How to get out of credit card debt without paying? Legally, can I walk away from my debt without paying?

In summary, you have three credit card debt relief programs to choose from if you can’t afford to pay your debt or above the monthly minimum payments. And, of course, there’s the option of stopping payment on all of your cards and doing nothing.

If you walk away from paying credit card debt without a program or plan in place:

- You could get served a credit card summons, and if ignored, that could turn into a default judgment resulting in ruined credit, wage garnishment, or having assets taken.

- Balances will continue to rise due to late and collection fees.

- Your credit will get negatively inflicted with delinquent and collection accounts, resulting in ruined credit for up to seven to ten years.

- You can expect creditor harassment.

- Eventually, the statute of limitations could allow you to escape some of your debt without paying. Still, typically the higher the balance, the more likely creditors are to sue a person.

Can’t afford to pay credit cards in full?

If you can’t afford to pay your credit cards in full, there are strategies that you can use to get out of debt without paying. These strategies could help you resolve your debt for a significant amount less than the total owed and result in getting the debt off your credit reports.

The following credit card relief strategies are ideal for anyone that’s struggling to pay off their balances. We will also explain the pros and cons of each option and warn you of the dangers that can arise when walking away from credit cards without paying.

Option one to deal with credit cards after falling behind on monthly payments:

Debt settlement programs allow you to stop paying credit card monthly payments and instead repay the balances on a debt reduction plan. As a result, you can become debt-free in three to five years. To get an estimate of how much you can save with debt settlement, try this free online calculator.

However, a credit card settlement program is a process that includes pros and cons. This process doesn’t magically make your debt disappear. Visit this page next to compare the pros and cons of each debt relief program.

Accounts must get written off and sold to debt collection agencies:

Credit card accounts will get written off and sold to third-party collection agencies after a person stops paying monthly payments, which happens within 4-6 months (i.e., stage one of a debt settlement plan).

Can you get served a credit card lawsuit after you stop paying credit cards?

You could get served a credit card summons after falling behind on monthly payments. However, in our experience over the last two decades, in more than 90% of cases, creditors don’t issue a summons after consumers stop paying credit card monthly payments.

Some creditors are more likely to sue, such as Discover. After falling behind on Discover’s credit card bills, they will issue a summons to the consumer in most cases.

Getting sued can sound scary, but if enrolled with a reputable debt relief company, they include lawsuit defense and can resolve the summons and settle the debt for less than you owe. One judge in Brooklyn quoted that more than 90% of credit card summons can get dismissed if challenged due to inaccurate and incomplete paperwork.

Why do credit card companies settle debt for less than the total balance?

Credit card companies recoup 100% of the money owed on a credit card debt after it’s written off through tax credits, banking insurance, and selling delinquent credit card accounts to third-party collection agencies. Consequently, third-party collection agencies can pay as little as 5% to 10% of the balance to purchase a credit card debt.

As a result, they’re willing to settle debt for less than the full balance.

Michelle Black, from CreditCardInsider.com explains, “When you settle your debt, you can sometimes pay 50% or less of the original balance. You may, however, have to pay taxes on the forgiven amount.”

Unfortunately, potential tax consequences are just one of several downsides to debt negotiation programs. Another major downside to debt settlement is that credit reports are left with late and collection notations.

Are you interested in signing up for debt settlement? Then, choose a BBB highly rated debt settlement company to maximize your chance of success with the program.

Option two to help a person get out of debt without paying:

