The following infographic highlights the benefits and downsides of each debt relief program.

Debt relief programs can reduce credit card balances down to a fraction of what they currently are and cut interest rates in half – and most importantly, bankruptcy can be avoided. But if you don’t thoroughly understand each program before choosing a plan, you won’t be able to pick your best option intelligently.

You could destroy your credit and have no idea on how to recover.

Before joining a debt relief program, make sure to understand:

- How each plan will affect your credit score.

- Is credit repair included in the program?

- If your credit score is adversely affected, how will you rebuild it?

- How will you deal with EACH potential downside?

- What if you get sued?

- Have any guarantees?

Original Source of Infographic:

Downsides exist on every debt relief program. Federal laws and regulations enforced by The Federal Trade Commission (FTC) require debt relief companies to disclose the disadvantages of each debt relief program, but companies don’t always do so.

A reputable debt relief company will put together a blueprint that will get you out of debt and financially healthy again. IF you have a complete plan in place, taking you from A-Z (buried in debt —>>> financially healthy again) – a program to reduce credit card debt can be your best option.

If some fast-talking sales representative calls you from ABC debt relief company that just opened up two days ago and has three employees – turn the steering wheel fast! Because that’s a bad accident waiting to happen!

Investigate a debt relief company’s credentials and client reviews at the Better Business Bureau and on Google. Make sure any debt relief, settlement or consolidation company that you’re considering using is a member of the International Association of Professional Debt Arbitrators, the Association for Credit Counseling, or a non-profit company.

Before you continue reading: If you’re not considering a debt relief program, visit this page here – learn the simplest way to get out of debt on your own.

Note: All of these programs are equally as valuable. Depending on each person’s unique situation, circumstances and needs — will determine what plan is best for each person.

Debt Consolidation for Credit Cards (option 1)

Is debt consolidation a loan to pay off my credit cards?

Yes, debt consolidation is a loan.

A bank or third-party financial company can grant you the loan.

You can even use a home-equity line of credit to consolidate your credit cards. And a home equity line of credit usually comes with a low interest-rate.

Debt Consolidation Benefits

- All debt gets paid off in one shot

- Can help credit score to improve (No adverse marks reported on credit report)

- Combines monthly payments into one

- Reduces interest rates, resulting in a shorter pay off period (assuming it’s a low-interest loan with no extra fees)

Negatives of Debt Consolidation

- Must pay the entire loan back, plus interest and fees (not ideal for anyone who is experiencing a financial hardship)

- Challenging to get approved for a low-interest loan due to strict credit restrictions

- Can take over 5-years to pay back

- No income-based repayment options

Debt Settlement for Credit Card Relief (option 2)

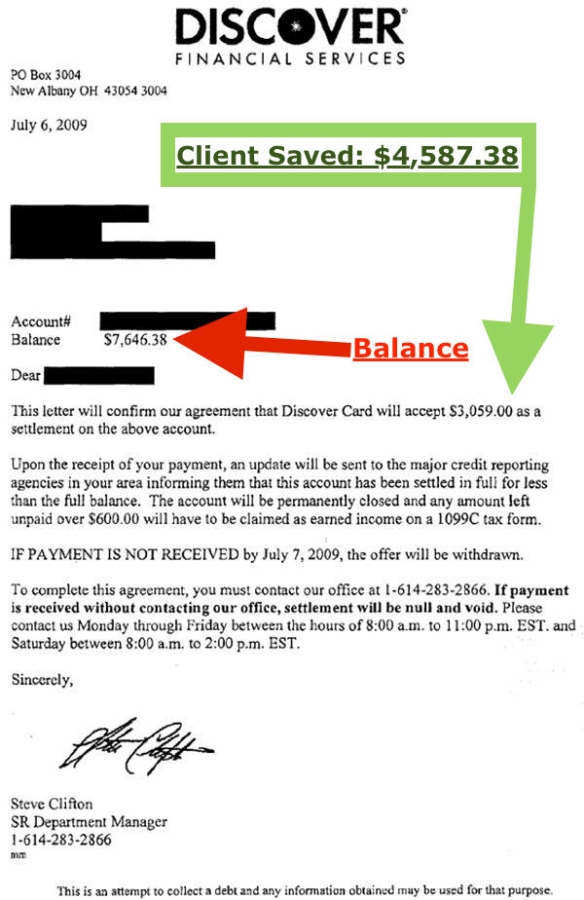

A debt settlement program acts as a liaison between you and your creditors. A negotiator contacts your debt collection companies to negotiate the balances on each debt, down to a fraction of the total owed. (i.e., $10,000 in delinquent credit card debt, can be reduced to $5,000.)

