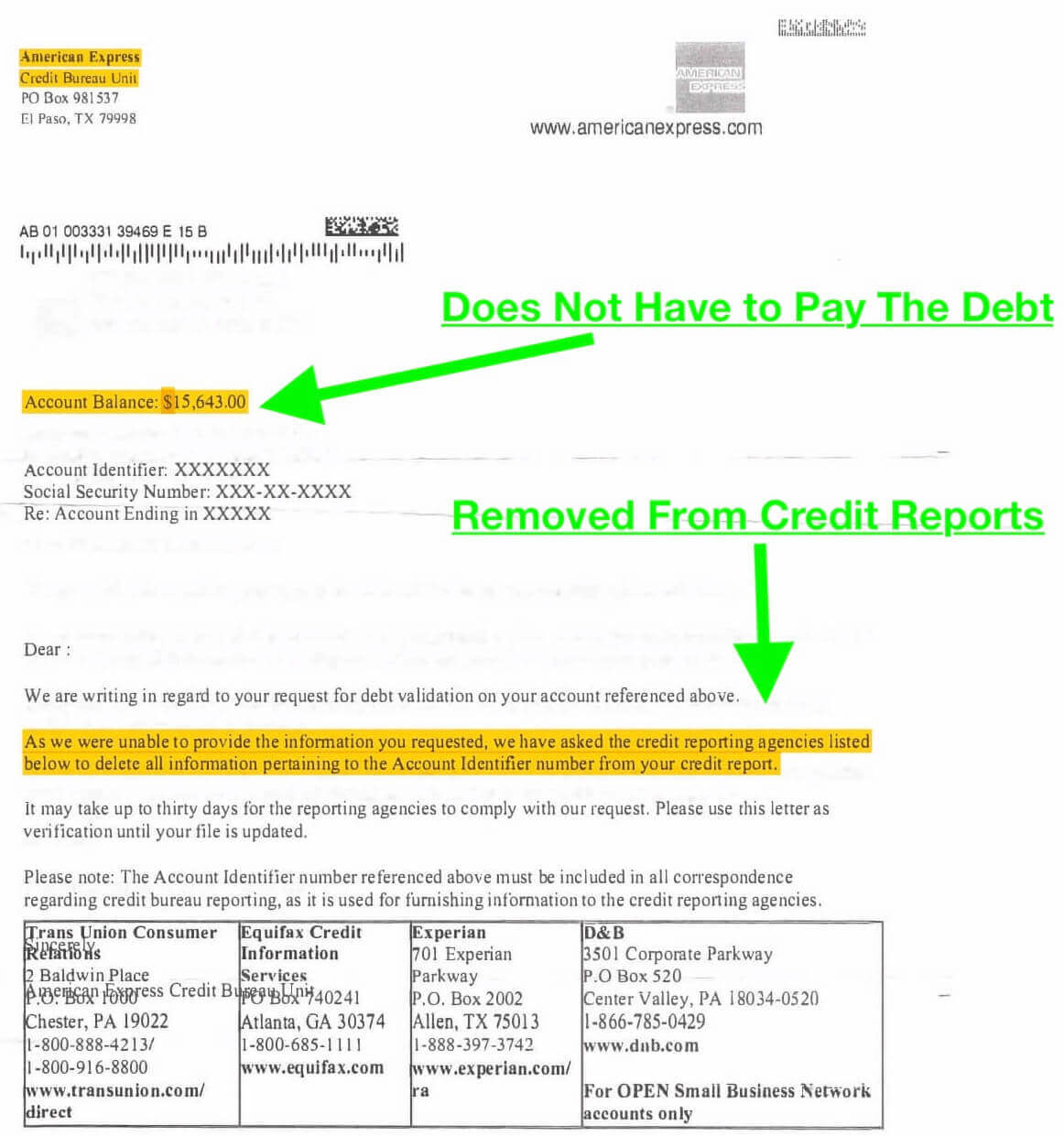

If a debt collection company can’t produce the records illustrating that they are legally authorized to collect on a debt, you don’t have to pay for the debt. And it can no longer legally remain on credit reports.

For example, a collection agency must produce the original credit card contract signed when you first applied for the credit card. The collection agency must have accurate information about the date the account was first past due, your personal information, and the date the account expires past the statute of limitations. The collection agency must produce its debt collector license to collect on a debt in a particular state. Finally, collection agencies must maintain an accurate and complete paper trail illustrating how they came up with the balance they claim you owe, including each monthly statement and a breakdown of the charges.

If they produce inaccurate information or incomplete records, the account becomes invalidated.

