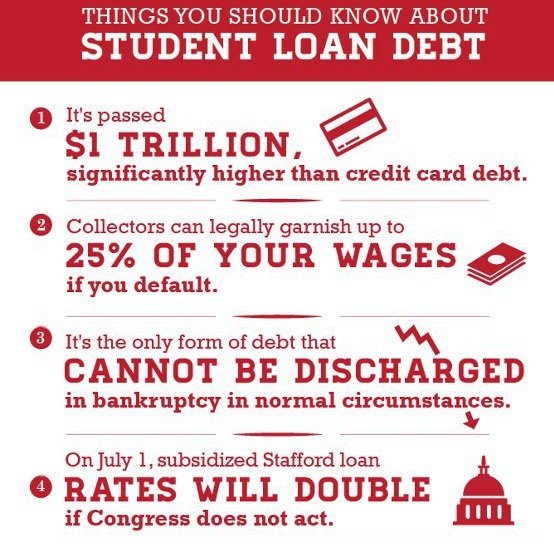

As our young student’s strive to better their education and solidify careers, student loan debt lurks behind them in the shadows, just building and building — and eventually escalating into “high and out of control debt.” If you or someone you know has student loan debt, consolidation programs can be your perfect solution, but first read about the Pros and Cons associated with student loan consolidation.

Some benefits of student loan consolidation

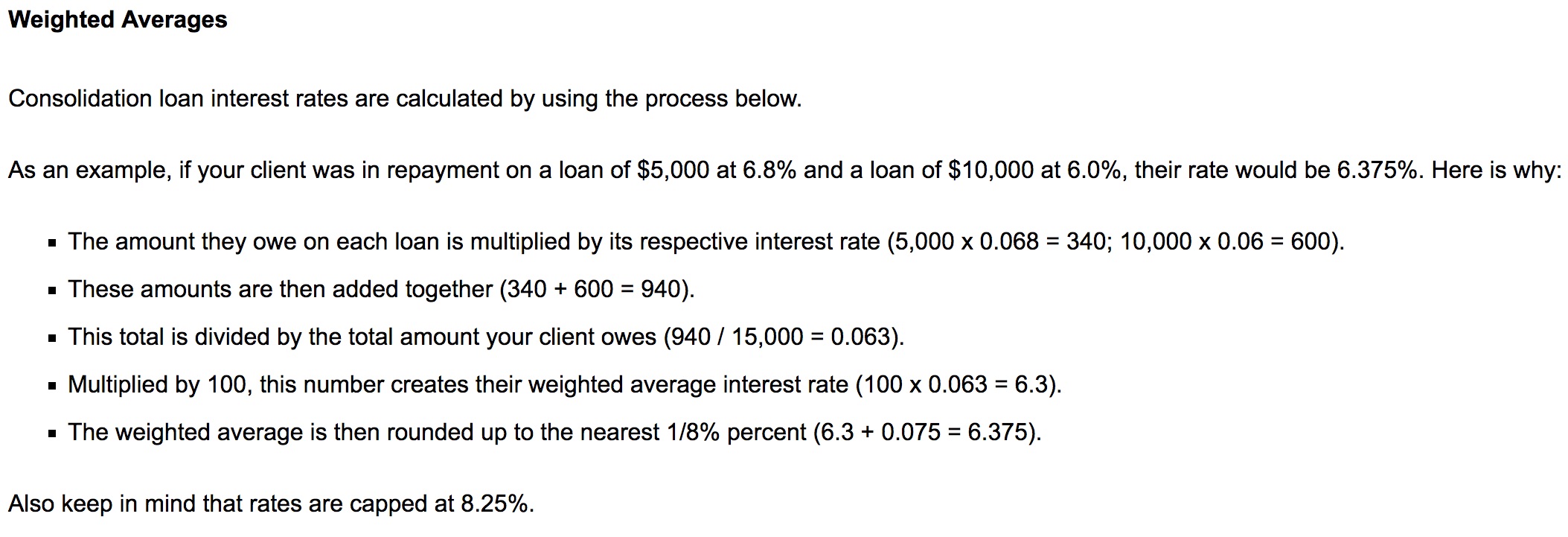

A. Your new consolidated student loan will have a fixed interest rate based on the rates of the underlying loans — eliminating your high-interest rates. The interest rate on your new consolidated loan will be calculated based on the “weighted averages” of the interest rates on your existing loans.

B. You will have one affordable payment per month — to one lender, instead of multiple payments to different lenders. If you have a financial hardship, an income based consolidation and repayment plan could drop your monthly payment down — close to “zero dollars” per month.

C. If you are behind on your monthly payments, you can request forbearance for 90-days; — giving you enough time to complete a student loan consolidation and repayment plan and waiving any due payments.

D. Federal Family Education Loan (FFEL) Program borrowers who consolidate into the Direct Loan program can take advantage of military benefits and Public Service Loan Forgiveness (PSLF). You may get your consolidation loan balance forgiven in 10-years, compared to 20-25 years for everyone else.

Some of the disadvantages of student loan consolidation

A. Due to the fixed interest rate on the new consolidated loan, you will not benefit if the variable interest rate goes down.

B. Beware; if your payment plan is stretched out over a longer period, you will continue to pay interest over that extended time and could end up paying more interest in the end.

C. If you enroll a Parent PLUS loan in your student loan consolidation, you will not be eligible for income-based repayment plans. You may still qualify for other programs such as the graduated repayment plan, but these other programs may not offer you as low of payment.

If you are looking to consolidate your student loans, FIRST; — SPEAK TO A CERTIFIED STUDENT LOAN RELIEF SPECIALIST — FOR FREE AT 1-866-376-9846. Learn your student loan relief options and get professional advice before making any final decisions. To learn more about student loan consolidation online, visit this page next.

Wesley (Wes) Hendrickson is the author of this post. Wes’s primary goal is to bring stress relief and a sense of “wholeness” back into the lives of those who are struggling with debt. Wes is a Certifed Student Loan Professional under the Association for Student Loan Relief (AFSLR) and he is accredited with the International Association of Professional Debt Arbitrators (IAPDA). CONTINUE READING ABOUT WES HENDRICKSON ONLINE OR CONTACT HIM FOR A FREE STUDENT LOAN RELIEF CONSULTATION AT; 1-866-376-9846.

If I have a fixed interest rate of 10% on my consolidation loan should I consolidate?

Can you really get a $0 per month payment after consolidating?

Your style is so unique in comparison to other folks I have read stuff from. Thanks for posting when you’ve got the opportunity, Guess I’ll just book mark this site.

I like how you illustrated the negatives of student loan consolidation, none of the other sites show the negatives so this is great.

I think this is one of the most important info for me. And i’m glad reading your article. But wanna remark on few general things, The web site style is perfect, the articles is really excellent : D. Good job, cheers

Thanks for your insight into debt relief options, this is very helpful. I am glad I have taken the time to see this.