Debtors prisons are a thing of the past and debt collection laws are in place to protect us from harassment and threats. But not everyone follows the law and some just exploit those who fell behind on their bills.

A Story About Two Men Who Scammed Millions Of Dollars

Doug MacKinnon and Mark Gray are two of the egregious examples.

The Buffalo, N.Y. men were sued by the Consumer Financial Protection Bureau and the New York Attorney General in November of 2016 for unfair collection practices.

According to the lawsuit, MacKinnon and Gray purchased millions of dollars of loans.

- The two men, through several debt collection companies they created, would add additional fees to what the consumers owed and make threats of legal action if the consumers did not pay.

- The company would spoof phone calls to make it appear that the consumer was being called by a government agency in order to threaten them to pay the money. In some cases, the company would call the consumer’s family.

- The above is an extreme case of abuse of the Fair Debt Collections Act (FDCPA) but it is not the only case. Consumers are called on their jobs, threatened and abused. Many people who seek debt relief are in distress not only because they owe the money, but because of the actions of some rogue debt collectors.

The FDCPA was passed by Congress in 1977. Until the creation of the CFPB in 2011, the law was enforced by the Federal Trade Commission.

Are you wondering if you have a claim?

Here’s a Simple Break Down of the FDCPA to See if You Have a Claim

What the law covers

- The law only takes effect after your bill has been turned over to a debt collector under the federal law.

- Florida’s debt collection law also protects consumers against abusive collection practices from the original creditor.

- Debt collection agencies include attorneys who act as debt collectors and companies that purchase debts.

- Illinois and Washington require debt collections to be licensed. You can find a list and explanation of state laws here.

- The law covers most types of debts. Mortgages, medical debts, and credit card debts are covered. Debts from an in-store purchase or other instances where you were granted credit also apply.

Debt collection rules

- Congress passed the FDCPA after hearing reports of debt collectors calling late at night or early in the morning and making threats against consumers. The FDCPA only allows debt collectors to contact you between 8 a.m. and 9 p.m.

- They cannot call you at work if you tell them you are not allowed to be contacted there. The debt collectors are not allowed to harass or threaten you or anyone who answers the telephone at your work or residence.

- Some people try to stop debt collectors from calling them by saying they have an attorney. But having an attorney doesn’t mean the debt collectors have to stop contacting you. First, the attorney must be representing you in relation to the debt. Second, the debt collector will verify the attorney is representing you. Once it is confirmed that you have an attorney, the debt collectors are required to stop calling you.

You can always send a letter to a debt collector and ask that communication stop. While this may stop the phone calls and letters, you still owe the debt and the creditor or debt collector can still file a lawsuit against you.

Threats and harassment

Unless you are involved in some type of fraud, you cannot be criminally prosecuted just because you haven’t paid a debt. But some unscrupulous debt collectors want you to think so.

Stories like the ones at the beginning of this article are reported often to the CFPB and police. Some go unreported because the debtor is ashamed of owing the debt and just wants to settle the issue quietly.

Debt collection companies also resort to less scary tactics. These forms of harassment include:

- Calling you at work when they have been asked to stop.

- Telling others, including co-workers and family members that don’t live with you.

- Calling you frequently.

- Threatening lawsuits. Filing a lawsuit against a debtor is a long process. Most debt collectors can’t authorize a lawsuit.

- Threatening arrest. It’s been said before but it’s worth saying again—you cannot be arrested for owing a debt except for a rare case when fraud is involved. And debt collectors do not have the power of arrest.

How to Defend Yourself From Debt Collectors

- If you believe you are being continually harassed and threatened, you can file a complaint with your state’s attorney general or with the CFPB. The CFPB accepts complaints online and by phone at 855-411-CFPB. You can also scroll through the CFPB complaint database to see if anyone else has a complaint with your debtor.

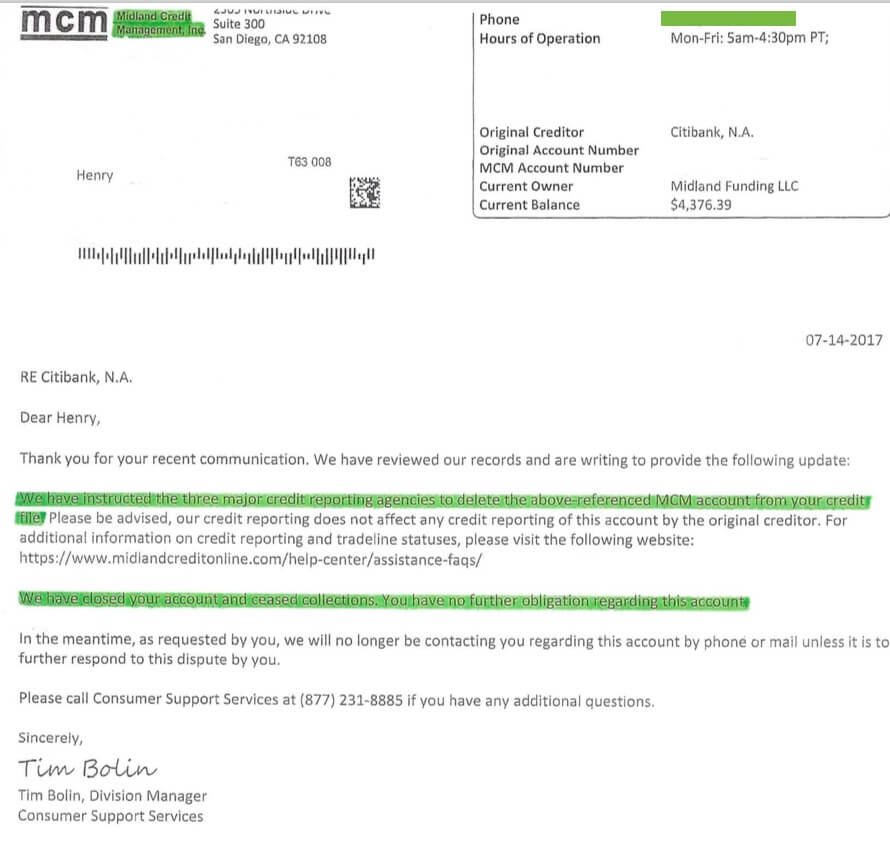

- Debt validation – this is your legal right to dispute a debt. If the debt collection company can’t validate it, the debt becomes legally uncollectible. A legally uncollectible debt is one that you don’t have to pay and it can’t be legally reported on your credit report. This can be the least expensive way to dealing with an unsecured debt and getting it off your credit report.

- Debt validation programs are available through Golden Financial Services where consumers get free credit repair included and a money back guarantee. Call (866) 376-9846 to see if you qualify now!

Learn about debt relief programs by visiting this page next.

Do you really owe the debt?

Remember the story of the alleged debt collection scam above?

This happens. So, if you don’t think you ever owed the debt or you don’t owe as much you need to question the debt. It’s best to send a list of questions in writing that include:

- The identity of the original creditor

- How much money you owe. Make sure you get a breakdown of interest fees and late charges.

- Any other information about how you can dispute the debt.

The debt collector should have sent you the information in writing five days after they first called or emailed you.

How to Dispute a Debt on Your Own

Once you decide that something is not right about the debt collector’s claim, you can dispute the debt.

- The first step is gathering the information above.

- Then, send a written letter to the company saying you are disputing the debt.

- When the debt collection agencies receive the request, all debt collection activities must be stopped until you receive verification of the debt. Even if the debt collector provides verification, that doesn’t mean they are right.

- Check your own records. If they don’t match up, you can challenge the debt through the court system or by filing a complaint with the CFPB.

If you would prefer to hire a professional debt relief company to dispute your debt, contact Golden Financial Services at 866 376-9846. (A money back guarantee and free credit repair are included).

Disreputable debt collectors count on people who won’t verify the debt. They also know that some will give in because of fear. Know your rights and defend yourself.