What is a shopaholic person? By definition, a shopaholic means that you’re addicted to shopping. In other words, you have a compulsive shopping disorder, and it’s a severe problem. In addition, compulsive buying (CB) is a mental disorder that may require treatment.

The following blog post will help you recognize if you’re a shopaholic, credit card debt solutions get revealed, and you’ll learn how to end your shopping addiction.

Shopaholics and Credit Card Debt

Shopaholics and debt are nearly synonymous because a shopping addiction almost always turns into credit card debt. Shopaholics buy stuff on credit cards because, in many cases, they don’t have the funds to purchase the times otherwise.

And similarly, people with high debt often have the underlying condition of being a shopaholic.

When you’re a shopaholic, you have overpowering urges to buy stuff, regardless of if the outcome will be debt that you can’t afford to pay off.

Can you tell a shopaholic by how they look?

When you think about a shopaholic, you may think of a superficial woman out shopping with lots of makeup and fancy clothes, like Isla Fisher in the movie Confessions of a Shopaholic.

But the truth is, shopaholics don’t have any particular face; they can be old, young, tall, short, stocky, thin, male or female, and all of the people in between.

Even the rich and famous can be shopaholics with high debt. There is no shortage of rich and famous people that were shopaholics and ended filing for bankruptcy caused by their shopping addiction. Take a look at these six celebrities that went broke due to their overspending habits.

7 Shopaholic Symptoms: Who is a shopaholic person?

Here are questions to ask yourself to help determine if you’re a shopaholic:

- 1. After you go on your shopping binge, do you feel guilty? Shopaholics often feel intense guilt after purchases but even still cannot stop. Similarly, a drug addict that has been thirty days clean who then slips up and does drugs one night may also feel extreme guilt the next day.

- 2. Do you spend a lot of time planning, obsessing, and thinking about going shopping? Maybe, you’re up late at night obsessing over going shopping the next day. Every chance you get, you’re on the iPhone browsing your favorite stores. Or possibly, you ran out of money, so you’re scheming over how you’ll find the cash to go on a shopping binge. “In World Psychiatry, Donald Black outlines four phases of compulsive buying disorder: anticipation, preparation, shopping, and spending. During the first phase, anticipation, a person becomes preoccupied with a soon-to-be-made purchase or the idea of going shopping.”

- 3. Do you find yourself buying stuff that you don’t need? For example, maybe you have a sneaker addiction. Most people may need 2-3 pairs of shoes per year at the maximum. Perhaps you need a new pair of running shoes and dress shoes for work every year. But if you’re buying 5-20 or more pairs of sneakers/shoes per year, this is shopaholic type behavior. Ask yourself the next time you’re about to purchase items whether it’s something you need. And it doesn’t matter if you buy cheap stuff or expensive items. Just because you only buy cheap stuff at Target doesn’t mean you don’t have a money problem because cheap stuff adds up too.

- 4. Is shopping interfering with your life, including family time or employment? Shopaholics will find themselves missing work because of their shopping addiction or not spending time with their family because they’re too busy shopping.

- 5. Do you buy items on credit cards that you can’t afford to pay off in full that same month? If you have credit card debt that you can’t afford to pay off in full that same month, that can be a sign that you have a shopping addiction. Carrying credit card balances costs you money in interest every month. Therefore, your balances should get cleared in full every month.

- 6. Do you hide purchases from your spouse? For example, you go shopping but keep the stuff you bought in your trunk to avoid your spouse seeing the items. Again, this is a sign of a problem.

- 7. Do you already have debt problems resulting from your shopping addiction? (e.g., bouncing checks, paying late fees, can’t afford monthly payments on credit cards, creditors calling and harassing you)

Here are a few more personality traits to consider when evaluating whether you have a shopping addiction.

What is the mindset of a shopaholic? (Personality traits)

- Kindhearted, never rude, and sympathetic (e.g., quickly sold by a store’s salesperson and seeking relationships)

- Low self-esteem (putting on new clothes makes you feel better)

- Depressed (shopping can mask your depression)

- Poor impulse control (what you see, you need to get)

- Materialistic (always trying to impress others by wearing the hottest clothes and driving a fancy car)

- Image spenders (those that love flashy items)

- Bargain hunters (always searching for the next deal)

- Codependent spender (feeling that you need to buy others stuff to win their love, loyalty, and friendship)

A Total Life Transformation

To address your shopping addiction and debt problem requires a complete life transformation.

Your way of living must change today.

And the good news is, it’s not too late.

- Create a budget and stick to it

- Credit card debt solutions can eliminate your high bills

- Follow the solutions explained below step-by-step and you can take control of your shopping addiction

By gradually changing your lifestyle one day at a time, you can maintain sobriety from your shopping addiction.

You can have excellent credit again.

You can eventually build wealth.