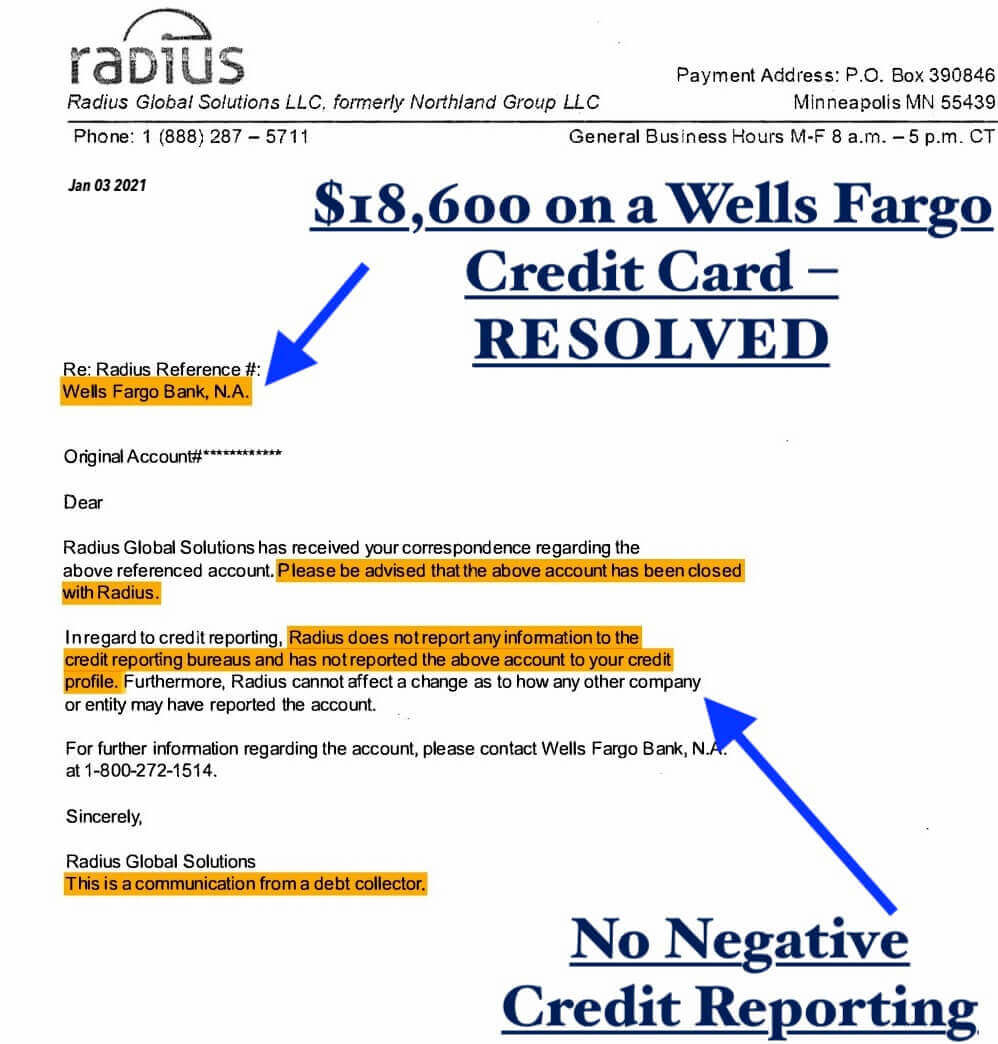

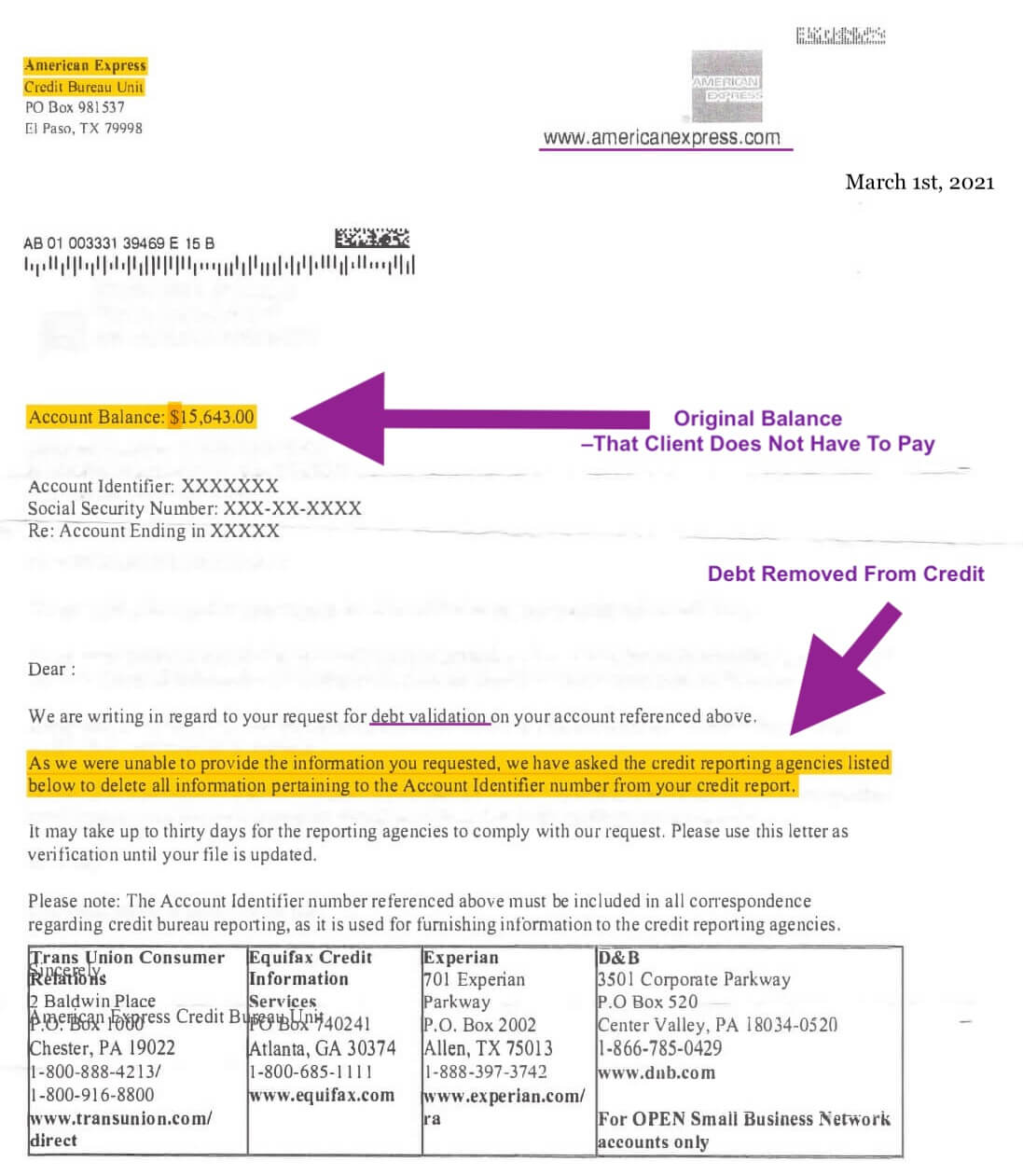

Debt validation programs offer you a less expensive credit card debt solution than settlement plans because you walk away from the debt without paying anything besides the company’s fees.

Benefits of a validation program:

- Late marks and collection accounts can get removed from credit reports after an account is invalidated.

- There are also no tax consequences on an invalidated debt.

- Pay less than what it would cost to use a debt settlement program.

At Golden Financial Services, we recommend an attorney-based Debt Resolution Program. This credit card relief option first fights the debt by challenging the collection agency to prove that they are legally authorized to collect on the debt by forcing them to produce complete and accurate records.

In many cases, this first line of attack results in debt becoming legally uncollectible and not having to get paid.

If an account is validated, the second line of attack is to use debt negotiation. The law firm will negotiate a debt reduction plan allowing the consumer to pay a significant amount less than the total debt owed.

As a third benefit to a Debt Resolution Program, the attorney will dispute the invalidated accounts from all three credit bureaus to remove the debt and its associated negative marks from the consumer’s credit reports.

If a lawsuit occurs at any point, the lawyer will fight the summons, resulting in either debt dismissal or a settlement for the consumer.

Option three to eliminate credit card debt without paying:

Chapter 7 bankruptcy makes it possible for a person to get out of credit card debt without paying it back. You can eliminate your credit card balances in under six months.

However, consumers will pay the price of bankruptcy in two major ways;

1.) seven-ten years of adverse credit

2.) up-front bankruptcy attorney fees

