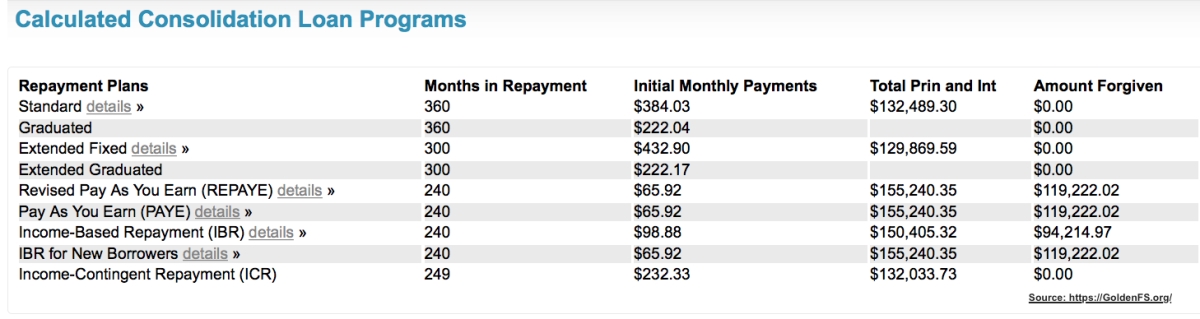

Federal Student Loan Repayment Plans

When it comes to federal student loans, debt settlement and credit counseling won’t help. You can’t settle a federal student loan debt, but you can qualify for loan forgiveness. Student loan forgiveness is similar to a debt settlement but without a negative effect on your credit. To qualify for loan forgiveness you must first consolidate and then get on an income-driven repayment plan.

Student loan consolidation and refinancing are your only two options to resolve federal student loans. For most folks, federal student loan consolidation is the best route because after consolidating students can utilize an affordable repayment plan offered through the government and eventually get their balances forgiven.

The following page will help you understand each federal student loan repayment plan, highlighting the plans that offer loan forgiveness.

If you choose an income-driven repayment plan it’s important to remember that you must recertify every year. Recertification is necessary in order to keep the lowest monthly payment and eventually qualify for loan forgiveness.

Do you have a Public Service job?

You can qualify for loan forgiveness in only ten years through an income-driven repayment plan. However, YOU MUST complete the Public Service Loan Forgiveness Employment Certification Form and submit it to Fed Loan every year for ten years. Most people are unaware of this point. President Donald Trump is currently in the works of some new legislation that could result in everyone getting loan forgiveness in only fifteen years, but this is yet to come.

Visit StudentLoans.gov to recertify your income-driven repayment plan every year, or simply contact Golden Financial Services for help at (866) 376-9846.

For assistance with federal student loan consolidation start by completing this online application.

Income-Based Repayment (IBR)

The Income-Based Repayment plan is a financial hardship plan that offers loan forgiveness. The IBR bases your monthly payment on your Adjusted Gross Income (AGI) and family size. Family size includes anyone living with you if you pay more than 50% of their expenses. Unborn children count.

You must be experiencing a partial financial hardship to initially select this plan.

Monthly Payment on the Income-Based Repayment Plan

Standard Repayment

The Standard Repayment Plan is not a financial hardship plan and it does not offer loan forgiveness.

The Standard Repayment is considered the default plan.

If you don’t apply for an income-driven repayment plan after consolidating you’ll get put in the standard repayment plan. Your payments will remain a fixed amount for the entire repayment term. If you have a high income, you may have to utilize this plan. The good news is, this repayment plan saves you money over time because your monthly payments may be slightly higher than payments made under other plans. You’ll pay off your student loan debt in the shortest time. For this reason, you will pay the least amount of interest over the life of your loan on the Standard Repayment Plan. The bad news is that you won’t get any loan forgiveness on this plan!

Graduated Repayment

The Graduated Repayment Plan is not a financial hardship plan and does not offer loan forgiveness.

With Graduated Repayment, your payments start out low and gradually increase over the life of the loan (typically every 2-4 years). The good news is that at times this plan may offer you the lowest monthly payment. You could always use the Graduated Repayment Plan for one year, and then next year switch to one of the other plans.

The Extended Fixed plan is not a financial hardship plan and does not offer loan forgiveness.

The Extended Fixed Repayment Plan allows you to lower your monthly payments by extending your repayment term. Your payments will remain a fixed amount for the entire repayment term.

The extended repayment plan gives you up to 25 years to pay off your loans, so of course, your monthly payment will generally be lower.

Under the Extended Fixed Plan, your monthly payment stays the same throughout repayment. If you choose the Graduated Repayment Plan your payments will start low and then increase (every two years).

Extended Graduated

The Extended Graduated plan is not a financial hardship plan and does not offer loan forgiveness.

Extended Graduated Repayment allows you to lower your monthly payments by extending your repayment term. Your payments will gradually increase over time throughout the repayment term.

Revised Pay As You Earn (REPAYE)

The Revised Pay As You Earn is a financial hardship plan that offers loan forgiveness.

The Revised Pay As You Earn (REPAYE) plan bases your monthly payment amount on your (and your spouse’s, if applicable) Adjusted Gross Income (AGI), family size and state of residence. To enroll in this plan, you must provide either 30-days worth of pay stubs or your tax return.

Pay As You Earn (PAYE)

The Pay As You Earn is a financial hardship plan that offers loan forgiveness.

The Pay As You Earn plan bases your monthly payment on your Adjusted Gross Income (AGI) and family size. You must be experiencing a partial financial hardship to initially qualify for this plan. This plan is similar to the Income-Based Repayment Plan; however, provides a lower monthly payment during periods when you are experiencing a partial financial hardship.

Income-Contingent Repayment (ICR)

The Income-Contingent Repayment is a financial hardship plan that offers loan forgiveness but is only ideal for an individual that has Parent-Plus loans because the monthly payment is typically higher than the other financial hardship programs.

Income-Contingent Repayment bases your monthly payment on your Adjusted Gross Income (AGI) and family size. If you do not qualify for the Pay As You Earn Plan or Income-Based Repayment, Income-Contingent Repayment might be a good option for you.