Are you looking for guaranteed ways to boost your credit score? The following four strategies are guaranteed to improve creditworthiness and boost credit scores fast. Before we dive in, let’s start with some basic “healthy credit habits” that you need to follow.

Credit Strategy#1: Use and Pay Credit Card Balances in Full Monthly

Start by using your credit cards every month and pay off the bill in full when it arrives. By doing so, you’ll quickly establish positive payment history and maintain a low debt to credit ratio (i.e., your credit utilization ratio).

A simple rule:

Don’t buy something on your credit card if you can’t afford to pay it off in full when the bill arrives.

By actually, using your credit cards EVERY MONTH, and paying the bill off IN FULL EVERY MONTH, shows that you are a responsible borrower. Your credit score will go up by practicing this (use and pay total balance every month strategy), guaranteed!

If you never use your credit card, you will probably lose your credit card. Banks often close out a credit card because it’s not getting used. So, make sure to use your cards every month and always pay the balance in full.

Never close out a credit card because that’s the fastest way to hurt your credit utilization ratio. At the very least, keep an old card open and use it for gas once per month, then pay the balance in full.

According to Bankrate:

“Since credit utilization makes up 30 percent of your credit score, it’s a good idea to keep your available credit as high as possible—and your debts as low as possible. Running up high balances on your credit cards raises your credit utilization ratio and can lower your credit score.”

You will pay more money by not paying your balance in full

If you carry a balance over to the next month, you will pay interest, also known as fees. You can avoid interest by paying your balance in full every month.

If you have a credit card that pays cashback, you can save extra money by using that card for purchases rather than paying cash while simultaneously improving your credit scores.

Try this debt calculator tool. See how much interest you will end up paying over the long term based on your current interest rate and monthly payment.

If you’re struggling with paying credit card balances in full, use this debt snowball calculator tool.

Also, compare credit card relief programs side-by-side with the debt calculator above. From New York to California, to Texas, and everywhere in between, programs are available to help pay off debt.

Before signing up for a credit card relief program, understand each option’s pros and cons, as illustrated in this credit card relief infographic.

Credit Card Debt Relief Program INFOGRAPHIC (Pros VS. Cons)

Do you want more options to help clear your credit card balances faster? – Click here for the ten best ways to clear credit card debt.

