Is your goal to generate income and growth? Dividend growth stocks can help you accomplish precisely that.

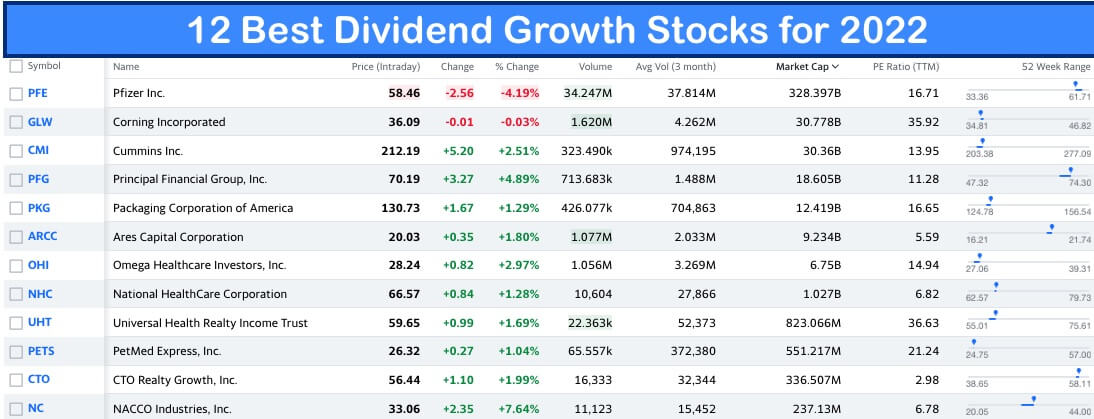

The following Yahoo Finance “Stock Screen” that Golden Financial Services created illustrates the twelve best dividend growth stocks for 2022.

Dividend growth stocks offer multiple benefits, including:

- companies that are growing their earnings and dividends

- an income stream that will keep growing in the future

- potentially provide growth in value and income

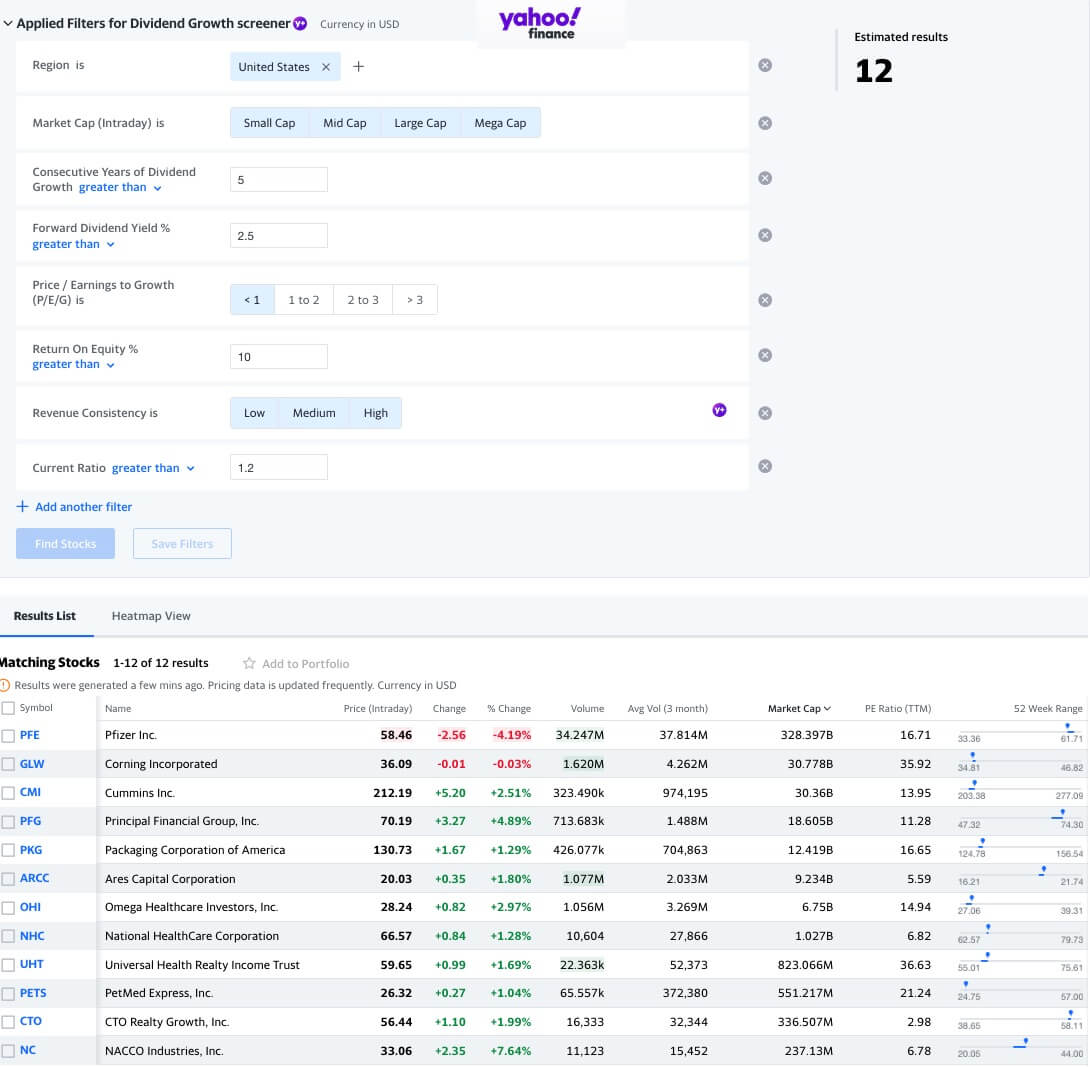

The Factors used to select the following 12 dividend growth stocks

- Market Cap (all sizes)

- Consecutive years of dividend growth (at least 5)

- The dividend yield (greater than 2.5%)

- The Price / Earnings to Growth, also known as the PEG ratio (Less Than 1)

- Return on Equity (above 10)

- Revenue Consistency (must have consistent revenue growth)

- Current ratio (above 1.2)

12 Best Dividend Growth Stocks to Consider for 2022

- Pfizer (PFE)

- Corning Incorporated (GLW)

- Cummins Inc. (CMI)

- Principal Financial Group, Inc. (PFG)

- Packaging Corporation of America (PKG)

- Ares Capital Corporation (ARCC)

- Omega Healthcare Investors, Inc. (OHI)

- National Healthcare Corporation (NHC)

- Universal Health Realty Income Trust (UHT)

- PetMed Express, Inc. (PETS)

- CTO Realty Growth, Inc (CTO)

- NACCO Industries, Inc. (NC)

How to invest in dividend growth stocks if you’re uncomfortable picking individual stocks?

Consider investing in a low-cost dividend growth index fund.

One of my favorite dividend growth stock index funds is the Vanguard Dividend Growth Fund (VDIGX).

This fund provides a growing stream of income and long-term capital appreciation.

Related blog posts that you may want to read next

How to Earn $50K Per Year Off Dividend Income (16 Best Dividend Stocks)

One Up On Wall Street by Peter Lynch (Book Summary)

Common Stocks and Uncommon Profits Book Summary and PDF

Who is Golden Financial Services?

At Golden Financial Services, we help consumers get out of debt. In many cases, monthly payments can get reduced significantly with debt relief programs. As a result, consumers can become debt-free within three to four years on average.

So people often come to us asking, “What should I do with the extra money, now that I’m debt-free?” Although our company is not a licensed financial advisory firm, we extensively study all aspects of finance, including investing, credit repair, and debt relief.

Is your goal to invest in income-paying stocks?

Well, that’s a great goal to have. However, before you can earn 10%-20% off your $10,000 investment, you’ll need to pay off that $20,000 of credit card debt that’s carrying a 25% interest rate. Otherwise, you’ll pay more in interest than you earn on income-paying stocks, defeating the entire purpose of investing.

If you have high-interest debt, clear your balances before investing in stocks.

It’s possible to transform your financial health from bad credit and high debt to excellent credit and debt-free. No matter what your situation looks like today, you can achieve financial freedom.

Check out these articles to help you pay off debt and achieve financial freedom:

Financial Freedom: Learn How to Achieve Financial Freedom step-by-step

The 10 Best Ways to Clear Credit Card Debt (Free Guide).

To learn about credit card relief programs, visit this page next.

Let’s examine each factor used to select the twelve best dividend-paying stocks in the screener above.

Market Capitalization

Market Cap allows investors to understand the relative size of a company.

Smaller companies tend to offer more growth but are riskier investments.

Like Verizon and Coca-Cola, Larger companies tend to provide safety and a high dividend.

When designing your portfolio of income paying dividend growth stocks choose a mixture of small, mid, and large-cap companies. The stock screener we used above includes companies of all sizes.

Consecutive years of dividend growth

These top dividend-paying stocks all meet the criteria of raising their dividends for at least five consecutive years. And that means these companies have increased their dividend even after COVID-19.

Forward Dividend Yield

All twelve of the best dividend growth stock picks provided in this blog post have at least a dividend yield of 2.5%.

According to Dividend.com, “The S&P 500′s average dividend yield is approximately 2.00%.”

Price / Earnings to Growth (PEG ratio)

The PEG (price/earnings/growth) ratio can illustrate whether a company’s five-year earnings growth rate is higher than its price/earnings ratio. If the PEG ratio is below one, the growth rate is higher than the price-to-earnings ratio.

