Golden Financial Services is pleased to announce new scholarship offers for high school seniors and college students.

Improving the financial state of our economy is something that Golden Financial Services strives to do on a daily basis. By providing scholarships to students across the nation and helping them to pursue their college dreams–-catapults our future economic prosperity.

How To Apply For A College Scholarship:

To apply for a scholarship, students must provide a unique solution to the following problem.

**“ In the United States there is $15+ billion in delinquent credit card debt (people who are more than 90-days behind on credit card payments) — besides restricting the act of lending what are viable options for solving this problem?”**

With 90% of Americans purchasing items they cannot afford, it’s no wonder that 78% are living from one paycheck to the next (Ramsey, 2017a). As Americans continue charging items that they do not need and should not buy, credit card companies are raking in the dough making over $155 billion dollars a year (Schmoll, 2015). With that, there are over $15 billion dollars in unpaid consumer debt that is at least 90-days behind.

With this national crises, what can be done to help solve the problem? I know from observing my children’s father that a credit card company restricting his lending didn’t work. He maxed out one credit card with a $26,000 credit limit. When he reached his limit, the credit card company allowed him to continue spending even though he didn’t have the funds to pay it back. Once he reached $30,500, 18% more than his limit, the credit card company restricted his spending and his credit card was declined each time he tried to use it.

Unfortunately, restricting his spending did not solve the problem. In fact, it just added to the $15 billion dollar consumer debt Americans are in. After his credit card was declined a few times, he picked up a credit card application from a different company and applied. This time, he was issued a credit card with a $15,000 dollar limit. Can you guess what he did? Yep, he overcharged on items he didn’t need and shouldn’t have bought and now he has a second maxed out credit card. He never learned from his first mistake. Rather, he continued overspending adding to the “$15+ billion in delinquent credit card debt”.

I believe a better solution to this crises is to educate those who are falling into the statistics for Education is Power. When a person maxes out a credit card, they should be required to take classes on learning how to become debt free and make a budget. When an individual learns how to properly budget their finances and live within their means, they will decrease the delinquent credit card debt. The credit card companies may not like this idea for overall what is losing $15 billion a year when you are earning over $155 billion in that same year! Nevertheless, consumers can overcome their habit through education and start saving their money each month rather than throwing it away on interest and other credit card fees.

Dave Ramsey’s (2017) Financial Peace is one of many courses available to help individuals get on the right track to financial freedom and solving the problem of consumers’ credit card debt. He teaches an individual how to use cash instead of credit cards. He points outs that when a person uses cash to purchase an item, there is a psychological response that has them spend less money compared to when they use a credit card. He further gives an example of a study done that revealed Americans spend 47% more at McDonalds when they used their credit cards (Ramsey, 2017b). His findings were verified by Rahhubir and Srivastava’s (2008) study that linked a shopper’s spending behavior with their mode of payment. When an individual paid with a credit card, they would spend more money, purchase more unhealthy items and not be as committed to the purchased item (Dholakia, 2016).

Once the struggling consumer is educated and realizes the consequences of their spending habits, they are ready for the next step to make a change. Dave Ramsey gives practical, easy to follow advice to do this. He teaches individuals to make a list of all credit card debt owed. From there, he teaches the consumer to focus on paying their smallest credit card debt first while making the minimum payments on all their other credit cards. Once their smallest debt is paid off, Ramsey teaches them to add that payment amount to the next lowest debt’s minimum payment and continue paying as much as the individual can on that debt while making the minimum payment on the rest.

