Income-Based Student Loan Consolidation Programs – if you are struggling with federal or private student loan debts, repayment plans and consolidation programs are available to the public.

You may not know about your options. In college, they fail to teach students about paying off student loans, and of course, the student loan servicers do an awful job at making these programs readily available.

Navient is one of the largest student loan servicers in the United States. Navient was sued by the Consumer Financial Protection Bureau not once but three times over the last six months.

What did Navient do wrong?

— guided consumers into costly plans that weren’t right for their situation

— steered customers into forbearance without disclosing that interest is still accumulating

To summarize the lawsuits; Navient directed students into the wrong plans and made the consolidation and repayment process extremely complicated.

Is it possible to get approved for a $0 monthly payment?

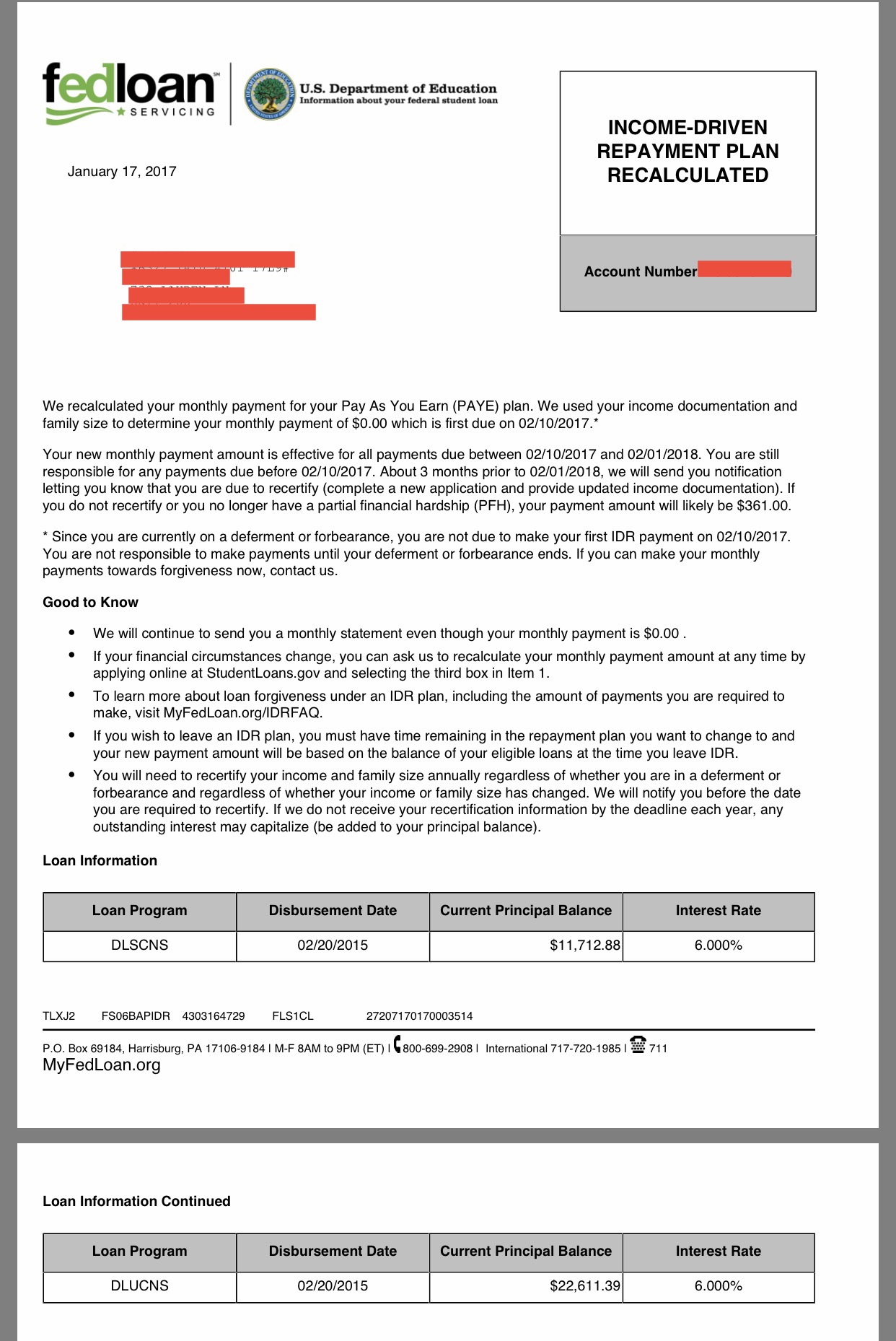

Here; take a look.

This client had $34,324.27 worth of federal student loans. Within 90-days we consolidated their student loans, and their existing loans were paid off in full.

Now they are left with the new consolidated loan to pay back, but their payment is only zero dollars per month.

Each year we will recertify their repayment plan for them.

Additionally; we can change their repayment plan to a different plan if their income and situation change.

GIVE US A CALL TO TALK ABOUT YOUR STUDENT LOAN DEBTS AT 1(866)332-3083.

Public Service Loan Forgiveness for Student Loans

In the case example above; the debtor is a teacher and works in public service. Since they work in public service, their loan balance can be forgiven in ten years.

That means; if they continue paying zero dollars per month over ten years, how much did they end up paying back towards this consolidated loan? You guessed right, that’s “zero dollars”!

If you have student loan debt, consolidation programs can be your best friend. Give us a call at our national debt relief center. We are not affiliated with the government or loan servicers, but we are on your team. Our objective; to get you the lowest possible consolidated student loan monthly payment and loan forgiveness.

About the author:

Wesley Hendrickson: The primary goal of Wesley’s service to clients is to bring stress relief and a sense of “wholeness” back into the lives of those who are struggling.

An expert with over 20 years in the Financial Services industry, Wes brings a background in Financial Investments, Insurance, Estate Planning & tax processes plus Debt Relief with a unique perspective and understanding of financial issues. Continue reading about Wesley (Wes) Hendrickson by visiting his Golden Financial Services profile page next.