Author: Wesley Hendrickson

Often, a person’s biggest fear centers around their inability to maintain proper finances and reliable employment. Our goal today is to help you get rid of this unnecessary fear, for good. And never look back again!

Financial Solutions & the Path to Financial Prosperity

Inside this post, Golden Financial Services provides;

A. Steps to improve your current financial situation, financial health, and economic mindset! You don’t need to live in fear of losing your income or job.

B. Learn how to increase your current income, build wealth and save money, eliminate debt and improve your overall financial health.

Firstly, master the mental game, replace your negative thinking with positive thoughts. The mind is a powerful money making tool!

The first strategy: Visit and read top finance blogs, watch YouTube tutorial videos or take free financial related online courses to get financially educated. Learn from financial experts.

Immediately after a negative thought enters your mind, jump into learning mode. Use the negative energy to read an online course or educational blog post. This action of redirecting energy allows you to transform old harmful habits, into positive financial habits.

Convert your negative energy into positive energy fueling positive actions, such as learning new financial related subject matter while reading industry leading financial blogs.

Between all of the different financial blogs online, a person can be empowered with the capability to acquire shrewd financial guidance, ultimately improving their overall financial health. Furthermore, an individual may activate learning cells that may currently be sleeping! You don’t have to pay to get a college education, thanks to the internet. Once the material is learned, you are now equipped to take baby steps towards reaching new financial goals.

For business ideas or tips on how to improve job performance, the following blogs are a perfect starting point. You don’t always have to reinvent the wheel, just replicate what has worked for others.

Forbes (http://www.forbes.com)

Inc.com (http://www.inc.com)

Harvard Business Review (https://hbr.org/www)

Secondly, maintain your current job and use the income to increase your overall net worth. It is imperative to be proactive and take action towards financial wealth.

Want to get fit? Go to the gym regularly, in a disciplined manner, routinely and consistently, but also work out correctly. Do proper exercises and form, spread out rest periods for the appropriate number of days, group the right muscles together and get a trainer. With financial health, it requires a similar pattern.

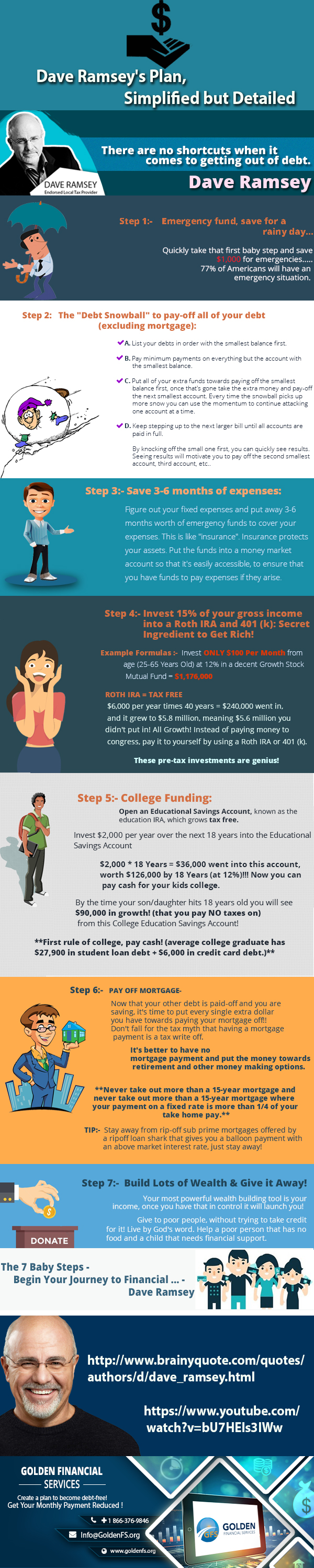

EXPERT FINANCIAL TIP: Don’t imprudently spend your entire paycheck. Take a portion of your paycheck, and designate it for tax-free investments as illustrated in the infographic below. This part of your paycheck should not even exist in your mind; it’s automatically going into investments, where you forget you even have it.

Thirdly, create additional income. You are probably thinking, this sounds easier than it is. The truth is, it’s not that hard! No place says it better than Good Financial Cents. Click here to learn “23 Passive Income Ideas You Can Start Today.“ (Implement at least “1” of these passive income ideas into your life, now!)

Fourthly, open investment accounts that earn high interest. Here are some reputable financial institutions to get you started. (Morgan Stanley, Vanguard and Merrill Lynch)

By creating an account at Morgan Stanley, Vanguard or Merrill Lynch, you can take advantage of free financial advice.

When calling any of these financial institutions, expert financial advisors can provide you with free financial insight.

A person needs to understand how to invest in a combination of stocks and bonds. There are many factors involved. For example, a sixty-year-old will want to invest in less aggressive stocks, while a 21-year-old will probably want a more aggressive portfolio. Some investors will be better off with a portfolio consisting of a higher percentage of stocks over bonds, while others may want a more conservative portfolio.

The Dave Ramsey Info-Graphic Below provides expert financial advice and investment suggestions.

The following image illustrates what Golden Financial Services’ believes are Dave Ramsey’s best financial tips. You may share this image on your website or social media; we give you permission.

Please include attribution to https://goldenfs.org/infographic/ with this graphic.

Lastly, learn about debt relief programs by Clicking Here.

If you fell into a financial hole, Golden Financial Services can pull you out. Debt relief programs are ideal for the person who’s credit has already been negatively affected, and too much debt has accumulated to pay off on your own.

Just give one of our financial wizards a call at 866-376-9846. Get Free Financial Debt Relief Program Information.

Sources:

Dave Ramsey, www.daveramsey.com

Good Financial Cents, http://www.goodfinancialcents.com/passive-income-ideas/

Golden Financial Services, https://www.GoldenFs.org

Learn About Wesley Hendrickson, the author of this post.

An expert with over 20 years in the Financial Services industry, Wes brings a background in Financial Investments, Insurance, Estate Planning & Tax processes plus Debt Relief with a unique perspective and understanding of financial issues. This comprehensive experience is most helpful when seeking to understand the issues of each client and the circumstances that they find themselves needing to resolve. Due to the industry-leading programs offered by GFS, Wes can assist customers with credit card debt, personal and private student loans, Federal Student Loans, Medical Debt and Credit Restoration. Always seeking to bring the highest level of integrity with full disclosure to each client seeking help, Wes will find the best program to meet your needs. Our programs offer the cleanest, least expensive and most comprehensive options available to get you out of debt in the least amount of time and leave you with a big sigh of relief. Wesley can be contacted for a free debt relief consultation at 866-332-3083. Wesley can pull your credit report and score, at no cost to you. Wesley is considered one of Golden Financial’s most experienced debt specialists!

Read more at https://nomorecreditcards.com/author/wesley-hendrickson/#H5qa4eVeUuOl7tJR.99

I visited multiple blogs however the audio quality for audio songs current at this website is actually fabulous.

Very good blog! Do you have any tips for aspiring

writers? I’m planning to start my own website soon but I’m a little lost

on everything. Would you suggest starting with a free platform like WordPress

or go for a paid option? There are so many options out there that I’m totally confused ..

Any suggestions? Thank you!