Table of Contents: One Up On Wall Street Book Summary

- Blog Post Introduction Summary

- Peter Lynch’s – Investment Fundamentals

- How to Find a Company’s Growth Rate

- How to Evaluate a Company’s Financial Situation

- Lynch’s Favorite Financial Ratio and How to use it

- Best Stock Picks for 2021

- How to get ideas on what stocks to buy?

- The 6 Categories Peter Lynch Uses to Pick Stocks

- Look for share buybacks

- The Truth About The Professionals and Financial Advisors

- The Big Edge That You Have Over Wall Street Analysts

- The One Up On Wall Street Stock Screener Free Tool (updated monthly with a new list of stocks)

YouTube Summary of One Up On Wall Street

One Up On Wall Street Summary

Peter Lynch is one of the most successful investors of all time and the author of my favorite book on investing, “One Up On Wall Street.” Summaries of this book can be found online, but none of them tie in the book’s principles with 2021’s best stock picks, as this summary reveals.

“Between 1977 and 1990, Lynch’s Fidelity Fund outperformed the market by a whopping 29% per year annualized. Lynch accomplished this by using fundamental principles and paying close attention to a firm’s growth prospects and “their story” (i.e., what it is that the company is going to do, or what is going to happen to bring the desired results), which the book One Up On Wall Street reveals. Lynch’s goal was to find growing companies at a reasonable price, or even better, find companies selling at a price/earnings ratio equal to or less than its growth rate.

The following summary of One Up On Wall Street highlights some of the main principles explained in the book. Paul Paquin, the author of this blog and CEO at Golden Financial Services (GFS), integrates modern-day investment theories with the principles provided in One Up On Wall Street.

Investment Fundamentals

Lynch’s fundamental way of investing centered around “when a company’s earnings continue to rise year after year, the share price follows along.”

According to Peter Lynch, when evaluating potential buying opportunities, one must consider:

- free cash flow (Has the free cash flow been going down or rising over time?)

- long-term debt (Has the company’s long-term debt been rising over the last 5-10 years or getting lower? Debt reduction is a positive sign)

- profit margins (Have the company’s profit margins been expanding?)

- price/earnings ratio (Is it near the growth rate or less?)

These are a few examples of the fundamentals that Peter Lynch uses when picking stocks. Increased free cash flow, less debt, and widened profit margins are all positive signs. If a company’s price/earnings ratio is less than its growth rate, this indicates a bargain.

How to Find a Company’s Growth Rate?

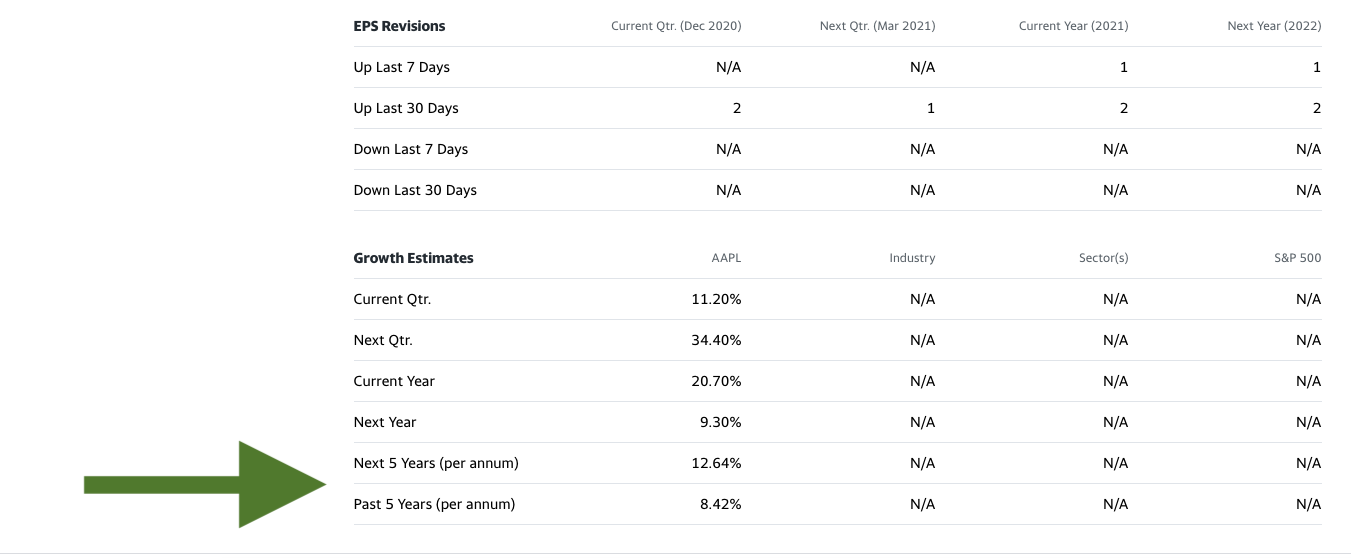

The easiest way to find a company’s growth rate is to check the company at Yahoo Finance. Simply Google, the company’s name with Yahoo Finance. For example, if you want to look up Apple’s growth rate, just Google “Apple stock Yahoo Finance.”

After arriving at the company’s profile at Yahoo Finance, click “Analysis.” Scroll to the bottom where it says, “Growth Estimates.” There you will find the growth estimate for the next five years and the past five years.

Look at the growth rate for the next five years. Is it near the same or higher than the company’s price-to-earnings ratio?

The PEG (price/earnings/growth) ratio of a company can quickly illustrate whether a company’s growth rate is higher than its price/earnings. If the PEG ratio is below one, the growth rate is higher than the price-to-earnings ratio.

How to Evaluate a Company’s Financial Situation, from the book “The Intelligent Investor“:

One of Lynch’s Favorite Financial Ratios (Cash-to-Debt)

Lynch especially favors companies that have a high cash to debt ratio. To figure out a company’s net cash position, refer to its consolidated balance sheet. Add up the “cash and cash items” plus marketable securities. Lynch will then check the long-term debt. Your last step is to subtract the long-term debt from cash (assuming cash exceeds long-term debt), and that’s your “net cash minus debt” total.

Lynch will then deduct the net cash from the share price and re-evaluate the p/e ratio. Some stocks that appear to have a high p/e ratio are, in reality, cheaper than they look after, incorporating debt and cash into the equation.

EXAMPLE:

Using simple math here, let’s take a stock selling for $10 per share with $0.50 per share of earnings and a p/e of 20. The company has total cash of $8 per share and long-term debt of $5 per share. Lynch will subtract the long-term debt from total cash, figuring out in this case, the company’s “net cash minus debt” is $3 per share. Lynch would then subtract the $3 of net cash from the share price of $10, re-evaluating the enterprise value to be $7 per share. Enterprise value is what you would pay in a real transaction when buying another business, where cash and debt are normally included. With the new share price of $7 per share, the updated p/e ratio is 14.

You may be asking, but what about current liabilities (i.e., short-term debt)? Does Peter Lynch ignore it? Lynch does not pay any attention to short-term debt; as long as the total cash exceeds long-term debt, he’s comfortable ignoring the short-term debt.

During Lynch’s introduction chapter, he discusses the following points;

Don’t buy directly into “hope” (e.g., “it’s the next Amazon or Apple”).

Lynch explains:

There are ways to invest in this “next hot trend” without buying directly into “hope” and “an extravagant market cap.” One common method is by using an offshoot of the old “picks and shovels” strategy.” During the Gold Rush, most would-be miners lost money, but people who sold the miners the picks, shovels, tents, and blue jeans (e.g., Levi Strauss) – made a nice profit. Let’s look at a few examples of how we can use this concept in today’s world.

What are the Best Stock Picks for 2021?

We’re not about to claim that we can predict what stocks will be the best to buy in 2021, but what we will do is tie in the book’s principles with today’s hottest stocks. The following stock picks are an example of “the offshoot of the old picks and shovels strategy.” Remember, back during the gold rush days, you could make money by investing in the picks and shovels that the miners used to dig for the gold. You can make money off the suppliers, producers, and manufacturers of equipment used to make electric vehicles and batteries, computerized chips, and even the COVID-19 vaccines in today’s age.

Tesla (TSLA)

The company has a market cap of over $578 Billion and is selling for 950+times earnings. Many investors consider this overvalued. So, in Lynch’s day, how would he go about getting in on Tesla without directly investing in it? Here’s one possible way. Consider Tesla’s most significant suppliers and manufacturers.

- Panasonic Corporation

- Fujitsu Limited

- AGC Automotive: windshields

- Brembo: brakes

- Fisher Dynamics: power seats

- Inteva Products: instrument panel

- Modine Manufacturing Co.: battery chiller

- Sika: acoustic dampers

- Stabilus: liftgate gas spring

- ZF Lenksysteme: power steering mechanism

Some of these companies mentioned may not even be publically-traded companies. I’m only mentioning them as an example. Do your own research.

In general, the Electric Vehicle (EV) industry is booming. Any time a new IPO comes out, and the phrase “EV” is included in the name, watch the stock price soar like a rocket ship, and in many cases, these companies don’t even have earnings yet. So don’t be a fool and buy into this false hope because you may lose all of your investment. Instead, find established companies with a proven performance record and clean balance sheet that are benefiting from the “next hot trend,” like in Peter’s day buying the shovels to dig for the gold.

For this next example, consider the manufacturing companies that sell the parts to the EV industry, like Albemarle (a producer of lithium for EV batteries) or even better, BorgWarner. In fact, Borgwarner just announced the acquisition of Akasol, a lithium-ion battery supplier to commercial truck and off-highway equipment makers.

BorgWarner Inc. (BWA)

“BorgWarner Inc. provides solutions for combustion, hybrid, and electric vehicles worldwide.” Its biggest customers include Ford and Volkswagen.

As of March 25th, 2021, this company was selling at a Trailing P/E ratio of 18, while its growth estimate for the next five years is above 19. BWA is currently selling for less than its five-year average P/E ratio of 22.20.

This is a perfect example of a stock Peter Lynch may be interested in buying because its growth rate is higher than the P/E ratio, amongst other reasons. The company also has a Debt/Equity ratio of 59.58, illustrating low debt. And as of March 2021, BWA is carrying over $1.65 Billion in cash, more than it’s ever carried in the past.

According to MorningStar.com, “BorgWarner is well-positioned to capitalize on industry trends arising from global clean air legislation, consumers’ demand for fuel economy, and the popularity of sport utility and crossover vehicles around the world. ”

Thermo Fisher Scientific (TMO)

TMO makes the equipment for COVID-19 vaccine-producing factories and labs. This company is currently trading for 20 times its Forward P/E. The company is holding over $10-billion in cash and has a Total Debt/Equity ratio of 65.47. TMO’s return on equity for 2021 is around 19.87, up from 12.91 in 2019. Similarly, its net profit margin is 19.79, up from 14.47 in 2019.

Hanesbrands Inc. (HBI)

Think outside the box. Amazon’s price may have been too high as of June 2020 for some investors to buy, but not HBI’s stock price. HBI had just partnered with Amazon to sell more clothes. A retail company that sells clothes could see a significant boost in sales after partnering with Amazon, one of the tops sites on the internet, considering that near 70% of all retail sales are done online. Sure enough, HBI’s stock price more than doubled since June 2020, going from around $10 per share to above $20 per share as of March 15th, 2021.

GrowGeneration Corp. (GRWG)

The marijuana industry is hot, literally, as more and more consumers are lighting up legally! What weed company should you invest in? Using Peter Lynch’s methods, you may want to consider GRWG.

GRWG sells supplies to the weed companies, including “lighting and hydroponics products, lighting fixtures, nutrients, seeds, and growing media, systems, trays, fans, filters, humidifiers and dehumidifiers, timers, instruments, water pumps, irrigation supplies, and hand tools.” The company’s revenue in 2019 was just shy of $80 million, compared to in 2020, rising above $193 million. As legalization continues to get approved state by state, this company’s earnings should continue to rise. As of August 2019, the company’s e-commerce website at GrowGen.Pro.com had approximately 5,227 visitors per month. As of March 2021, the website gets over 24,000 visitors per month. Online organic growth is a sure-tell sign to growing profitability, as this is similar to visits to a local store.

How can you get ideas for Stocks to Buy?

Ideas are right in front of you.

Consider:

-Your favorite stores

-Items around your house

-The medicines that you take every day

-What’s in your wallet? (e.g., Mastercard, Visa, Chase)

Several years ago, I played this little game.

I looked around my house.

Apple TV on the wall.

Apple phone on the table.

Mastercard in my wallet.

Amazon Alexa, next to the table.

Apple Watch on my wrist.

Boxes on the doorstep for my wife (in Amazon boxes).

A new LG smart refrigerator.

OK, so Amazon and Apple were clearly my starting points.

I then visited the financial statements for Apple and Amazon.

As an example, when checking Apple (AAPL) in 2018.

- Price/Earnings ratio below 20 and its Enterprise Value/EBITDA of 13

- Rising Free Cash Flow

- The company was buying back shares ($32 Billion worth in 2017, and more than double that in 2018)

- PEG Ratio close to 1 (remember, under 1 means growth rate is above price/earnings ratio, so between 1-2 is also favorable)

- A Debt/Equity ratio of under 1.0 (as of 2018)

- A current ratio above 1.0 (According to Investopedia: “A company with a current ratio less than one does not, in many cases, have the capital on hand to meet its short-term obligations if they were all due at once, while a current ratio greater than one indicates the company has the financial resources to remain solvent in the short-term.”)

- Return on Equity near 50%, up from 36% in 2017 and 30% in 2013

- Average earnings rising over the last decade (see screenshot below illustrating Net Earnings from 2005-2020)

- Cash and Cash Equivalent (including marketable securities) of $25 Billion in 2014, $41 Billion in 2015, $66 Billion in 2018, and already $90 Billion for 2020

Apple’s Net Income (from 2005–2020)

Where do you go every day? Maybe, Starbucks or Dunkin Donuts? If you invested in either of these companies in the past, you would have made a profit by today.

What are your kids’ favorite things to do?

Sometimes, the best investments are right under your nose. After you find a potential company to invest in next, create a story for that company. To create the story, you’ll need to figure out what stage of growth a company is currently in.

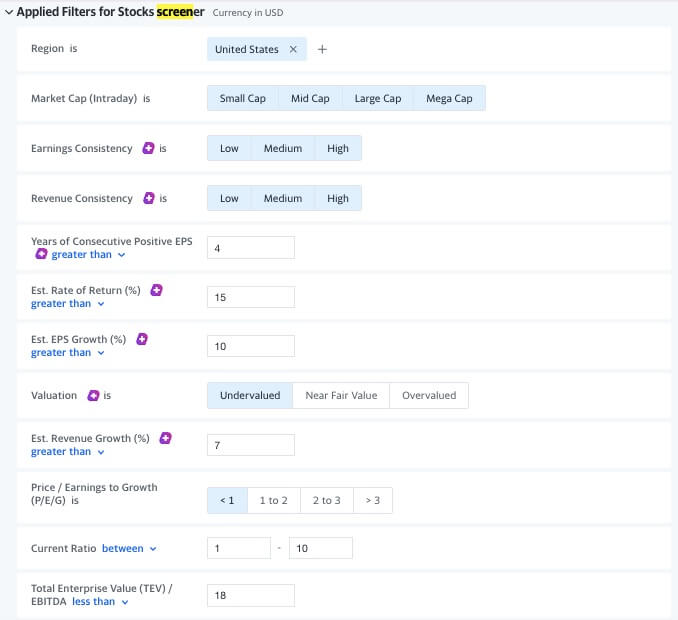

The One Up On Wall Street Stock Screener Tool

Golden Financial’s One Up On Wall Street Stock Screener Free Tool looks for companies that meet the following criteria:

- Region: United States

- Market Cap (Intraday): Small Cap, Mid Cap, Large Cap and Mega Cap

- Earnings Consistency: Low, Medium and High

- Revenue Consistency: Low, Medium and High

- Years of Consecutive Positive EPS: greater than 4

- Estimated Rate of Return (%): greater than 15

- Est. EPS Growth (%): greater than 10

- Valuation: Undervalued

- Est. Revenue Growth (%): greater than 7

- Price / Earnings to Growth (P/E/G): less than 1

- Current Ratio: between 1 and 10

- Total Enterprise Value (TEV) / EBITDA (similar to P/E ratio but this metric incorporates a company’s cash and debt into the equation) less than 18

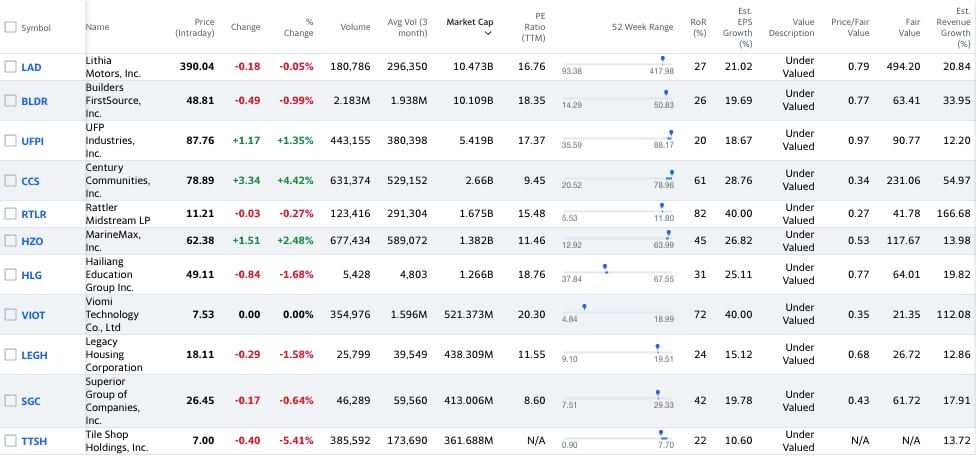

Here are the top eleven stocks that made the One Up On Wall Street Stock Screener list on May 4th, 2021.

You could also consider using a stock screener, as explained in this YouTube Video.

Peter Lynch’s six categories to consider when investing in stocks:

Some investors recommend holding a certain percentage of stocks versus bonds to diversify. But Peter Lynch recommends using the following six categories as a way of “diversifying your portfolio.”

- Slower Growers, like Coca Cola KO (1-4% growth per year that pays dividends)

- Stalwarts (10-12% growth per year)

- Fast Growers, like Amazon (20+%)

- Cyclicals, like Toyota (TM) and Nissan NSANY (profits rise and fall)

- Turnarounds, like IBM (poor financial health including high debt currently, but in the process of improving financial situation)

- Asset Plays, like Disney (lots of strong assets including land, films, and its brand)

A more detailed description of the six stages:

- Slow Growers: Large and aging companies are expected to grow only slightly faster than the U.S. economy as a whole but often paying large regular dividends. These are not among his favorites. Coca-Cola (KO) could be considered a slow grower as of 2020, but in Lynch’s day, it was considered a Stalwart.

- Stalwarts: Large companies that are still able to grow, with annual earnings growth rates of around 10% to 12%; examples include Coca-Cola, Procter & Gamble, and Bristol-Myers. If purchased at a good price, Lynch says he expects good but not enormous returns–certainly no more than 50% in two years and possibly less. Lynch suggests rotating among the companies, selling when moderate gains are reached, and repeating the process with others that haven’t yet appreciated. These firms also offer downside protection during recessions.

- Fast-Growers: Small, aggressive new firms with annual earnings growth of 20% to 25% a year. These do not have to be in fast-growing industries, and in fact, Lynch prefers those that are not. Fast-growers are among Lynch’s favorites, and he says that an investor’s biggest gains will come from this type of stock. However, they also carry considerable risk. Alibaba (BABA), Netflix (NFLX), and Amazon (AMZN) could be considered Fast Growers of 2020.

- Cyclicals: Companies in which sales and profits tend to rise and fall in somewhat predictable patterns based on the economic cycle; examples include companies in the auto industry, airlines, and steel. Lynch warns that these firms can be mistaken for stalwarts by inexperienced investors, but the share prices of cyclicals can drop dramatically during hard times. Thus, timing is crucial when investing in these firms, and Lynch says that investors must learn to detect the early signs that business is starting to turn down. Three of my favorite Cyclicals for 2020 include Toyota, Delta Airlines, and Nissan.

- Turnarounds: Companies that have been battered down or depressed–Lynch calls these “no-growers”; his examples include Chrysler, Penn Central, and General Public Utilities (owner of Three Mile Island). The stocks of successful turnarounds can move back up quickly, and Lynch points out that these upturns are least related to all the categories’ general market. IBM, Lending Club (LC), and Hanesbrands (HBI) are examples of turnarounds in 2020.

- Asset opportunities: Companies that have assets that Wall Street analysts and others have overlooked. Lynch points to several general areas where asset plays can often be found–metals and oil, newspapers and TV stations, and patented drugs. However, finding these hidden assets requires a real working knowledge of the company that owns the assets. Lynch points out that within this category, the “local” edge–your own knowledge and experience–can be used to the greatest advantage. Examples of Asset Opportunities for 2020 include Disney (DIS), GlaxoSmithKline plc (GSK), and Roche (RHHBY).

source: California State University, https://www.csulb.edu/, 12/20/2020

Figure out what stage a company is in before investing in that company. Peter Lynch diversifies by investing in companies that are in these different stages.

Do you see a particular company opening up all over the place? That’s a good sign and could indicate it’s a fast grower.

Or, do you see stores shut down, like back in the Blockbuster days, or more recently Toys Are Us days? That’s a bad sign.

Where will the future growth come from if the store is already on every corner in all countries? If the company can’t keep growing, you may not want to invest in it unless it pays a generous dividend and has a robust dividend track record, and you’re looking for an income-paying stock.

These are some of the questions you need to ask yourself before investing in a company. Also, evaluate how a company performed during bad times, not just considering a company during good times. For example, how did the company hold up during 2008, 2009, and following, after the financial disaster hit?

Look for Share Buybacks

Look for companies that buy back shares. When a company buys back shares, it makes your shares worth more. Share buybacks are similar to when a company pays you a dividend (i.e., income) but a more tax-efficient way of rewarding shareholders.

You can check a company’s annual report and search for where it says “stock outstanding or Average # of shares of Capital.” See if this number is getting lower. If the shares are shrinking, that means the company is buying back shares and is a great sign.

Peter Lynch Says, “Stop Listening to the Professionals!”

Lynch explains:

“Twenty years in this business convinces me that any average person using the customary three percent of the brain can select stocks just as well, if not better, than the average Wall Street stockbroker. I know you don’t expect the plastic surgeon to advise you to do your own facelift, nor the plumber to tell you to install your hot-water tank, nor the hairdresser to recommend that you trim your own bangs, but this isn’t surgery or plumbing or hairdressing. This is investing, where the smart money isn’t so smart, and the dumb money isn’t as dumb as it thinks. Dumb money is only dumb when it listens to smart money. “

Final Tips of the Intro-Chapter.

Invest in familiar companies that you know and understand. And do your own research before buying. Many people choose to invest in companies that they’ve never heard of and don’t know anything about, like a doctor investing in “One Megabit S-Ram Semiconductor” or the “Asynchronous Backward Compatibility.” In the doctor’s case, the cancer medication that he uses to save lives every day could actually also be his best investment option (and it’s right under his nose, but instead, he chooses to listen to the stockbroker that called him out of the blue the other day about Asynchronous Backward Compatibility.

You can easily be the analyst who tests Hanes underwear and quickly realize that they are very comfortable and a great seller. You don’t have to wait until a stockbroker calls you, saying, “I just finished analyzing Hanes Underwear, and they are great!”

After a lifetime of buying cars, cameras, and computers, you start to realize what’s low quality and what’s high quality.

Researching Dunkin Donuts includes sipping their coffee. Why wait for a Morgan Stanley stock analyst to analyze the company when you can do it on your own. You’ve sipped the coffee and ate all of their donuts a hundred times and can see that new Dunkin Donuts franchises have just recently opened up in multiple towns nearby.

Of course, before buying any stock, Peter Lynch says:

“Just because the Cabbage Patch doll was the best-selling toy of this century, it couldn’t save a mediocre company with a bad balance sheet.”

The BIG EDGE You have over the Financial and Wall Street Analysts:

You, as an individual investor, have multiple advantages over the Wall Street Analysts.

- Morgan Stanley won’t recommend a stock until the stock goes from at least $2 per share to $10 per share. The edge you have is that you noticed it at the $2 per share and can buy it at that low price. Some institutions can’t recommend smaller companies, so when waiting for analysts to recommend them, you could miss all of the early years of growth.

- You are free from the bureaucratic rules and short-term performance concerns that restrict Wall Street Analysts. Institutional investors don’t want to look bad. They would rather buy a safe company that they can be confident knowing will give you a 3%-6% return (like IBM), rather than taking a chance investing in a “less established” company that could eventually produce results tenfold. Nobody’s going to get mad at their investment advisor if some unexpected result occurs that brings down IBM, but on the other side of the coin, if Upwork or Twilio flops, a person may get very upset with their investment advisor because they never heard of these companies and will consider these “risky investments.” But the truth is, in the last year, both Upwork and Twilio could have doubled your money, while IBM not so much.

- More restrictions: some institutional investors are not allowed to invest in companies that have a union, non-growth stocks, oil, and steel stocks. These restrictions can prevent you from taking advantage of many great opportunities when going through an investment firm. Institutions, like Fidelity, are regulated by the SEC. SEC says certain institutional investors cannot own more than ten percent of shares in any given company, nor can they invest more than five percent of the fund’s assets in any given stock. Certain institutions or mutual funds are limited to investing in only 90-100 companies out of 10,000+ publicly traded. The point is, you, as an individual investor, are not held back by this never-ending list of restrictions.

- The local edge: Maybe it’s a company that you use every day for your job, and you thoroughly understand this company better than any Wall Street Analyst.

Click Here for PDF Version of One Up One Wall Street Summary

Disclaimer:

Golden Financial Services does not hold itself out as providing any legal, financial planning, insurance, investment, or other professional advice. Nothing contained in this book summary should be construed as an offer to sell, a solicitation to purchase, or any recommendation or endorsement regarding any investment, policy, or product. Also, Golden Financial Services does not offer any advice regarding the nature, potential value, or suitability of any particular investment, security, or investment strategy. The strategies, investments, and services mentioned in the book summary may not be suitable for you. If you have any doubts, you should contact an independent financial advisor. You should consult with an independent professional before initiating any investment strategy. The information contained herein is simply a summary of the author’s book. The summary does not constitute advice, and you should not rely on any material, in summary, to make (or refrain from making) any decision or take (or refrain from making) any action. You alone are responsible for making financial decisions appropriate for you based on your situation and personal financial goals. Some of the viewpoints in this summary of One Up On Wall Street may not be exactly as Peter Lynch intended them to be and are based on the author’s understanding of the book. Please refer to the book, One Up On Wall Street to verify specific details and word-by-word definitions. When this article was published, the author did hold positions in Toyota, Nissan, Alibaba, Netflix, Apple, and Amazon. If you’ve enjoyed this summary, Subscribe to our blog so that you are notified in the future when we publish the next summary of later chapters in “One Up On Wall Street.”