What is debt settlement?

Debt settlement (AKA: negotiation, arbitration) offers a consumer the option to reduce the balance on an unsecured debt. The reduced amount must be paid in a lump sum payment.

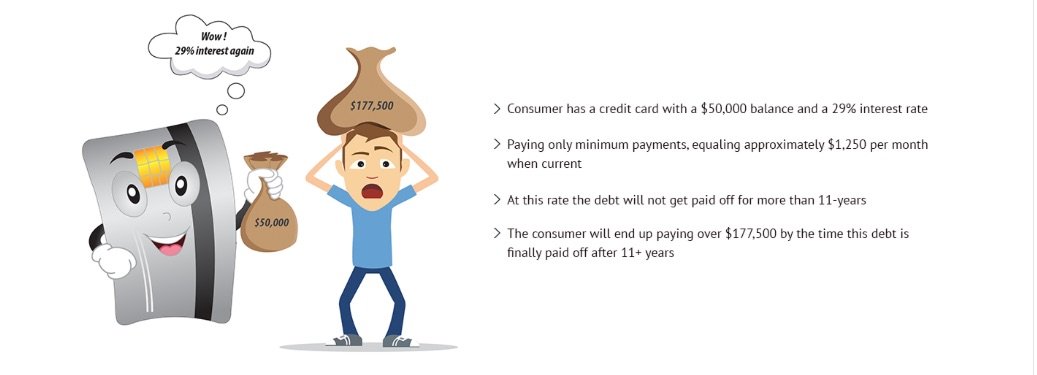

Here are two images to help explain how debt settlement works (see the before and after image).

BEFORE IMAGE: (illustrating $50K in credit card debt, with an average interest rate of 29% and a monthly payment of $1,250 per month)

AFTER DEBT SETTLEMENT IMAGE: (Illustrating How debt settlement reduced the payment from $1,250 down to $850.07 per month)

Is debt settlement the best debt relief program in 2019?

What this video, created by Paul Paquin – the CEO at Golden Financial Services – Reveals New Best Debt Relief Option!

How a Settled Debt Gets Reported to Credit Bureaus

In exchange for the lump-sum payment, the creditor considers the debt resolved and reports a zero dollar balance. On a person’s credit report a settled debt will show up as: “settled for less,” “paid,” “paid as agreed” and at times a debt will get removed entirely from a person’s credit report (best case scenario). Reputable debt settlement companies will negotiate to reduce a debt and also have it removed from a person’s credit report, but creditors don’t always agree to these terms.

Regardless of how a settled debt gets reported on a person’s credit report, in all cases, the debt is 100% resolved at the time it gets settled. And the reduced amount is completely forgiven. Debt settlement is not the same as bankruptcy. When you file for bankruptcy, the bankruptcy notation goes on your credit report, dropping your credit score by up to 200 points.

Negative Credit From Settling a Debt

With debt settlement you must be delinquent on monthly payments for it to work, so your credit score is also negatively affected after joining a debt settlement program. Late fees and collection accounts get reported on credit reports.

The good news is that you avoid having a bankruptcy on your credit report by settling your debt, minimizing the negativity at least somewhat.

Tax Consequences of Settling a Debt

Due to a portion of the debt getting forgiven, the IRS sees the amount saved when a debt gets settled for less than the full amount, as income. One of the downsides of debt settlement is that you could owe taxes on the amount saved. Any licensed account can assist a consumer who’s experiencing a financial hardship in eliminating a tax bill that resulted from debt settlement, by illustrating insolvency. Most consumers who complete a debt settlement program don’t end up paying taxes on the amount saved. A #982 tax form can resolve a tax bill received after having a debt settled.

Why do creditors agree to settle debt?

The original creditors and credit card companies will write off a debt after approximately 120-days of it being delinquent. By writing off a debt that allows the bank to get reimbursed. The bank shows the debt as a loss on their balance sheet, getting reimbursed through tax credits.

Additionally, banks sell the debt to a collection agency. More profit to the bank!

