The Federal Student Loan Forgiveness Guide

Learn how to deal with your federal student loans inside this easy-to-read guide. The point of this guide is to teach people how to get loan forgiveness for federal student loan debt. Forgiveness of student loan debt doesn’t happen automatically. There is a lengthy process involved.

And for most students, this lengthy student loan relief and consolidation process can be confusing and overwhelming. And for that reason, we’ve created this guide to simplify the entire process.

Below, are 16 step-by-step instructions on how to consolidate your federal student loans, maintain the lowest monthly payment on an income-based repayment plan, and get loan forgiveness.

Bad credit? Student loan consolidation is still an option for you, so don’t worry. Good credit? federal student loan consolidation and forgiveness options will only help make it better. So without further ado, let’s get this party started. You may want to have some coffee for this one!

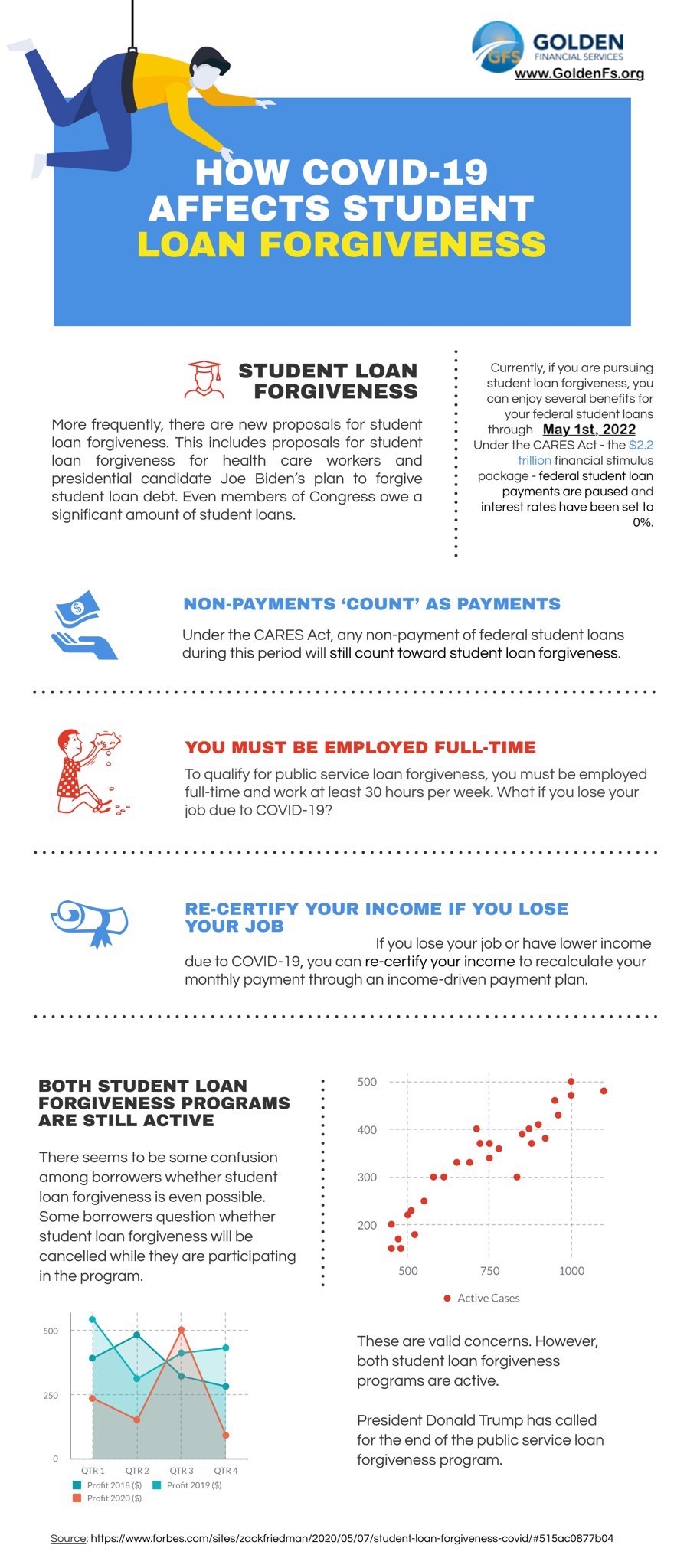

For Coronavirus-related student loan relief, refer to “Chapter Two”, and here’s an infographic that highlights some of the news:

How COVID-19 Effects Student Loan Forgiveness

Prefer not to have to deal with your student loans on your own? Schedule a Free Consultation with a student loan relief counselor at Golden Financial Services, by emailing StudentLoanHelp@GoldenFS.org.

Not all states qualify, and applicants must owe above $15,000 in federal student loans to be considered for the program. Programs are also available to help with credit cards, medical bills, collection accounts, and almost all unsecured debt at (866) 376-9846. Click Here to Read more about the top-rated national debt resolution program that has helped millions of consumers become debt-free.

Table of Contents

- Chapter 1: Introduction video

- Chapter 2: Coronavirus Student Loan Relief

- Chapter 3: How the PSLF works

- Chapter 4: Get FSA ID

- Chapter 5: Get a quote on consolidated payment

- Chapter 6: How to consolidate federal student loans

- Chapter 7: Review loans before consolidating

- Chapter 8: Choose a loan servicer

- Chapter 9: Family Size & Income

- Chapter 10: Choosing an IBR plan

- Chapter 11: Annual Recertification

- Chapter 12: Public Service Loan Forgiveness Instructions

- Chapter 13: Submit PSLF Employment Certification

- Chapter 14: Examples of public service jobs

- Chapter 15: How to deal with delinquent loans

Start by Watching This Short Video

Coronavirus Student Loan Relief

President Biden has approved student loan relief due to the Coronavirus that includes the following:

- No federal student loan payment up until May 2022

- No interest on your federal student loan payments up until May 2022

- No garnishment of wages, Social Security, and tax refunds for student loan debt collection up until May 2022

- No action is required to get the interest waived for the next six months, as this benefit is getting automatically applied to your student loans. However, you will need to contact your student loan servicer to request having your next six monthly payments waived, along with any existing past-due amount, as this action is not automatically applied but all students are eligible.

- Source: Jack Friedman, Forbes, 03/30/2020

For information on Coronavirus-related credit card debt relief–visit this page next.

Important Reminders About Federal Student Loan Relief:

Before jumping into the student loan relief guide below, please review the following summary and essential points to be aware of:

- Check what monthly payment you could be eligible for before starting the consolidation process by using this federal student loan consolidation Repayment Estimator Tool.

- Don’t forget to recertify your income-driven repayment plan every single year.

- Make sure you know how many payments you’ll need to make before becoming eligible for student loan forgiveness (i.e., 10-25 years)

- Submit your Public Service Loan Forgiveness (PSLF) Employment Certification form every year. (This step is only for consumers that have a public service job, like police officers and teachers) – If you are applying for the PSLF program, skim down on this page to where it says: “Public Service Loan Forgiveness Program (Aka: Teacher loan forgiveness & PSLF.”

- If delinquent on payments: request 90-days forbearance immediately to provide you sufficient time to get the student loan relief process completed and avoid getting your wages garnished.

- If late on payments and want to repair your credit (getting the default marks removed) you’ll need first to complete a loan rehabilitation program.

- If your wages are getting garnished, contact the collection agency and request a loan rehabilitation program (same as above, at the lowest possible monthly payment). Loan Rehabilitation will stop the garnishment and restore your federal options. Loan rehabilitation is straightforward to get started on; just call the collection agency and request a loan rehabilitation plan.

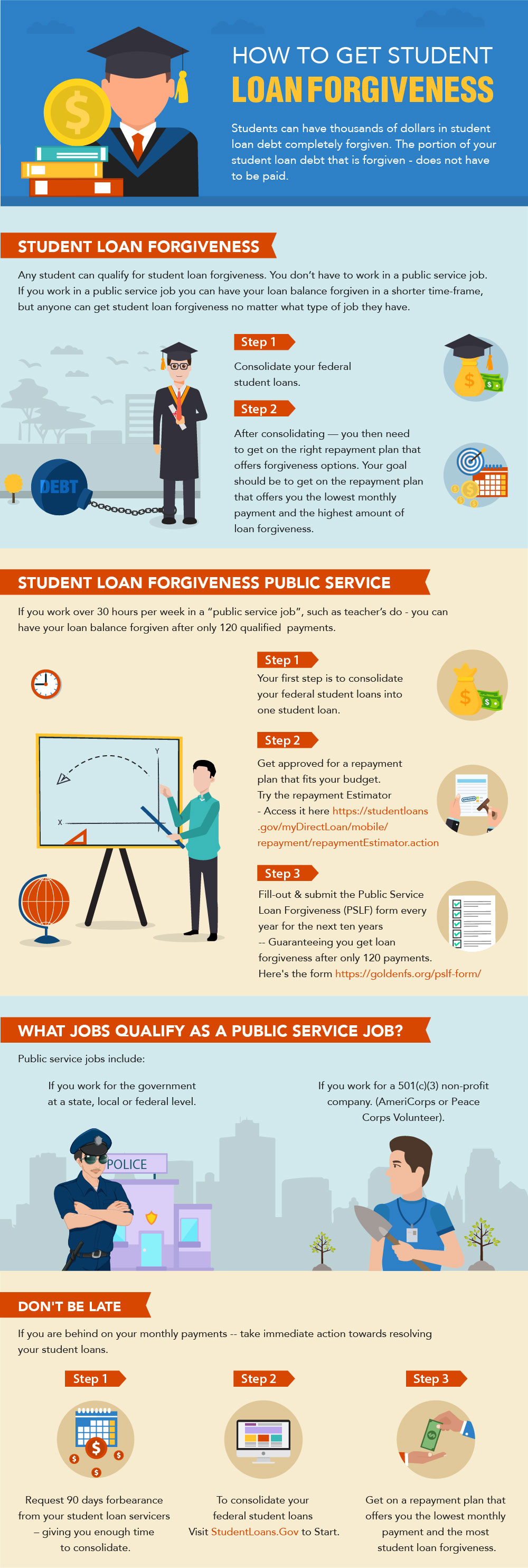

How to Get Public Service Loan Forgiveness (PSLF)

Copy Embed Code Below to Share this Image On Your Site

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Here are the 16 Steps To Consolidate, Get the Lowest Payment & Get Student Loan Forgiveness

Before you can become eligible for student loan forgiveness, you need first to consolidate your federal student loans and get on an income-driven repayment plan that offers loan forgiveness.

Step 1: Get FSA-id to consolidate federal student loans

You will need your Federal Student Aid Username and Password (FSA-id) to consolidate your federal student loans. Visit Fsaid.ed.gov to get it. (Click on where it says “Create an FSA-id” and follow the instructions)

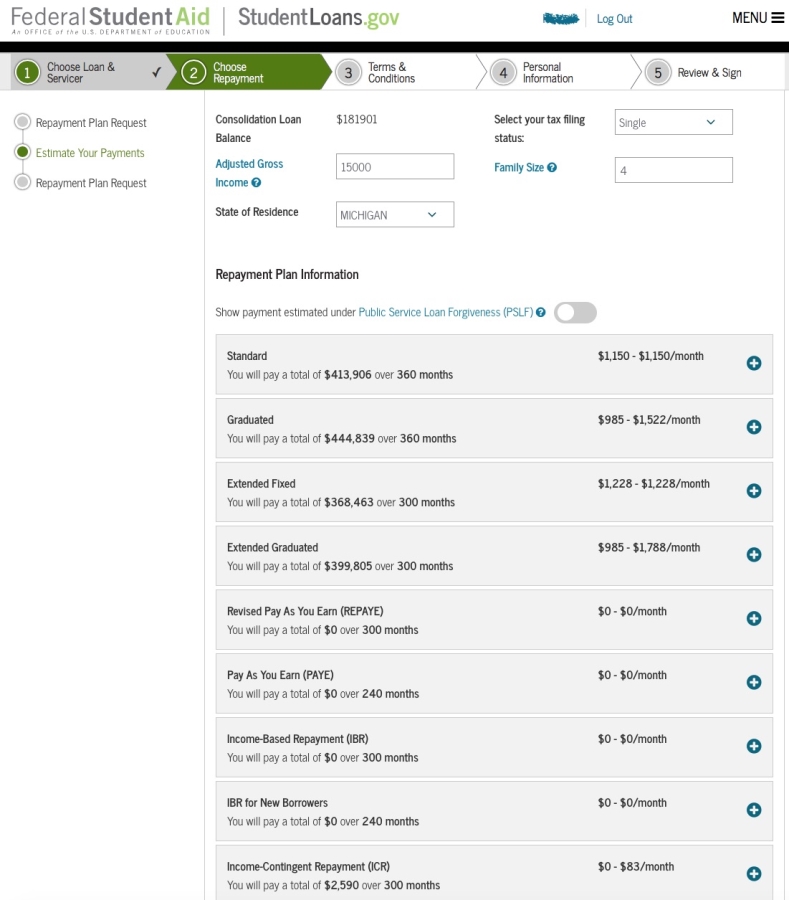

Step 2: (optional) Get a quote on what your new consolidated payment will be

Log in to the Student Loan Consolidation Repayment Plan Estimator to get a quote on what your new payment will be after consolidating. Get an idea of what your options are before starting the consolidation process.

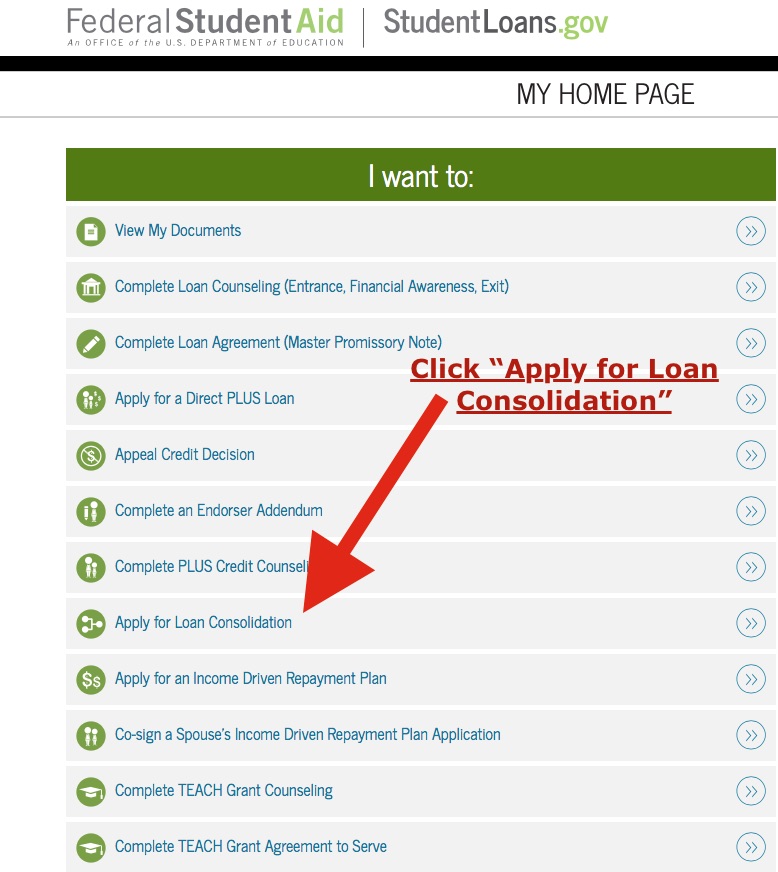

Step 3: Start consolidation… these are step-by-step instructions on how to consolidate.

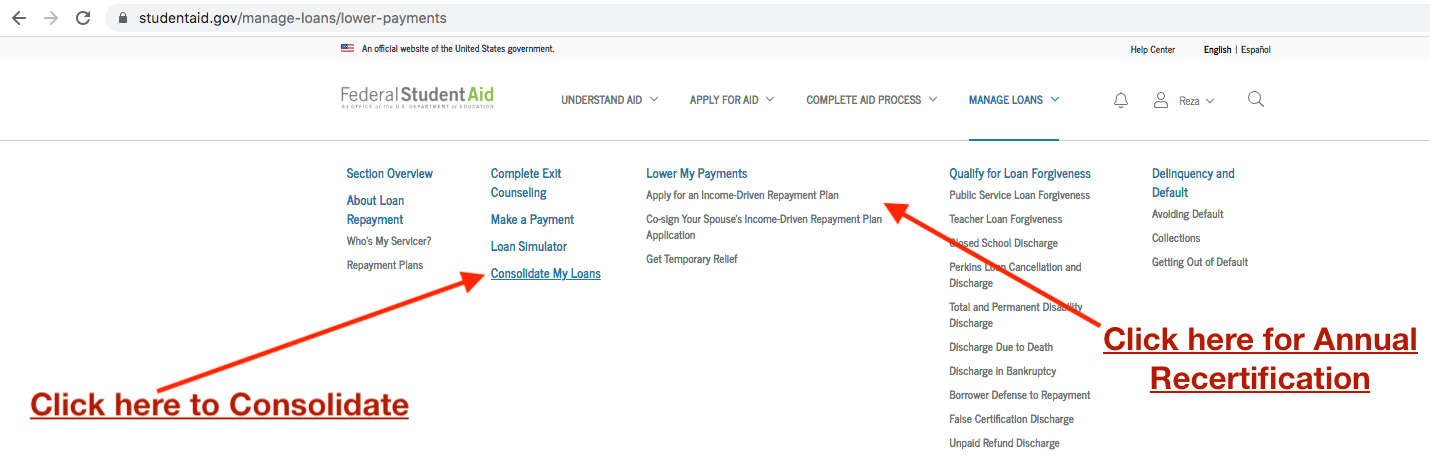

Consolidate your federal student loans at StudentLoans.Gov.

Once you log in at StudentLoans.Gov, to start the student loan consolidation process, simply click on where it says “Consolidate My Loans” and then follow the instructions.

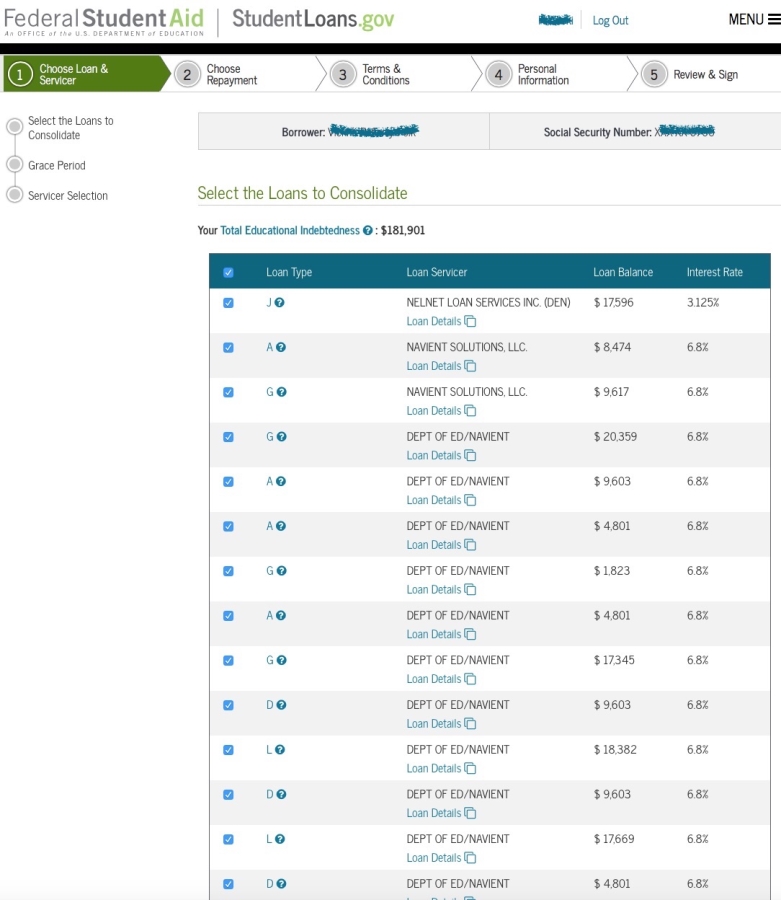

Step 4: Review all of the federal student loans that you want to consolidate

After clicking on “consolidate my loans”, next, you will be prompted to review all of the federal student loans that you want to combine.

If everything looks correct, continue.

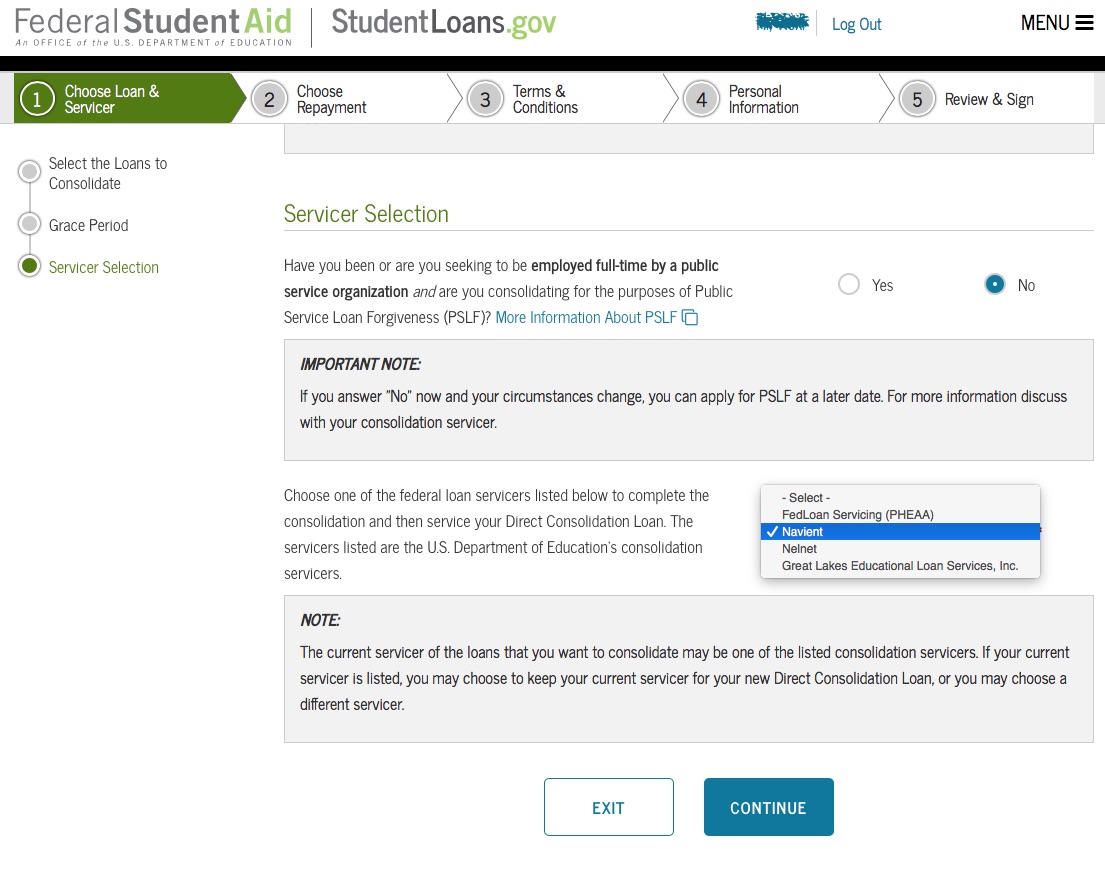

Step 5: Select a Student Loan Servicer

You can select Navient, FedLoan Servicing, Nelnet, Great Lakes Educational Loan Services, or any of the servicers available.

These loan servicers often change, but they all mainly do the same, that is, manage your consolidated loan.

You will log in to the loan servicers website to set up your monthly payment on the new loan, check updates including when you’ll be eligible for loan forgiveness, get tax documents. Your loan servicer will send you reminders when it’s time to recertify.

What is the Income-Driven Repayment Plan?

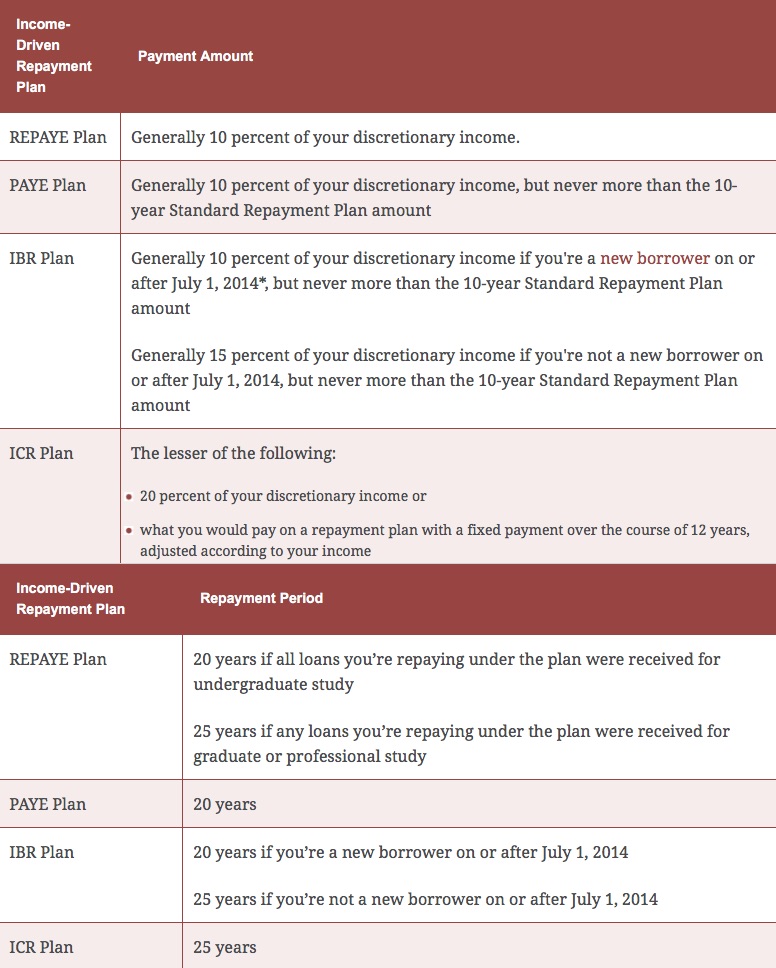

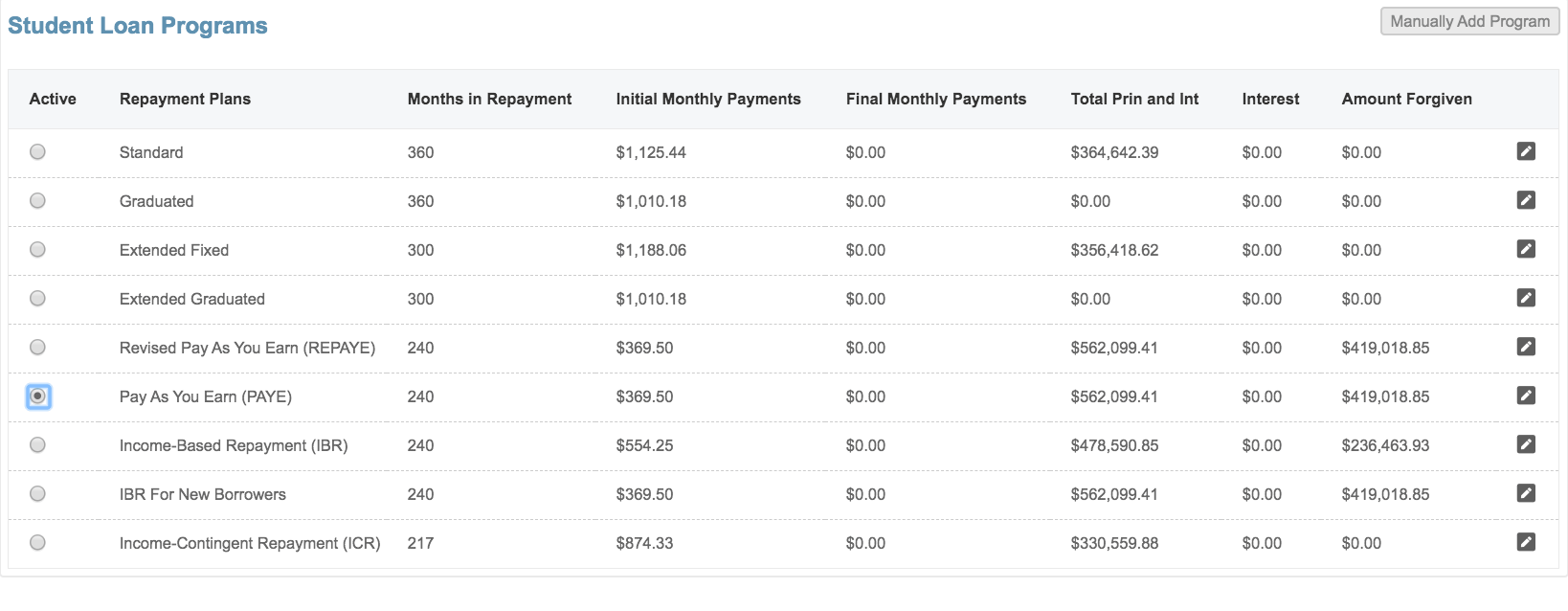

This next image illustrates the technical details that determine your monthly payment and amount of loan forgiveness.

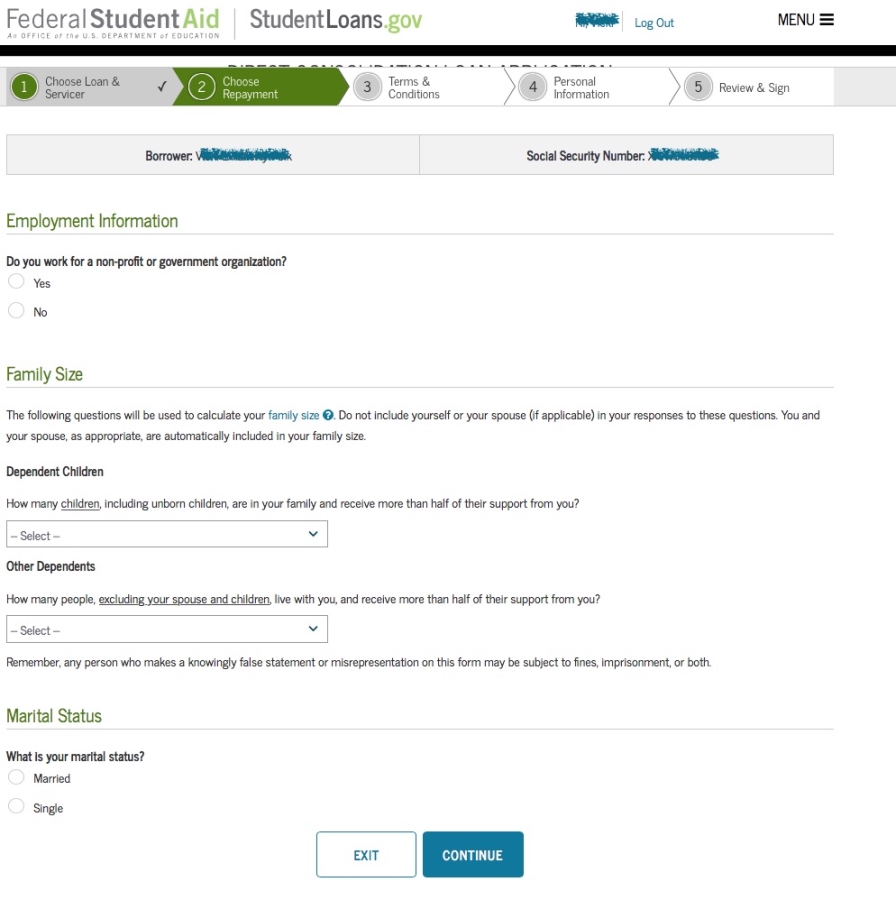

Step 6: Enter Your Family Size and Annual Gross Income

Your new consolidated monthly payment will be based on your family size and annual gross income.

TIP: The larger your family size –the smaller your monthly payment will be. Lower your income — the lower your payment will be.

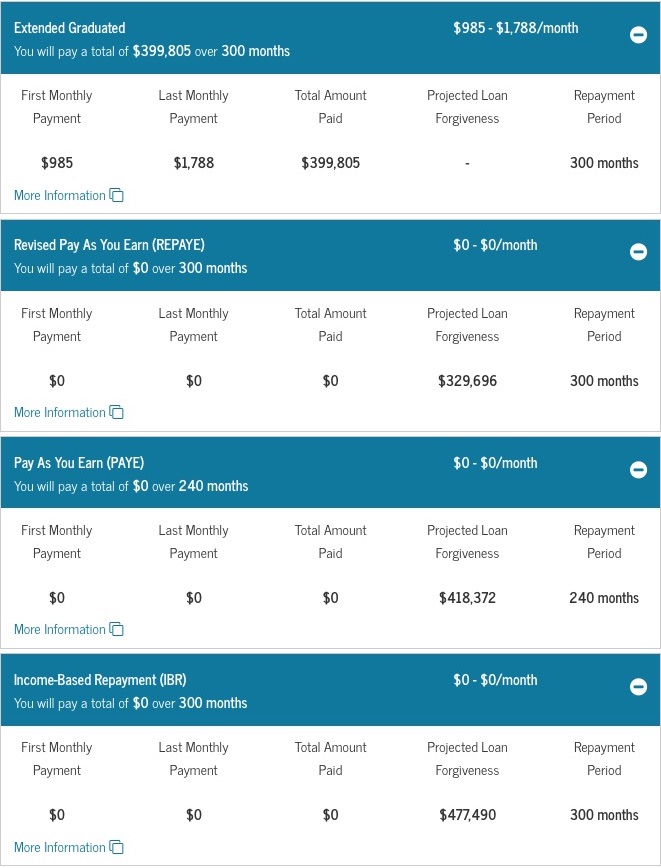

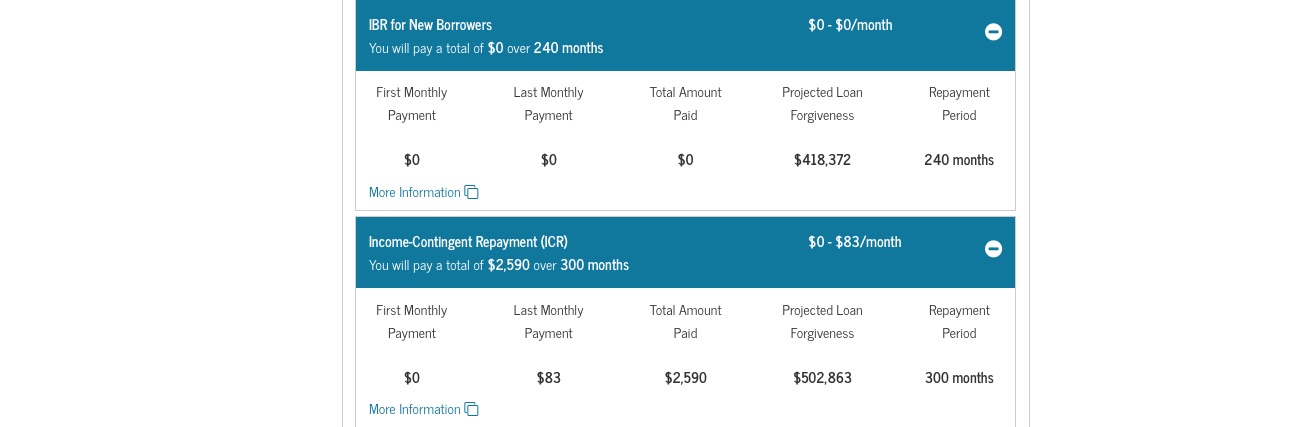

Visual of ALL the Student Loan Repayment Plans & Projected Loan Forgiveness

TIP: Cross these top 3 off your list if you’re looking for loan forgiveness.

Here are the income-driven repayment plans (most of these do offer loan forgiveness)

The Pay As You Earn (PAYE), Income-Based Repayment (IBR), IBR for New Borrowers, and Income-Contingent Repayment (ICR) are all excellent options that offer loan forgiveness.

How Does The IBR For New Borrowers Work?

Keep in mind; just because you are presented with all of these options when consolidating at StudentLoans.Gov, doesn’t mean you’re guaranteed to qualify for all of them.

You can only qualify for the IBR for New Borrowers if you are a new borrower on or after July 1, 2014.

What If I Have Parent PLUS Loans?

First, consolidate just like you would with any other type of loans. Next, you will need to get on the Income-Contingent Repayment (ICR) plan. This is the only repayment plan that you will be eligible for.

After year one of being on the ICR, for year two, you can recertify and switch from the ICR to the Pay As You Earn or Income-Based Repayment plan. At the second year mark, students can also apply for the Public Service Loan Forgiveness program. Start by submitting the Employment Certification Form.

Most people with Parent Plus Loans will never end up getting loan forgiveness because they don’t how to get out of the Parent Plus Loans, but this is how you do it! Consolidate your loans, use the ICR for one year only, and then switch out of the ICR into an income-based repayment plan that offers loan forgiveness.

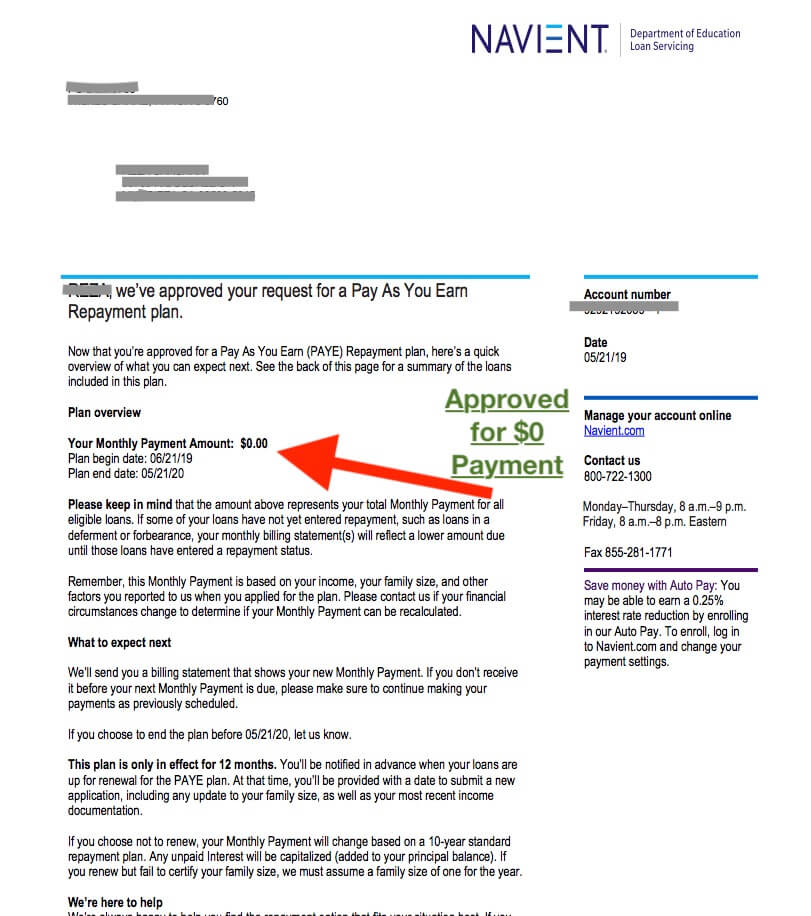

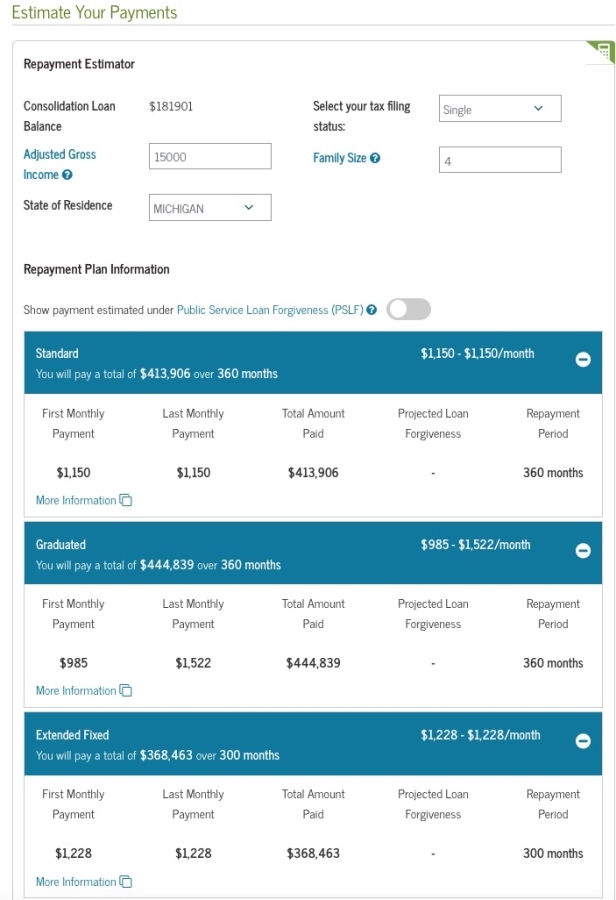

$0 Monthly Payment on the Income-Driven Repayment Plans

In this next image, you can see the consumer has $181,901.00 in student loan debt. Their family size is four in total. (2 kids & 2 additional dependents) and their annual gross income is $15,000. This client qualifies for a $0 monthly payment.

In this example, I would choose either the Pay As You Earn or the IBR for New Borrowers because both of these options offer loan forgiveness after 240 payments and a monthly payment of zero dollars.

What Is My Income Based On?

Your income is based on either your most recently filed tax return or 30-days worth of pay-stubs from within the last 90-days (go with whatever shows the lowest income).

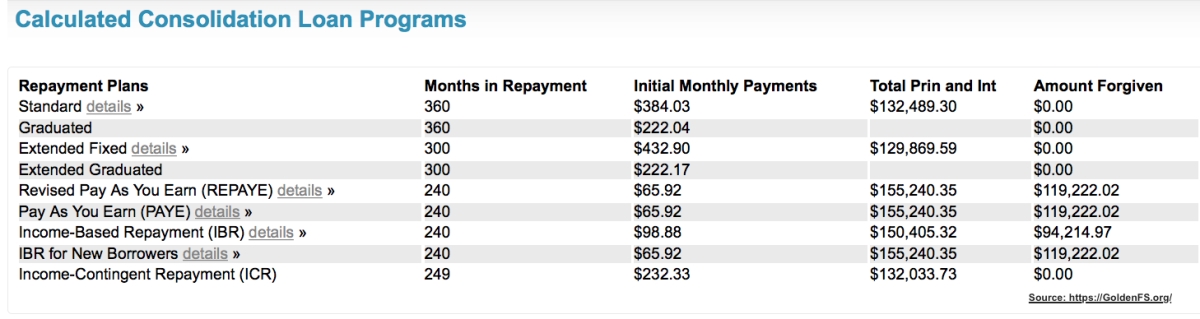

Here is another example of the different income-based student loan repayment plans & loan forgiveness options: (notice the column labeled “Amount Forgiven”)

In this example above, the most attractive program would be either the Pay As You Earn or the IBR for New Borrower — as both of these options would give you $119,222.02 of loan forgiveness and a low monthly payment of $65.92.

Step 7: Choose an income-driven repayment plan

Now that we have provided you several examples and lots of education on the different repayment plans available — it’s time for you to pick your income-driven repayment plan.

Select the plan that best fits your financial situation and helps you meet your goals.

Step 8: Electronically sign the paperwork, and it will get submitted to the loan servicer that you selected

Once you start the consolidation process at StudentLoans.Gov, the entire process only takes about 20-25 minutes to complete.

After choosing your income-driven repayment plan, you will be asked to agree to several disclosures and electronically sign everything.

Step 9: Receive loan pay-off summary

Within 3-6 weeks after your consolidation paperwork is submitted, you will receive a notice in the mail asking you to review the loans that are scheduled to be Paid in Full.

At that point, you can rest assured knowing that everything was approved, and your existing loans are about to be paid off.

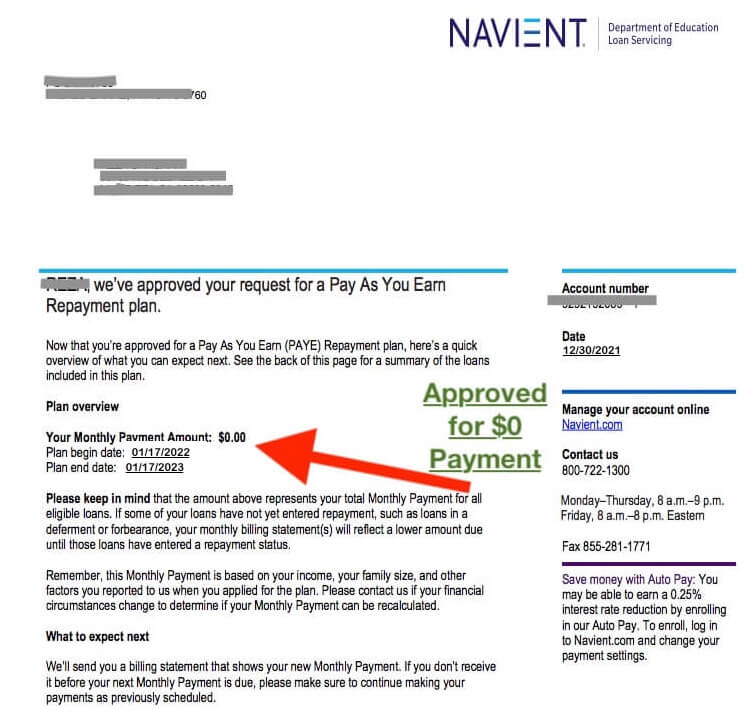

Step 10: Recertify every year

Remember, the monthly payment can change each year. If you forget to recertify at the end of the year, you can quickly get kicked out of the plan — your payment would then shoot back-up, and you’d no longer be making qualified payments towards your loan forgiveness. (most common mistake students make!)

Here Is What Happens If You Forget To Recertify

In this next image, the student is enrolled in an income-driven repayment plan with a payment of $0 per month, but if he forgets to recertify — his payment goes back up to $1,920 per month. (Look at this notice from his loan servicer)

How To Recertify Your Income-Based Repayment Plan (Annually)

To recertify your income-based repayment plan, you simply need to submit your annual income proof to whoever your loan servicer is.

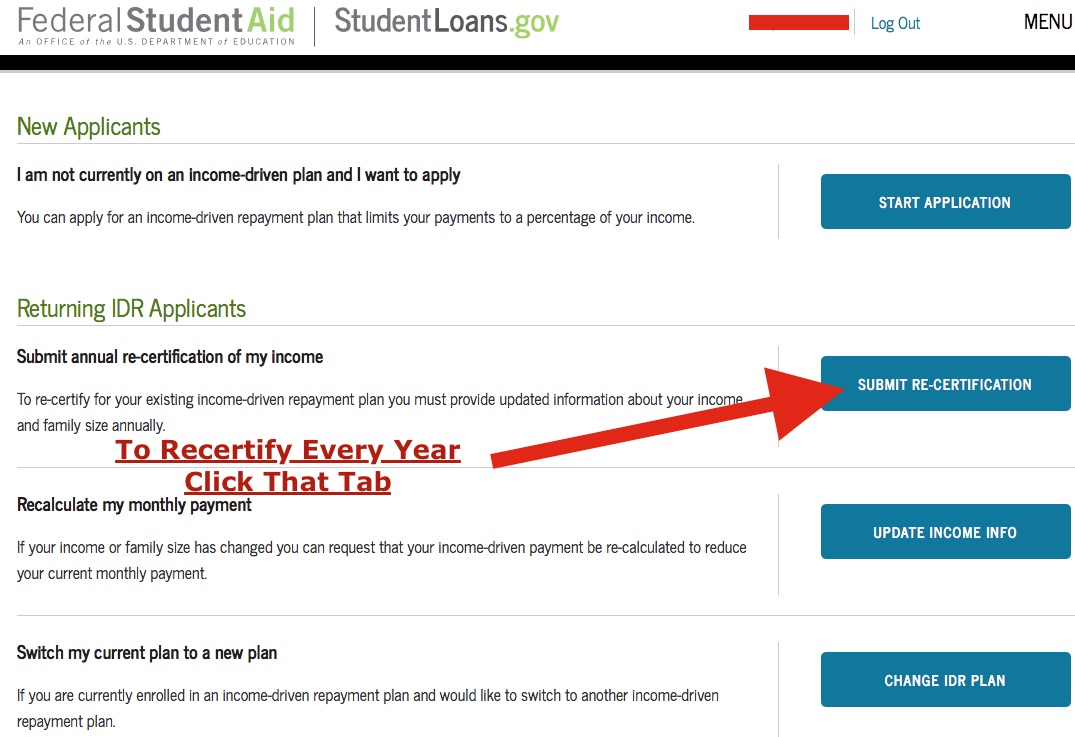

You do this by going back to StudentLoans.Gov, but instead of clicking on the consolidation option, you would log in and click on “Apply for an income-driven repayment plan”.

Next, you will be taken to a page that looks like this… Click on the button that says “Submit Recertification”.

Just follow the directions at this point.

Public Service Loan Forgiveness Program (Aka: Teacher loan forgiveness & PSLF)

If you work over 30-hours per week in a “public service job,” such as a teacher — you can have your loan balance forgiven after only 120 qualified payments (10-years) versus, 20-25 years for anyone that doesn’t work in a public service job.

A lot of the steps (not all) that we are about to go through are the same as for students that don’t have a public service job.

Step 11: Consolidate your student loans

Your first step is to consolidate your federal student loans at StudentLoans.Gov (precisely as explained in the steps above)

Step 12: Get on an Income-Driven Repayment Plan

Get approved for the income-driven repayment plan that offers you the lowest monthly payment and the highest amount of loan forgiveness. (so far the process stays precisely as explained above)

Step 13: Submit Employment Certification Form to FedLoan Servicing (Only applicable to PSLF)

Here is where the process changes for the Public Service Loan Forgiveness Program.

THIS PUBLIC-SERVICE-EMPLOYMENT-CERTIFICATION-FORM needs to be submitted to FedLoan Servicing before starting your new income-based repayment plan. After 120 qualified payments, you’ll be eligible for Public Service Loan Forgiveness.

By completing the employment certification form before making your first monthly payment on the income-driven repayment plan — you are solidifying proof that you’ve worked in a public service job for the entire duration of the last ten years.

There is also a section on the Public Service Employment Certification Form that your employer needs to complete and sign.

THIS FORM NEEDS TO BE COMPLETED AND SENT TO FEDLOAN SERVICING EVERY YEAR FOR THE NEXT TEN YEARS TO GUARANTEE THAT YOU’RE ELIGIBLE FOR PSLF.

Where to send the form?

Do not send the Public Service Employment Certification Form to your loan servicer — it needs to be sent to FedLoan Servicing. FedLoan Servicing is in charge of the Public Service Loan Forgiveness Program.

Mail to: U.S. Department of Education, FedLoan Servicing, P.O. Box 69184, Harrisburg, PA 17106-9184.

Or;

Fax to: 717-720-1628.

FedLoan will be your loan servicer if you’re applying for the PSLF. You cannot choose Navient or Great Lakes, you only have one option for the PSLF program, and it’s to use FedLoan as your loan servicer.

Could You Walk Away From Your Student Loan Debt Without Paying Anything?

At the time when you’re eligible for loan forgiveness, whether that’s in 10 years or 25 years — if you’ve remained on the $0 payment for the entire duration of the plan — YES, you could end up paying NOTHING in the end. You could have over $100,000 in student loans, and get every bit of it forgiven.

WARNING: Thousands of qualified consumers won’t be getting loan forgiveness because they forget to submit the employment certification form every year.

Examples of Public Service Jobs

- government jobs – at a state, local or federal level

- 501(c)(3) non-profit companies

- Teachers

- Americorps or Peace Corps Volunteers

What to do if you are behind on student loan payments?

The final three steps apply only for students that are behind on their student loan monthly payments.

Step 14: Request 90-Days Forbearance or IDR Forbearance (Only applicable if you’re behind on monthly payments)

IDR forbearance is forbearance that lasts until your income-driven repayment plan is processed. In the past, you’d have to request 90-days forbearance, but as of 2019, you can request IDR forbearance. If your income-driven repayment plan is approved within 60-days, the forbearance will end at that point to minimize having extra interest capitalized to the back of the loan.

Step 15: Consolidate Student Loans (Only applicable if you’re behind on monthly payments)

After requesting forbearance, you’ll now have sufficient time to consolidate and get on an income-based repayment plan without having to pay a past-due balance. So don’t waste any time, consolidate now! You can go back up to step number three in this guide and follow the detailed instructions on how to consolidate.

Step 16: Get on an Income-Driven Repayment Plan (AKA: IBR)

This is a bit redundant, but for those of you that are delinquent on their student loans, we have to back-track to ensure this guide accommodates everyone. For detailed instructions on how to recertify, go back up to step number ten.

If late on your student loans, request IDR forbearance for ninety days or less, consolidate, and then get on an income-driven repayment plan that offers loan forgiveness.

Need Help? Talk to a Certified Student Loan Relief Counselor at (866)-376-9846

Other posts that you may be interested in:

This is really a helpful article, but I have one question. What if I got kicked out of my student loan consolidation program? Now I received a letter saying that if I don’t take action my wages will be garnished within 30-days. What should I do?

This guide is excellent, thanks so much. I followed the instructions and just today received confirmation that my loans were paid in full and my new payment is only $45 per month, down from $480 per month. I will share this everywhere!