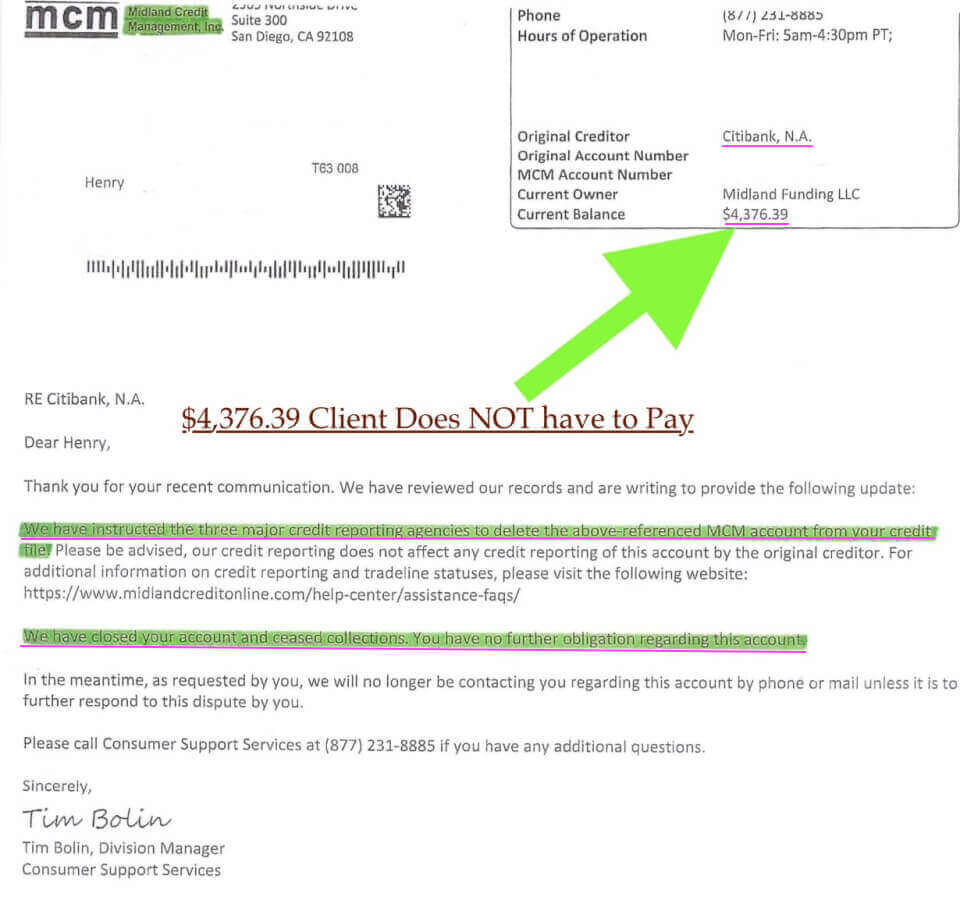

Example of how debt validation disputed an MCM Account:

The following example was once a Citibank credit card debt. MCM purchased the account. Debt validation disputed the account, and it’s now invalidated. Notice below, MCM closed the collection account and agreed to stop collection on the debt. MCM also agreed to remove the account from all three credit reports.

How to Use Debt Validation to Deal with Midland Credit Management Accounts

Call for assistance with your debt collection accounts if you owe above $10,000 in combined balances. Debts can include medical bills, collection accounts, car repossessions, unsecured loans, and finance company loans.

Golden Financial Services can offer you a flexible debt relief program that includes debt validation and settlement strategies to resolve all of your debts for the least possible amount. Contact Concepcion Gutierrez, the author of this post and a debt counselor at Golden Financial Services, for a Free Consultation today at 858-205-6122.

Watch Short Introduction Video:

For more information about debt validation programs, visit this page next.

How to Dispute a Small Midland Credit Collection Account

Per the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Billing Act (FCBA), you can challenge the validity of a small debt by using this simple one-page validation letter creator.

Debt Collection Laws for Third-Party Collection Agencies

As illustrated in the lawsuit above, Midland Credit Management has violated federal laws like the Fair Debt Collection Practices Act (FDCPA) by calling consumers earlier than 8 a.m., using false statements, and illegally Robo-dialing numbers.

Below is a summary of other debt collection laws for you to consider. Some of these laws pertain to third-party collection agencies, and others relate to the original creditor. These are some of the laws used inside a debt validation program.

Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act was created to protect consumers from illegal, fraudulent, and abusive debt collection practices.

Fair Credit Report Act (FCRA)

This federal law has to do with protecting a person’s credit report from inaccurate information. Click the link below to learn more about the FCRA.

Fair and Accurate Credit Transactions Act of 2003

This federal law has to do with protecting individuals from Identity Theft. Click the link below to learn more about the law at Investopedia.