Bankruptcy makes it difficult to recover financially, ruining your credit for up to seven years. For example, rebuilding your credit score requires positive payment history on unsecured and secured credit accounts.

With bankruptcy on your credit report, lenders may deny you credit, including credit for car loans and even a mortgage.

How can a person rebuild their credit with bankruptcy on it?

You could get a secured credit card even with bankruptcy on your credit report, use and pay the card in full every month and rebuild positive payment history. However, it will be a longer path to financial recovery than using a Debt Resolution Program.

According to Sean Pyles, a debt writer at NerdWallet, “Filing for Chapter 7 bankruptcy wipes out unsecured debt such as credit cards, but not without consequence. Chapter 13 bankruptcy can help you restructure your debts into a payment plan over 3 to 5 years and may be best if you have assets you want to retain. In addition, it can stay on your credit report for 7 to 10 years, though your credit score is likely to bounce back in the months after filing. However, some debts, such as student loans and tax debt, typically can’t be erased in bankruptcy”.

For more options, check out the 10 Best Ways to Clear Credit Card Debt – After COVID-19.

What happens if you stop paying credit cards and do nothing?

Dori Zinn, from Bankrate.com, explains: “If you stop paying your credit card bill, it gets turned into collections and your credit score tanks. But there’s a statute of limitations for how long creditors can sue you for outstanding credit card debt, which varies from 3-10 years in most states. So you could skip payments, but you might be liable for them later. Even at that point, if you are sued for outstanding payment, you most likely wouldn’t win the case.”

Will you eventually get sued over unpaid credit card balances if you don’t do anything at all?

There’s a good chance that you will get sued over an unpaid credit card balance before the statute of limitations expires.

You can still get sued after joining a debt relief program, but at least you’ll have lawsuit defense to resolve a lawsuit and save money.

Am I more likely to get sued with validation or settlement?

Another benefit of a validation program is that all collection activity must stop after an account gets disputed.

On the flip side, with a settlement program, only one account at a time is negotiated.

Consequently, some accounts may sit for over two years with a settlement program with no action taken towards resolving it.

However, if you enroll in an attorney-based debt settlement program and they contact your creditors after you sign up, notifying them that you have attorney representation, legally, from that point on, your creditors can only call your attorney.

Am I more likely to get sued over a larger balance?

“The process of seeking compensation through the court system takes time and resources, which means that the likelihood of being sued increases with the size of your delinquent debt. Should you assume that a creditor won’t sue you?

No. don’t do that. Having your wages garnished isn’t the end of the world, but you should seek to avoid garnishment at all costs,” explains Jesse Campbell from Money Management International.

Get approved for a program to help you pay less than the total owed on credit card bills:

You can also speak with a debt counselor at Golden Financial Services (GFS) for a free consultation at (866) 376-9846.

Enroll in a debt relief program to help you deal with high credit card bills. GFS is an A+ Better Business Bureau-rated company, a TX licensed debt management company, and in business since 2004.

Can you afford to pay at least minimum payments?

Consider the debt snowball method if you can afford to pay at least minimum payments on credit cards. You can even use Golden Financial’s Free Snowball Calculator Tool to assist you with this option.

What happens if you don’t pay your credit card debt?

Over 1-6 months after you stop making payments:

The original creditors will call and send letters over the next three to six months after you stop paying your credit card payments. Late fees and interest will continue to accrue every month, so your balances will continue to Thes. The original creditor (i.e., the credit card company) will write off the within approximately six months debt.

Can you be sued over credit card debt?

After you stop paying your credit cards, there’s a chance that creditors will issue a credit card summons. Show up to court and explain your hardship to the judge. Credit card lawsuits can get dismissed.

Check out this article about Midland Credit, the largest debt collection agency in the nation. You will see how they misled and illegally collected debt from millions of consumers over several years.

Default Judgements

You could get a default judgment against you if you skip court.

Therefore, never skip court. Just show up.

Will credit card companies forgive debt?

Credit card companies may forgive a portion of a credit card debt, but you’ll receive the most significant discount after the account is sold to a third-party collection agency.

Yes, that’s right, two to three times what is owed! And that’s even after you walk away from the credit card debt without paying.

How is that possible?

Here’s how.

First off, creditors write off a debt to show a loss and get reimbursed.

Secondly, creditors have banking insurance. Creditors can get reimbursed a second time through insurance. Similar to if you wreck a car and your insurance pays you a check for the price of the vehicle, banks have insurance and can get reimbursed for unpaid debt.

Thirdly, creditors will sell delinquent credit card accounts to a third-party collection agency, bringing more profit. Collection agencies may only pay ten cents on the dollar for a credit card debt. Consequently, collection agencies will settle that same debt for 40%-70% in some cases, not counting debt settlement program fees.

When an account ends up in third-party collection status, it’s no longer the original creditor coming after you. They have been paid back and will have wiped their hands clean of the debt.

The collection agency may send you letters offering to settle for a fraction of the total owed but think twice before settling a debt. Even after you settle an account, the late marks and collection accounts remain on credit reports for up to seven years.

Start with debt validation. You may be able to get out of credit card debt without paying, aside from the program’s cost, and result in the debt coming off your credit entirely.

How to get out of credit card debt without paying?

If you can’t afford to pay your credit cards, your best debt relief option would be to enroll in a debt validation program.

The sooner you enroll, the better! The validation program will dispute all of your debts after they are sold to third-party collection agencies. Meanwhile, you’re only making one affordable monthly program payment.

Most of the time, these third-party collection agencies can’t prove the debt is valid. The result – the debt becomes legally uncollectible and does not have to get. Instead, clients only end up paying the program’s cost, which you can receive a quote by visiting our debt calculator page here.

For a Free Consultation, Speak to an Experienced Counselor Toll-Free (866) 376-9846.

As a last resort, debt settlement programs can allow a person to pay back approximately 70% of their debt, including settlement fees. The bad news about debt settlement is that even after your bills are settled and satisfied, the late marks and collection accounts remain on credit reports for up to seven years. You could also owe taxes on the amount saved.

For more information about debt validation services, visit this page next.

Both debt validation and settlement programs have downsides, which you can read about at GoldenFS.org.