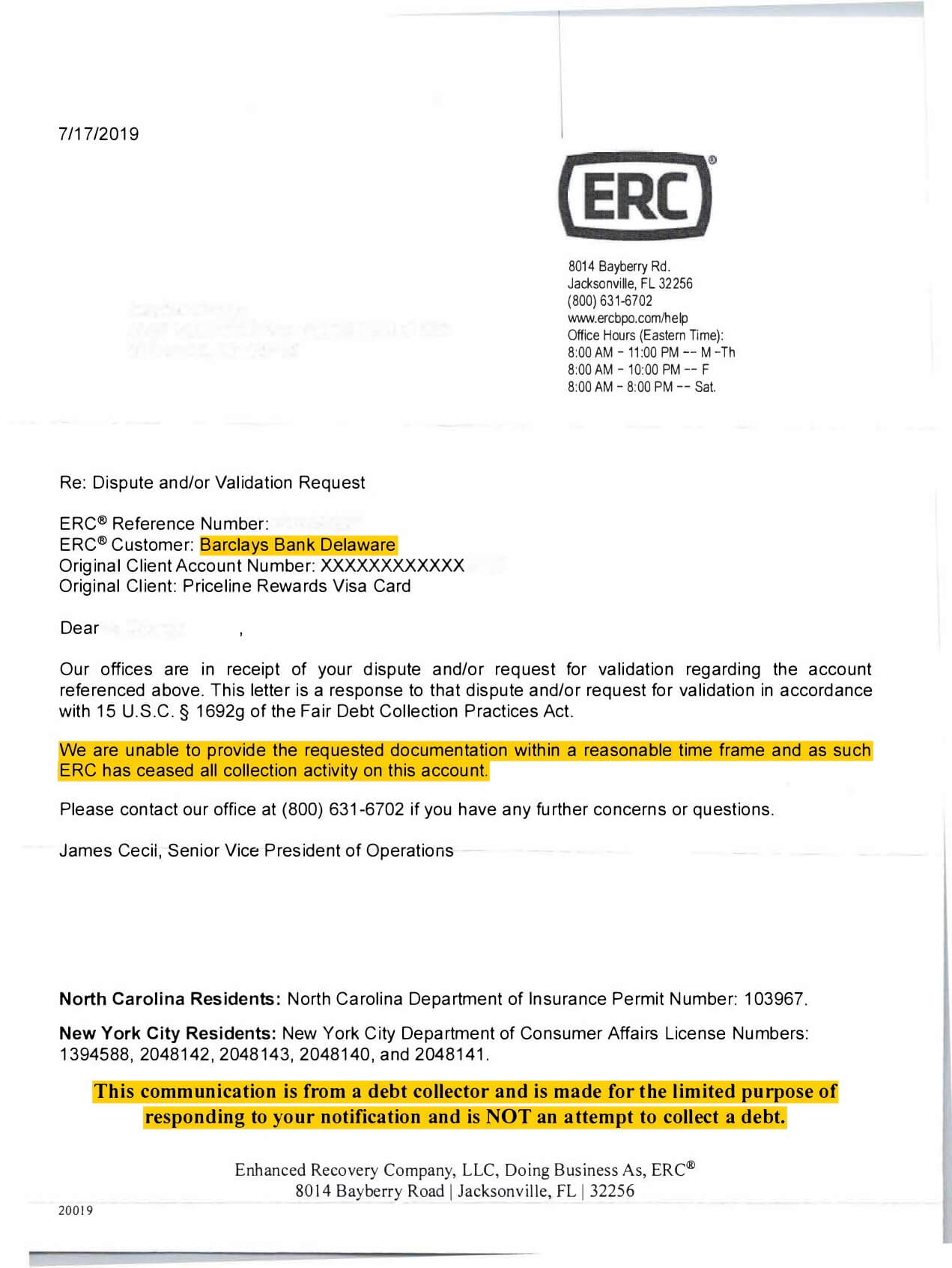

The collection agency will only pay 10-20 cents on the dollar to purchase the debt from the original creditor, which is why they are willing to settle a debt for only around half with the consumer. The banks use minimal effort to generate maximum profit, but through this process they get careless, paperwork goes missing, information turns inaccurate and fraud occurs. For this reason, debt validation programs offer consumers a less expensive route to resolve unsecured debt collection accounts in many cases, as explained in the video above.

Attorney-Model Debt Settlement Programs

If you have over $7,500 in debt, you can sign up for an attorney model debt settlement program.

- Minimizes creditor harassment due to federal laws including the FDCPA that prohibit creditors and collection agencies from calling you after they know that you have attorney representation

- Don’t have enough money to settle a debt right now? Debt settlement programs work out a feasible monthly payment for you to pay, allowing you time to build up enough funds to be able to afford to pay off a settlement

- You can focus on life, while the debt settlement law firm deals with resolving your debt

- If you get served a summons to go to court, have an attorney respond to it without having to pay high attorney fees

- Become debt-free in 24-48 months

Call Golden Financial Services Today for a Free Consultation with an IAPDA Certified Debt Counselor at (866) 376-9846

Before settling your debt, use debt validation to dispute it

A debt validation program will challenge your debt, similar to how a person hires a lawyer to challenge a speeding tick. In the example above, this collection agency agreed to stop collection on the debt due to their inability to provide the requested information that by law they are required to maintain in their records.

Debt validation is not saying that it wasn’t your credit card or that you never spent the money. What debt validation is disputing is whether or not the third-party collection agencies were abiding by federal laws, have complete and accurate records and are doing their part that federal laws require them to abide by.

What is the best debt relief option for 2019?

Watch the video above to help you figure out what your best debt relief option is. Depending on your current financial situation and goals, are all factors to consider.

Try this debt calculator tool to compare your potential savings on each debt relief program

The best debt relief option to help improve your credit score

If you want to improve your credit score immediately, no debt relief program can help you accomplish this goal. What you’ll need to do is pay down your balances on your own, resulting in positive payment history and an increase in your credit utilization ratio. That’s how you can increase your credit score while working to get out of debt fast. You could also consider using a home equity line of credit, debt consolidation loan or a balance transfer card to pay off any high-interest accounts and consolidate payments into one, without hurting your credit score.

To pay down your debt without a debt relief program, start by making a budget analysis with this free tool online.

You can then use the debt snowball calculator here to get out of debt quickly, save money and improve your credit score.