What is the William D. Ford Act?

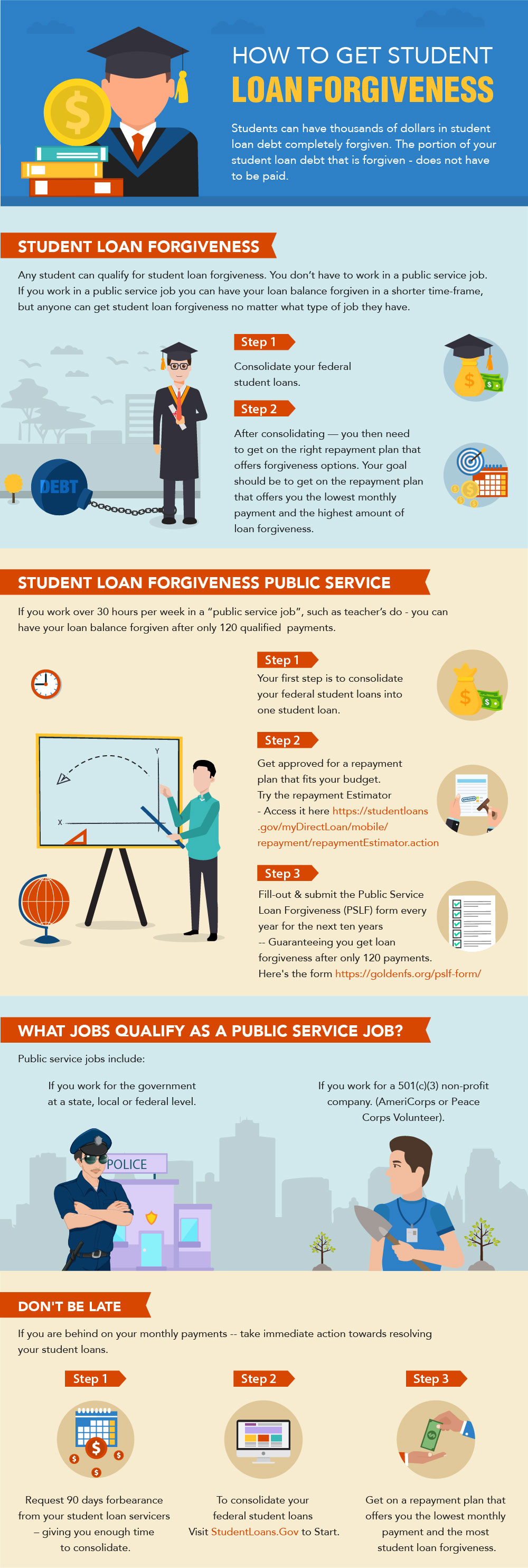

Through the William D. Ford Act, students can utilize multiple federal student loan repayment plans, including the Income-Based, Pay As You Earn, Revised Pay As You Earn, and Income-Contingent Repayment Plan. All of these plans make it easier to pay off federal student loan debt for students that are experiencing a financial hardship. For a detailed summary of each student loan repayment plan that will be available in 2020, visit this page next.

The William D. Ford Act is also known as the “Obama Student Loan Forgiveness” because this Act came about when President Obama reformed part of the Direct Loan program in 2010.

What is the William D. Ford Act loan forgiveness?

Thanks to the William D. Ford Act, students can now also get loan forgiveness.

For a detailed explanation on how to get student loan forgiveness visit this page next.

What is the William D. Ford Program?

The William D. Ford Federal Direct Loan Program provides “low-interest loans for students and parents to help pay for the cost of a student’s education after high school. The lender is the U.S. Department of Education, rather than a bank or other third-party financial institution.” [1]

Eligible Loans Under the William D. Ford Federal Program

Direct Subsidized Loans, Unsubsidized Direct Loans, Direct PLUS Loans, and Direct Consolidation Loans are all included in the William D. Ford Federal Program.

Next, let’s take a closer look at the four best options now that the William D. Ford Act was passed.

PLAN #1: Revised Pay As You Earn (REPAYE) Plan

The Revised Pay As You Earn (REPAYE) plan is a repayment plan with monthly payments that are generally equal to 10% of your discretionary income, divided by 12.

Discretionary income for the REPAYE plan is the amount by which your income exceeds 150% of the poverty guideline amount.

Eligible loans for the REPAYE plan are Direct Loan Program loans other than:

(1) a loan that is in default

(2) a Direct PLUS Loan made to a parent borrower, or

(3) a Direct Consolidation Loan that repaid a Direct or Federal PLUS Loan made to a parent borrower.

PLAN #2: Pay as You Earn (PAYE)

The Pay As You Earn (PAYE) plan is a repayment plan with monthly payments that are generally equal to 10% of your discretionary income, divided by 12.

Discretionary income for the PAYE plan is the amount by which your income exceeds 150% of the poverty guideline amount.

Eligible loans for the PAYE plan are Direct Loan Program loans other than:

(1) a loan that is in default

(2) a Direct PLUS Loan made to a parent borrower, or

(3) a Direct Consolidation Loan that repaid a Direct or Federal PLUS Loan made to a parent borrower.

What is a new borrower for the PAYE Plan?

You are a new borrower for the PAYE plan if:

(1) you have no outstanding balance on a Direct Loan or FFEL Program loan as of October 1, 2007, or have no outstanding balance on a Direct Loan or FFEL Program loan when you obtain a new loan on or after October 1, 2007, and

(2) you receive a disbursement of an eligible loan on or after October 1, 2011, or you receive a Direct Consolidation Loan based on an application received on or after October 1, 2011.

PLAN #3: Income-Based Repayment (IBR)

The Income-Based Repayment (IBR) plan is a repayment plan with monthly payments that are generally equal to 15% (10% if you are a new borrower) of your discretionary income, divided by 12.

Discretionary income for the IBR plan is the amount by which your adjusted gross income exceeds 150% of the poverty guideline amount.

Eligible loans for the IBR plan are Direct Loan and FFEL Program loans other than:

(1) a loan that is in default

(2) a Direct or Federal PLUS Loan made to a parent borrower, or

(3) a Direct or Federal Consolidation Loan that repaid a Direct or Federal PLUS Loan made to a parent borrower.

You are a new borrower for the IBR plan if (1) you have no outstanding balance on a Direct Loan or FFEL Program loan as of July 1, 2014 or (2) have no outstanding balance on a Direct Loan or FFEL Program loan when you obtain a new loan on or after July 1, 2014.

PLAN #4: Income-Contingent Repayment (ICR)

If you have parent-plus loans you won’t qualify for the IBR or PAYE plan. Parent-plus loans will be eligible for the ICR. The good news is that you can still qualify for loan forgiveness. The bad news is that your payment will be higher on the ICR, compared to what it would be on the IBR or PAYE.

The Income-Contingent Repayment (ICR) plan is a repayment plan with monthly payments that are the lesser of (1) what you would pay on a repayment plan with a fixed monthly payment over 12 years, adjusted based on your income or (2) 20% of your discretionary income divided by 12.

Discretionary income for the ICR plan is the amount by which your adjusted gross income exceeds the poverty guideline amount for your state of residence and family size.

Eligible loans for the ICR plan are Direct Loan Program loans other than:

(1) a loan that is in default

(2) a Direct PLUS Loan made to a parent borrower, or

(3) a Direct PLUS Consolidation Loan (based on an application received prior to July 1, 2006, that repaid Direct or Federal PLUS Loans made to a parent borrower). However, a Direct Consolidation Loan made based on an application received on or after July 1, 2006, that repaid a Direct or Federal PLUS Loan made to a parent borrower is eligible for the ICR plan.

Do you need help with credit cards? Learn about credit card relief programs next.

Have you had your wages garnished over student loan debt? Learn how to stop wage garnishment.

Interested in joining a student loan relief program? Click here for more info.