Are you struggling to pay off student loans and credit card debt? Did your monthly payments or interest rates recently increase? I bet they did. And I’m not a mind reader. I only know this because the Federal Reserve increased it’s Federal Funds Rate (Fed Rate) four times in 2018.

The Fed Rate is the rate that banks lend to each other. Whenever the Fed Rate increases, within about sixty days later, interest rates increase on credit cards and on any loans that carry a variable rate. A variable rate is one that can change.

About the author: The following blog post is by Paul J Paquin, the CEO at Golden Financial Services and Senior Editor at the GoldenFS.org Debt Relief Blog:

Should I pay my student loans or credit card debt first?

First and foremost, you need to know if they are private or federal student loans. Federal loans take precedence over everything.

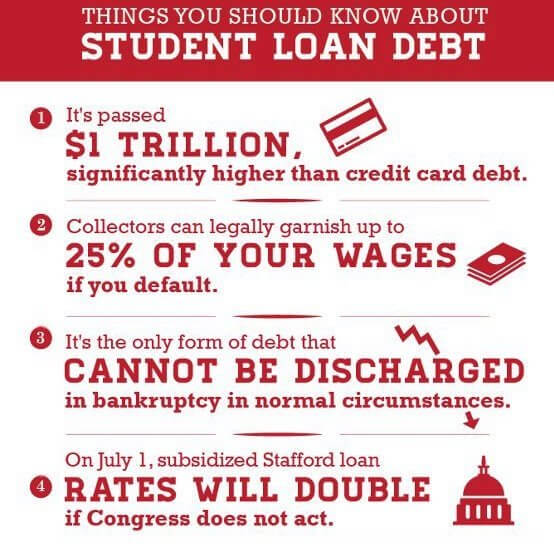

Behind on federal student loan payments? Prioritize dealing with these student loans first — the reason why is because 25% of your wages could get garnished over student loan debt.

Can my IRS tax refund get taken?

The Department of Education can withhold your entire tax refund using the Treasury Offset Program.

If you filed a joint tax return, the IRS can also withhold your spouse’s refund.

How to Resolve Federal Student Loan Debt When Behind on Payments?

Want to get the late marks removed from your credit report? Want to stop a garnishment?

