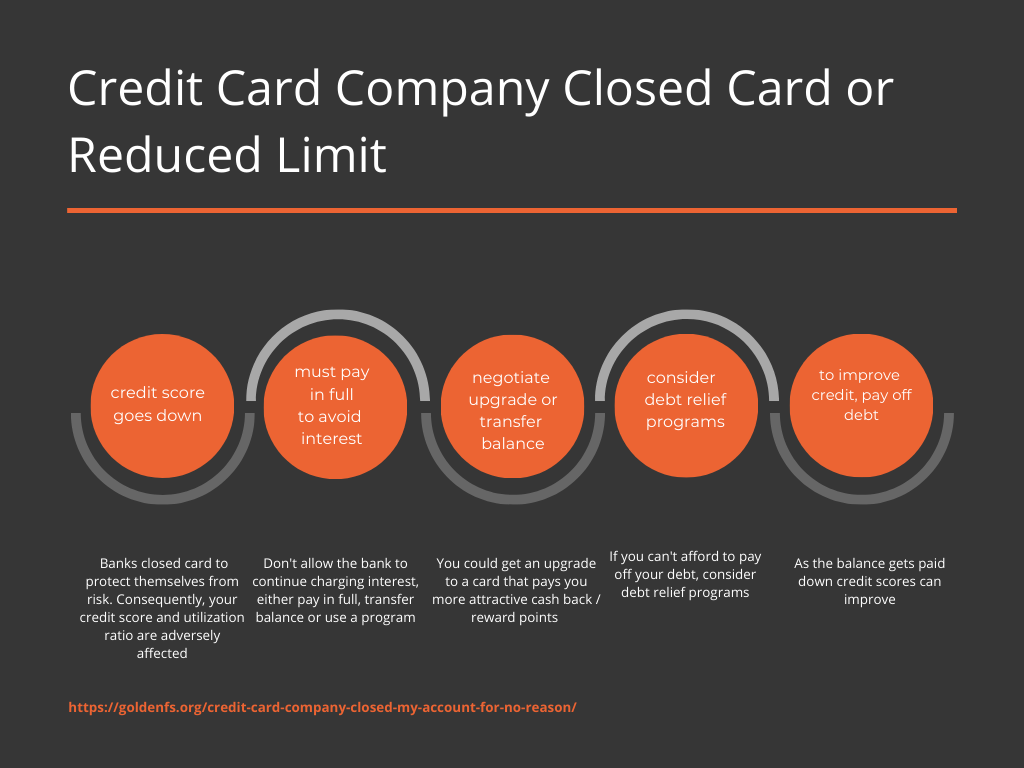

Did a credit card company/issuer close your credit card or lower the limit for no reason? What a big slap in the face! Credit scores drop after a credit card company closes your credit card because your credit utilization ratio is negatively affected. The following post will explain why a credit card company would close someone’s account for no reason, the consequences of this action, and solutions.

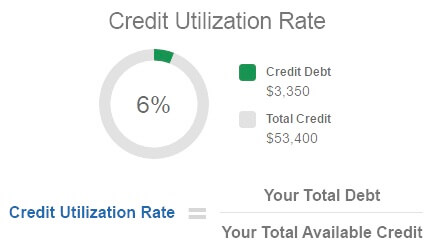

What is the “credit utilization ratio”? Your credit utilization ratio makes up 30% of your credit score, according to Experian. The credit utilization ratio is the amount of credit you have available on a credit card. Below are more tips on how to improve credit scores or visit this page next.

Example:

- Card Limit: $53,400

- Total Balance: $3,350

- Credit Utilization Ratio: 6%

So-called “Credit Experts” that work for credit card issuers and banks will say; you want to keep your debt under 30% of your limit. Still, at Golden Financial Services, we believe that the better advice is to pay your balance in full every month to avoid 100% of interest.

Similarly, when a credit card issuer lowers your limit, or even worse, closes your card out, that’s a drastic hit on your credit utilization ratio, especially when they close out your credit card for NO REASON!

Why does a credit card issuer lower someone’s limit or close out their card?

A credit card issuer will lower a person’s limit or close out a card entirely to protect themselves from risk. Creditors are afraid that they won’t get paid back the money consumers borrow, due to consumers’ incomes getting reduced due to COVID-19. Consequently, your credit card issuer may have recently closed your card or reduced the limit.

