American Express (AMEX) debt settlement and credit card payment assistance includes:

- American Express debt settlement (and forgiveness) plans

- Debt resolution

- American Express financial relief program

- Consumer credit counseling for AMEX and other credit cards

- Debt consolidation loans

Have you heard of debt resolution or American Express financial relief programs? Debt resolution plans are offered through a third-party credit card relief company or law firm that acts like a fiduciary having your best interest–working to save you the maximum amount and ensure your consumer rights are protected. The American Express financial relief program, is offered through American Express.

How does the American Express Financial Relief Program work?

You can have your interest rate and minimum payment reduced through the American Express financial hardship program. AMEX offers this program directly, so they structure it to benefit themselves and ensure they get paid the maximum.

Benefits of AMEX Financial Relief Program

- Get late fees waived

- Reduce monthly payment and interest while experiencing temporary financial hardship

- You can continue using your credit card up to a certain amount for the AMEX short-term payment plan.

Downsides of AMEX Financial Relief Program

- It’s only temporary relief

- According to AMEX’s website: “After the Reduced APR Period, your APR and annual membership fee, if any, will resume in accordance with your Cardmember Agreement.”

- The credit limit can get reduced, resulting in a negative effect on credit scores. AMEX also reports to credit bureaus that you’re enrolled in this program, leading to future creditors rejecting you for credit.

- You won’t save money any money on the AMEX financial relief program

Are you ready for a better AMEX credit card debt solution?

A Debt Resolution Example:

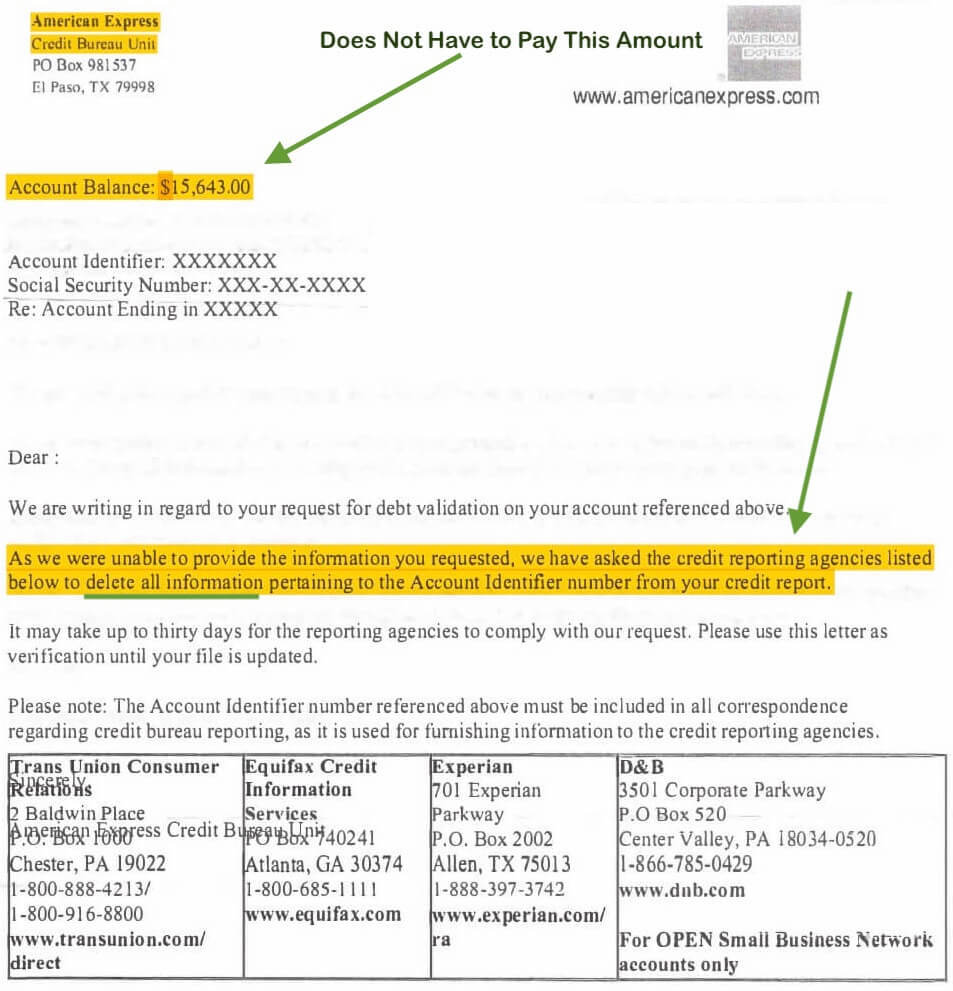

This consumer owed more than $15,000 to AMEX. However, debt validation disputed the debt, making it legally uncollectible. A legally uncollectible debt does not have to get paid and can’t legally remain on a person’s credit report. If this same consumer went straight into debt settlement, AMEX could have required them to pay at least $7,500 to settle, plus the settlement company’s fees.