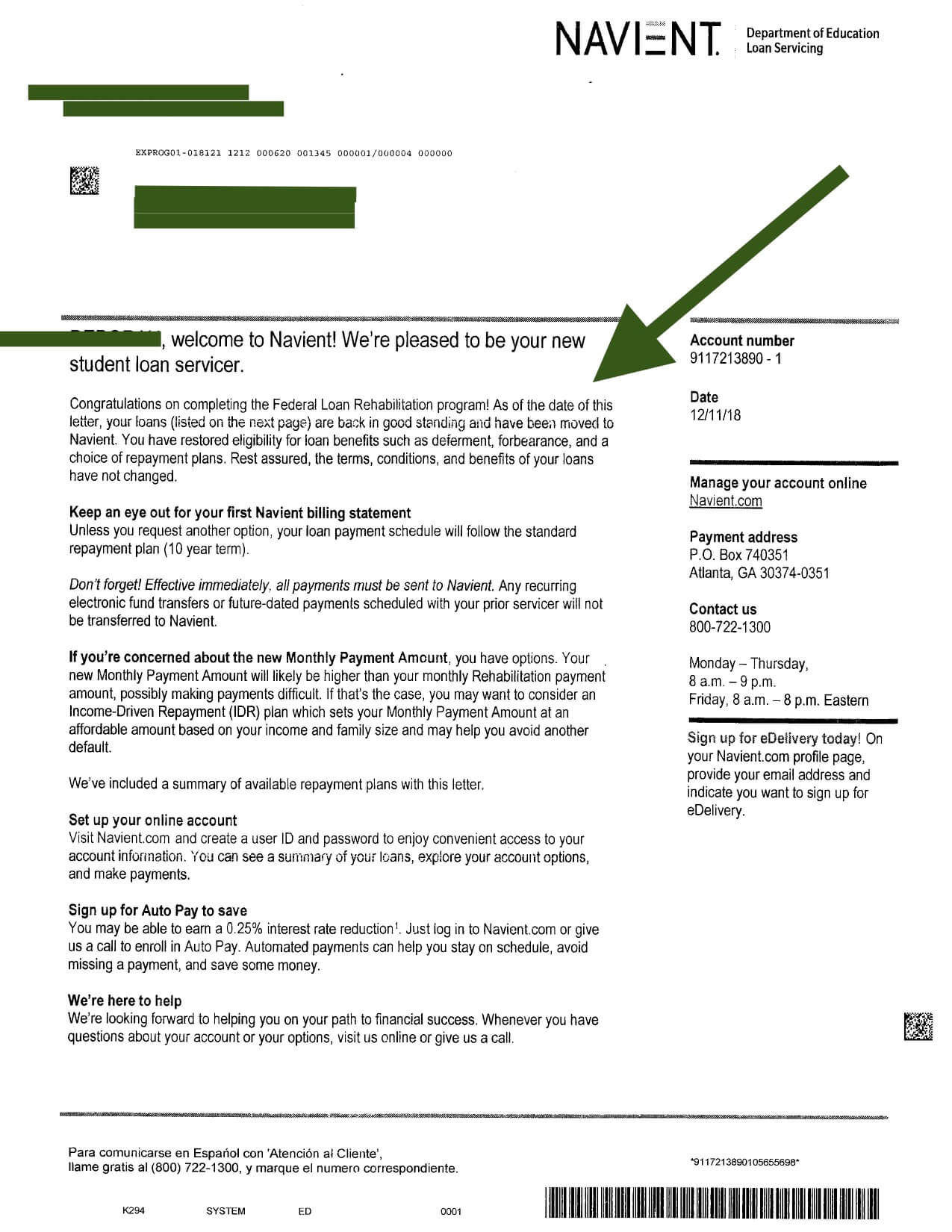

Sign up for a loan rehabilitation program. This is your only resolution at this point!

Loan Rehabilitation Program to Remove Negative Credit & Stop Garnishment

Contact your student loan servicers and request to get on their loan rehabilitation program. All federal student loan lenders are legally required to offer a loan rehabilitation plan.

The good news is that your monthly payment can be as low as five dollars per month. In 2019, most student loan collection agencies will require a person to make five monthly payments of as low as $5 per month to complete a loan rehabilitation program.

When your student loan servicer goes over the income-related questions, give them the lowest possible income that you can show.

Meaning, if your most recently filed tax return shows a lower income from what you are currently earning, provide your most recently filed tax return instead of providing recent pay stubs.

The more people you have in your family, the lower your loan rehabilitation program payment will be. Make sure to include even an unborn child and anyone living in your household if you pay more than half of their expenses.

Once set up on the loan rehabilitation program, you only need to make between five to nine monthly payments to complete it.

After completing the loan rehabilitation program your federal student loans will be in good standing and eligible for the government student loan benefits.

Next – Consolidate Your Federal Student Loans

Consolidate your federal student loans through the government debt relief programs at StudentLoans.Gov.

Behind on student loan monthly payments?

Request 90-days forbearance before consolidating.

Forbearance will give you enough time to consolidate your debt, not having to worry about your wages getting garnished in the meantime.

After consolidating, you can get on an income-driven repayment plan and your new consolidated monthly payment could be close to zero dollars per month.

Here is a step by step guide on how to consolidate federal student loans

Can you comfortably afford to pay more than minimum payments on credit cards?

If you can afford to pay more than minimum payments, we recommend using the debt snowball method.

Debt Snowball Method:

- Organize your debts in order from the smallest account first, to the largest debt last

- Attack your smallest debt first, while continuing to pay minimum payments on the rest

- Make a budget and find expenses that you can lower

- With the extra money you find, put it all towards paying off that smallest debt first

- After your smallest debt gets “paid in full,” you will have one less debt to pay each month

- Roll that extra money up with the rest of the funds that you are using to pay towards the next smallest debt in line

- Right after each debt gets paid in full and cleared off the table, your available monthly cash-flow will continue to grow in size just like a snowball grows when you roll it

- That momentum will continue to carry you all the way until you’re debt free

Here’s how the debt snowball method works, explained by Dave Ramsey

Say you have the following four debts:

1. $500 medical bill ($50 payment)

2. $2,500 credit card debt ($63 payment)

3. $7,000 car loan ($135 payment)

4. $10,000 student loan ($96 payment)Using the debt snowball method, you would make the minimum payments on everything except the medical bill. For this example, let’s say you have an extra $500 each month from taking a side job and cutting your expenses down to the bare minimum. You are gazelle intense.

Since you’re paying $550 a month on the medical bill (the $50 payment plus the extra $500), that debt will be done in one month. You would then take that $550 and attack the credit card debt. You can pay $613 on the plastic (the freed-up $550 plus the $63 minimum payment). In about four months, you’ll wave goodbye to the credit card. You’ve paid it off!

Now punch that car loan in the face to the tune of $748 a month. In 10 months, it’ll drive off into the sunset. Now you’re on fire!

By the time you reach the student loan—which is your biggest debt—you can put $844 a month toward it. That means it will only last about 12 months. After that, Sallie Mae better get used to living somewhere else, because you’ve kicked her out!

