The very word “millennial” is tossed around with such reckless abandon these days that millennials are almost offended to be called millennials. This is because there are several negative stigmas attached to the term. However, if you are a millennial (no offense), it may be beneficial for you to identify as one for the sake of this blog, just to put things in context. As a millennial in debt, you are not alone. There are millions of millennials suffering through early debt issues that may be looking for the same help. Tell a friend about Golden Financial Services!

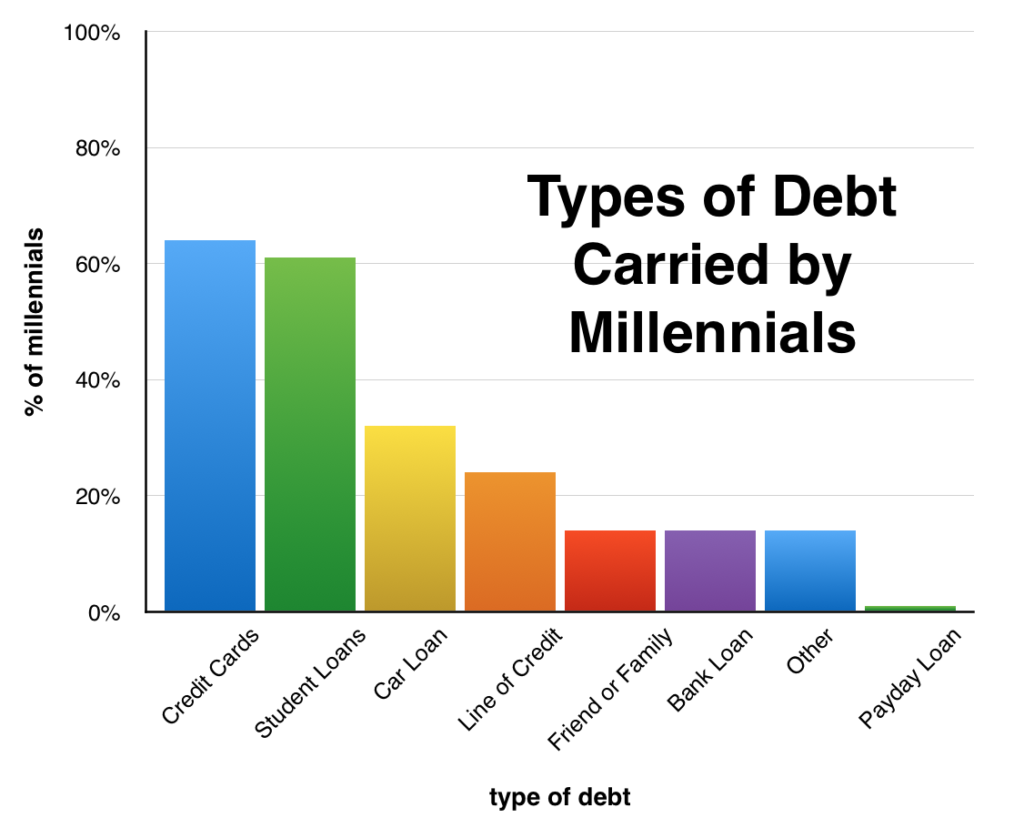

According to DaveRamsey.com, “At the end of 2018, the average millennial debt (for 18–29-year-olds) reached a record high of over one trillion dollars—one trillion dollars! That’s the highest it’s been since 2007.” With that in mind, here are some tips for millennials suffering through things like student loans, credit cards, leftover travel expenses, and their first car payments.

Work for a Qualifying Public Service Loan Forgiveness Employer

This outside-the-box idea comes from Forbes: “Find an employer who is a qualified participant for the public service loan forgiveness program. If a graduate has a lot of student loan debt, strategically working within the public service field over a 10-year period can qualify the person to have the remaining balance of their student loan debt completely forgiven. Also, a person can change jobs over the ten years as long as the employer qualifies (501c3 status).”

While many blogs will tell you how to nickel and dime save your way to better credit score health and less debt, this idea actually will take some time. However, the end result is being debt-free!

Set Financial Goals

Ok, here is one of those no-brainers, but it also makes total sense. Sometimes the best way to attack a problem is to envision the finish line first, then go back and set up the steps it will take to get there.

InCharge.org breaks it down like this: “Start with your overall goal: becoming debt-free by (insert a date). That could be by age 25, 30 or even 35, but targeting a certain date will keep you on track. Then start with incremental goals. Getting a job in your chosen career, earning a full-time salary, starting a savings account, buying your first car and getting your first mortgage.”

Use the Debt Snowball Payment Method

We’ve covered this topic a lot, but it really does apply to nearly every type of credit card debt strategy. Golden FS has created a Budget Calculator to get you started, the first step following the setting of financial goals we just detailed above. Once you are armed with some firm numbers and a game plan, the Budget Calculator will lead you straight into the Snowball Payment Calculator.

Start paying the credit card or loan with the highest interest rate or balance first, while making the minimum payments on your other bills. Once you have the first balance cleared, move on to the next obligation with the lowest balance and wipe it out. Soon, you will have increased cash flow, a rainy day spending fund, and an improved credit score.

Finding a Workable Budget

Lastly, once you have a snowball plan in place, the last task is to find tools to help you stay on track. The Balance lists several useful applications within a full explanation: “When dealing with short-term debt like credit card debt, millennials should try to stick to a traditional budget and should avoid using credit cards as a backup to pad a monthly budget that is simply beyond one’s means. If the pen-and-paper or Excel versions of a budget aren’t working, an online budgeting platform like Mint, Wally, or You Need a Budget are good alternate options.”

For additional support, call Golden Financial Services today at (866)-376-9846 or info@goldenfs.org. You can check out our blog here, and do your research on our services here. Let’s talk soon!