The Solution for Shopaholics – Starts with small steps.

Have you ever walked into a store to buy something, and you ended up buying more than what you went there for in the first place?

We’ve all experienced that at least once in our life. But controlling these urges is the difference between a financially savvy individual versus a shopaholic.

Like with all addictions, recognize you have a problem.

This seems like a small step, but it’s a huge step. Insight and understanding are crucial to recovery.

So congratulations, you’re on your way to recovery. Just reading this blog post shows you’re working towards better understanding your problem and seeking solutions.

Debt-Free Shopaholics

Another step that you need to take is to become debt-free. Shopaholics can’t truly get past their shopping addiction until they are debt-free. That’s part of your total life transformation.

Pay off your credit card debt in full.

You can use credit card relief programs or the debt snowball method.

And if that’s not enough debt relief options for you, check out the ten best ways to clear credit card debt as of 2022, according to industry experts.

Do you owe above $7,500 in unsecured debt?

If you owe above $7,500 in unsecured debt, including credit cards, medical bills, unsecured loans, or collection accounts – Get a Free Consultation with a Debt Counselor at (866) 376-9846.

Your debt needs to get paid in full. By doing so, your mindset begins to change.

Set goals.

Without goals in place, where are you heading? Goals eliminate your path from leading into a dead-end, or even worse a complete 360-degree turn.

How much money do you want to have in the next ten years? And how much money do you want to have in the next twenty years? To achieve these goals, how much will be required for you to start saving today. And how much does your savings need to earn for you to achieve your savings goals in 10-20 years.

Earning only 8% on your savings results in doubling your money in 9 years. Check out this guide on how to achieve financial freedom, by Paul Paquin.

Change your unhealthy addiction, into a healthy addiction.

Shift your addiction from overspending and shopping to saving and growing your money.

An unhealthy addiction can turn into a healthy addiction, and that’s a key to transforming your lifestyle.

Next step: Start Saving

After your debt is gone, it’s time to start accumulating wealth.

Set up a Roth or Traditional IRA as your retirement account.

Invest money into your retirement account every single week, maxing it out every year. $105 invested in a Roth IRA every week starting at age 19 and earning 6% annually, makes you a millionaire by age 60.

If you’re over fifty years old and don’t have a Roth or Traditional IRA, maximum contributions can amount to $7,000 per year, including catch-up contributions. If you’re under fifty and married, you can invest up to $6,000 per year in a Roth or Traditional IRA.

You will transform your unhealthy shopping addiction into a healthy savings plan. Check out The Total Money Makeover Summary

