High credit card debt, unpaid taxes, fraudulent financial advisors, gambling debts, drug addiction; are just a few examples of what can cause rich celebrities to become broke celebrities. Celebrities can go up fast in fortune but can go down even faster if their finances are poorly managed, due to lack of financial education or if addictions come in the way. In fact, not just celebrities, but anyone can fall victim to debt and go from being wealthy to broke if they are not meticulous about how they manage their finances. If we can learn anything from the following top seven celebrities who went broke, it’s that financial disasters are never too far away. Some sound financial tips will be included with this post. The advice won’t help the following seven celebrities that went broke but could help you.

From their Hugo Boss handbags and Armani wardrobes to their brand new Ferraris, celebrities like to roll in style. Even if it’s only to take out their credit card to pay for an Elida Natural Geisha 803 coffee (a $100 cup of coffee), celebrities want to show off their American Express “Black Card.” Just because celebs bring in cash like an ATM doesn’t mean they know how to manage it, which is why so many of the rich and famous have filed for bankruptcy and turned to credit card debt relief programs.

The fact of the matter is, this American Express black card that so many celebrities carry has the most expensive annual fee out of any credit card. So, why would anyone want this expensive credit card? Celebs often want it because of the stigma this card carries, that only the rich and famous can have it. Out of all the celebrities who went broke, the following blog post illustrates the ones with the highest amount of unsecured debt, including credit cards, student loans, and medical debt.

Anyone can get in over their head with bills that they can’t afford to pay if they don’t properly evaluate whether or not they can afford something before taking out their wallet to pay for it. Everyone should ask this question, “Do I have the money to pay this bill in full after it arrives (that same month)?”.

Rick Sorrentino, a Financial Counselor at Golden Financial Services, explains, “When it comes to using a credit card, you have to ask yourself…Is it something you want or something you need? Never buy something you want if you can’t pay the balance that month. If it’s something you need, you have to ascertain how badly you need it & make a wise decision if it’s worth carrying a balance…”

Without further ado, here are your Top 7 Celebrities Who Went Broke for 2021.

7 Broke Celebrities

1. Miles Teller Owed Over $100,000 in Student Loan Debt

From this list, this first actor owes the most student loan debt, equalling over $100,000 worth.

Miles Teller was once voted “hottest male actor” alive!

Unfortunately, Teller put more time into his looks, over learning about good financial habits.

Not all famous people are in debt for buying tigers, luxury cars, and mansions on the ocean. Instead, Teller took out over $100,000 in student loans to study acting at New York University.

Although Teller started his acting career in his senior year in college and was making money before he graduated college, he still couldn’t afford to pay off his high-interest student loans.

Student loans are easy to manage if you understand how the federal debt relief programs work. These programs include loan forgiveness and payment plans that can offer a monthly payment as low as zero dollars per month.

2. Gary Busey Owed $500K+ in Unsecured Debts

Gary Busey had a 45-year-long career in Hollywood, acting in more than seventy movies. While on his path to success as an actor, he also racked up more debt than he could handle.

A large portion of his debt was due to medical bills.

In 1988, Busey crashed on his motorcycle. He wasn’t wearing a helmet and almost died, suffering severe head trauma.

In 1995, Busey overdosed on cocaine leading to another visit to the emergency room and more medical debt.

Among others, these accidents contribute to Busey’s $500,000+ in unsecured debt, including bank loans and medical debt.

How did Busey deal with all this debt?

Busey ended up filing for Chapter 7 bankruptcy to wipe away his debts.

This was a poor financial decision because Busey ruined his credit score by filing for bankruptcy. After filing for bankruptcy, expect your credit score to drop by around 175 points.

If Busey only knew about debt relief programs, he could have avoided bankruptcy. In Busey’s case, he could have easily resolved these unsecured debts with a debt settlement or validation program or using the debt snowball method.

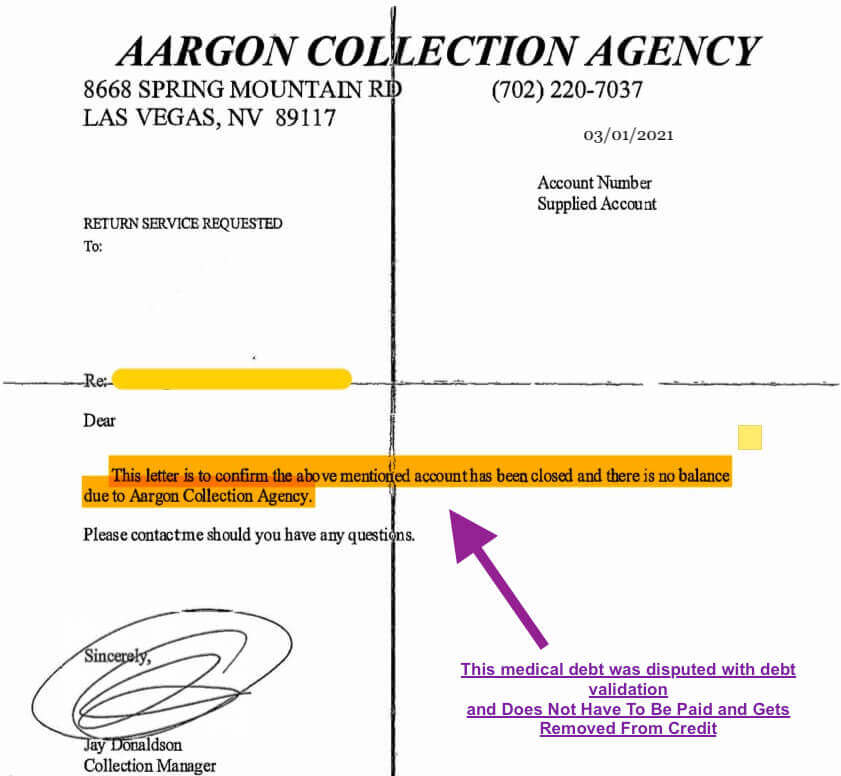

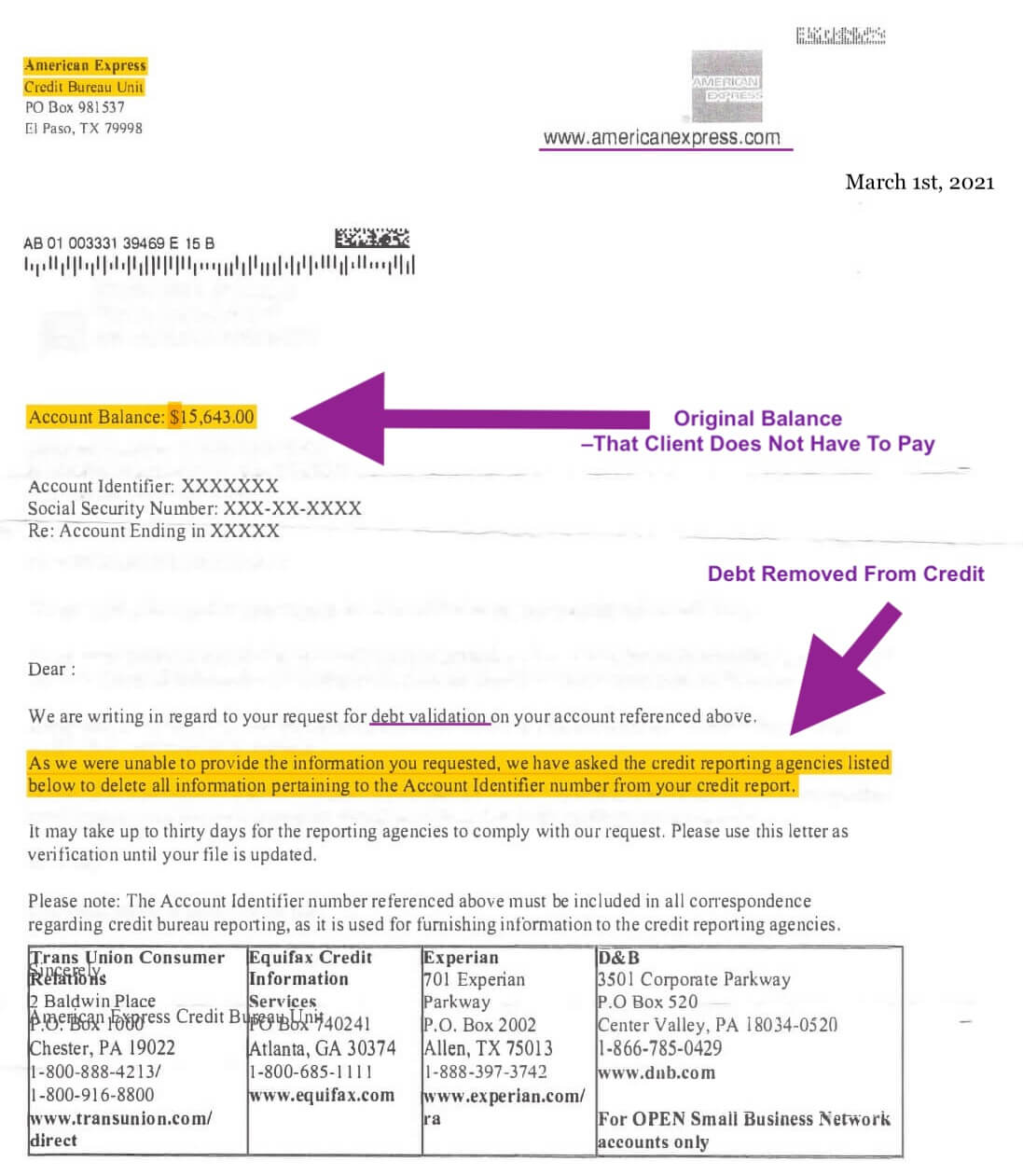

Medical debt relief programs can reduce a person’s debt by 60% before debt relief company fees, making the debt affordable to pay. In many cases, debt validation can save a person even more money by disputing the debt and often becoming legally uncollectible. It doesn’t have to get paid and can no longer remain on credit reports.

Here is an example of how debt validation can resolve a medical debt collection account. This person ended up not having to pay this medical debt because the creditor could not prove it was valid.

3. David Cassidy Owed $350K+ in Credit Card Debt

It’s hard to imagine how someone can rack up all this credit card debt. Still, when you consistently remain current on payments over many years, have a decent income to show creditors, and are using almost all your available credit every month, banks will usually offer you more credit. Banks have no problem with allowing you to rack up more debt if you continue making that minimum payment each month because that’s more profit for them.

David Cassidy sold more than 30 million records. Unfortunately, while releasing all those records, he was simultaneously using his credit cards daily. Instead of paying his credit card bills in full each month, like he could have probably afforded to do, he decided to pay minimum payments, and some months not pay anything. Eventually, the famous David Cassidy racked up over $350,000 in credit card debt between late fees and interest and could no longer afford minimum payments.

Altogether, Cassidy owed the following credit card debt.

- $290,000 to Wells Fargo

- $21,000 to American Express

- $17,000 to Citibank

More debt accumulated as Cassidy received three DUIs between 2010 and 2014, turning his financial situation upside down. His wife then divorced him after his third arrest, leading to attorney fees that Cassidy could not afford to pay. Sadly, the former Partridge Family singer passed away last year from organ failure (67).

He denied having any financial issues less than a year before his death.

Credit card debt can get disputed on a debt validation program and proven to be legally uncollectible in many cases.

Example of an American Express Credit Card Debt That Was Proven to be Invalid & No Longer Needed to be Paid:

4. Charlie Sheen Owes Over $300,000 in Credit Cards

While starring as the lead actor in Two and a Half Men, Charlie Sheen could comfortably afford his credit card payments, which by the way, exceeded $6,000 per month. However, since leaving “Two and a Half Men,” “Sheen’s income dropped from $613,000 a month to an estimated $87,834”, according to People.com.

After having this drastic reduction in income, Charlie found himself in a position where he could no longer afford to pay his credit card bills, mortgage, and all outstanding monthly debt payments.

As of 2018, over 21% of American’s have been late on at least one credit card payment. “In the first quarter of 2018 alone, $23 billion worth of all credit card debt in the U.S. was delinquent”, according to CNBC.

How much is a credit card late fee?

A recent article on CNBC explains, “Your first late payment fee is at most $27 but, if you continue paying late, the penalties can get as high as $38, depending on your agreement with your credit card issuer.”

Like many of us, Sheen found himself deep in debt with nowhere to turn.

Altogether, Sheen owed over fifteen million dollars in debt, including his mortgage and tax debt.

Sheen owed over $300,000 on one credit card alone, his American Express “Black Card” (the one that only “the rich and famous” and “millionaires” carry).

There’s a hefty price tag on that card to own it. Even if you don’t use it once over a year, you still owe the annual fee that’s above $500 per year. Preferably, try to find a credit card that has no annual fee.

The minimum payment on Sheen’s American Express credit card was above $6,000 per month.

The only way to deal with this amount of debt is to either pay it off in full (if you can afford to do so) or use a credit card relief program to lower the balance.

A $300,000 American Express credit card debt could get settled for around $140,000 with a debt settlement program before settlement company fees, making it more affordable to pay. Although debt settlement hurts a person’s credit score, you’ll have an easier time rebuilding your credit score after settling a debt than if you were to file for bankruptcy and have that notation on your credit report.

Looking for a credit card that pays high cash-back and reward points? Check out the Chase Sapphire card, which is the preferred option due to its high cash-back and rewards.

5. Stephen Baldwin Owed $70K+ in Credit Card Debt

Lots of people owe more than $70,000 in credit card debt. Stephen Baldwin was one of these people. For someone like Baldwin, he could have easily avoided bankruptcy and paid off this credit card debt if he only knew the best direction to take. Unfortunately, nobody ever took the time to educate Baldwin on debt relief options besides the attorney who sold him on bankruptcy (Bad Move). Most bankruptcy attornies will recommend bankruptcy ten out of ten times because that’s the product they sell and how they make a living.

Baldwin couldn’t afford to pay his credit cards, and for six years, he failed to make a mortgage payment.

In some cases, bankruptcy is a smart move, like filing for bankruptcy to save your home.

Unfortunately, Baldwin filed Chapter 11 bankruptcy. Chapter 13 is what he needed to file to save his home from foreclosure, which was the fault of the incompetent attorney he hired. So, he ended up filing for Chapter 11 bankruptcy and losing his home to foreclosure.

People often use Chapter 11 bankruptcy because it does not affect their credit, but in the case of Baldwin, he needed to file Chapter 13 to save his home from foreclosure.

With chapter 13 bankruptcy, the judge works out an affordable payment plan for the debtor to repay a portion of their debts but keep certain assets.

At the end of the day, Baldwin should consider himself lucky to have been able to stay in his multi-million-dollar home for all these years for free before it finally was foreclosed on in 2017.

6. Toni Braxton (Queen of R&B) – Owed $1,000s in Department Store Credit Card Debt

Allmand Law reports, “American R&B singer Toni Braxton has filed for bankruptcy again; the first time was in 1998. Braxton’s recent bankruptcy filing states that she has between $10 million and $50 million in debt but only has between $1 million and $10 million in assets.”

Lots of people who are in debt also have a shopping addiction. Google Analytics reports illustrate that the number one habit that GoldenFs.org’s visitors have is “shopping.”

You don’t have to be addicted to shopping at high-end stores to end up in debt. Some people are addicted to spending money at Walmart and Target and end up in just as much debt.

Toni Braxton is addicted to shopping at high-end stores and living an extravagant lifestyle. According to bankruptcy filing reports, most of Braxton’s credit card debt came from department store cards, like Tiffany & Co. and Neiman Marcus.

Additionally, Braxton used credit cards to pay for cosmetic surgeries, The Four Seasons Hotel, and medical bills.

Braxton spent over $2.5 million on clothing and cosmetics in under two years, not counting the purchase of her new Porsche.

7. Michael Jackson

When Michael Jackson passed away, he allegedly owed 400 million in debt. Selling more than 61 million albums in the U.S. didn’t stop the singer from borrowing, spending huge sums of money over his career.

Shortly before his death, Jackson announced a tour to use the proceeds to pay his way out of all this debt, but unfortunately, that never happened.

The True Cost of Credit Card Interest

Interest is a trap.

That trap does not discriminate.

Let’s look at an example of how credit card debt can be a trap.

Let’s suppose you charged $20,000 on your credit cards to purchase school supplies.

When paying minimum payments on $20,000 in credit card debt with an average interest rate of 25%, you end up paying around $480 per month.

At $480 per month, it would take you eight years and three months to pay this debt off in full.

In total, you would pay $47,149, including all the balance and interest. You would end up paying your debt back not once but twice, plus handing over an additional $7,149 on top of that.

Someone loans you $20,000, and now you have to pay them back $47,149. Does that seem fair? Is it even legal? Well, this is the reality of credit card debt.

Most people cannot afford to pay back their debt twice, which is why so many people end up falling behind on monthly payments.

The moral to the story:

If you spend money on a credit card, pay the balance in full every month. If you can’t afford to pay your balance in full when the bill arrives, don’t buy something! If it’s too late and you’re in over your head in debt, contact Golden Financial Services. Let one of our IAPDA Certified debt counselors help you find a plan to get out of debt and rebuild your finances.

Whether you’re a broke celebrity or have an ordinary nine-to-five job, you can get out of debt with the right solution.

Source: Golden Financial Services, Six Celebrities that Went Broke or Are Still Broke in 2019, https://goldenfs.org/six-celebrities-that-went-broke-in-2019/