Selecting a tax advisor to assist you with taxes is always a good idea if you are unsure about tax deductions and tax credits, or if you are filing freelance taxes for the first time. If you are attempting to start a small business and this is your first year filing your business taxes, a tax advisor is almost a must.

Choosing the right tax advisor fully depends on the type of taxes you are filing, the experience of the advisor, and their ability to save you money by utilizing the appropriate tax credits and deductions. With that in mind, here is how to hire a tax advisor by the type of taxes you will be filing.

Finding a tax advisor for freelancers

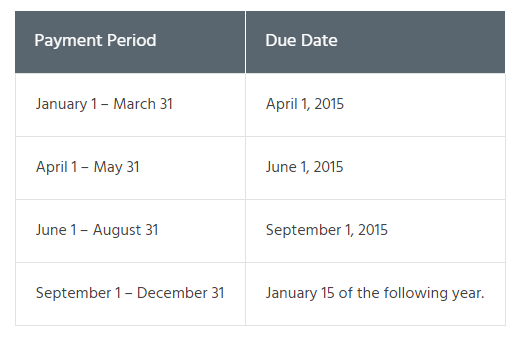

First time filing 1099 forms as a freelance professional? While some of the freelance tax filing steps are similar, the majority of how to file is very different from working a full-time job and filing a W2. For starters, if you plan to make more than $1,000 in a calendar year from freelance work, you will be required to file quarterly in addition to a final filing to recap the previous year by the standard April 15 deadline.

Secondly, the paperwork for filing freelance taxes is completely different than a standard W2 because in a W2 scenario your taxes are automatically deducted from each paycheck, whereas with freelance you receive all of the funding without any deductions. Your tax professional should be very familiar with these forms because they require quite a bit of self-reporting for write-offs while accounting for all income sources. Your tax advisor will need to walk you through the Schedule SE tax form, Standard Form 1040, and how to cover the 15.3% standard tax fee for Social Security and Medicare. Dave Ramsey has additional info for freelance taxes that is clear and very helpful. Here is a helpful note from the blog post:

“Remember, the self-employment tax is in addition to your regular income tax rate. That’s why Dave recommends setting aside 25–30% out of your freelance checks in a separate savings account: because that’ll cover both your income and self-employment taxes. This will keep you from getting hit with a huge bill at tax time.”

Finding a tax advisor for small businesses

As you navigate your small business journey, you will quickly find yourself looking for a combination of cheap and effective. For example, your marketing team might only be one or two people at this stage, working on a freelance basis to accomplish your ad campaigns, social content, etc. This same approach can be applied to finding a tax advisor. Many tax professionals are leaving firms to be their own boss in our modern environment, and they offer must cheaper rates than an agency or company with overhead to cover.

Entrepreneur.com words it best: “The best tax professionals are always CPAs, Certified Public Accountants. Most business owners should use a CPA because these professionals are the most knowledgeable and passionate about reducing taxes. The second option is an enrolled agent, and finally, there are the mass production companies like you find in the mall. Some very small businesses can get by with an enrolled agent. Business owners and serious investors should never use a mass production company or do their own taxes.”

Double down on your research of cost vs effectiveness by comparing prices before hiring a tax advisor. If your tax advisor is aggressive in pushing you towards their services, it might be a red flag. So you have an idea of how much a tax advisor or preparer might cost, NerdWallet provides some excellent statistics:

“How much do tax preparers charge? The average fee for preparing a tax return, including an itemized Form 1040 with Schedule A and a state tax return, was $294 in 2018, according to the National Society of Accountants. The average cost to prepare a Form 1040 and state return without itemized deductions was $188.”

Filing taxes for first-time home sellers

Capital gains is the term that refers to when you sell a home that has appreciated beyond what you currently owe on your mortgage. This income does need to be reported to the IRS, and you will be expected to take a chunk out of this income and hand it to the federal government.

Some CPAs specialize in real estate that can directly handle this task for you. You should get them involved in the proceedings of selling the home before it sells if you anticipate making more on the home sale than what is owed on a mortgage, or if your mortgage is already paid off.

MoneyUnder30.com provides an excellent resource for navigating this process so you can be prepared to hire a professional and speak their language when the time comes. The most important thing to remember is when planning finances and what to do with your windfall from your home sale, take the necessary step of filing your capital gains first so you know exactly how much of your recent cash influx will not be in your pocket after taxes.

____________________________

If you found our blog looking for financial advice or assistance with credit card debt relief or debt consolidation, call Golden Financial Services today at (866)-376-9846 or info@goldenfs.org. You can check out the rest of our blog here, and do your research on our services here. Let’s talk soon!