Editor’s note: Many people will continue to deal with creditors on their own because they have misconceptions about debt relief and how it works. We sat down with Wes Hendrickson, Executive Manager of Golden Financial Services and an IAPDA Certified Debt Relief Expert, for some answers.

Here are the “debt relief program” related questions that we asked Wes Hendrickson from Golden Financial Services:

1. I am drowning in credit card debt. I call you. What can you do for me?

2. How long does a debt relief program take?

3. My only debt is student loan debt but I am being threatened with garnishments. Can you help me?

4. What are some of the misconceptions about debt relief programs?

5. Do you have advice for consumers who feel like they are on the verge of a financial crisis?

6. Tell me about Golden Financial and their reputation in the industry.

Question 1: I am drowning in credit card debt. I call you. What can you do for me?

Here is the answer to this question, provided by IAPDA Certified Debt Relief Professional From Golden Financial Services – Wes Hendrickson

- I will ask a few questions to determine what information and debt relief programs will best fit your situation and how they’ll work. Program availability is first determined by the state in which the client lives. Some states don’t allow almost any type of relief for their residents. We have one program that’s available in all 50 states that other companies don’t offer.

- I’ll explain the appropriate debt relief options based on the information gained from the caller and email a description with a quote on the cost. Most debt relief programs will dramatically reduce the pay-off amount and include zero interest, affordable payments.

- Our two most popular programs will have the client out of debt within 15-18 months and include free credit restoration to improve their chances of being able to obtain a loan in the future to buy a car, house and other items.

- We provide education on their Federal Consumer rights and education on how to keep excellent credit in the future. In most cases we will ultimately cause their debts to be released in full by the creditors and then remove the debt accounts from their credit reports along with any other incorrect notations on their reports. These debt relief programs include a money back guarantee or an assurance of performance.

Question 2: How long does a debt relief program take?

Here is the answer to this question, provided by IAPDA Certified Debt Relief Professional From Golden Financial Services – Wes Hendrickson

- On average, the entire debt relief program takes around 18-36 months to complete.

Here is an example illustrating how long each debt relief program would last and the total cost of each plan, based on $25,000 in debt:

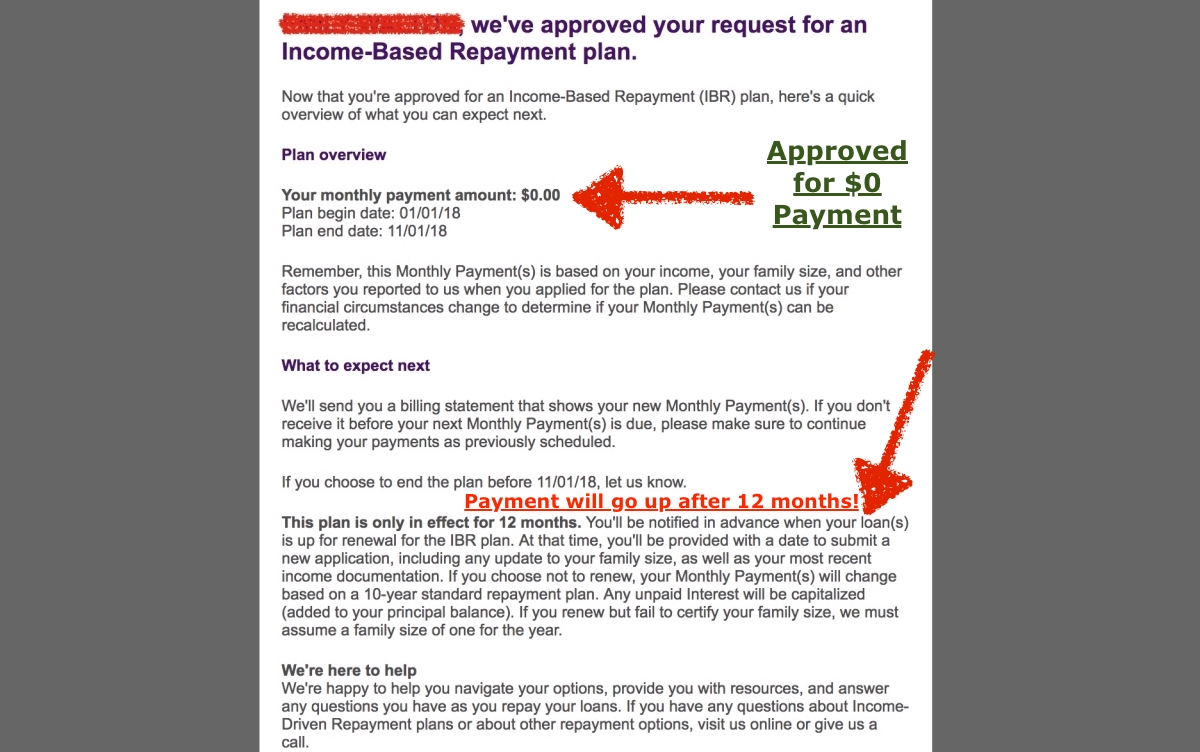

Question 3: My only debt is student loan debt but I am being threatened with garnishments. Can you help me?

