Golden Financial Services, an IAPDA Accredited and BBB “A+” rated debt relief and consolidation company provides the best tips inside this blog post on how to escape credit card debt after falling behind on your payments. We are familiar with all of your debt relief options, and not just one option because that’s what we are trying to sell you. This blog post is not intended to promote our services in any way whatsoever. The purpose of this blog post is to — open eyes — and inform people of their options. You have options;– that’s right — you have options to get out of debt and improve your credit.

What happens if you stop paying your credit cards?

If you stopped paying your credit card bills — you need to take action fast. The credit card company could sue you. Late fees and interest will accumulate, making your balance even higher. Your credit score will drop. You will be restricted from using your credit to purchase items, get a new credit card, finance a car, get approved for a mortgage, etc.. and for many years to come! You will get harassed by creditors and third-party debt collection companies. And the problem won’t go away on its own. After 180 days of being delinquent, the debt will be “charged off” and sold to a debt collection agency. The debt will continue to get sold from one collector to the next. Once the debt lands in the hands of a third-party debt collection company, at that point a debt validation program should be your primary plan of action.

Debt validation can force a debt collection company to stop collection on a debt and to remove the debt and any associated marks from your credit report. Debt validation can be your secret weapon to fighting debt. It is one of the most underused debt relief solutions available today, and only because 99% of the population is unfamiliar with the debt validation laws.

An Analogy of how debt validation works:

“Just like when you get a speeding ticket, there’s a process you can use to challenge the ticket and get it dismissed. That same theory is used in a debt validation program. Yes, you were speeding, but that ticket gets easily dismissed when properly challenged.” There are laws that regulate credit card and debt collection companies, different laws for each, so if these laws are not abided by, debt can also be either dismissed or invalidated. In either case, once a debt is proven to be invalided or dismissed by an attorney, it can no longer legally be reported on a person’s credit report.

This is why debt validation can be a better choice than debt consolidation or settlement services, to deal with debt collection accounts. Getting the debt collection account removed entirely, from your credit reports, will help your credit score. Now with debt validation, the debt is not dismissed, but it is proven to be legally uncollectible in some cases, and a legally uncollectible debt is one that you don’t have to pay and it cannot be legally reported on your credit report. Here is another blog post that explains in detail — how debt consolidation affects your credit score.

Examples of what a debt validation program requires your creditors to abide by:

The debt collection companies must provide these items within 30-days of being requested. If they can’t supply any of the following requested items, the debt collection company cannot continue collecting on the debt. The information must also be 100% accurate in order for a debt to be validated. If one “T” isn’t crossed or an “i” not dotted, your debt can be invalidated.

- the copy of the original contract is requested.

- a statement showing how the interest was calculated and a breakdown of each statement illustrating what services were added are requested.

- their debt collector license that is legally required to collect on debt in the state where you reside is requested.

- a legally required 14-page debt collector disclosure statement is requested.

Now keep in mind, this is a micro-version of what is being requested on a debt validation program.

In the debt validation program that we recommend at Golden Financial Services, there are actually over 30-pages of documents that are sent to your debt collectors on round one! They must go through each page, line by line, and send in everything being requested — and required by laws. The case managers and debt defense team continue challenging a debt, until the debt is “fully disputed”. Every legal debt relief angle is used to force your creditors to play by the rules.

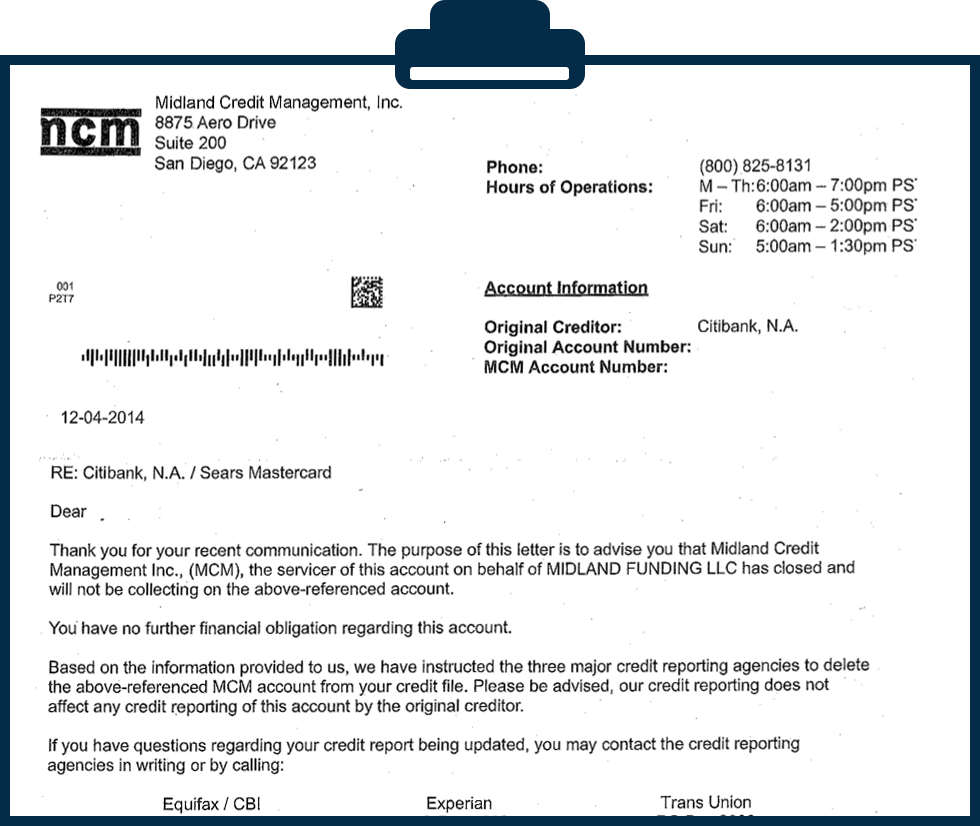

Here is an example — debt validation letter — the debt collection company agrees to stop collection on the debt and remove the derogatory information from the consumer’s credit report.

If a debt is legally uncollectible — YOU MAY NOT HAVE TO PAY IT!– Give our trained debt specialists a call to talk about your debt at 1-866-376-9846 — IT’S FREE

Credit Restoration is Included with a Debt Validation Program — FOR FREE

If you would like to continue reading about debt validation — Visit our official debt validation program page next.

Source: Golden Financial Services, https://goldenfs.org/debt-validation-programs/, 07/06/2017

ABOUT THE AUTHOR – WESLEY HENDRICKSON