Debt Relief Programs for Credit Cards

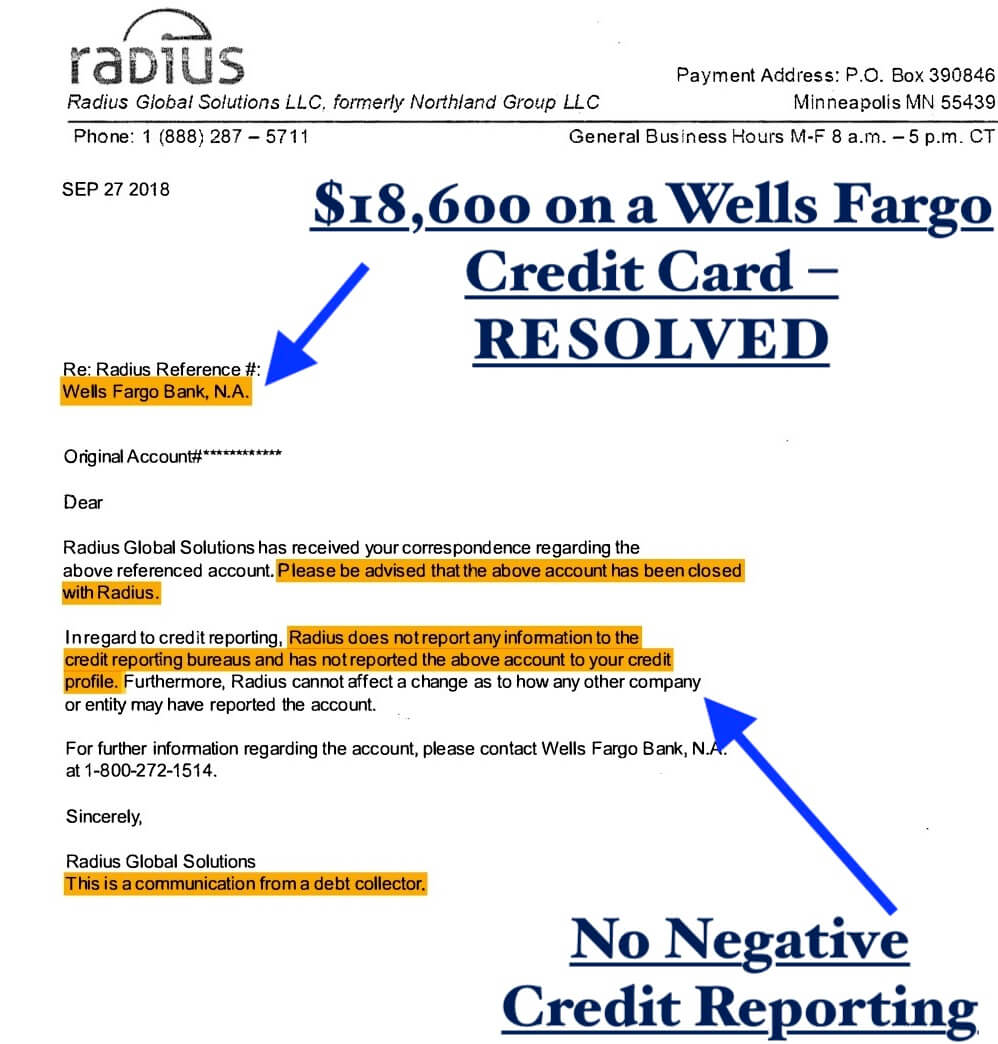

Credit card debt relief programs reduce the amount that you need to pay on each account.

Are you only paying minimum payments on high-interest credit cards?

If so, it’s time to consider a debt relief program. Interest rates are supposed to rise at least three more times in 2019. So, if you’re struggling to make payments now, it’s only going to get harder.

Consumer Credit Counseling

- This type of credit card relief program has a minimal effect on your credit score because you remain current on payments

- You make only a single payment each month to the credit counseling company

- The credit counseling company pays your creditors but at a reduced interest rate

- You can become debt free in under five years with this type of plan

Here are more details on consumer credit counseling.

Can’t Afford to Pay Your Credit Cards?

If you can’t afford to pay minimum payments on credit cards, you should consider a financial hardship program.

Here’s what a hardship debt relief program can do for you:

- Flexible and personalized plans (plans range from 18-42 months long)

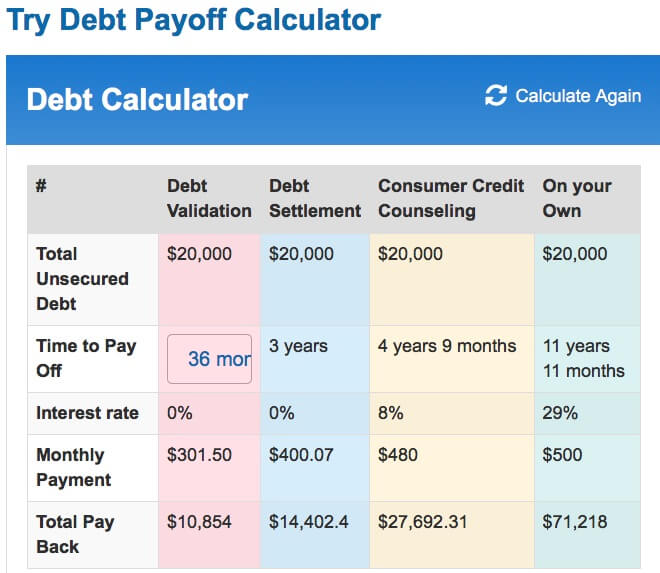

- Example: $25,000 in credit card debt can get resolved in 36 months at a monthly payment of $357.06, VERSUS when paying minimum payments on credit cards that have an average interest rate of 29%, it could take you 72 months at $750 per month to pay off this debt. Try debt calculator to get an online savings estimate for your situation

- You get one affordable payment each month (could save up to 45% on monthly payments)

- Debt relief company takes over communication with creditors

- Debt relief company can tailor a full-recovery plan which includes credit restoration

Learn about the best debt relief program for 2019 (for high credit card debt)