The following dividend growth stocks all meet the criteria of having a PEG ratio of less than one, one of Peter Lynch’s favorite characteristics he looks for when buying a stock. A PEG ratio of less than one can illustrate an undervalued company.

Stocks with a PEG ratio of less than one likely will provide attractive growth to an investor. If you can find a dividend growth stock with a PEG ratio of less than one, this type of investment could benefit you in multiple ways, including growth and income.

Return on Equity

Stocks that perform best have a high return on equity. A high return on equity often correlates with a stock that rises in value. Why do you think that is?

Return on equity is a measure of profitability. So a high return on equity illustrates that a company is very profitable. And remember, as earnings continue to rise, the stock price should follow that trend.

For example:

- Apple (AAPL) stock has a return on equity of 147%

- Google’s (GOOGL) return on equity is above 30%

- Amazon’s (AMZN) return on equity is above 25%

- Nvidia’s (NVDA) return on equity is above 41%

These are a few of the best-performing stocks over the last five years.

The twelve best dividend growth stocks provided above all have a return on equity above ten.

Highlights include:

- Pfizer’s (PFE) return on equity is 27.75%.

- Cummins (CMI) has a return on equity of 25.78%.

- Packaging Corporation of America (PKG) has a return on equity of 21.96%.

Revenue Consistency

A stock’s price will typically follow the trend of its earnings and revenue. So, for example, if a company continues to grow its earnings and revenue, the stock price will likely rise.

The twelve dividend growth stocks mentioned in this post have at least consistent revenue growth.

Current Ratio

“The current ratio is a liquidity ratio that measures whether a firm has enough resources to meet its short-term obligations.” Wikipedia

This ratio measures the short-term debt that needs to get paid within the next year versus the cash expected to come in.

“Current assets would include cash, cash equivalents, accounts receivable, stock inventory, marketable securities, pre-paid liabilities, and other liquid assets.” Investopedia

Current liabilities measure debts that need to get paid in the next twelve months.

It’s healthy for a company to have more cash coming in over the next year than its monthly payments owed on debts.

Pretend you’re a stock:

Let’s suppose you’re earning 10% off a stock’s dividend yield, but you’re also paying 25% in interest on the same amount of credit card debt. And you have no savings. Would you want to invest in yourself if you were a stock?

Warren Buffet likes companies with a current ratio of at least 1.5%.

Final tips to consider when investing in stocks

- Consider a company’s long-term debt. High debt can result in reduced earnings in the future as interest rates rise. High debt can also result in a company filing for bankruptcy and investors losing all of their money. Check a company’s debt/equity ratio. The lower, the better.

- Consider Rule 72. The Rule of 72 is a method to figure out how long an investment will take to double, given a fixed annual rate of interest. By dividing 72 by the annual rate of return, investors can get an estimate of how many years it will take for their initial investment to double. For example: If you earn 9%, you’ll double your money in eight years (72/9=8 years). If you earn 8%, it takes nine years to double your money (8*9=72). You can quickly figure out the other if you know the one figure, rate, or time. So the key is, leave your money in stocks that allow you to compound your growth year over year, and the longer you leave your money, the more it will grow and continue to double. If you hold your investment in an index fund that earns 9% annually (on average), after 24 years, your money will have doubled three times.

- Nobody can time the market, so using dollar-cost averaging (consistently investing the same amount regularly) is critical. You should be investing and saving money every single week. And when the market turns down by 10% or more, that’s when you could invest extra. Whatever your portfolio consists of, the key is consistently saving money and investing every week. Ignore the day-to-day market fluctuations unless you’re using these fluctuations to take advantage of investing more on down days.

- Do you want to invest in income-paying stocks? Make sure to consider your age and tax rate. If you’re young and in a high tax bracket, you may want to invest more in small-cap stocks and tax-exempt bonds to avoid having to pay any taxes on your investments. When you invest in small-cap stocks, you only have to pay taxes on the capital gains when you sell. On the other hand, if you’re getting ready to retire and your goal is to generate the most income, invest in dividend-paying stocks and high-yield bonds.

Disclosure:

Golden Financial Services does not hold itself out as providing any legal, financial planning, insurance, investment, or other professional advice. Nothing contained in this blog post should be construed as an offer to sell, a solicitation to purchase, or any recommendation or endorsement regarding any investment, policy, or product.

Also, Golden Financial Services does not offer any advice regarding the nature, potential value, or suitability of any particular investment, security, or investment strategy. Therefore, the method, investments, and services mentioned in this blog post may not suit you. If you have any doubts, you should contact an independent financial advisor.

You should consult with an independent professional before initiating any investment strategy.

You alone are responsible for making financial decisions appropriate for you based on your situation and personal financial goals. If you have a question about any dividend growth stocks mentioned in this post, please submit your question in the comments section below.