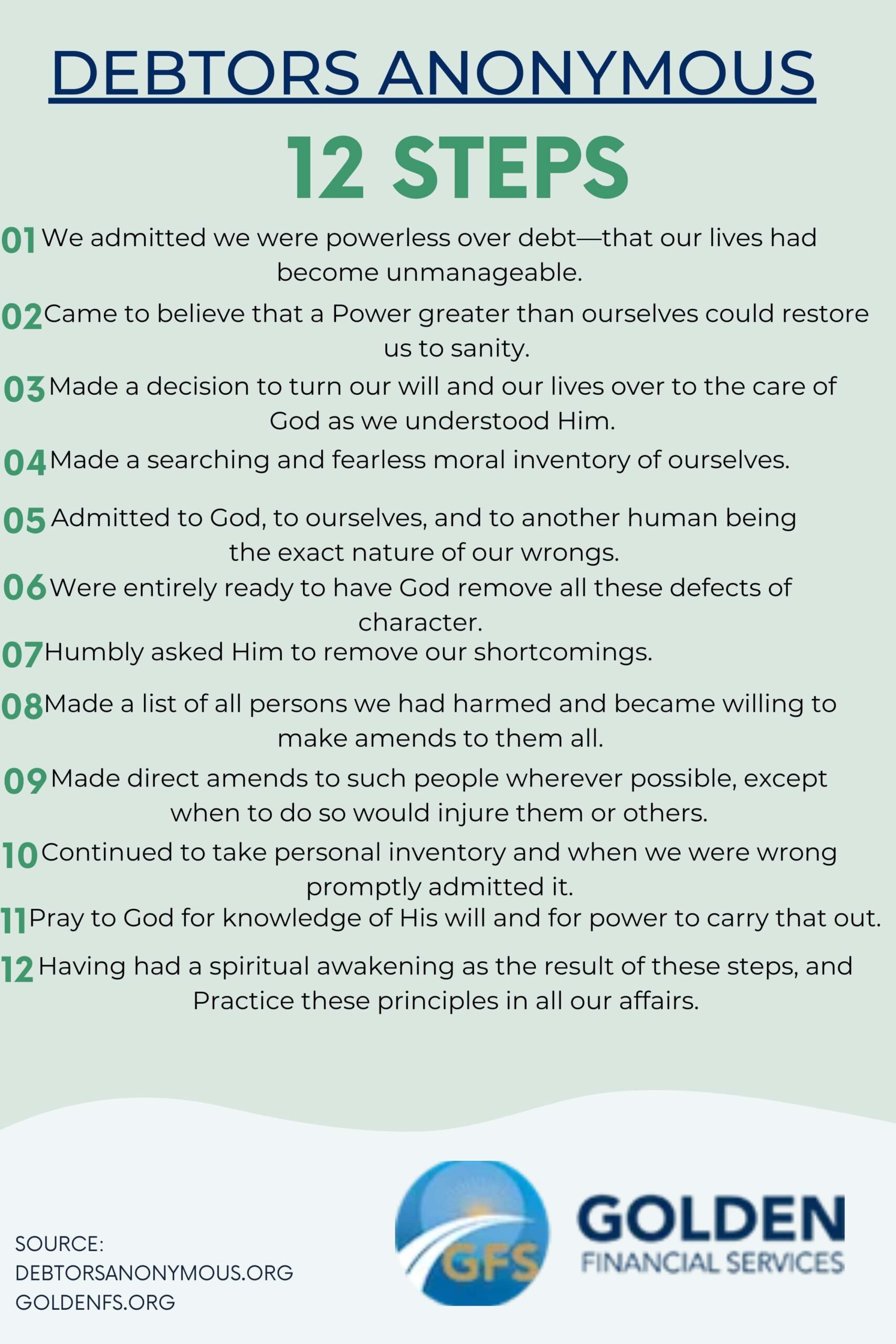

Attend Debtors Anonymous Meetings

Shopaholics must attend weekly meetings with a counselor or through Debtors Anonymous.

Subscribe to Golden Financial’s debt blog at GoldenFs.org/Debt-Relief-Blog/.

The Devastating Consequences of Shopping Addiction

What’s realistic about the movie, Confessions of a Shopaholic, is that Rebecca Bloomwood (Isla Fisher), a true shopaholic, shops so much that she is drowning in debt.

Likewise, at Golden Financial Services, millions of clients need a debt relief program to help deal with high credit card balances that they incurred from shopping, medical debt, and financial hardships (like COVID-19).

With any addiction, unhealthy compulsive behaviors can land you in serious problems. Just like with candy and junk food, you can eat it in moderation and live a healthy life — but if junk food becomes an addiction of yours, it may kill you at an early age due to heart disease.

How to stop being a shopaholic and solutions

- Don’t go into a store without a list. And make it a rule, no matter what, you won’t buy anything that’s not on your list. That needs to be your new law.

- If you have an urge to buy something, never buy it right when you have that urge. Always wait at least one day (your cool-down period). That very next day, you may decide, “Wow, I did not need that item.” Especially if it’s time to buy a new car, take your time. Never walk into a car dealership and buy a new car that same day, no matter how attracted you are to the car salesmen or how nice that guy or gal seems to be!

- Only buy something on a credit card if you can afford to pay it off that same month. Credit cards should only be used as tools to build excellent credit. If you can’t resist charging something on a credit card when you don’t have the funds available to pay for an item, then you’ll have to cut up all your cards. So when you pull out your credit card, first ask yourself, “do I have the funds in my bank account to pay for this item today?” If you’re using your cards to buy stuff because you don’t have the funds available right then, that’s a sure-tell sign that you’re a shopaholic (excluding extreme circumstances, like if you just lost your job and need to use the credit card to purchase food).

- To cure a shopping addiction, you must start working towards becoming debt-free. As you pay off debt, you’ll continue to get more motivated because you’ll see positive results. If you can’t afford to pay at least minimum payments on credit card debt, talk to a debt counselor at Golden Financial Services for a Free Consultation at (866) 376-9846. You may also use our free debt reduction tools, including this free budget and snowball calculator. Here’s an article at Golden Financial Services that explains The 10 Best Ways to Clear High Credit Card Debt Quickly.

- Like you can attend Alcoholics Anonymous, you can also participate in Debtors Anonymous. https://debtorsanonymous.org/ Debtors Anonymous phone meetings can teach you about the 12 steps for Debtors Anonymous.

Like any other illness, shopaholics have to control their addiction throughout their life. You can do this through self-education, like reading financial and addictive-behavior-type blogs.

Get a membership at a credit monitoring service that helps you maintain a high credit score and provides you alerts on improving your credit. If you’re already deep in debt from shopping, programs are available to help you get financial freedom. Don’t be afraid to ask for help. Contact Golden Financial Services Today.

Additional Resources:

You can have weekly meetings with a counselor or participate in Debtors Anonymous at https://debtorsanonymous.org/.

Subscribe to Golden Financial’s debt blog at GoldenFs.org/Debt-Relief-Blog/.

Sources: