With September being Self Improvement Month, this is the best time of year to review your personal finances if you are planning on shopping for affordable car insurance while in major credit card debt.

More than ever before, millennials are finding it difficult to build a credit score, buy a house, or even find affordable apartment renting. Here at Golden Financial Services we strongly encourage the youngest generation of adults to consider building credit before moving out on their own, and this plays a major factor in finding the car insurance coverage that makes sense in each financial situation. Before proceeding in this blog, you may want to review a recent write-up where we covered how to fix credit debt for millennials that started off on the wrong foot with their financial adulting. By the way, if you are considering debt relief services in order to find more affordable car insurance, Golden Financial Services is here to help.

Which Auto Insurance Company is the Cheapest?

The most commonly searched question for car insurance shoppers according to Google, this question usually doesn’t receive a straight-forward answer. You will read, practically anywhere you search on the web, that it all depends on credit score and driving history. While this is largely true, there are some companies that extend longer olive branches to potential drivers needing coverage.

For example, US News conducted a study of all vehicle insurance providers and came to the conclusion that overall, USAA provides the most affordable options for motorists seeking coverage: “USAA is the cheapest car insurance company on our list, with a study rate of $895. USAA presents the cheapest auto insurance study rates for various demographic profiles used in our study, ranging from 25-year-old men to 60-year-old women.”

GEICO, Travelers Insurance, and State Farm rounded out the list of the most affordable car insurance options.

Who Has the Cheapest Full Coverage Auto Insurance?

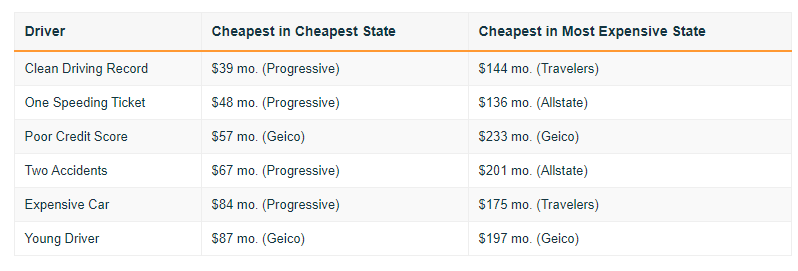

According to a study from Cheapfullcoverageautoinsurance.com, if you live in states where living is more affordable, Progressive will be your cheapest option for full coverage (liability+bodily injury), with GEICO being a close second option. If you live in a state like California, New York, or others that are population-dense, you may want to take a look at Travelers or Allstate. Here is the full list of options provided by the site, plus a little bit of context on their picks:

“As you can see, it’s not uncommon for monthly rates to fluctuate dramatically from driver-to-driver and from state-to-state. Another very important thing to recognize is that no one company always offers the cheapest rates. A company that offers one driver the cheapest rate might not offer a different type of driver the cheapest rate at all.”

How Can I Get the Cheapest Car Insurance?

The best bargain hunters know not to take the first offer they get just because it seems affordable. Sure, the car insurance you find first might be in your price range if you have plugged in all your budget numbers into the calculator, but what if you can save even more monthly? Maybe even enough to start a snowball debt payment plan.

To do the due diligence and get the lowest rate for your needs, consider some of these methods:

- Remember that car insurance prices and rates vary by state. Here is a great study from NerdWallet showing the disparity in offerings from vehicle insurance companies by state: “Here are some of the rates we found for a 40-year-old driver with good credit and a clean driving record, buying a full coverage policy:

- In Alabama, Allstate would charge $1,287 a year, on average — the cheapest rate in the state for a driver without a military connection. Geico’s average rate is $487 higher.

- In Oregon, it’s the opposite: Geico is cheapest, with an average rate of $1,221, and Allstate’s average is $729 higher.

- Esurance is the cheapest option for California drivers at $1,196, on average, but in New York, it’s the most expensive at $3,544.”

- Ask About Discounts. Renting an apartment or room? Have more than one vehicle to cover? Have a solid driving history with no recent accidents? If you answered in the affirmative to any of these questions, you likely have the option to bundle your insurance needs while receiving a good driver discount. This can save a considerable amount monthly. Insurance providers are always willing to take a few dollars off if it means they are your only insurance provider and you have multiple policies with them.

- Pass on collision coverage for older vehicles. Collision coverage is basically needed when you have a newer vehicle where the value of that vehicle would easily be more than the cost of any repairs to damages caused by collisions. If your vehicle is older, has a lot of mileage on it, or has previous damage that hasn’t been fixed, it significantly reduces the value of that vehicle. Make sure you have enough coverage for the other vehicles involved in the event that the accident is your fault, but if your vehicle is going to be an immediate wash after an accident in terms of value-to-repair comparison, collision coverage is unnecessary.

Final Thoughts

If you aren’t a big fan of reading and skimmed your way here, the bottom line thoughts are these: Remember car insurance rates vary largely by state, so there is no one clear leader in affordable car insurance. If you are in severe debt, consider receiving counsel from debt specialists before making any major financial decisions. Lastly, know your financial situation intimately: Calculate your debt, and your budget, then consider bundling insurance policies. Your affordable car insurance solution isn’t really a solution unless it fits your budget AND fits into your long-term plans to get out of debt.

If you found our blog looking for financial advice or assistance with credit card debt relief or debt consolidation, call Golden Financial Services today at (866)-376-9846 or info@goldenfs.org. You can check out the rest of our blog here, and do your research on our services here. Let’s talk soon!