Straight Talk On Investing (Book Summary)

Straight Talk On Investing by Jack Brennan, Vanguard’s CEO, is one of the most outstanding books on investing. The book provides straight talk on investing principles for beginners and advanced investors, including information on building a diversified portfolio of low-cost index funds.

The following blog post highlights ten rules from the book Straight Talk On Investing, summarized by Paul J Paquin from Golden Financial Services. And towards the bottom of this post, we share the truth about buying bonds as interest rates rise, according to Jack Brennan!

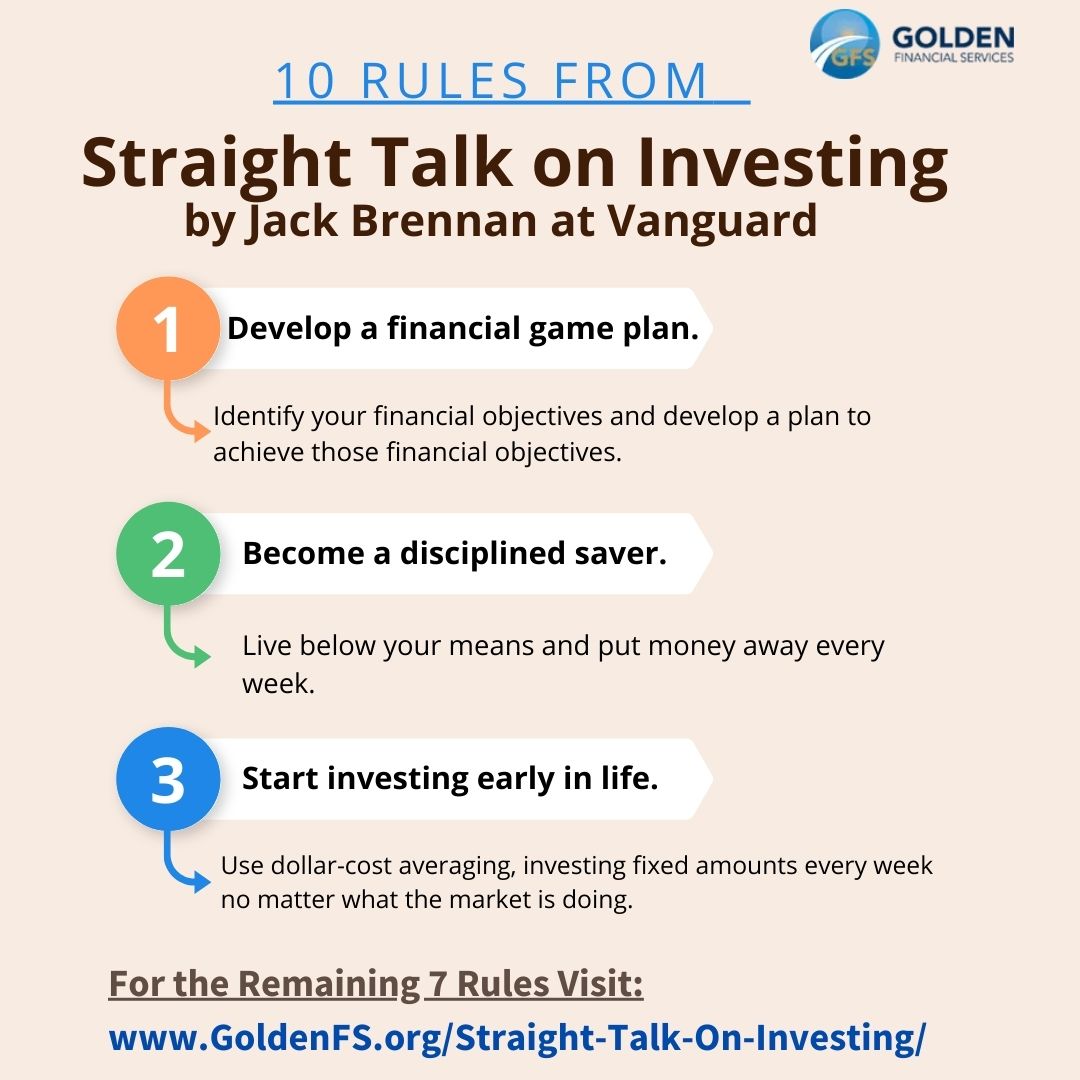

10 Rules From Straight Talk on Investing, by Jack Brennan

More Details About the 10 Rules on Investing from Straight Talk on Investing by Jack Brennan

- RULE #1: Develop a financial game plan. Identify your financial objectives and develop a plan to achieve those financial objectives. And be conservative about how fast you expect your money to grow; don’t assume stocks will grow at 10% per year.

- RULE #2: Become a disciplined saver living below your means and putting money away every week. If you have credit card debt, relief programs are available to help you quickly pay off your balances. You may also consider the debt snowball method, as explained in the 10 Best Ways to Clear Credit Card Debt for 2022.

- RULE #3: Start investing early in life and keep it up. Make “time” your “friend”! Use dollar-cost averaging, investing fixed amounts every week no matter what the market is doing. Reinvest the dividends from stocks and income from bonds – and enjoy the miracle of compounding over your lifetime! Consider that if you earn on average 6% per year on your investments, you will double your money every twelve years.

- RULE #4: Invest with diversification and balance. For balance, invest across at least two of three major asset classes. (i.e., stocks, bonds, and cash investments). For diversification, make sure you’re NOT over-concentrated in any particular company or industry. Use mutual funds for balance and diversification. For example, you could invest your funds into an all-stock and all-bond index fund at Vanguard to ensure a diversified portfolio.

- RULE #5: Control your costs. Choose no-load funds that have low expense ratios. For example, at Vanguard, the best index funds have expense ratios as low as 0.05%.

- RULE #6: Manage risk so that you can sleep at night and not get stressed in volatile markets. Consider the levels of risk. For example, small companies with no net income but rapidly growing revenue are considered higher risk investments than for example, Coca Cola which has more of an established history of positive net income and growing dividends. However, these smaller, fast-growing companies can also potentially provide you with the most growth because eventually, the small company will be profitable and could grow into a large company. The price of the stock follows the money, if a company’s revenue and net income are growing, so will the stock price. On the other hand, Treasury bonds are considered low risk because the United States government can almost guarantee your money. You won’t lose much sleep worrying about losing all of your money when invested in a diversified index fund of over one hundred bonds.

- RULE #7: Buy and hold; don’t buy and sell frequently in stocks or mutual funds. Set up a sensible portfolio and stick with it through thick and thin, holding onto these investments for 10-20 years or longer, allowing them to compound year over year as the interest, growth, and dividends continue to get reinvested and grow.

- RULE #8: Avoid fads and once-in-a-lifetime opportunities. Instead, remain diversified and stick to your game plan.

- RULE #9: Tune out distractions, including the constant news updates on television that scream to buy one industry and avoid another and then say the complete opposite one day later.

- RULE #10: Maintain a long-term perspective because there will be good times and challenging times. When times are good, be grateful, not greedy. When times are bad, be patient. Check an S&P 500 stock chart of the last 100 years when you need a realistic viewpoint of things because you’ll see that over the previous 100 years, besides the occasional dips, stocks have continued to rise like a mountain.

A final thought about “Investing in Bonds.”

As of 2022, many consumers are afraid to invest in bonds because they hear the news about how “bonds lose value as interest rates rise.” That point is valid, but here’s where the news stations get it wrong.

First off, why do bonds lose money when interest rates rise? Before we answer that question, another question needs to be answered. Why buy bonds in the first place?

You buy bonds for two reasons:

(1) Bonds provide diversification, allowing you to invest in an asset class that doesn’t correlate with stocks. And, bonds provide balance, offering you a lower-risk investment.

(2) Bonds pay us interest, and when you’re living in retired life, that income can support you.

Why do bonds lose value as interest rates rise?

Existing bonds are less attractive when interest rates rise because new bonds are issued that pay a higher interest rate. As a result, the new bonds being issued offer more income for an investor, making the old bonds less attractive and decreasing in value.

The Benefit of Bonds When Interest Rates Rise

As interest rates rise, new bonds get issued that pay more income. So the good news is, that your bond index funds will start paying more interest income.

So, in reality, bonds are more attractive as interest rates rise, assuming that you’re invested in a diversified, low-cost bond index fund.

Bond index funds have an advantage over individual bonds because they swap out old bonds with new bonds that pay higher interest rates as rates rise. So at first, you will see your bond index fund lose value as interest rates rise, but over the long term, the old bonds will get swapped out with new bonds that pay you higher interest rates and income.

Conclusion about buying bonds in 2022, as explained in the book Straight Talk On Investing

Continue to dollar cost average into low-cost bond index funds even as interest rates rise. Over the long term, you’ll get rewarded with increased income, and if you reinvest that income, your bonds will increase in value.

Don’t sell your bonds any time soon, or you could lose money.