Paying the Minimum Payment for Credit Cards

When paying the minimum payment on credit card debt, there aren’t many benefits that you’re receiving, besides for having a small monthly payment (but that small payment could last for eternity!). Paying the minimum payment for credit cards will benefit your creditors the most because that’s how they earn the most interest. Earning interest is how a bank makes money. Need help with credit card debt? Check out this page next.

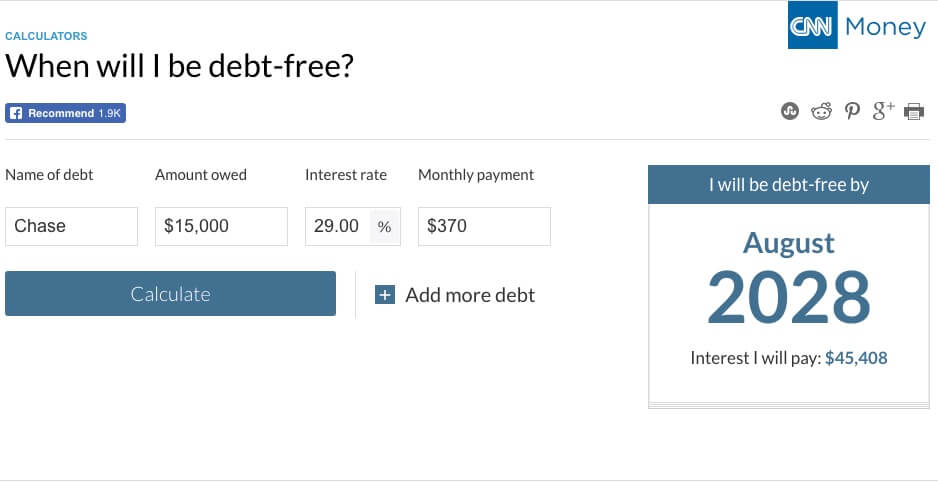

Paying minimum payments on $15,000 of credit card debt with a 29% interest rate

The FTC illustrates what happens when someone makes just the minimum payment on a credit card balance (see video)

Here’s another example of what paying only minimum payments results in:

- $25,000 in credit card balances with an average interest rate of 24%

- If you pay $600 per month (near minimum payments)

- You’ll be debt-free in 7 years and seven months paying $54,290 in total (that’s more than twice your debt)

What are the downsides of paying minimum payments on credit card debt?

- You will pay more interest.

- You will be in debt for the longest possible timeframe.

- Your credit score suffers if you only pay minimum payments on maxed out debt.

What are better options than paying minimum payments on credit cards

Here are five better options for you to consider than only paying minimum payments on credit cards. Click the link to learn more about each option, and you’ll be taken to the appropriate page.

- Debt snowball method: This is when you organize your debts from small to large and then start paying off the smallest account first. The debt snowball method allows you to break the cycle of only paying minimum payments for eternity and simultaneously can help improve credit scores. Although you will continue to pay minimum payments on all accounts besides the first smallest debt, this method allows you to pay off one debt after another quickly. Here at Golden Financial Services, we offer a free debt snowball calculator.

- Debt avalanche method: this method prioritizes paying off the account with the highest interest rate first, like the debt snowball method, you’ll quickly get out of debt. Before using the debt avalanche method, start by creating your budget; here’s a free budget calculator to help you. The budget analysis makes it easier to find extra cash to use towards paying off the account with the highest interest rate first. You can pay off almost any type of debt with the avalanche method, including unsecured and secured debts.

- Consumer credit counseling: this is a program to consolidate credit cards and help reduce the interest rates, getting you out of debt in around five years but reducing the amount of interest you pay. Only credit cards can be consolidated with consumer credit counseling programs.

- Debt settlement: this is a hardship program for consumers that can’t afford to pay at least minimum payments, making it possible to pay less than the full balance owed on each account. Here’s a complete summary of credit card debt relief programs, including the pros and cons of each.

- Debt validation: this last program assists consumers in forcing collection agencies to prove a debt is valid. Validation is a top choice for consumers in 2020, helping thousands of consumers deal with high credit card debt that they could not afford to pay. Although validation doesn’t pay your debt, validation effectively deals with debt so that consumers only have to pay it if it’s proven legally collectible.

The last three programs on the list can provide you a monthly payment that equates to less than credit card minimum payments. So if your goal is to pay less than the minimum payment on credit cards, consider consumer credit counseling, debt settlement, and validation. Here’s a debt calculator that lets you compare all three programs.

Directory of debt relief programs if you can’t afford to pay more than minimum payments:

Pennsylvania debt relief and settlement

For additional statewide programs, visit GoldenFs.org and choose your state. Minimum payments can keep you paying on debt for the rest of your life, so break that cycle today! Just because you’re “current on monthly payments,” by paying only minimum payments towards maxed-out credit card debt, your credit score is not benefiting.

Related articles:

Learn how to avoid paying interest on holiday purchases

Is it OK to pay the minimum payment?

Understanding debt negotiation

source:

https://www.consumer.ftc.gov/media/video-0058-minimum-payments-credit-cards