How to Get Credit Card Debt Relief & a Permanent Solution to Credit Card Debt

According to Susanne Woolley and the Federal Reserve debt figures, the average United States household had $16,061 in credit card debt, as of the third quarter of 2016. As debt accumulates, astronomical credit interest rates can make paying that debt down an impossibility. Who hasn’t seen a billboard advertising a company to help rescue people from the red? This cannot be the focus of our intervention, however. Too often we focus on treating the symptoms when something becomes an issue, instead of battling the underlying illness. So what are the characteristics of a credit debt crisis, and how can we spearhead a mission to warn people of the potential dangers?

Credit cards can be convenient, and even life-saving; credit card debt can destroy your life financially, and cause stress overload. I believe that banks do not offer enough information and assistance in responsibly using credit. Providing information in a meaningful and memorable way would benefit both the provider and the consumer of the services, as debt affects both ends of the exchange. In a similar vein, institutions that provide credit debt acknowledgment and resources will be perceived as both more trustworthy and more consumer-oriented, a desirable attribute in a culture of business and bank distrust.

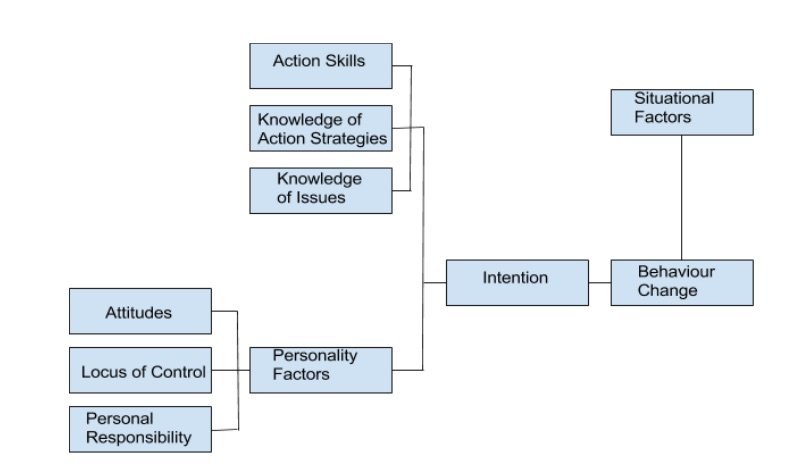

The mechanisms I propose to reach this goal of increased responsible credit use relies mostly on the Hines model of behavior change, often used to promote environmentally conscious behavior.

The model itself is featured on the next page, a short explanation of the variables follows.

Attitudes: How people feel about the behavior, influenced by a myriad of internal and external forces.

Locus of Control: The magnitude of ability people feel to influence what happens in the behavioral sense.

Personal Responsibility: How responsible people feel for the consequences of doing or not doing the behavior.

Personality Factors: Aspects of someone’s character that may alter how they react to interventions, how they change behaviors (frugality, apathy, anxiety, etc.)

Action Skills: Skills that people have to change the given behavior.

Knowledge of Action Strategies: Knowledge people possess that enable them to change the behavior.

Knowledge of Issues: Acquired knowledge that an issue exists/how bad it actually is.

Intention: What people want to do.

Situational Factors: Possible outside influences such as cost, time, or availability that may influence how a behavior is or is not changed.

Behavior Change: Every factor influences the desired outcome of a behavior change.

In this case, I believe the most important aspects to target to inform and fight against credit card debt are;

–Action Skills

–Knowledge of Action Strategies

–Knowledge of Issues.

These three contributors are the powerhouse of informed and intelligent decisions.

To start, increasing the common knowledge about debt will be important. We as a culture tend to hide our issues, and as a result, deal with our debt alone. In reality, almost 80% of Americans carry some form of debt, and 37% of Americans have credit card debt (PEW, 2015). Debt can feel like an insurmountable obstacle when you stand alone, which brings us to Knowledge of Action Strategies. It is vital that people have resources to go to when in debt, or when applying for a credit card. Many banks and financial institutions do provide advice and assistance related to credit card acquisition and use, however, the reality is that people tend to take the easiest path, and assume they can do things on their own. Few will seek out a credit advisor and ask questions, even fewer the right questions. Action skills give the people the power, providing paths and tools for them to take on their way to zero debt and responsible credit use.

Financial institutions can help.

An intervention to target these three aspects could be an online, half-hour ‘class’ or ‘introduction’ to credit encompassed within the application process. Parts of these programs could include the statistics about how many people really have debt, personal anecdotes regarding the impact of debt, explanations of how to responsibly use credit, resources available to guide credit use or guide getting out of debt, and other pertinent information. I propose an applied knowledge quiz at the end of this tutorial, and a financial reward as the institution sees fit to motivate applicants to truly learn. An

An applied knowledge quiz will be much more effective than a simple multiple choice questionnaire, as it forces people to think more than topically about the subject at hand, and the information is more likely to be embedded into the long-term memory. With total credit card debt around $779 billion, it is worth it for banks to spend some money to better educate and motivate their clientele.

Works Cited

Hines, J. M., Hungerford, H. R. & Tomera, A. N. Ž . 1986r87 . Analysis and synthesis of research on responsible environmental behavior: a meta-analysis. Journal of Environmental Education 18, 1-8.

Urahn, Susan K, et al. “The Complex Story of American Debt: Liabilities in Family Balance Sheets.” The PEW Charitable Trusts, July 2015.

Woolley, Suzanne. “Do You Have More Debt Than the Average American?” Bloomberg.com, Bloomberg, 15 Dec. 2016,

www.bloomberg.com/news/articles/2016-12-15/average-credit-card-debt-16k

-total-debt-133k-where-do-you-fit-in.

Golden Financial Services Scholarship Application: Cover Letter Ashley Hamersma

I am a student at the University of Michigan at Ann Arbor, intending to graduate in 2019 with a double major in Botany and Earth & Environmental Sciences. I chose to apply to this scholarship because though my heart belongs to the natural sciences, I believe in constant learning and the incredible importance of financial literacy. My father has supported (and financially educated) our family of four through watertight business practices and financial savvy for almost twenty years, having pulled together a construction company from a business degree, a knack for carpentry, and a few dedicated employees.

Should you choose my application, I will put your generous funding towards my degree through tuition payments. Upon completion, I will contribute to the scientific community through steadfast and meticulous research, creativity, and good old hard work. The versatility and hidden secrets of plants are numerous and awe-inspiring. So many medicines have been first discovered in the botanical community, and then synthesized for widespread and life-saving use. Much of cutting-edge botanical research is based upon analyzing and incorporating what plants have to teach us into our human world. Paleobotany, the study of fossilized plants, can even teach us about past conditions and life in ways that can be used to adapt to the present.

My other area of study, the earth sciences, has been an obsession since before I could talk. Volcanologists, seismologists, geoengineers, and others, are constantly working to help human life adapt to the usually-solid world underneath our feet when it decides to explode, melt, or shift. They discover new ways to extract fuels and work with botanists and chemists to develop new ones. As in every period in human evolution, challenges now face us, including changing climates, antibacterial resistance, and dwindling arable land. I hope to bring new ideas, perspectives, and my personal passions to the front lines of these challenges, and hopefully, do some good for both my fellow man and the planet that we all call Home.

To learn about debt relief programs visit Golden Financial’s National Debt Calculator Tool.