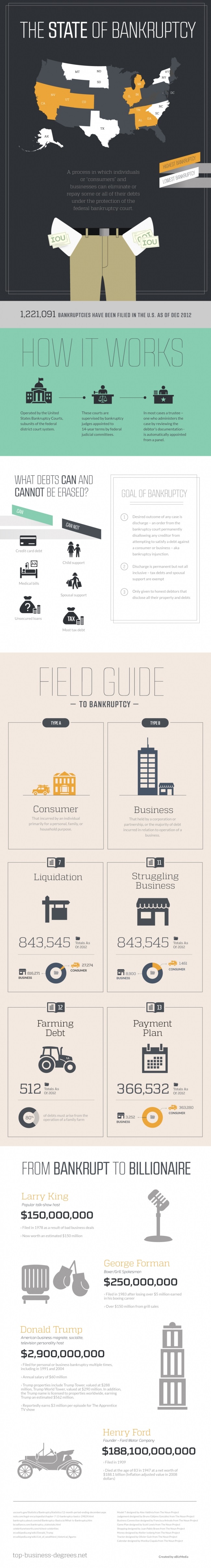

Infographic Explaining Each Type of Bankruptcy

At Golden Financial Services we believe that bankruptcy should be the last debt relief option that anyone ever considers.

However, there are times where people cannot qualify for debt settlement or consumer credit counseling programs, where bankruptcy is the only debt relief option left. If you’re getting served with multiple credit card lawsuits and can barely afford $100 per month, bankruptcy may be your best bet.

Bankruptcy could eliminate and wipe away the credit card lawsuits, but leaving you with a nasty scar on your credit report. If you’re a struggling business owner, Chapter 11 bankruptcy could clear all of your business debts.

While it might seem confusing at first, bankruptcy is actually a fairly simple system that you can use to remove your debt if it becomes overwhelming. It’s a good idea to have a lawyer represent you since he or she will know all of the associated laws, but you can always file for bankruptcy by yourself. Here are a few things that you should know about bankruptcy before moving forward.

How it Works

Bankruptcy is fairly simple. There is a court for bankruptcy cases. This court is headed by appointed judges that serve on the panel for 14 years or longer. While the judges are sometimes needed for cases, the vast majority of people will see a trustee. This is a person underneath the judge that is in charge of heading most bankruptcy claims and cases.

If you are filing Chapter 7 or 13 bankruptcy, which most people do, then you will most likely talk to a trustee. If you have a larger case and you have to see a judge, then you will definitely want a lawyer to accompany you.

Chapter 7 and 13 Bankruptcy

While there are a handful of different bankruptcy types, the two most common are Chapter 7 and 13.

Chapter 7, also known as a liquidation bankruptcy, is when your property is sold to cover the debt. If you don’t have the money for your debts, then Chapter 7 is better.

Chapter 13 is when your debts are changed and reorganized to make them easier to pay. With a Chapter 13 bankruptcy the debtor is allowed to keep their property and repay their debts over 3-5 years.

The Hearing

After your bankruptcy is scheduled, you will have an appointment to see a trustee. This is most commonly held in a room with about 10 to 20 other people that are also filing for bankruptcy so that all of the cases can be quickly finished.

You will speak with the trustee and tell him or her why you are filing bankruptcy. The trustee will then take your documents and rule on your case.

The majority of bankruptcy cases are very simple and you might even be able to do it on your own. At the same time, it’s a good idea to get a lawyer so that you can be sure that everything is filled out correctly and goes as smoothly as possible.

To learn more about debt relief programs available in the U.S. we recommend visiting our Florida debt relief page next.

We also recommend checking out our latest creation that teaches people how to pay off credit card debt fast.

Awesome infographic! I like the design and the information is relevant and helpful. Great work.