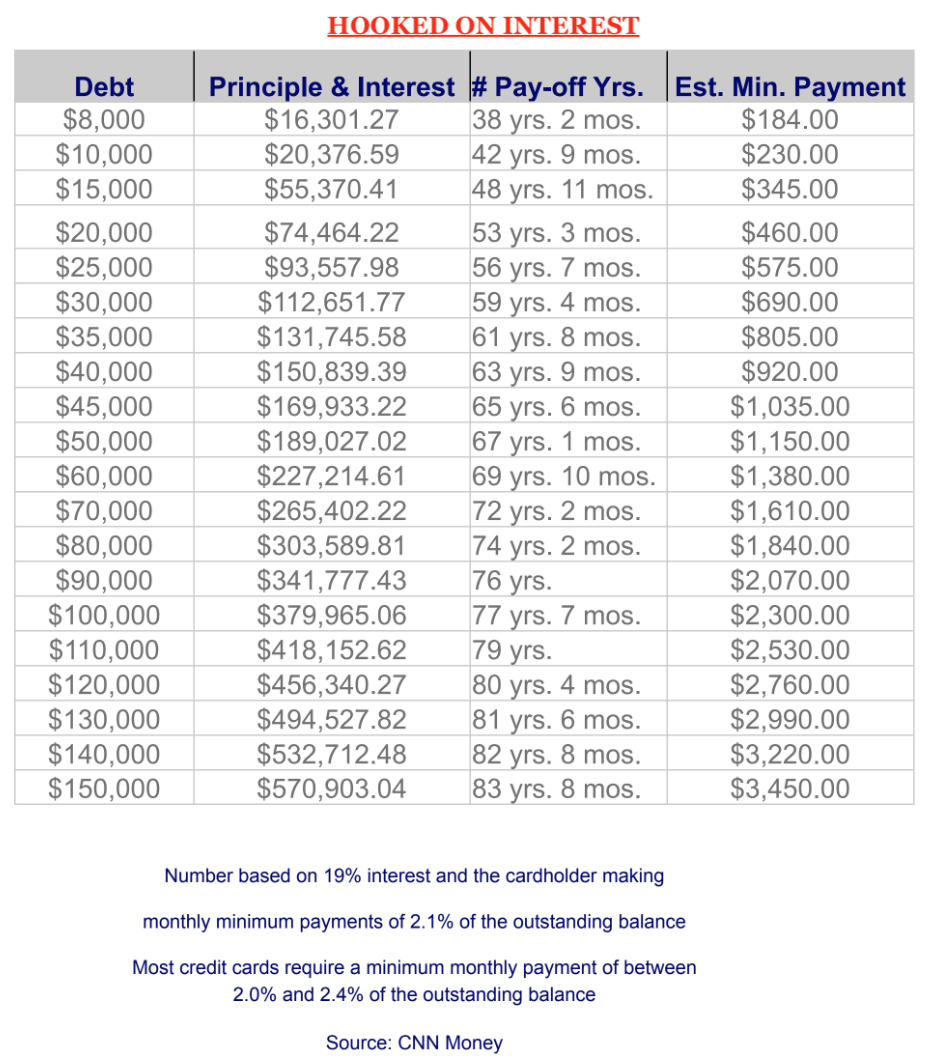

The Shocking True Cost of Credit Card Interest When Paying Minimum Payments

Credit Strategy #2: Raise Credit Limits

Raising credit limits is the fastest way to improve a person’s credit utilization ratio. And credit utilization ratio makes up approximately 30% of a person’s credit score.

When the credit card company raises your credit limit:

- you instantaneously get more available credit

- your credit utilization ratio improves

- and credit scores increase

After practicing tip number one for six to nine consecutive months, using and paying balances in full every month, there is a good chance that the credit card company will raise your credit limit. But there is also a chance they won’t.

So there is some risk involved when requesting that a credit card company raise your credit limit. If they deny your request, you’ll end up with a credit inquiry lowering your credit score. In many cases, credit card companies will raise credit limits automatically, without you even having to ask if you use and pay your card in full every month after nine months.

If the credit card company doesn’t automatically raise your limit, CALL THEM AND REQUEST A CREDIT LIMIT INCREASE OF AT LEAST $500.

What if the credit card company denies your request for a credit limit increase?

Even if your income is low, they should raise your credit limit due to your perfect payment history over the last nine months.

The higher your income, the better the chance to raise your credit limit.

However, after getting your credit limit increased several times, the credit card company may eventually reject your request for a credit limit increase. Their reason may be that you don’t need any additional credit based on your average monthly spending history.

For example, if you have an $80,000 credit limit but only spend about $1,000 per month, they may deny your request for a credit limit increase because they feel you don’t need more credit based on how much you’ve been spending in the past.

Knowing this point, make large purchases where you spend at least 50% of your credit limit and pay the debt in full when the bill arrives that month. Then, wait a few months and then request the credit limit increase.

Set a goal and map out how you will achieve that goal. For example, within five years, “I want to have a 750 credit score.” Your plan could include establishing $100,000 in available credit between five credit cards. Map out how much of a credit limit increase you’ll need to get every six months to achieve your goal within five years.

Set clear goals and define the path to achieve those goals. If you have a map in place, you can have a clear path to your destination rather than driving down a road not knowing which turn to make next.

Tip: 3-5 credit cards are a good number of cards to have.

You can alternate which cards you request a credit limit increase on if you have three or more credit cards, so you’re not requesting credit limit increases too often on the same card.

Staying debt-free on credit cards and getting an increase in your credit limit will GUARANTEE THAT YOUR SCORE GOES UP! EVERY TIME! Simultaneously, make sure to have other types of debt you’re also paying on, including an installment loan, car, and mortgage payment.

Sign up for some credit monitoring service like CreditKarma.com or FreeCreditReport.com, and you will get alerts as your score goes up, seeing these practices work.

Credit Hack #3: Piggyback off a Family Member’s Credit

If you have no credit or bad credit, you may need to get a secured credit card to prove your worthiness to the banks.

Or use this next trick that is GUARANTEED to raise your credit score.

Our CEO at Golden Financial Services, Paul Paquin, used the piggyback credit hack himself. He used this hack to help transform his bad credit to excellent credit when he was in his early twenties.

CLICK HERE to learn how to do the #1 Rated “Piggyback Credit Hack” (step-by-step instructions)

Credit Tip #4: The Power of Autopay:

Set up autopay to ensure you are never late on credit card payments. You can set it up to automatically pay the balance off in full every month.

Setting up autopay guarantees you will never be late on credit card payments. Being late on credit card payments is a guaranteed way to ruin your credit! If you can’t afford to pay your credit cards, learn debt relief options to help you get out of debt without paying.

Final Bonus Tips to Follow When Trying to Boost Credit Scores

Get credit cards –

- with no annual fees

- cards that pay attractive cashback or reward points

About the author:

Concepcion Gutierrez is an experienced credit counselor and a debt relief industry-leading expert. Over the past two decades, she worked on all sides of financial debt solutions, from debt settlement to consumer credit counseling. Gutierrez has assisted thousands of consumers over the years in becoming debt-free. She currently supervises her team of debt counselors at Golden Financial Services working on the frontline in assisting consumers with credit and debt problems. Click here to read more about Concepcion Gutierrez and her credit counseling experience.

Wow great post on credit. I have been searching all day long for some reliable information to help increase my credit score. I will start following these tips right away, thank you very much.

Yes, very helpful information. My credit is shot so this information will certainly help me out. I will print this out and post it on my refrigerator. thanks.