The number is eye-popping: Cumulative non-housing debt in the United States tallied $4 trillion at the end of the first quarter of 2019, according to the Federal Reserve Bank of New York. Of that $4 trillion, over $623 billion of it is considered past or overdue.

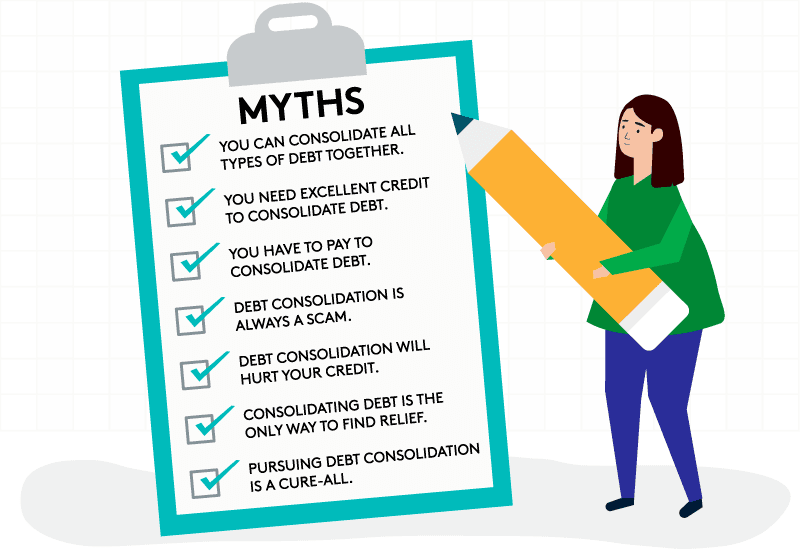

Debt consolidation by means of a personal loan or debt consolidation service is actually less daunting than you might think. While researching how to tackle high debts, you may encounter a lot of myths that sound discouraging or off-putting, but rest assured it is a tried and true way to get back on your feet. For this blog, we’ll tackle a lot of commonly asked questions and separate the myth from solid tips.

Does Debt Consolidation Hurt Credit Score?

Myth 1: Debt consolidation destroys your credit score, but clears up your credit debt.

The Real Story: Applying for a debt consolidation is considered a hard inquiry on your credit report. Hard inquiries do indeed shave a few points off your credit score. However, the tradeoff of a few points now is still vastly superior to the future damage continued debt will do to your FICO credit score. If you don’t cut debt through unnecessary expenses (we covered some tips for that here), you are likely to spiral deeper as your credit score drops in the future.

NerdWallet covers the tradeoff here with some solid financial wisdom: “…your credit may improve if consolidating means you’re better able to pay your debts on time, a factor that makes up 35% of your FICO score. ‘The short-term hit to your credit may be worth it if it allows you to stay on top of your debt repayment plan,’ says Ben Smith, a CFP and founder of Cove Financial Planning.”

Is It Good to Consolidate Debt?

Myth 2: Debt consolidation reduces your debt

The Real Story: First of all it’s important to note that debt consolidation and debt settlement are not the same thing. That said, paying off debts like student loans, credit cards, or even a mortgage with a consolidation loan won’t reduce or forgive your overall debt amount. You will still need to make your payments on time, and the total debt simply rolls into the loan you take out. You will make monthly payments toward the balance of your debt. However, you will have a more lenient pay schedule, and a solid roadmap with a definitive end game.

Here’s an excellent summary from Debt.org: “The purpose of any debt consolidation loan is to save money. In the examples mentioned above, credit score is going to play a prominent role in the interest rate you receive. If you have a lot of credit card debt, your credit score usually suffers, which means you probably will pay a high interest rate so keep that in mind as you shop around. If the interest you pay on debt consolidation loans isn’t considerably less than you were paying on your credit card bill, a debt management plan might be a better option. DMPs have agreements in place to lower interest rates regardless of credit scores.”

Also, if you happen to be in the Army, Navy, Coast Guard, and you are facing student loan debt, you might want to check in on President Trump’s new debt relief program for service members.

How Long Does Debt Consolidation Stay on Your Record?

Myth 3: A debt consolidation stays on your permanent record

The Real Story: This myth comes from the thought process along the lines of, “It takes years to build up positive credit, and only a few bad decisions to destroy it forever.” While banks and creditors operate on judgements based on years of your credit history, it doesn’t mean you have a “permanent” record.

Today.com summarizes it like this: “That you settled a debt instead of paying in full will stay on your credit report for as long as the individual accounts are reported, which is typically seven years from the date that the account was settled.”

What is the Best Debt Consolidation Company?

Myth 4: All debt consolidation companies are a scam

The Real Story: All debt consolidation companies profit most when they bring vetted clients capable of paying their consolidation loan to potential lenders. If you are still skeptical, take a moment to look up a few debt consolidation companies (like Golden Financial Services) on the Better Business Bureau’s website, where you can see their rating (GFS is an A+).

If you are a visual learner, these videos on debt consolidation should help put your mind at ease about how useful it can be.

_______________________________

If you found our blog looking for financial advice or assistance with credit card debt relief or debt consolidation, call Golden Financial Services today at (866)-376-9846 or info@goldenfs.org. You can check out the rest of our blog here, and do your research on our services here. Let’s talk soon!