- Presuming we’re talking about Federal Student Loans we are, to the best of our knowledge, the only processor that has been successful in resolving FSL debt that’s defaulted to this level.

- We have recent cases where we have been able to reverse the wage garnishment order already in force and consolidate all the loans into one low monthly payment, saving the client tens of thousands of dollars due to our relationship with the DOE.

- We have equally been successful in resolving Private Student Loans; however, the process is entirely different with PSLs as opposed to FSLs.

Question 4: What are some of the misconceptions about debt relief programs?

- There are several, the first being debt relief programs don’t work.

- Others say debt relief programs leave a person with bad credit.

- Others say the debt is not permanently resolved

- and the person will still get sued or have their wages garnished.

We have testimonials from our thousands of clients to prove these are not true.

Question 5: Do you have advice for consumers who feel like they are on the verge of a financial crisis?

- We can help more than you know and in some cases, people say it sounds too good to be true.

- When a person is in a financial crisis, they are in major denial, overly stressed, often not thinking clearly and have no hope for resolution.

- The financial industry has built a strong misconception that bad credit is the worst thing in the world and they have created the idea that a customer who doesn’t pay will be sued and potentially have liens placed on property or other equally negative consequences.

- Financial hardship in America has a stigma that it’s “the end of the world.” It’s not the end of the world.

- There are multiple, legal ways to get people’s finances on track and back with great credit in a matter of months.

- These programs are “tried & true” over many years and in our case, most of our programs are fully guaranteed and include credit restoration.

Question 6: Tell me about Golden Financial and their reputation in the industry.

- GFS has the highest level of integrity and ratings in the industry.

- You can’t beat an A+ rating with the BBB and absolutely zero complaints.

- Most companies in our business have hundreds of complaints in the last 3 years alone with the BBB, but consumers need to remember to click on the Reviews/Complaints tab while on the BBB webpage.

- We have earned the “Best Debt Relief Company” designation for several consecutive years and our company name is highest ranked in organic Google searches in most categories.

- We maintain credentials with the IAPDA for debt relief and the AFSLR for Student Loan processing.

- Finally, our programs are performance-based, where consumers only pay if results are achieved.

- We assure our customers that if we can’t help you, we know someone who can, and we’ll gladly refer you, without charge, to a competent and highly-rated organization who can solve their financial issues.

Here are a just a few testimonials:

1 review

Published Wednesday, November 29, 2017

Verified order

I cannot say enough about how Wes …

I cannot say enough about how Wes helped me when I was to the point of asking myself in despair, “What am I going to do?”. Life has dealt me several harsh blows of late and I felt helpless and hopeless. This morning when I woke up, instead of thinking the usual, “Ugh. I’m still alive.” – I woke up thinking, “Wes and the team at GFS have got that. Thank you, Jesus! Now, why don’t I take one day and do something beneficial since NOTHING is beneficial about worrying.” So, I am.

1 review

Published Tuesday, November 21, 2017

Verified order

5-Star Team — Wes and Golden Financial Services!

Wes and the team Golden Financial Services team may be the last good people of a dying breed of angels out there to help consumers, fighting to do the right thing, like myself to be successful. Wes, without any cost or upfront fees, took the time, upon my request, to counsel me on a happening reposession we had on my account. As an entrepreneur, one knows that there are ups and down — Wes was able to help come up with a strategy when the bank, other credit service companies (and even his experience) said it was impossible to overcome.

In talking with Wes, he was able to assess the situation and provide meaningful alternatives. But it doesn’t stop there, he spent over an hour talking with me guys — who do you know, in their right heart (and mind) still does that for people they don’t know will be a customer.

Not only am I grateful to the team at Golden Financial Services — I will do business with them for the upcoming credit improvement and as me and my family make our way back to where we need to be.

Thanks Wes! Thanks guys.

11 months ago-

I am dealing directly with Wes Hendrickson. Very professional individual. Very easy to work with. Very patient with everything going on. Took his time with me. I didn’t feel rushed. I feel this service is a PERFECT 10 and look forward in the next year to seeing not only my credit improve but rebuilding my credit the RIGHT WAY.

I would recommend this company to anyone!

a year ago

I have just started the validation process working with Wes Hendrickson. He has been most patient in helping me understand this approach to helping me handle my credit card debt. Further he was very careful to explain the details of the application and in answering my questions. His communication skills are excellent. Your organization is lucky to have him.

2 months ago-

This is my first experience working with Golden Financial and it won’t be last. My wife was having her wages garnished, due to Student Loans for my son. We were deep in the process with Collections agencies constantly trying every angle to pick her pockets. Once I started working with GFS and must say they were all professional. It’s nice to truly work with a team that truly cares about you personally. I feel like a built a friend ship that make’s me comfortable to discuss our problems. They really pulled my butt out of the fire. Thank you GFS, it’s a nice Christmas Gift.