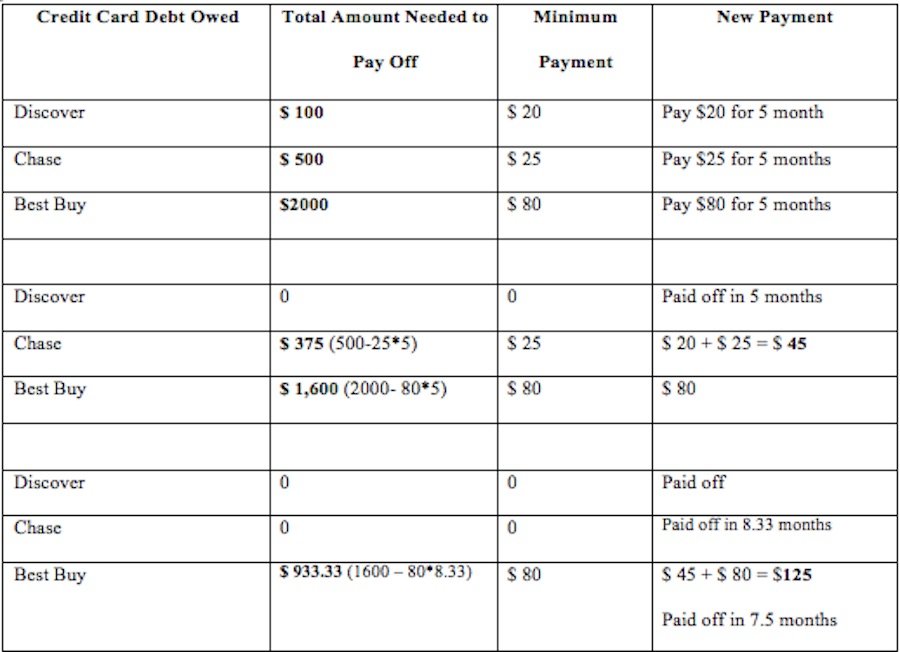

Below is an example on how this works with paying off $ 2,600 in credit card debt over 21 months:

Now that the consumer has been educated on how to pay off their debt, and is working towards that goal, they are ready to learn how to make a budget and live within their means, so they don’t get into the credit card debt again. Dave Ramsey (2017c) gives practical advice on how to do this too by using a “zero-based” budget. Basically, the individual jots down how much money they earn each month. Then they make a list of all the money they spend during the month which includes those items that are paid quarterly, semi-annually and annually. Once the list is made, the individual allocates the proper monetary amount into each category. When this is finished, they check to see if there is any money left over or if they are short. If money is left over, the individual allocates that money into a category until the balance is zero. If there isn’t enough money, Ramsey teaches a person to go back to their list and see where they can cut back on a category or categories until they balance their income and expenses to zero. With each dollar properly accounted for a budget is made and the individual is on their way to living within their means debt free.

Credit card companies are allowing individuals to become further and further into debt while they are becoming richer and richer when they allow individuals to go over their credit limits and charge them hefty interest fees each month to do so. In order to tackle this national crisis, I believe education is the solution. With education, a person can become aware of the credit card traps, learn how to pay off their credit cards, live within their means and make a budget to stay on track. Educating each delinquent credit card user can have a rippling effect in tackling the “$15+ billion dollars in delinquent credit card debt” in the United States.

Try Golden Financial’s national debt calculator to learn about debt relief programs available in 2018.

References

Dholakia, U. (2016). Does it matter whether you pay with cash or a credit card? Psychology Today. Retrieved on May 12, 2017 from https://www.psychologytoday.com/blog/the-science-behind-behavior/201607/does-it-matter-whether-you-pay-cash-or-credit-card

Raghubir, P., & Srivastava, J. (2008). Monopoly money: The effect of payment coupling and form on spending behavior. Journal of Experimental Psychology: Applied, 14(3).

Ramsey, D. (2017a). You can wander into debt, but you can’t wander out. Retrieved on May 12, 2017 from https://www.daveramsey.com/get-started/debt.

Ramsey, D. (2017b). The truth about credit card debt. Retrieved on May 12, 2017 from https://www.daveramsey.com/blog/the-truth-about-credit-card-debt/.

Ramsey, D. (2017c). How to budget using simple, zero-based budgeting. Retrieved on May 13, 2017 from https://www.daveramsey.com/budgeting/how-to-budget/

Schmoll, J. (2015, April 7). How do credit cards make money? I found out the hard way. Frugal Rules. Retrieved on May 12, 2017 from http://www.frugalrules.com/how-do-credit-cards-make-money-hard/.

Hey There. I found your blog the use of msn. That is a very smartly written article. I will be sure to bookmark it and come back to learn extra of your useful information. Thank you for the post. I will definitely return.

After looking at a few of the blog articles on your web page, I really appreciate your technique of writing a blog. I saved it to my bookmark site list and will be checking back in the near future. Please visit my website too and let me know how you feel.

Hiya! Quick question that’s totally off topic. Do you know how to make your site mobile friendly? My site looks weird when viewing from my apple iphone. I’m trying to find a template or plugin that might be able to resolve this issue. If you have any recommendations, please share. Appreciate it!

My brother recommended I might like this website. He was once totally right. This publish actually made my day. You cann’t consider just how a lot time I had spent for this information! Thank you!

I love reading a post that will make men and women think. Also, thanks for permitting me to comment!

Saved as a favorite, I really like your website!

whoah this weblog is fantastic i love reading your posts. Keep up the good work! You recognize, many individuals are searching round for this info, you can aid them greatly.

Outstanding post however I was wondering if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit further. Cheers!

Hello, I desire to subscribe for this webpage to obtain most recent updates, thus where can i do it please help.