Many people have been asking how to get credit card annual fees waived. These fees can be high, especially if you have Bank of America or Chase credit cards. However, sometimes, the yearly fee is well worth it because of the card’s attractive reward points and cashback, which we’ll discuss below.

Note: Credit card companies make their money off annual fees and interest rates. So, they won’t automatically waive your annual fee, no matter how positive your credit history looks.

And also, keep in mind, you’ll need to be able to illustrate to your creditor sufficient positive payment history, which includes using and paying your credit card on time every month for at least a year. So don’t even attempt to get your annual fee waived if you have late payments and insufficient positive payment history over the last year showing up on your credit profile.

How to eliminate interest on credit cards?

To avoid paying interest on your credit cards, pay your balance in full every month.

If you can’t afford to pay your balance in full, check out these 10 Best Ways to Clear Credit Card Debt for 2022.

You may also want to consider credit card relief programs.

How to get the annual fee waived:

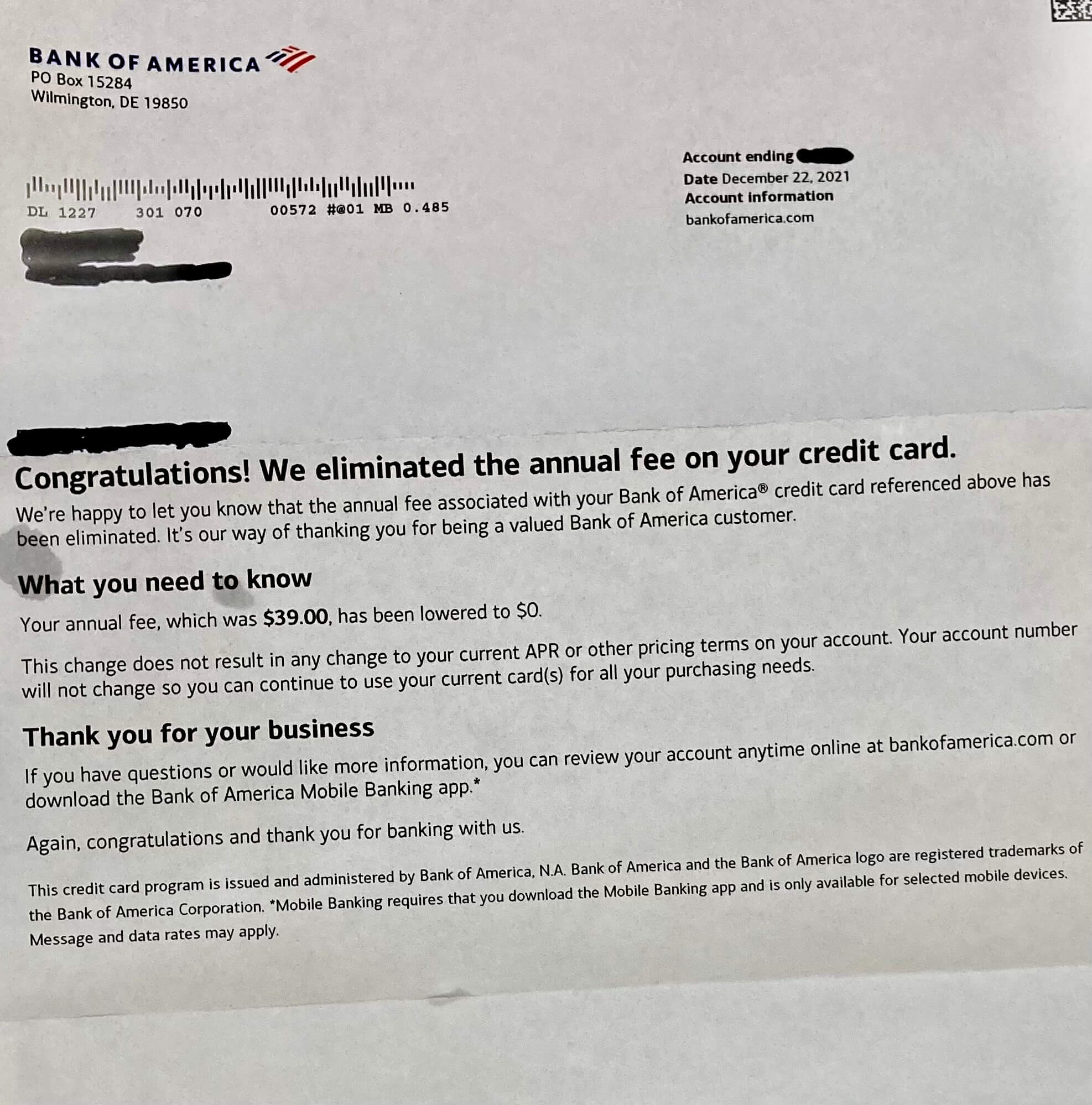

Here is an example of Bank of America agreeing to waive this client’s annual fee of $39. We’re going to provide you with the exact details of how this client (and many more) went about getting their annual fee waived.

Step 1: to eliminate the annual fee

Call your credit card company and request to speak to a supervisor about the annual fee on your credit card.

Script for Calling Credit Card Company to Negotiate Waiving Annual Fee

“I noticed I have an annual fee for $__. Because I’ve always paid my card in full and have never been late (or whatever the favorable circumstances are related to your situation), can you please waive the fee?” Adjust this line to reiterate the details of your positive past payment history.

Your creditor may say, “We will consider your request,”:

Don’t worry. This is not bad news.

You then need to say:

“If this doesn’t get waived, I will have to cancel the card and get one that doesn’t have an annual fee.”

Let them know:

“I received another credit card offer for a credit card with no annual fee and 2% cashback. This credit card offer triggered me to call you in the first place. I don’t want to close my card with you. I expected you would approve my request since I’ve been such a great paying client. Unfortunately, I will be switching to this other card and closing my card with you if you’re not able to waive the annual fee.”

If your creditor doesn’t approve your request on the phone at that point, don’t worry:

Request for your creditor to “Make a case”:

They will review your case and send you a letter in the mail within a month, most likely approving your request.

The letter will say:

“Congratulations! We eliminated the annual fee on your credit card.”

Will Capital One, American Express, and Chase waive the annual fee? Yes, these creditors and almost all will agree to waive the annual fee if you’ve been using and paying your credit cards for 18-24 months.

When is the annual fee worth it?

Do the math.

If you travel every month and it’s a travel credit card that pays you 5% back on all purchases related to traveling, that $199 annual fee would be well worth the price.

Have you enjoyed this quick money tip? Check out more at www.GoldenFs.org/Blog/, #1 Rated Financial Blog Online.