Many consumers have never even heard of a debt resolution program. This option could be the least expensive route to getting out of AMEX credit card debt. Settlement strategies are included with debt resolution, but before settling an AMEX account, the law firm uses federal consumer protection laws to invalidate it. Often debt validation results in not having to pay an AMEX credit card debt, as illustrated in the example above.

American Express Credit Card Debt Settlement

Does American Express work with debt settlement companies? American Express works with debt settlement companies, but there’s no guarantee that they will settle your American Express card balance for a certain percentage.

What percentage does Amex settle?

If a settlement company guarantees that they can settle AMEX credit card debt for 40% or 50%, or any particular percentage, they are misrepresenting themselves. AMEX does not have settlement agreements with any debt settlement company. AMEX will settle but settlement rates vary. Furthermore, settlements often occur after an AMEX account gets written off and sold to third-party collection agencies.

For example, American Express settlements can reduce the debt by 20% or 60%, there is no set number. A lot of factors come into play. For example, how long has the account been delinquent? Is there a summons attached to the debt?

AMEX may not agree to settle at all. Reputable settlement companies quote you an average settlement rate based on past client results and will lean towards the conservative side ensuring they don’t over-promise and underdeliver.

The best settlement companies offer performance-based programs, meaning they don’t charge any fees until after the debt is settled. Consequently, these performance-based plans offer the incentive for the debt negotiator to get paid faster, by settling the client’s debt quicker. So make sure only to use a performance-based debt settlement program that charges no fees until after the account is settled and paid. Furthermore, it’s illegal for a settlement company to charge fees before settling the debt.

AMEX may settle your debt for less than the total balance owed, however, after AMEX writes the debt off and sells it to a collection agency is when consumers can obtain the best settlement offers.

American Express Consumer Credit Counseling

American Express credit card consolidation is another option.

Debt consolidation comes in the form of a loan, and also you can consolidate American Express debt with consumer credit counseling programs. American Express debt management plans (DMP) can reduce your AMEX credit card interest rate and help you pay off the debt faster.

If it’s up to American Express, consumer credit counseling is the program they will recommend because they get paid in full, plus interest with this type of plan. Consumer credit counseling companies work for credit card companies.

How much does AMEX debt management plans cost?

American Express pays consumer credit counseling companies a “fair share” fee if they successfully set up a debt consolidation program with you. That’s right; non-profit consumer credit counseling companies get paid on both sides! Credit counseling companies charge consumers up to $50 per month, and they get paid by the creditors.

As of 2022, AMEX is offering its own internal debt management plan. AMEX will offer to do basically the same thing that a consumer credit counseling company could offer you but without the extra fees, through their financial relief program as explained above.

American Express Credit Card Consolidation Loan

Suppose you have a high-interest rate American Express credit card or multiple cards. In that case, a consolidation loan could reduce your interest rate by consolidating your American Express and other credit cards into one low-interest loan.

However, to qualify for a low-interest consolidation loan, you must have a high credit score and positive monthly cash flow (i.e., good income).

Aside from these three options mentioned, there are additional ways to reduce and consolidate American Express credit cards that could save you more money or avoid the negative effect on your credit, depending on your goal. The following guide will walk you through all of your options as of 2022. If you’re interested in learning more or determining if you qualify for American Express debt consolidation, speak to an IAPDA certified counselor at (866) 376-9846.

Getting Late Fee Waived on American Express Card

Discover, and American Express credit card companies will waive your late fee or reduce credit card interest rates upon request.

Especially with good payment history over the years, AMEX will most likely approve reducing your credit card interest rate and waiving a late fee, possibly for the long-term. Act upon this option permanently if you can get AMEX to reduce your interest rate! On the other hand, through the AMEX financial hardship program, you’re only getting a temporary reduction in interest rates and payments, which is not a good option unless you’re only temporarily needing a reduction due to financial hardship. AMEX financial hardship program information can be obtained by calling AMEX direct at 1-866-703-4169

Golden Financial Services recommends communicating directly with your creditor and asking them to work with you before resorting to debt settlement. However, make sure that whatever reduction AMEX is offering you is a permanent reduction that saves you long-term money. Don’t be lazy, do the math and read the entire credit card relief agreement and terms, even that tiny print.

You want to do everything you possibly can to maintain staying current on monthly payments and avoid ruining your credit, as long as you can comfortably afford your necessary living expenses (e.g., food, house payment).

Everyone’s situation is different and requires a personalized debt solution. Professionals at Golden Financial Services can help you personalize a debt solution based on your goals and needs. Another option to consider is the debt snowball method, helping you save money and improve credit scores. The debt snowball method is a debt reduction strategy that you can implement yourself, using free tools like the budget and snowball calculator offered by Golden Financial Services.

Can I Negotiate With American Express Card?

Does American Express offer settlements? You can negotiate with American Express on your own. First, write down your financial goal. Then map out a plan to achieve that goal.

Mapping out means creating a budget analysis helping you see all of your finances. Mapping out includes projecting future income and expenses to ensure you’re mapping out an appropriate long-term plan. All financial programs require a budget analysis, including projections, to help you reach short-term objectives and, ultimately, long-term goals. Be realistic about your situation.

Click here to learn how to settle debt on your own.

Reduce Interest Rate on AMEX Credit Card

Explain to AMEX on a phone call that another credit card company is offering you a more attractive card with reward points and cashback. Make sure to speak with a supervisor.

Tell them: “However, I’d like to stay with AMEX if you’re willing to reduce my interest rate and match this other credit card company’s offer.” AMEX will most likely reduce your interest rate.

Another option is, instead of asking for a reduction in the interest rate, you could ask for a reduction in the monthly payment if you’re experiencing financial hardship. Explain to AMEX that you’re experiencing financial hardship and don’t want to fall behind on monthly payments. They should approve your request as a one-time courtesy, especially post COVID-19.

What is your goal? Some people need a reduced payment, while others look to save money by paying less interest. Personalize your own script based on your needs and goals before calling your creditor. Visit this page next to learn more about how to negotiate debt.

Or if you already fell behind on the monthly payment, ask if they can waive the late fee and re-age your account to show it’s current, as a one-time courtesy since your history with them has been so positive. Illustrate that you’re experiencing financial hardship. Send them proof of your financial hardship.

What happens if I can’t pay my AMEX bill?

If you fall behind on your AMEX credit card payment, AMEX will charge you a late fee and could increase your interest rate. Before your payments become more than thirty days delinquent, you need to take action.

(1) negotiate with AMEX on your own

(2) speak with a debt counselor at a consumer credit counseling company or Golden Financial Services

Your AMEX debt will only continue to grow after falling behind on monthly payments due to late fees and interest and potentially getting sued.

Does AMEX Have a Debt Relief Program?

AMEX will recommend a consumer credit counseling program for consumers experiencing financial hardship. Consumer credit counseling is the most beneficial program for AMEX because it ensures they get paid 100% of the debt PLUS interest. So, of course, AMEX credit card payment help includes consumer credit counseling.

AMEX will refer you to a licensed consumer credit counseling service (CCCS). However, you don’t need to go through their referral. Instead, visit the Department Of Justice website and check for licensed consumer credit counseling companies in your state. You should always shop around with different companies and find the plan that sounds best. Compare each company’s Better Business Bureau (BBB) rating, online reviews, and details of complaints against a company. Also, check how long a company has been in business. Then, if you’re contemplating using consumer credit counseling, go with the best-rated company.

Related Articles:

Check out the Top 10 National Debt Relief Companies for 2022

10 Best Ways to Clear Credit Card Debt Fast in 2022

What is consumer credit counseling?

Consumer credit counseling services consolidate your credit cards into one monthly payment. A consumer credit counseling program is considered debt consolidation, but it’s not a personal loan.

Instead, you pay the consumer credit counseling agency every month, and from that payment, they pay your creditors but at a reduced interest rate. So, you’re responsible for making a single payment every month, no matter how many cards you have.

Consumer credit counseling companies have agreements with most major credit card companies allowing them to reduce the interest rate for their clients. Consequently, you can get a lower monthly payment than what you’re currently paying, and past due payments can be re-aged to show current helping your credit score.

Does a Consumer Credit Counseling Service Work for AMEX or You?

We’ve already mentioned this point, but to clarify:

Consumer credit counseling companies work for the creditors. They get paid a “fair share” fee from your creditor. So, in reality, a consumer credit counseling agency works for your creditors, not you.

Explore Credit Card Relief Programs That Work For You

At Golden Financial Services, we recommend getting an unbiased consultation from an IAPDA certified debt specialist that can offer multiple debt relief programs. These programs work for you and represent you, not your creditors.

IAPDA certified debt specialists will be able to offer you more flexible payment options than what a consumer credit counseling company can offer.

Contact Golden Financial Services for a Free Consultation at (866) 376-9846.

For consumers with AMEX Credit Card Debt in Collection

AMEX does not offer credit card payment assistance if your account is in third-party collection status. You can settle AMEX credit card debt at this point. However, if you owe $10,000 or more in combined credit card balances, you may want to explore professional debt relief programs.

A debt resolution program has your best interest and does not work for AMEX. Debt resolution programs use debt validation to force the collection agency to prove that they are “legally authorized” to collect on the debt. And in many cases, they can’t prove the debt is valid. Click here to learn about how debt resolution programs work.

If you owe above $10,000 in combined AMEX credit card balances and any other unsecured debt:

Golden Financial Services recommends either;

(1) a performance-based debt settlement program or

(2) an attorney-based debt resolution program.

Our counselors can set you up with both options if you’re eligible.

AMEX Credit Card Payment Assistance Calculator

How much does each credit card relief program cost? The following calculator compares consumer credit counseling, debt settlement, and validation programs.

Cost for AMEX Credit Card Debt Settlement:

AMEX credit card settlement company fees can vary from one company to another. Legally, settlement programs can only charge fees after a debt is settled. These fees add up to 25% of the total debt enrolled in the program. For example, if your credit card debt gets settled for 50% of the balance, with settlement fees included, clients pay 75% of the debt in total.

Cost for Consumer Credit Counseling

Consumer credit counseling companies can’t charge more than $50 per month. However, non-profit consumer credit counseling companies do get paid double. They get paid from the consumer and a fair share fee from creditors.

Who is Golden Financial Services

Golden Financial Services (GFS) has provided national debt relief services since 2004 and has pre-arranged agreements with the best debt relief, settlement, and consolidation providers in the United States. These agreements allow GFS to offer qualified consumers the lowest possible monthly payment and the best savings available for these plans.

Even better, consumers don’t have to pay GFS. Instead, the debt relief providers pay GFS, similar to how credit card companies pay consumer credit counseling companies. However, unlike consumer credit counseling companies that work for the creditors, GFS works for the consumer and has the consumer’s best interest.

GFS has maintained an A+ Better Business Bureau rating and is #1 rated at TrustedCompanyReviews.com in the Top 10 Debt Relief Companies for 2022.

How Does GFS Offer The Best Debt Relief Programs?

Debt relief companies choose to work with Golden Financial Services because our financial education websites come up at the top online. We have one of the most trusted brands on the internet for providing unbiased financial education.

Still, our relationship with debt relief providers is contingent upon many factors.

Providers must pass stringent compliance testing that we put them through. For example, providers must be licensed and have positive online reviews. In addition, they must have a history of success with clients, and many more factors exist.

Does the company have effective lawsuit defense policies in place?

Is the company transparent with its clients?

Does the company offer compliant and affordable payment plans?

Does the firm have licensed attorneys representing the client in a particular state?

Initially, GFS acts as a liaison between you and the debt relief company, ensuring you get enrolled in the right plan and with the best possible savings.

How to Sign Up for AMEX Credit Card Settlement Programs

GFS can give you a free and unbiased debt relief consultation. Call today at (866) 376-9846.

Why not sign up with the debt relief company directly?

Consumers could shop around on their own and sign up for a program directly, but they won’t get a better deal that way, so they choose to go through Golden Financial Services to get all of the added benefits and ensure they get the best possible savings. We’ve done that work for them, and our reviews and credentials can evidence that. And, if there’s ever a problem with a particular program, clients know that GFS will represent their side and help find a resolution.

Think of a similar scenario; a person could invest money into the stock market on their own or use a reputable licensed financial advisor that acts as their beneficiary and helps them make the most intelligent investment choices. Consumers choose to use a financial advisor in this case because their experience can result in the consumer growing their investment much faster over the years.

Or consider when it comes to paying taxes. For example, a person could file their own taxes or pay to use a licensed tax advisor. A licensed tax advisor knows the tax codes and laws and can better represent the consumer, ensuring they get their maximum allowable benefits (including write-offs).

You can learn how to get out of debt and stay out of debt by contacting the counselors at Golden Financial Services. You will learn healthy financial habits to transform your financial situation over the long term.

AMEX Credit Card Settlement

After you fall behind on AMEX credit card payments, eventually, accounts get written off and sold to third-party collection agencies. At this point, an AMEX credit card debt can get negotiated, reduced, and settled, allowing you to pay a significant amount less than the total owed.

AMEX credit card settlement programs set the consumer up with one affordable monthly payment. So, you’ll make a single payment every month, and this payment is deposited into a special purpose savings account. Creditors are not paid every month with debt settlement. In this account, funds from your monthly payments continue to accumulate. As your balance in this account grows, each debt is settled one by one.

Nothing comes out of your program account until you agree to the settlement offer. At that point, the settlement is finalized in writing. Your creditor will then get paid in one lump sum payment. For example, you could pay $7,000 to resolve a $10,000 AMEX credit card debt. $5,000 could go to AMEX and $2,000 to the debt negotiator.

Benefits of Consumer Credit Counseling vs. Debt Settlement?

The main benefit of consumer credit counseling over settling AMEX credit card debt is that you remain current on monthly payments.

Consequently, credit scores are less negatively affected over the program’s first year.

You also won’t have to deal with creditor harassment with consumer credit counseling.

And late payments can be re-aged to show “current” with consumer credit counseling.

The Downside of Consumer Credit Counseling

On the flip side, consumer credit counseling programs take approximately five years to graduate. Debt settlement takes closer to three years to complete.

Consumer credit counseling is reported on a person’s credit report, which some creditors view as a negative notation. For example, it will show that a consumer credit counseling program manages your AMEX credit card payment on your credit report.

Downsides of Credit Card Settlement

You must fall behind on credit card payments to use debt settlement. Accounts then get sold to third-party collection agencies, and credit scores are negatively affected.

Can American Express sue me?

In addition, you could get sued while on a settlement program, which scares many folks away from this option. But the truth is, getting served a summons while on a reputable settlement program is not scary. A summons can get settled like any other debt, and you’ll never have to go to court.

3 Downsides of AMEX Credit Card Debt Settlement

(1) the chance of getting served a summons

(2) the harmful effect settlement plans have on a person’s credit score

(3) you may have to pay taxes on the savings

The Best AMEX Credit Card Settlement Program

The best settlement programs will:

- loan funds to their clients to settle each debt faster

- include lawsuit defense and legal protection

- only charge fees after the debt is reduced, settled and at least one payment made towards the settlement

To qualify for this debt settlement loan, clients must make at least three on-time debt settlement program monthly payments, amongst other factors.

The best AMEX credit card settlement plans also include legal protection. So why is it essential to have a debt negotiation lawyer involved?

First, an attorney will respond to the summons on your behalf. And more importantly, before the law firm attempts to settle an AMEX credit card debt, they will dispute it using federal consumer protection laws.

In the best-case scenario, debt resolution programs dispute the debt, resulting in you not having to pay it because it becomes legally uncollectible.

Worst case scenario, you get a credit card summons, and the law firm negotiates a settlement on it so that you end up paying less than the total balance and with no interest. In many cases, an attorney will find legal violations committed by AMEX or the “assigned to” collection agency and can use these violations as leverage when negotiating a settlement.

So, in the end, even after getting served with an AMEX credit card lawsuit, you could save a significant amount more than if you were to have used consumer credit counseling.

AMEX Credit Card Summons

Debt settlement attornies can fight a credit card summons if legal violations are found. For example, if you fall behind on an AMEX credit card debt, it could eventually get disputed with debt validation. After disputing the debt, AMEX may illegally issue you a credit card summons. That’s illegal because debt validation legally forces a collection agency to stop collecting a debt until it’s validated. So, if AMEX ignores this clause in the law, they are illegally attempting to collect on a debt.

An attorney knows to illustrate to the judge at court that the credit card debt was disputed and the creditor never validated it, then issuing this summons. The judge should require the creditor to validate the debt at that point, or it could get dismissed. Call Golden Financial Services today and get AMEX credit card debt assistance.

Any questions? Please let us know in the comments section here.