You’re Not Alone, Check Out These Statistics:

Millions of consumers are complaining about this happening.

- 1 in 5 cardholders saw a limit decrease of at least $5,000, since March 2020.

- 2 in 5 cardholders with annual incomes of more than $100,000, were the most likely to have their credit limit cut.

- 4 in 9 young millennials, currently between 24 and 31, had a card closed, while 5 in 9 had their credit limit reduced.

“We know an awful lot of millennials got very enthusiastic about credit card rewards over the last few years,” said Matt Schulz, Chief Industry Analyst at CompareCards.com. “So, they may have a few cards in their wallet that they haven’t used in a while.”

Can credit card companies close your account due to inactivity?

Has a credit card issuer closed one of your accounts that you have not used in a while?

Unfortunately, yes, credit card issuers can close your card due to inactivity. For that reason, make sure to use your credit cards at least once per month, even if it’s for only small purchases.

As I always tell my wife, “if you’re going to use your credit cards, make sure to pay off whatever you buy within two weeks after you buy it. I pay my credit cards in full twice per month, not just once. The more you can pay off credit cards in full, the more positive credit history you will be able to build on your credit report. Positive payment history equals higher credit scores!

Can card companies lower my limit for not making sizeable purchases ever?

Occasionally, charge a big purchase on your credit card, but make sure to pay the entire debt in full that month. Otherwise, that purchase will cost you more than what the price tag said it would cost due to the credit card interest you’ll end up paying if letting the balance carry over to the next month.

What to do if the credit card company closed your account or reduced the limit for no reason?

Do you want to keep that credit card account?

If you want the credit card to remain open, call your creditor. Explain how you feel and ask the card issuers what they will do to make it up. Will they offer you an upgraded card with a lower interest rate? Will they offer you a new card that pays better cashback and reward points?

Let the card issuers know that if they don’t work with you, that you will be transferring the balance to one of your other cards and closing their card out entirely. If the account gets closed out and you transfer the entire balance to another card, the creditor will not receive compensation from that point on. By moving the balance or even paying it in full right away, that will block the credit card issuer off from earning any additional money from you in interest. So that’s your way to slap them right back!

The Card Issuer Closed My Account:

If your credit cards were closed, pay them off immediately (in full) to avoid paying interest charges and improve your credit score. If you have multiple credit cards that need to get paid off, check out The 10 Best Ways to Get Rid of High Credit Debts.

Are you struggling to pay off the credit card balance, due to reduced income?

There are multiple debt relief programs available in 2020 to help with medical bills, credit cards, unsecured loans, repossessions, and more.

Before joining a debt relief program, speak with an experienced debt counselor. The counselor can get you a free credit report and review your credit history together with you. By reviewing your credit report a debt counselor can easily figure out what your best debt relief options are. The counselor can then go over all of your options and help you find the right path to achieving your financial goals.

Call (866) 376-9846 for a Free Consultation and Free Credit Report Today!

To qualify for a debt relief program an individual must have over $7,500 in credit card balances.

Is your credit account closed? You can settle credit card debt for much less than the full balance owed. With debt settlement, credit accounts will get closed and credit reports can be negatively affected. It is essential to understand the pros and cons of each program before deciding to join. Here’s a full rundown of each credit card relief program, which includes pros and cons.

A less expensive option than debt settlement is a debt validation program to dispute closed accounts after they get written off and sold to third-party collection agencies. You can dispute credit card debt, similar to how someone would fight a speeding ticket and get it dismissed. There are many benefits with a debt validation program over debt settlement.

Lastly, you can consolidate credit card debt with consumer credit counseling programs, reducing the interest rates on accounts. Closed credit cards can also be entered into this type of plan. Of a matter of fact, if your accounts were not closed, accounts will get closed after joining a consumer credit counseling program. If you don’t want your account closed, don’t include that account in a debt relief program, that’s the bottom line.

Tips on How to boost your credit score

For a complete rundown of each credit card relief program, visit this page next.

source:

https://money.yahoo.com/banks-close-credit-cards-and-slash-credit-limits-amid-the-pandemic-survey-finds-170739834.html