Benefits of Debt Settlement

- Debt-free in 36-42 months

- Reduce debt by 25%-32% (including fees)

- Get a low monthly payment

- Avoid bankruptcy

- Pay only if results are achieved

- Flexible payment options

Negatives of Debt Settlement

- Negative marks on credit (late and collection marks)

- Could get sued or get harassed by creditors (reputable debt settlement companies will offer lawsuit defense in this case)

- IRS could report a person’s “savings” as “taxable income” resulting in a tax bill. (The IRS “Form 982” can be used to illustrate the inability to pay a debt due to being insolvent)

- Balances continue to grow until the debt is settled due to late fees and unpaid interest

- Not all clients can complete the program for various reasons, including their ability to save sufficient funds

Do my creditors get paid with a debt settlement program?

Debt settlement companies set you up with an affordable single monthly payment, no matter how many accounts a person has. That single payment goes into a trust account. Creditors don’t get paid on a monthly basis with debt negotiation services.

How low can my payment be with debt settlement?

The payment can be as low as half of what you would be paying when paying minimum monthly payments. Try this debt relief program calculator to get a better idea.

The funds continue to accumulate in a client’s trust account until they have about half of what they owe on one of their debts available – and around that time is when the first debt will get settled.

Will a debt relief program hurt my credit score?

The action of not paying your creditors each month is what negatively affects a person’s credit score when joining a debt relief program.

With bankruptcy, your credit report gets severely scarred with “bankruptcy” on it for seven years.

Consumer Credit Counseling Program (option 3)

Consumer credit counseling programs combine a person’s credit card payments into one single payment.

Consumer credit counseling is not a loan. Creditors continue to get paid with consumer credit counseling but at a reduced interest rate.

Upside to Consumer Credit Counseling

- Reduces interest rates on each credit card (could be reduced from 25% down to 8%)

- Consolidates payments into one single payment

- Debt-free in 4.5 to 5-years

- No creditor harassment since creditors get paid “on time” every month

- Credit score shouldn’t go down

Negatives of Consumer Credit Counseling

- A small reduction in monthly payment, compared to when paying minimum payments

- 3rd-party notation on credit report Source:

- Takes longer than debt settlement to pay off credit card debt

- Only credit card debt qualifies

- Inflexible payment terms

Debt Validation Program (Option 4)

Disputes a credit card debt that was sold to a third-party debt collection company. After a debt is disputed the debt collection company must cease all collection activities until they can produce the legally required documentation and accurate records being requested.

Debt validation is the program that you want to do before debt settlement. There is a chance with debt validation that your debt can be proven to be invalid, and you could walk away without paying it. Additionally, the debt could come of off your credit report entirely. Debt validation clients do pay the company fees but don’t pay their alleged debt when it gets invalidated, making debt validation a more effective debt relief program over debt settlement in many cases.

Client walked away from paying over $4,000 on a credit card debt and was able to get it off their credit report.

Upside to Debt Validation

- Can be the least expensive debt relief option

- Flexible and affordable monthly payment

- Consumers get to defend themselves from illegal debt collection

- Don’t have to pay a debt that can’t be validated

- Get “financial education” – learning about laws such as the Credit Card Act and Fair Debt Collection Practices Act (FDCPA)

Negatives of Debt Validation

- The dispute process starts after accounts are written-off and sold to a third-party debt collection company, resulting in a temporary adverse effect on credit scores

- Results may vary

- Creditors can issue a lawsuit

- The debt doesn’t disappear until after the statute of limitations expires (unless an attorney can get it legally dismissed due to legal violations)

Do federal credit card relief programs exist?

There are NO federal credit card relief programs currently available.

Federal student loan relief programs do exist. Here you can learn how to consolidate your federal student loans on your own and get student loan forgiveness.

You may also be interested in “31 Ways To Get Rid Of Credit Card Debt.”

Author:

Paul J Paquin is the CEO of Golden Financial Services and the author of the book called; “A Complete Debt Consolidation Guide to Becoming Debt-free.” Paul spent the last 15-years engulfed in debt consolidation, as the CEO at Golden Financial Services, learning about the most effective debt relief options by researching and testing different methods. You can follow Paul on Twitter.

Sources for this page: