Credit card debt relief options can stop the bleeding of interest compounding and balances spiraling out of control even further. Millions of consumers have had their incomes reduced, having to rely on credit cards to pay bills throughout the Coronavirus/COVID-19 pandemic. However, now these same credit cards that acted as a rescue boat throughout the pandemic, have high balances and need to be paid.

People have been able to defer credit card payments and use government stimulus relief to get them through this far, but now what? No credit card debt relief government program exists. So what options are there for credit card assistance for those folks that have been adversely affected due to COVID-19?

The following page is a credit card relief guide for 2021, in response to COVID-19.

Government debt assistance and free debt relief resources are provided.

Credit Card Relief Starts With Making A Budget

Every credit card debt relief plan starts with the same thing – Make a Budget! So before we even provide any resources, let’s start with this essential step.

You need to figure out how much money goes out every month towards your required living expenses (i.e., food, mortgage, car payment, school bills, heat, electric bill).

You also need to know how much money goes out each month towards non-essential expenses (i.e., shopping for your tenth pair of new shoes for the year, blasting the air conditioner all winter, buying toys for the kids every time you’re in a grocery store).

After you create your budget, you’ll be able to see where every dollar is going each month.

Scan Budget and Reduce Expenses

The next step is to scan through your budget and figure out ways to reduce and eliminate expenses. As you reduce and eliminate expenses your monthly available cash flow will increase. This monthly cash flow is what you will use to pay down your credit card debts, whether you use a debt relief program or snowball method.

You can turn the air conditioner off for half the day, saving $50 per month right there. You could use coupons at the grocery store and save another $50 per month. Just by cutting down two expenses, your cash flow increased by $100 per month. That $100 will be used to pay down credit card balances.

Contact Your Creditors for Interest-Free Deferment / Forbearance

In response to COVID-19, you can contact all of your creditors and ask them for interest-free deferment or forbearance. You may have already done this, and now it’s expiring, but if you haven’t, it’s worth making a phone call to each of your creditors and asking.

As long as there’s no additional interest getting tacked on or capitalized to the back of the loan, if creditors are willing to pause or waive payments, it’s a good deal for you. Even if only one or two of your creditors are willing to pause the payments for a few months, that frees up additional money that will increase your cash flow and be used to pay down credit card debt.

Federal Student Loan Relief

There are several ways to reduce student loan payments and put the extra money towards getting out of credit card debt.

First off, you could get on an income-based repayment plan that offers a zero-dollar payment. The CARES Act also may be extending the federal relief, offering no payment or interest. And thirdly, there are forbearance and deferment options to consider. Refer to this student loan forgiveness guide for options.

After you finish reducing expenses on your budget, next, it’s time to execute your credit card relief plan.

Free Credit Card Debt Relief Resources in Response to COVID-19

- FREE BUDGET CALCULATOR TO CREATE BUDGET

- MINT: THE BEST PAID APP FOR CREATING A BUDGET

- WHAT TO DO IF PAYMENTS ARE ABOUT TO RESUME

- 3 BEST DEBT FORGIVENESS PROGRAMS

- STUDENT LOAN RELIEF GUIDE

- DONALD TRUMP CREDIT CARD DEBT RELIEF OPTIONS

- A GUIDE FOR JOB CORPS AND UNEMPLOYMENT BENEFITS IN YOUR STATE

- GUIDE TO TAX DEBT RELIEF OPTIONS

- CREDIT KARMA’S GUIDE ON DEBT RELIEF PROGRAMS BEING OFFERED BY THE CREDIT CARD COMPANIES

- SBA.GOV SMALL BUSINESS RELIEF OPTIONS

Your Best Credit Card Debt Relief Options Post COVID-19

OPTION 1: DEBT SNOWBALL METHOD:

The snowball method is a fast way to pay off credit card balances while simultaneously improving credit scores and your financial health.

Can you afford to pay above the minimum payment on at least one of your credit cards? Your best option is the Debt Snowball Plan.

The debt snowball method allows you to focus on paying off your smallest credit card balance first while paying minimum payments on the others.

The debt snowball method, popularized by “The Total Money Makeover” author Dave Ramsey, has been proven, by Harvard Business Review, to be “the most effective debt repayment strategy”. The snowball method is one that you do on your own, without debt assistance from a company. Here’s a free debt snowball calculator to help you out.

OPTION 2: CREDIT CARD DEBT RELIEF PROGRAMS:

Can’t afford to pay more than minimum payments on even one card? Credit relief programs could help. There are a few to choose from. Debt relief, settlement, validation, and consumer credit counseling programs are available as of 2021.

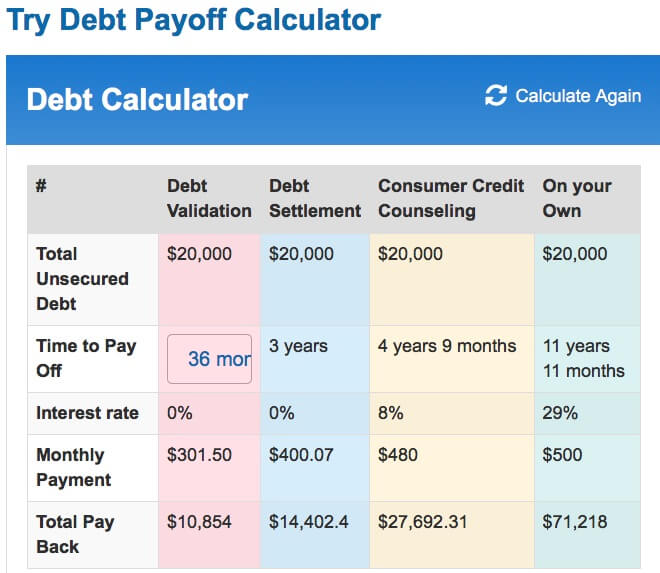

Here’s a screenshot of each program taken from Golden Financial’s debt calculator. The following screenshot will give you an idea of how much a person can save on each program. To try this debt relief program calculator on your own, simply click the image below.

Speak to one of GFS’s IAPDA Certified credit counselors for a free consultation at (866) 376-9846.

Debt relief programs can help you deal with credit card debts that you can’t afford to pay on your own. If you’re considering any of the following credit relief programs that are illustrated above, visit this page next to compare the pros and cons of each option.