Fair Credit Billing Act (FCBA)

The Fair Credit Billing Act is a 1974 federal law designed to protect consumers from unfair credit billing practices. This law gives consumers the legal right to dispute things like unauthorized charges, charges due to errors, and undelivered goods or services.

Source: Investopedia, Fair Credit Billing Act (FCBA)

Telephone Consumer Protection Act (TCPA)

Unless you give debt collection agencies written consent, the TCPA limits unsolicited prerecorded telemarketing calls (robocalls) to be made to your landline home telephone and all auto-dialed or prerecorded calls or text messages to your cell phone.

Source: National Association of Consumer Advocates, TCPA

Service Members Civil Relief Act (SCRA)

According to Justice.Gov, “The Service Members Civil Relief Act is a law designed to ease financial burdens on servicemembers during periods of military service. See 50 U.S.C. §§ 3901-4043. The law covers issues such as rental agreements, security deposits, prepaid rent, evictions, installment contracts, credit card interest rates, mortgage interest rates, mortgage foreclosures, civil judicial proceedings, automobile leases, life insurance, health insurance, and income tax payments.”

- To read more about this Act, visit Justice.gov.

Source: Department of Justice, The Servicemembers Civil Relief Act (SCRA)

Truth in Lending Act

The Truth in Lending Act was designed to protect consumers from lenders and creditors. Creditors must disclose to the borrower the annual percentage rate (A.P.R.) and fees associated with the loan before extending credit.

Credit Card Act of 2009

According to Experian.com, “The Credit Card Accountability Responsibility and Disclosure Act of 2009 (or Credit CARD Act) was the most significant legislation regulating and reforming the credit card industry in decades. The Credit Card Act was put in place to protect consumers against unfair, deceptive, and abusive practices by the credit card industry. Many consumers and legislators felt that the credit card industry engaged in abusive and deceptive practices before passing the Credit Card Act. For example, credit card issuers were free to raise consumers’ interest rates for any reason and without notice. The industry was also allowed to impose unlimited fees, such as late fees and over-the-limit fees, even while card issuers approved transactions above consumers’ credit limits.”

These are a few examples of laws governing third-party debt collection and credit card companies.

How to report debt collection fraud and scams?

Report deceptive and abusive debt collection acts to the CFPB, the supervisory department for debt collection companies.

Validation Programs Request Proof That Collection Agencies:

- Are abiding by the federal laws mentioned above.

- Can produce complete and accurate records to verify what they claim you owe is accurate.

- Are licensed to collect on a debt in any given state.

How to get Midland Funding and Credit Management Accounts Removed from Your Credit Report

After an account is invalidated, the collection agencies can no longer legally report the debt and its associated derogatory notations, including late and collection marks on your credit report. In summary, by invalidating these debts, you no longer have to pay them and could potentially get them removed entirely from your credit reports. In addition, if an account is invalid, the FCRA gives you the legal right to dispute the account from your credit report.

Debt validation programs can result in “not having to pay” a debt because it is proven to be invalid. You can then dispute the invalid or inaccurate account from credit reports. However, in many cases, as illustrated in the letter above, the collection agency will willingly remove the account from the consumer’s credit report after it’s invalidated.

Disclosures: There is no guarantee that a validation program can invalidate a debt or get it removed from a client’s credit report. Validation is the first line of defense we use to deal with most debt collection accounts at Golden Financial Services. This is because if an account is not validated, you don’t have to pay it. If you’re “current on monthly payments” and join a debt validation program, expect your credit scores to go down and your credit to get negatively affected. If you can afford to pay your creditors in full, we do not recommend joining a debt settlement or validation program. Remember, validation can only dispute a debt after it’s with a third-party collection agency. By defaulting on payments to use a debt relief program, you’re taking on the risk of potentially getting sued, hurting your credit, and ending up with more debt than what you originally started with. The programs we recommend at Golden Financial Services are for consumers who have third-party collection debts or can’t afford to stay current on monthly payments. Golden Financial Services is not a law firm or a registered financial advisor, or a consultant. This blog post is not legal advice, but rather it’s education being provided based on the experience of Golden Financial Services.

Do Midland Funding L.L.C. and Midland Credit Management Accounts Qualify for a Debt Validation Program?

Eligible Accounts for a debt validation program:

- Midland Credit Management collection accounts

- Credit cards

- Medical bills

- Most unsecured loans

- Almost all third-party debt collection accounts

Total Debt Requirements to qualify for debt relief options

Consumers must owe above $7,500 in total unsecured debt to be eligible for a debt relief program at Golden Financial Services.

To reiterate, if you can’t afford to stay current on your monthly payments, a debt settlement and validation program could be a viable option to consider, but there are downsides that you need to understand. Before joining a debt relief program, it’s imperative to speak with an experienced debt counselor to help you plan for the long term. Understand the potential downsides so that you can proactively work to improve your credit over the long term.

Should I settle with Midland Funding?

A debt settlement program can provide you a single monthly payment to settle each debt for less than the total balance. You can choose a comfortable monthly payment that fits your budget. You will have legal representation included with the program if creditors violate your rights, break laws or issue you a summons.

Debt settlement programs offer you the last resort to settle Midland Credit Management accounts for a fraction of the total owed. The downside with debt settlement is that the collection account, default, and late marks will remain on your credit report after settling for less than the entire balance. In addition, credit scores don’t improve by settling a debt unless the collection agency agrees to remove the debt from your credit.

How to Settle a Midland Credit Management Debt on Your Own

Can you settle with Midland Credit Management?

If you don’t pay Midland Credit Management and they are harassing you, eventually they will either;

A.) issue a summons for you to go to court (hoping you skip the court appearance so that they can win by default judgment and then garnish your wages) or

B.) offer to settle for less than the entire balance.

Neither of these options benefits you, the consumer.

A settlement could save you money because you’ll resolve the account for less than the total balance you once owed to the original creditor. But keep in mind, the original creditor no longer owns the debt. MCM has been reimbursed fully through tax credits, banking insurance and has earned additional profit from selling the account to MCM. So your original creditor has wiped their hands clean of the debt; MCM now owns it. And they purchased the account for possibly 10-20% of what you originally owed or less.

If you settle MCM debt collection accounts, you end up with trashed credit because the collection account will remain on all credit reports. And then you’ll receive a nice tax bill from Uncle Sam expecting you to pay taxes on the “money saved.”

How to resolve MCM debt (the best way)

Getting the debt invalidated will benefit you because you’ll pay a smaller amount than if you were to settle. After an account is invalidated, it can no longer remain on credit reports (legally anyway).

How to settle MCM collection accounts

According to Paul Paquin, C.E.O. at Golden Financial Services, “If you owe a small collection account, you could try negotiating to settle the debt on your own. Offer 20%-30% of the balance as a settlement letting the collection agency know that it’s all of the money you have available in your name. Illustrate to the collection agency that you have a limited income and can’t afford even “necessities” (i.e., food). Explain your financial hardship in detail. Most importantly, only agree to a settlement if the collection agency agrees to entirely remove the debt from your credit report. Let the collection agency know that this attempt to settle the debt is your last resort before turning to bankruptcy.”

Even if the collection agency comes back with a counteroffer to settle for 50% or 60%, if they’re willing to remove the debt from your credit report, it’s well worth it. You could save money paying less than what you owe and improve your credit.”

How much money Midland Credit Management makes off your debt

Collectors make their living off commissions from collecting on a debt. For example, suppose the Midland Funding collection agency buys a credit card debt from Bank of America with a balance of $1,000, but Midland only pays $100 to purchase the delinquent debt.

Midland Credit Management then offers the consumer to settle the thousand-dollar debt for $200. The collection agency doubled its money from this deal since they only paid one hundred dollars to purchase the debt from Bank of America.

Look at the operating margin for the Publicly Listed Company, Encore (ECPG), and you’ll see its operating margin is a whopping 41.11%. Remember, Encore owns Midland Midland Credit Management and Midland Funding.

Credit card debt services can settle collection accounts for sometimes half the balance because collection agencies pay such a small amount to purchase the accounts.

Why do consumers see Midland Funding on their credit reports?

According to Midlandcredit.com, “Midland Credit Management (MCM) is a debt collector that services accounts owned by Midland Funding. However, MCM also purchases and owns some of the accounts it services. This is why some consumers see Midland Funding on their credit reports.”

Does Midland Credit Management offer debt repayment plans?

According to their website, Midland Credit Management is a debt management company whose goal is to help the consumer. Still, in reality, they are working for Midland Funding and working on behalf of the collection agency and its best interest.

Rather than contacting the collection agency directly, contact a reputable debt settlement or debt relief provider to learn all of your options from an unbiased professional.

Source: MidlandCredit.com

About the author:

Concepcion Gutierrez has worked for over a decade as a Certified Consumer Credit Counselor and Debt Specialist for debt settlement and validation programs. Gutierrez currently works on the frontline at Golden Financial Services and has assisted thousands of consumers in becoming debt-free. For a free consultation with Concepcion Gutierrez at Golden Financial Services, call her direct at 858-205-6122. As a reminder, consumers must owe above $7,500 in total unsecured debt to qualify for the programs available at Golden Financial Services.