Why does it always seem like FICO credit score improvement advice is basically just telling you to make your payments on time, and more aggressively? It’s not just a simple solution to suddenly make more money, or be better with your impulse purchases.

Credit scores, by their very nature, are slow movers. It takes a long time to build up a positive credit score, and what seems like forever to perform credit score rehab. But what if there is a way to improve your credit score, without paying down debt in the beginning? Here are some questions Golden Financial Services is commonly asked, and here’s how to attack your credit score.

Diversify your credit lines and increase your total available credit

If you aren’t aware, when you apply for a new line of credit, this counts against your credit score. It is called a “hard inquiry,” and it tells potential lenders that you are reaching out for help with finances in a way that says you are not generating enough income to cover all expenses. That said, there are certainly appropriate times when taking a small hit to your credit in favor of benefits, in the long run, is worth it. Your credit score may drop with the inquiry, but the benefit of a better available credit to debt ratio is generally worthwhile. Your credit score will begin to go up after adding a new credit line, as long as you don’t add significant debt to the balance, and you pay off your minimums each month.

You can consider opting for a secured credit card. In this format, you take what little fluid cash flow or savings you have, and you put it towards what essentially amounts to a pre-paid credit card. It’s your money, minus some service fees, that you access slowly. The card company can use your money, and in exchange the payments you make go toward positive credit. Here is a high-level explanation from Credit.com: “With a secured card, you can make a small deposit—typically a couple hundred dollars—with the credit card issuer and get a card. Your card’s credit line is usually, but not always, your deposit minus any fees charged by the card issuer. Some issuers will give you a credit line larger than your deposit.

An alternative to a secured credit card would be a credit builder loan. A credit-builder loan holds the amount borrowed in a bank account while you make payments, building credit. It is very similar to a secured credit card, but the balance usually has a limit of $500 or less. Here is a fantastic explanation from NerdWallet.

Be careful when applying for loans online. It can be difficult to tell when a credit lender is legitimate or a scam. Knowing the differences can be vital for protecting your identity.

How to build credit with a credit card

If you don’t think you will qualify for a credit card, you might want to check out a recent blog where we covered how to build credit without a credit card. Without making a single new payment, here are some methods to try that might provide a slight, but instant boost:

Request a credit limit increase. Did you know that you don’t have to wait for the credit card company to grant you more credit? If you recently got promoted at work, or if you have a steady history of making at least the minimum payment on time, you may be able to apply for a credit limit increase. You will need to go online and sign in to your account, then be sure your income numbers are updated. From there, most credit card companies have the option to apply built-in, and you will receive a decision via email within 48-72 hours. The only catch is that you must have a demonstrated history of making payments. Here are more details from Experian:

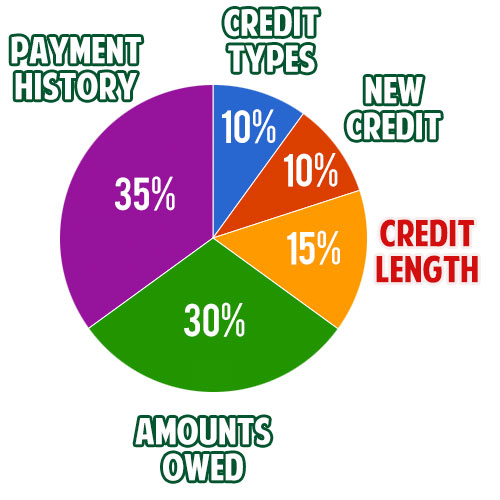

“After you have paid down your debt and decreased your utilization rate, or if your credit is already in good standing, you may consider asking for a credit limit increase from your credit card provider. Your credit utilization ratio is a comparison between the total amount of credit available to you versus the total amount you’re using, and it’s an important factor in your credit score.A credit utilization ratio of 30 percent or less is often considered good by lenders and others; the lower the ratio the better it is for your credit score.”

Check your credit report for errors. Your credit score is still controlled by humans, which means mistakes are possible. Sometimes you will find that items you paid off years ago are still showing as open on your report. Or maybe you went through a divorce and signed off the title on your ex-wife or ex-husband’s vehicle, but the vehicle payments are still showing on your report. Another great example is a utility payment liability at an address where you no longer live.

Do NOT close inactive accounts. While on the surface this may seem like a good idea because it’s a financial loose end, it is actually better to hold onto those empty accounts because the available credit balance improves your available credit to debt ratio we mentioned above. It can reduce your overall available credit, and it shortens your average age of accounts, both of which are factors in your score.

While this may be a retroactive task compared to the other tips on this list, you may need it as a reminder for the future.

Reduce monthly financial commitments

Obviously, you need a cellphone for daily living, but are you using ALL of the data you are paying for monthly? You may be able to reduce your cellular plan, thereby limiting the need to use your credit card since extra cash flow is in your pocket. This philosophy applies to cutting cable, buying groceries instead of eating out, and limiting other vices like alcoholic beverages, sporting events, and concerts, etc.

Reducing these expenses may even lead to extra cash flow in your account. You must resist the urge to spend this money right away, however. If you are not familiar with the Debt Snowball Payment method, it would certainly be worthwhile at that point to check it out. It starts with determining your overall budget after all expenses are accounted for. Calculate how much you can pay toward the credit card with the lowest interest rate or total debt owed. Take it from there and begin attacking your debt!

Summary

Undoubtedly, your credit score impacts your immediate and future financial well-being. It’s never too late to get started, but the sooner you can identify the patterns that are generating debt in your finances, the faster you can come up with a game plan for improvement.

Be vigilant, be proactive, and know your options when it comes to shaping your credit score. Being in debt can be temporary, but only if you treat your situation as a serious issue.

____________________________

If you found our blog looking for financial advice or assistance with credit card debt relief or debt consolidation, call Golden Financial Services today at (866)-376-9846 or info@goldenfs.org. You can check out the rest of our blog here, and do your research on our services here. Let’s talk soon!